Mega Thread on $JOE :

The @traderjoe_xyz team has been shipping non stop during the bear and I firmly think that they are well position to explode in the coming weeks.

This thread will dissect the key features of $JOE and why I am so fucking bullish on it.

LFG

The @traderjoe_xyz team has been shipping non stop during the bear and I firmly think that they are well position to explode in the coming weeks.

This thread will dissect the key features of $JOE and why I am so fucking bullish on it.

LFG

Introduction

@traderjoe_xyz is the largest DEX on @avalancheavax

$JOE started its omnichain expansion by deploying its @arbitrum DEX followed by @BNBCHAIN later this mth

$JOE can soon be bridged natively through their partnership w @LayerZero_Labs and @StargateFinance

@traderjoe_xyz is the largest DEX on @avalancheavax

$JOE started its omnichain expansion by deploying its @arbitrum DEX followed by @BNBCHAIN later this mth

$JOE can soon be bridged natively through their partnership w @LayerZero_Labs and @StargateFinance

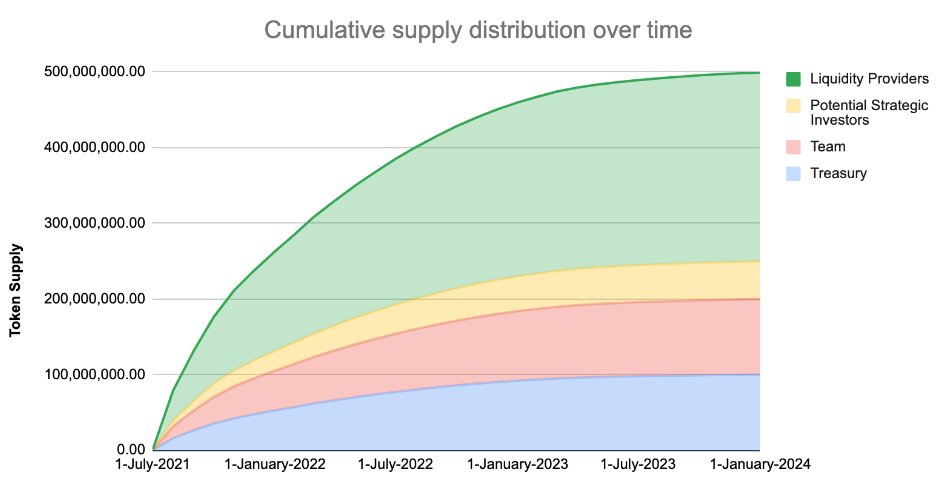

Tokenomics

+ Marketcap - $72m

+ Max Supply - 500m

+ Current Supply - 464m (93% of Max)

+ Total emissions - 259,200 JOE/day

+ Emissions (via farms) - 14,768 JOE/day

+ Surplus tokens are held in treasury for future long-term growth incentives

+ Emissions stop by Jan 2024

+ Marketcap - $72m

+ Max Supply - 500m

+ Current Supply - 464m (93% of Max)

+ Total emissions - 259,200 JOE/day

+ Emissions (via farms) - 14,768 JOE/day

+ Surplus tokens are held in treasury for future long-term growth incentives

+ Emissions stop by Jan 2024

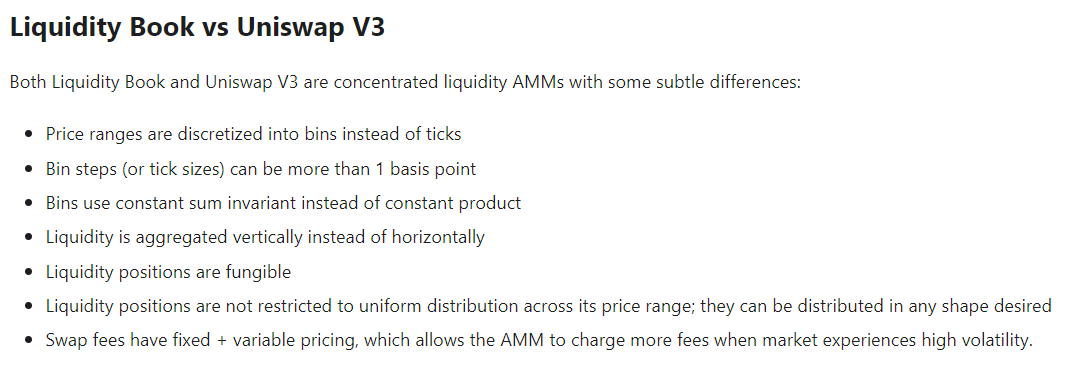

Liquidity Book Introduction

@traderjoe_xyz has launched its Liquidity Book (LB) model which allows it to be a concentrated liquidity AMM.

