1/X

robert.p.balan (PAM)

Feb 13, 2023 10:54 AM

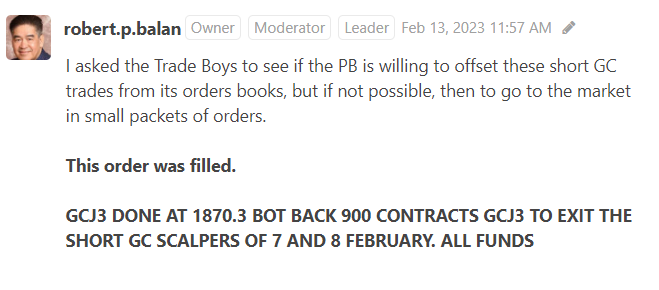

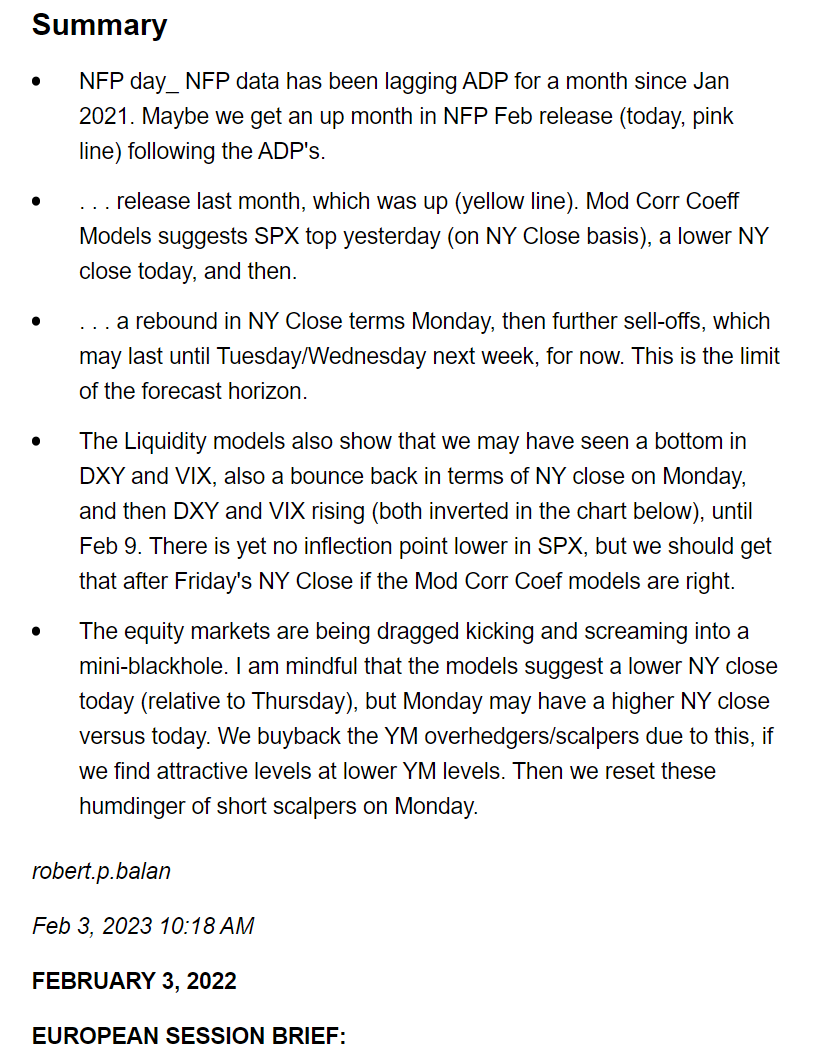

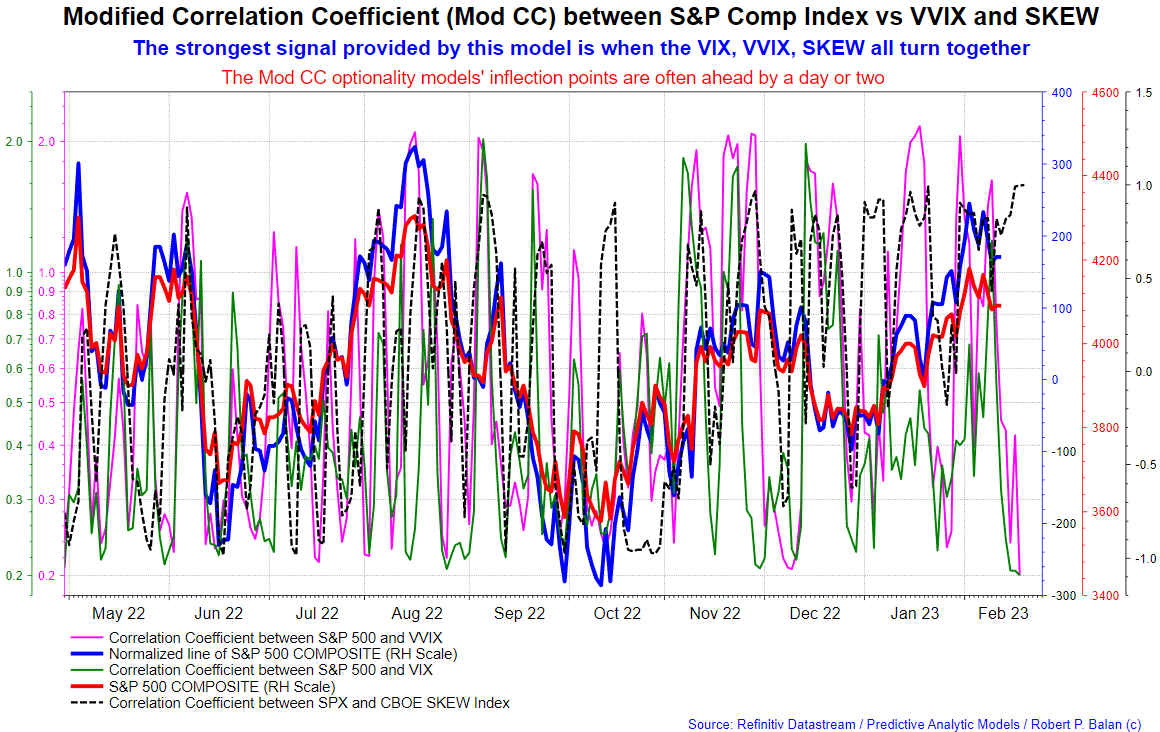

We are seeing a preliminary dtermination (not all factors agree at this time) of a further declines to February 15/17 from the Corr Coeff Model featuring the SPX vs the VIX, VVIX, and SKEW Indexes.

robert.p.balan (PAM)

Feb 13, 2023 10:54 AM

We are seeing a preliminary dtermination (not all factors agree at this time) of a further declines to February 15/17 from the Corr Coeff Model featuring the SPX vs the VIX, VVIX, and SKEW Indexes.

2/X

robert.p.balan (PAM)

