R/BBBY has been in chaos for the last day in a perfect encapsulation of the reality distortion field that these groups develop.

on Feb 1st BBBY missed an interest payment on three tranches of bonds, this was confirmed by the WSJ via a company spokesperson.

Presumably the spokesperson was unnamed to avoid retaliation from apes. As if to prove the wisdom of that the WSJ writer was doxed and harassed.

There was confusion as some retail bond holders appeared to receive payment, probably automated systems from their brokers.

Feb 2nd several of the confirmed bond payouts get reversed, indicating that they were automatic payouts and the brokers didn’t actually receive their payment from BBBY (as per company statement to the WSJ).

Later in the afternoon several people decide to email BBBY investor relations to get clarification. IR responds hours later in the affirmative.

The first person to post their reply email gets smeared as a FUDster, then several true-blue apes post their own copies of the same email. “Yes, we missed the bond payment and are in a 30 day grace period, exploring all possible options”

All hell breaks loose.

All hell breaks loose.

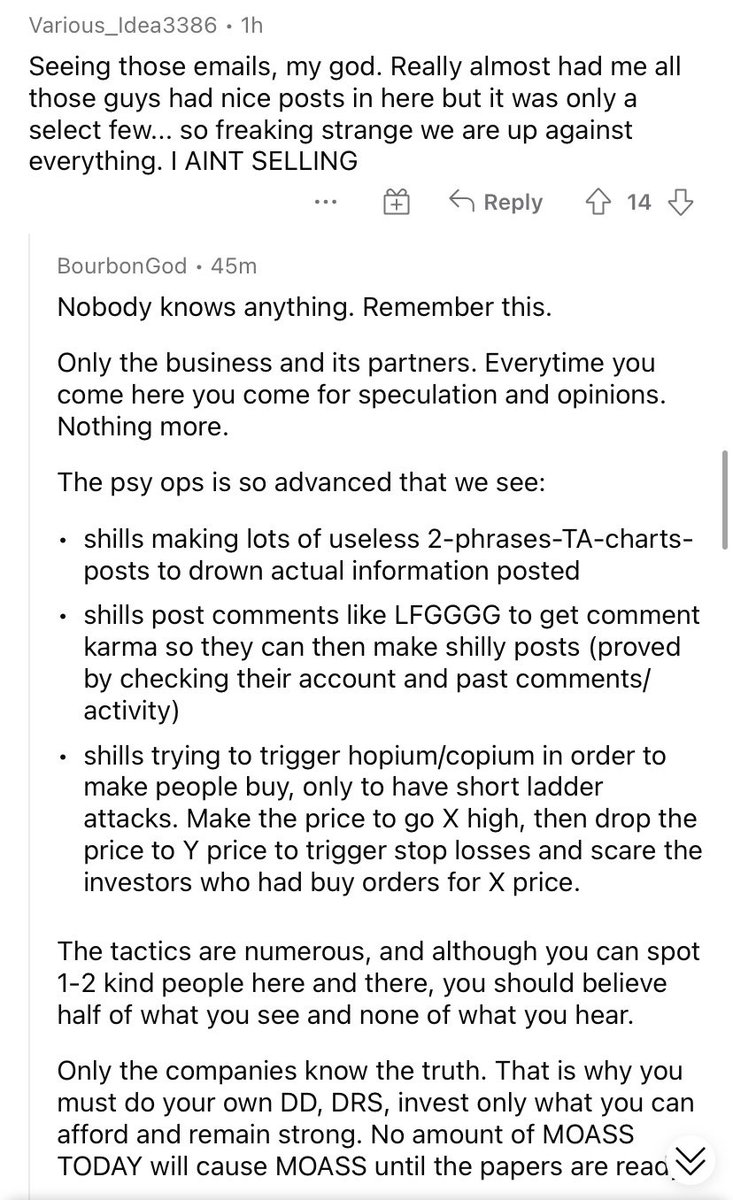

Users posting their emails are accused of being deep cover shills planted months and months ago by hedge funds waiting for this exact moment to trick them into selling. Every minute detail is scoured for something that can be spun as an inconsistency.

The emails went out just before 10pm ET (BBBY is based in New Jersey). It is unusual for IR to send out emails at 10pm ET? Yes.

Obvious explanation: the company is going bankrupt and investor relations is pulling overtime dealing with it.

Ape explanation: BBBY has been hacked.

Obvious explanation: the company is going bankrupt and investor relations is pulling overtime dealing with it.

Ape explanation: BBBY has been hacked.

Over the course of two hours of brainstorming reasons why this official statement from the company can’t be real, no meaningful arguments are made, a lot of people are downvoted and banned, and it simply becomes accepted truth that the emails are fake.

There is simply no standard of acceptable proof for bad news, not even the company’s own statements.

Like, this is the standard of information that we're dealing with here.

A journalist said "with" instead of "for" in an email reply to an ape trying to dox the BBBY spokesperson and it has become Accepted Ape Truth that said spokesperson was fabricated.

A journalist said "with" instead of "for" in an email reply to an ape trying to dox the BBBY spokesperson and it has become Accepted Ape Truth that said spokesperson was fabricated.

https://twitter.com/Webbox83/status/1621741078780035076?s=20&t=UTufjRj2AqQ7dueczLJ6dw

The fact of the matter is that if the Wall Street Journal fabricated a false statement from a Bed Bath & Beyond spokesperson, or if a spokesperson went rogue, or if an employee or associate acted out of role as a spokesperson and told lies, BB&B would be on that so fast.

They have their own channels of communication, they have their website which is wholly under their control, they have mailing lists, they have social media. If they had, in fact, made the bond payment and WSJ lied and made up an official statement, there would be an instant reply

But that doesn't matter, what's really relevant to apes is that the journalist said "works with the company" and not "works for the company"

When you dumped half your life savings into a bunch of "investments" that are all down 90% it's just so much easier to believe that there's a conspiracy to fabricate official statements from the company than to believe that the company didn't pay their bills.

• • •

Missing some Tweet in this thread? You can try to

force a refresh