Behind the bond market's disconnect from the Fed on the interest-rate outlook:

The Fed thinks inflation won't come down as quickly as do investors, who are factoring in a greater probability of a sharp downturn that brings inflation down

w/@akaneotani

wsj.com/articles/stock…

The Fed thinks inflation won't come down as quickly as do investors, who are factoring in a greater probability of a sharp downturn that brings inflation down

w/@akaneotani

wsj.com/articles/stock…

The Fed “can learn from what the market is thinking and saying,” said William English, who was once the top adviser on monetary policy at the central bank.

“That’s information for policy makers. It isn’t something to be particularly feared.”

“That’s information for policy makers. It isn’t something to be particularly feared.”

Markets will try to get ahead of a data-dependent central bank, even if that means pricing for perfection.

“For market participants, the risk is that you’re missing out on a market rebound," said Daleep Singh, a former senior New York Fed executive.

“For market participants, the risk is that you’re missing out on a market rebound," said Daleep Singh, a former senior New York Fed executive.

The Fed would rather err on the side of tightening too much rather than too little.

From the perspective of a central banker such as Jay Powell, “the greatest danger is to allow inflation to spiral upwards," said Singh.

From the perspective of a central banker such as Jay Powell, “the greatest danger is to allow inflation to spiral upwards," said Singh.

Powell, who spent a career in finance, echoed this point:

“It’s our job to restore price stability and achieve 2% inflation. Market participants have a very different job... It’s a great job. In fact, I did that job for years, in one form or another. But we have to deliver.”

“It’s our job to restore price stability and achieve 2% inflation. Market participants have a very different job... It’s a great job. In fact, I did that job for years, in one form or another. But we have to deliver.”

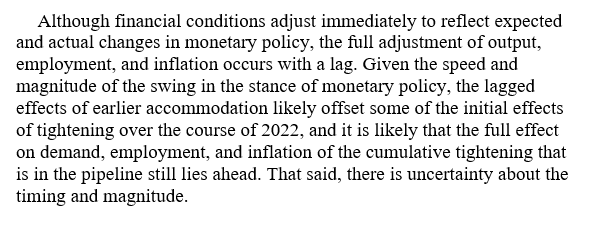

When a central bank says what it thinks the nominal long-run equilibrium rate is, once the central bank takes rates above the level and then stops hiking, the market will price in some greater likelihood that the next move is *down* to the neutral rate. This is not unusual.

Where the Fed could get into trouble is if the market doesn't believe or properly understand how it would react to incoming data (its "reaction function"), and this eases financial conditions (which would be unwarranted).

• • •

Missing some Tweet in this thread? You can try to

force a refresh