Key difference between LB and Uni v3 in the pic attached.

@traderjoe_xyz has launched its Liquidity Book (LB) model which allows it to be a concentrated liquidity AMM.

Key difference between LB and Uni v3 in the pic attached.

Liquidity Book Advantages vs UniV3

+ Higher Liquidity efficiency

+ Customizable Liquidity shapes

+ Fungible Liquidity Positions - Allows protocols to incentivize pools directly

+ Dynamic fees to capture additional value during volatility

+ Higher Liquidity efficiency

+ Customizable Liquidity shapes

+ Fungible Liquidity Positions - Allows protocols to incentivize pools directly

+ Dynamic fees to capture additional value during volatility

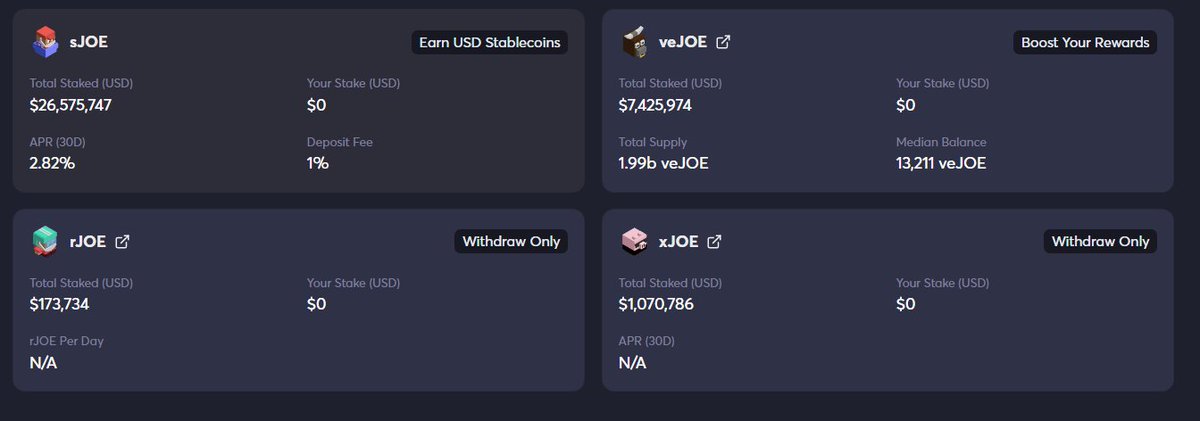

Staking Model ( Token Utility )