Feb 13, 2023 11:08 AM

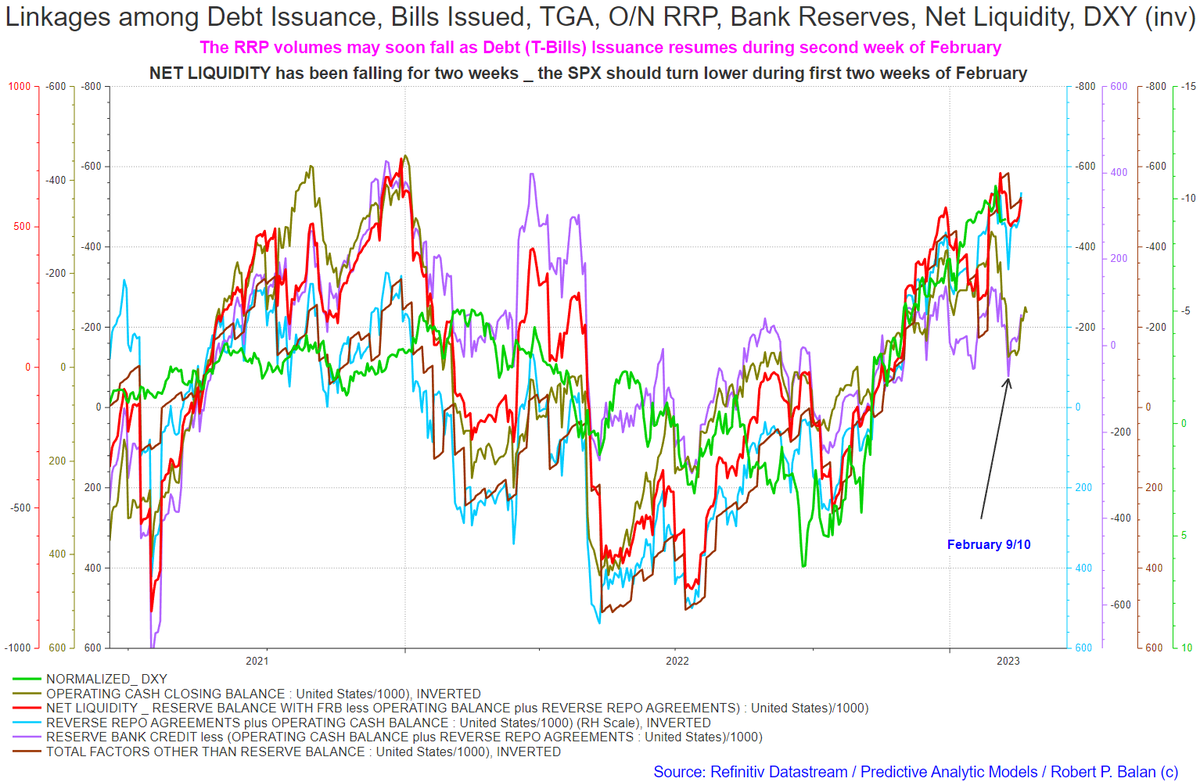

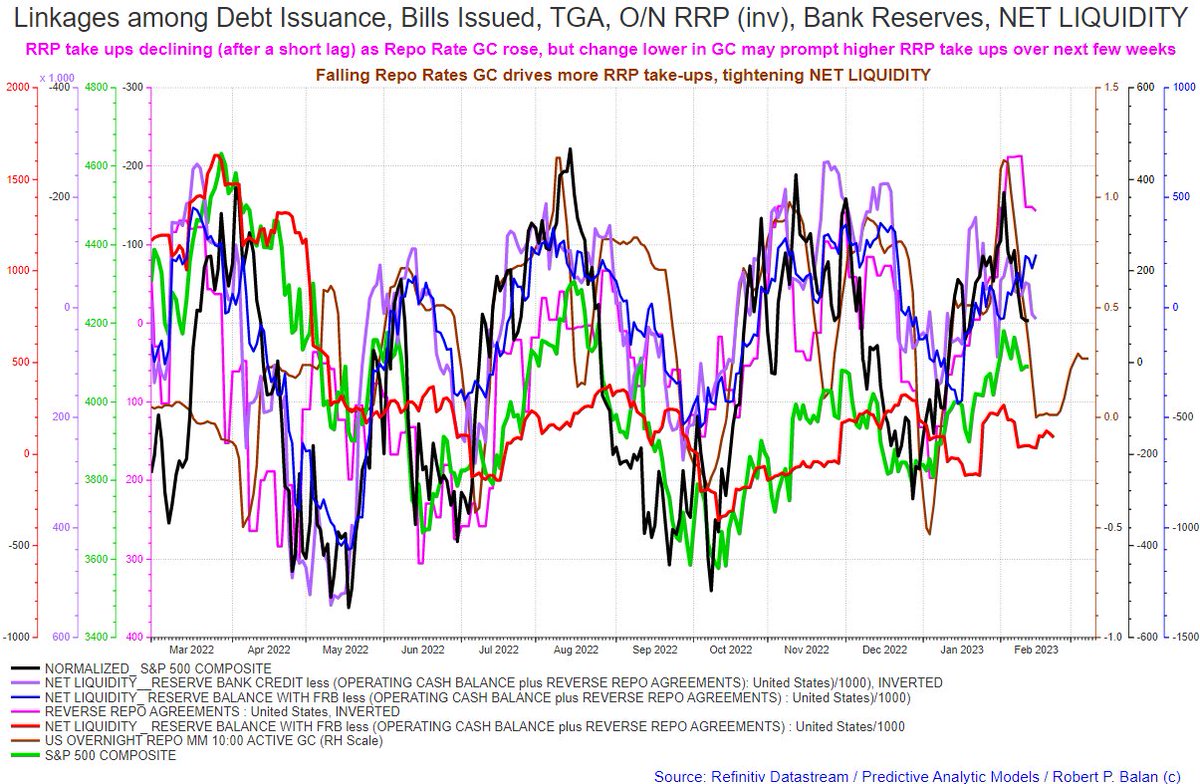

Falling Repo Rates GC drives more RRP take ups, which tightens NET LIQUIDITY. RRP take ups have been declining due to rise in Repo Rates GC, but that changed late last week. Repo Rates are now drifting lower, . . .

robert.p.balan (PAM)

Feb 13, 2023 11:08 AM

