We cordially invite you to a one-of-a-kind Investor Conclave with Industry Stalwarts!

@shyamsek (@ithoughtpms)

@KalpenParekh (@dspmf)

@Ihabdalwai (@ICICIPruMF)

Anupam Joshi (@hdfcmf)

Watch it live on Youtube -

#VoicesofTomorrow #VOT2023 #ithoughtVOT

@shyamsek (@ithoughtpms)

@KalpenParekh (@dspmf)

@Ihabdalwai (@ICICIPruMF)

Anupam Joshi (@hdfcmf)

Watch it live on Youtube -

#VoicesofTomorrow #VOT2023 #ithoughtVOT

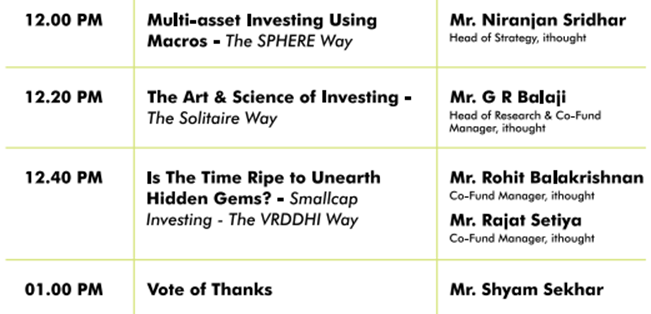

Schedule for the conclave:

The stalwarts will be talking about the #Budget2023, International Investing, Indian Equity Opportunity and Indian Fixed Income Opportunity!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

The stalwarts will be talking about the #Budget2023, International Investing, Indian Equity Opportunity and Indian Fixed Income Opportunity!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Fund managers of @ithoughtpms will be talking about their style of investing:

@rohitkrishnan & @rajatsetiya on unearthing hidden gems by PE style due diligence.

@balajispice on the art & science of investing.

@theninjax on multi asset investing using macros.

@rohitkrishnan & @rajatsetiya on unearthing hidden gems by PE style due diligence.

@balajispice on the art & science of investing.

@theninjax on multi asset investing using macros.

Thread on Kalpen Parekh's speech on International Investing.

Check out the India vs Berkshire Hathaway battle!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Check out the India vs Berkshire Hathaway battle!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621741363162222592

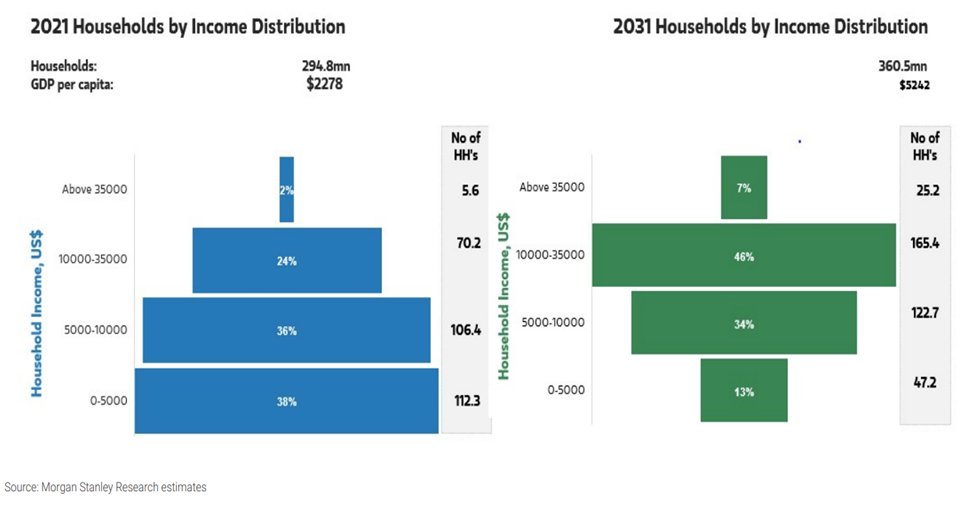

Thread on Indian Equity Opportunity by Ihab Dalwai.

The interesting shift in per capita normal curve when income rises!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

The interesting shift in per capita normal curve when income rises!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621750115424931846

Thread on Indian Fixed Income Opportunity by Anupam Joshi.

Interest rates fall as countries move up the economic ladder. Time to lock in those long duration bonds.

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Interest rates fall as countries move up the economic ladder. Time to lock in those long duration bonds.

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621755756755419137

Thread on Multi Asset Investing using Macros - the Sphere way by Niranjan Sridhar.

Master the market cycles. Gold rose from the bottom of the pile in 2021 to be the leader in 2022.

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Master the market cycles. Gold rose from the bottom of the pile in 2021 to be the leader in 2022.

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621767856714301440

Thread on the Art and Science of Investing - the Solitaire way by G R Balaji.

Check out the best performing US Stock. Hint - Its not FAANG!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Check out the best performing US Stock. Hint - Its not FAANG!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621772677336944643

Thread on "Is the time right to unearth hidden gems?" by Rohit.

PE style due diligence the Vrddhi way.

"MULTIBAGGER" Google Search = best indicator?

#VoicesofTomorrow #VOT2023 #ithoughtVOT

PE style due diligence the Vrddhi way.

"MULTIBAGGER" Google Search = best indicator?

#VoicesofTomorrow #VOT2023 #ithoughtVOT

https://twitter.com/sanjaylangval/status/1621779063395487744

• • •

Missing some Tweet in this thread? You can try to

force a refresh