+ veJOE - boosted JOE rewards from select Farms + Governance

+ sJOE - share of all platform revenue generated

+ rJOE (Depreciated) - allocation token used to enter Rocket Joe Launches

+ veJOE - boosted JOE rewards from select Farms + Governance

+ sJOE - share of all platform revenue generated

+ rJOE (Depreciated) - allocation token used to enter Rocket Joe Launches

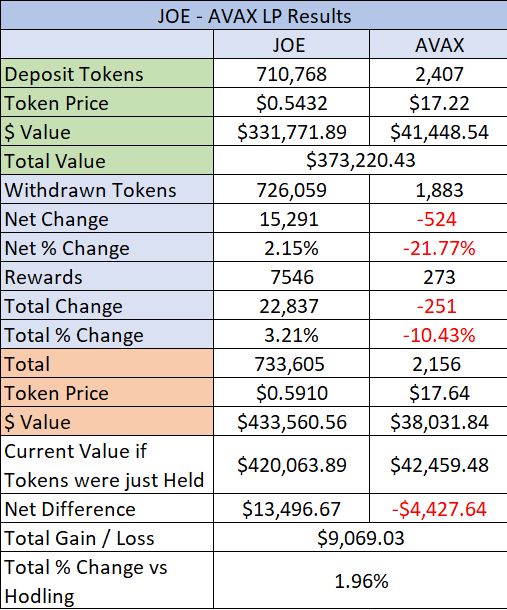

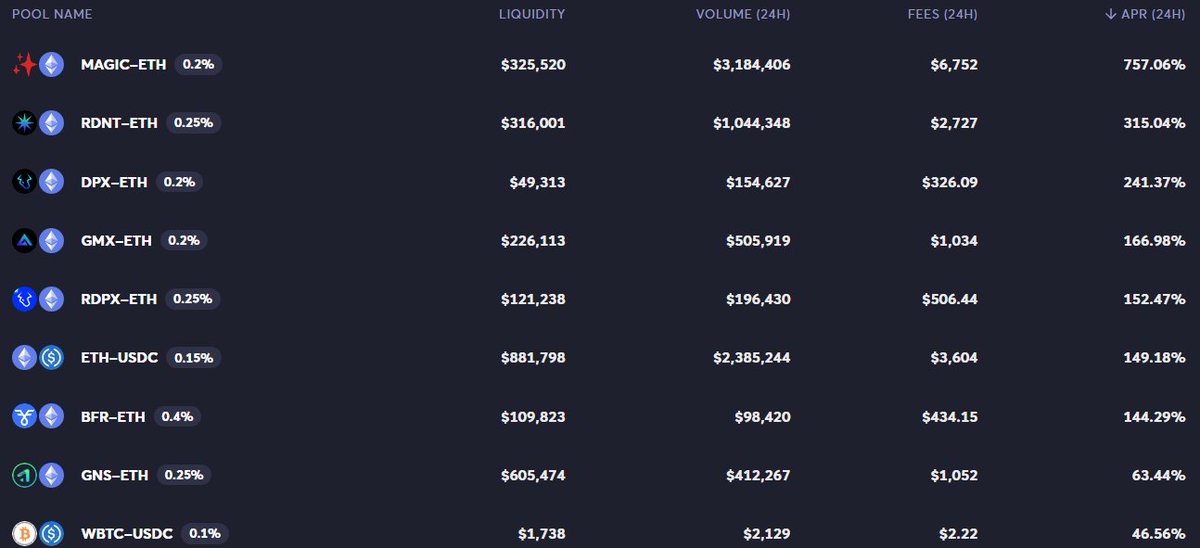

Catalyst - Real Yield

+ Current @traderjoe_xyz LPs are generating massive fees with the LB Model

+ The fees switch for sJOE will soon be turned on and a portion of all Dex fees will be funneled towards $JOE Stakers

+ This means that real yield narrative starts for $JOE

+ Current @traderjoe_xyz LPs are generating massive fees with the LB Model

+ The fees switch for sJOE will soon be turned on and a portion of all Dex fees will be funneled towards $JOE Stakers

+ This means that real yield narrative starts for $JOE

Catalyst - Omnichain

+ sJOE staking will be siloed by their respective chains

+$JOE LP has $8.2m Liquidity vs $26m staked in sjoe vs $7.3m in vejoe.

+ The 2 sJOE launches on both chains ( @arbitrum & @BNBCHAIN ) would see JOE liquidity being thinned out from $JOE LPs.

+ sJOE staking will be siloed by their respective chains

+$JOE LP has $8.2m Liquidity vs $26m staked in sjoe vs $7.3m in vejoe.

+ The 2 sJOE launches on both chains ( @arbitrum & @BNBCHAIN ) would see JOE liquidity being thinned out from $JOE LPs.