Falling Repo Rates GC drives more RRP take ups, which tightens NET LIQUIDITY. RRP take ups have been declining due to rise in Repo Rates GC, but that changed late last week. Repo Rates are now drifting lower, . . .

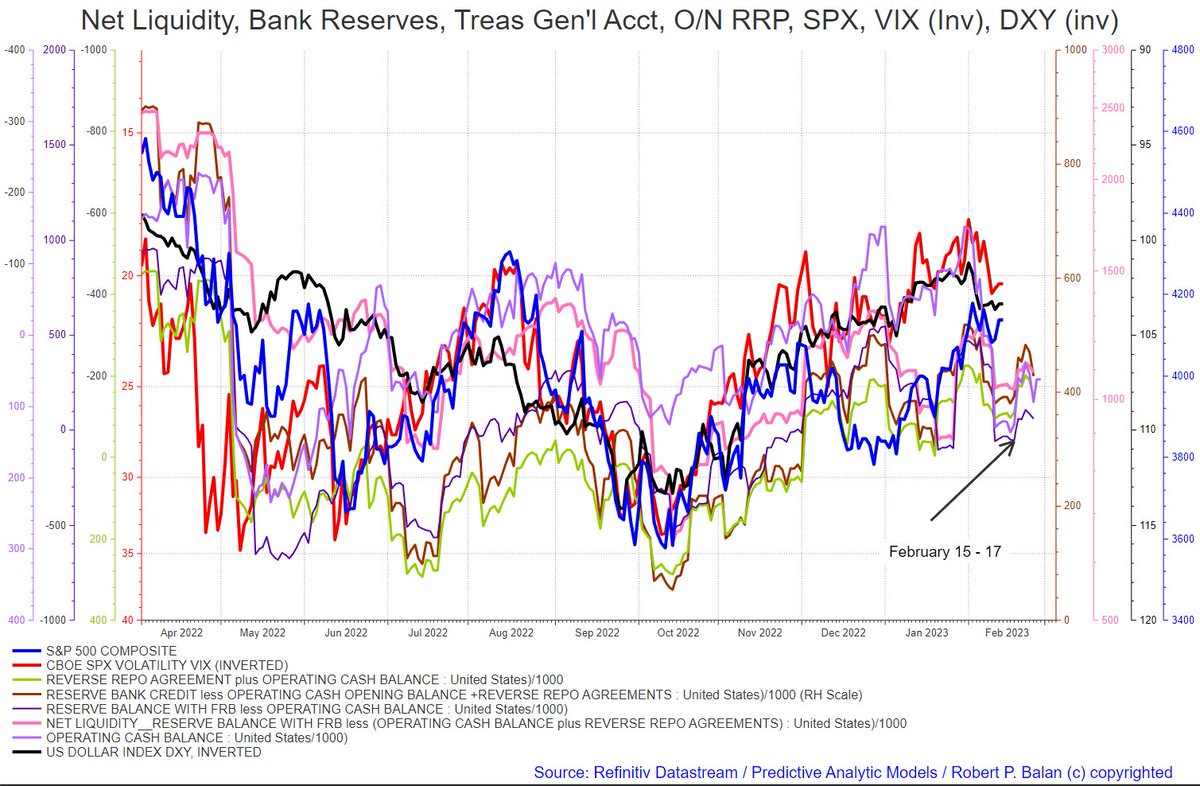

3/X . . . and so RRP takes ups are building again -- followed by falling NET LIQUIDITY -- removing a tail wind for risk assets. Low provided by this model is also Feb 15.

