Next is Mr Ihab Dalwai (@Ihabdalwai). He is the lead Fund Manager for ICICI Prudential Large & Midcap Fund and ICICI Prudential Infrastructure Fund. He is the youngest in history of @ICICIPruMF to be given the additional responsibility of Fund Management along with Research role.

https://twitter.com/sanjaylangval/status/1621716943798673408

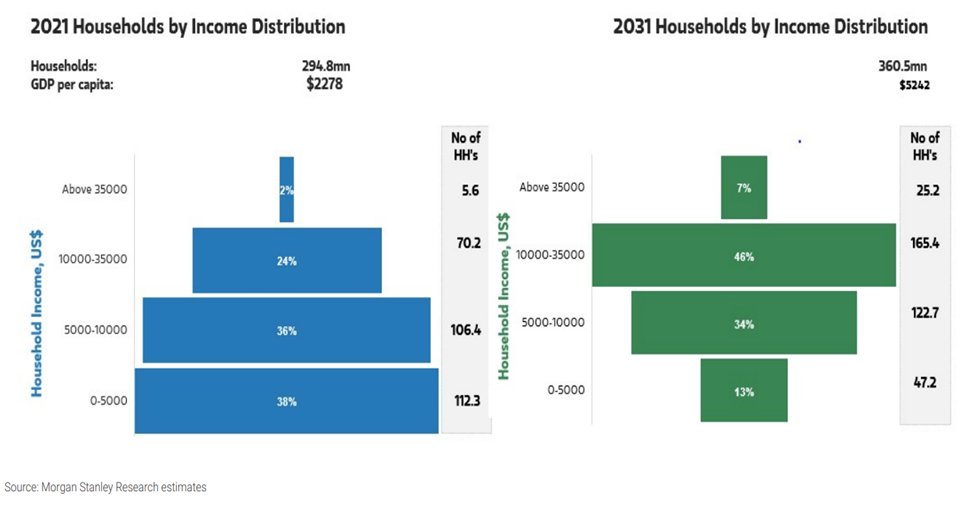

As income level rises, few sectors will see non linear growth.

Number of Indian households with income of more than $10000 is expected to more than double this decade!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Number of Indian households with income of more than $10000 is expected to more than double this decade!

#VoicesofTomorrow #VOT2023 #ithoughtVOT

Counter Cyclical / Non consensus Style

Try to be non-consensus and go right.

Market will consistently overvalue favored stocks and undervalue out of favor stocks. Market will find itself over optimistic on forecast of best stocks and too pessimistic on those of worst stocks.

Try to be non-consensus and go right.

Market will consistently overvalue favored stocks and undervalue out of favor stocks. Market will find itself over optimistic on forecast of best stocks and too pessimistic on those of worst stocks.

Capital Cycle (Industry/Business cycle) Investing

Based on idea that prospect of high returns will attract excessive capital (and hence competition), and vice versa. The strategy requires one to have a supply focused capital cycle model. Most analysts focus on the demand side.

Based on idea that prospect of high returns will attract excessive capital (and hence competition), and vice versa. The strategy requires one to have a supply focused capital cycle model. Most analysts focus on the demand side.

Trick is to avoid investing in sectors or markets, where investment spending is unduly elevated & competition is fierce, and to put one’s money to work where capital expenditure is depressed, competitive conditions are more favorable. As a result, prospective returns are higher.

• • •

Missing some Tweet in this thread? You can try to

force a refresh