Catalyst - Market Making program

+ ETA within 1 mth

+ veJOE will be integrated into the MM program to boost rewards

+ LPs rewarded based on fees earned

+ Protocols will be allowed to further incentivise their own LP pools w native tokens

+ ETA within 1 mth

+ veJOE will be integrated into the MM program to boost rewards

+ LPs rewarded based on fees earned

+ Protocols will be allowed to further incentivise their own LP pools w native tokens

Catalyst - Market Making program (2)

+ Users will be incentivised to LP within tight range to generate maximum MM rewards

+ Protocols providing additional incentives will get deeper liquidity that protects them from large slippage swaps

+ Win - Win for both LPs and Protocols

+ Users will be incentivised to LP within tight range to generate maximum MM rewards

+ Protocols providing additional incentives will get deeper liquidity that protects them from large slippage swaps

+ Win - Win for both LPs and Protocols

Catalyst - Governance Model

+ VeJOE is also being utilized by gov aggregators like @yieldyak_ and @vector_fi

+ The Gov Aggregators permanently lock $JOE for increased veJOE allocations.

+ The Perma lock of veJOE ensures that the Governance capital is sticky and not mercenary

+ VeJOE is also being utilized by gov aggregators like @yieldyak_ and @vector_fi

+ The Gov Aggregators permanently lock $JOE for increased veJOE allocations.

+ The Perma lock of veJOE ensures that the Governance capital is sticky and not mercenary

Catalyst - Governance Model (2)

+ Upcoming MM Program likely to see an uptick in veJOE importance

+ Increased $JOE locked in veJOE = Lower supply in market

+ Lower supply + Increase demand for token = Supply Shock Incoming?

+ Upcoming MM Program likely to see an uptick in veJOE importance

+ Increased $JOE locked in veJOE = Lower supply in market

+ Lower supply + Increase demand for token = Supply Shock Incoming?

Catalyst - Permissionless Pools

+ Current LP Pools are carefully curated to ensure reliability of constituent assets

+ Permissionless deployment is in the works

+ Permissionless Pools = Degen Alts can deploy = Degen Central = Dex Vol OnLyUP

+ Current LP Pools are carefully curated to ensure reliability of constituent assets

+ Permissionless deployment is in the works

+ Permissionless Pools = Degen Alts can deploy = Degen Central = Dex Vol OnLyUP

Speculation - $JOE Pool Incentives

+ With $JOE gg multichain and a MM Program upcoming, I expect $JOE pools to be incentivized to bootstrap liquidity

+ IMHO, $JOE LP incentives on @arbitrum and @BNBCHAIN are highly likely

+ $JOE printing $JOE. Can't wait for this to happen.

+ With $JOE gg multichain and a MM Program upcoming, I expect $JOE pools to be incentivized to bootstrap liquidity

+ IMHO, $JOE LP incentives on @arbitrum and @BNBCHAIN are highly likely

+ $JOE printing $JOE. Can't wait for this to happen.

Summarizing Thoughts

+ $JOE has set up the perfect flywheel for the coming month.

+ Low Emissions

+ Staking model that restricts $JOE Supply

+ Highly Efficient Liquidity Model

+ Effective way for Protocols to Incentivize Liquidity

All signs points towards a supply crunch

+ $JOE has set up the perfect flywheel for the coming month.

+ Low Emissions

+ Staking model that restricts $JOE Supply

+ Highly Efficient Liquidity Model

+ Effective way for Protocols to Incentivize Liquidity

All signs points towards a supply crunch

Summarizing Thoughts (2)

+ With the flywheels in place, I expect $JOE to explode once MM Incentives are turned on.

+ Deep Liquidity + LB Model = Fees blackhole

+ Beyond the MM Incentives, market exposure of LB to the masses will be help fuel long term organic growth

+ With the flywheels in place, I expect $JOE to explode once MM Incentives are turned on.

+ Deep Liquidity + LB Model = Fees blackhole

+ Beyond the MM Incentives, market exposure of LB to the masses will be help fuel long term organic growth

Summarizing Thoughts (3)

Really excited about the upcoming developments for $JOE.

All signs point to the inevitable. The Future is $JOE.

Help Like, Share and Retweet if you liked the thread.

Cheers!

Really excited about the upcoming developments for $JOE.

All signs point to the inevitable. The Future is $JOE.

Help Like, Share and Retweet if you liked the thread.

Cheers!

https://twitter.com/Defi_Maestro/status/1622620292966387713?s=20&t=py6zE92Y8JjIOVbITIAAMw

• • •

Missing some Tweet in this thread? You can try to

force a refresh