4/X

robert.p.balan (PAM)

Feb 13, 2023 11:08 AM

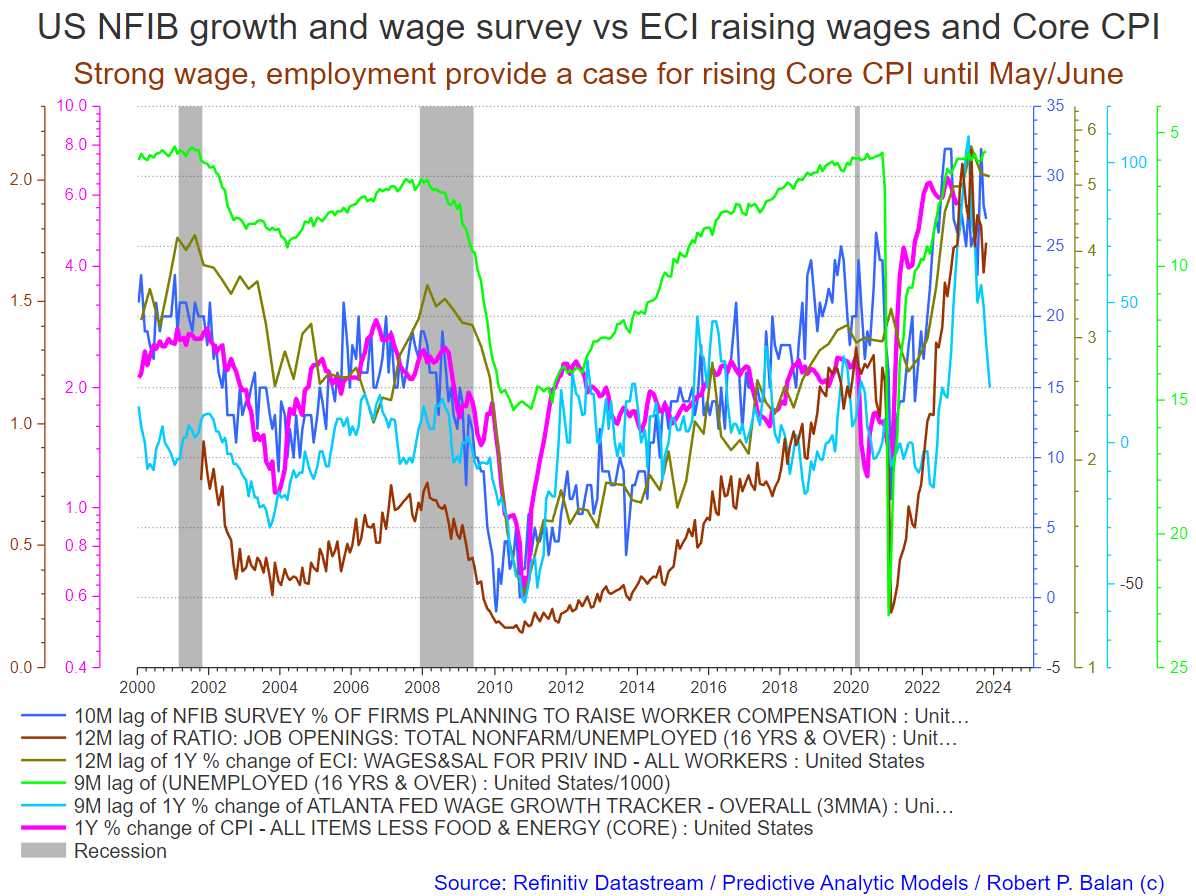

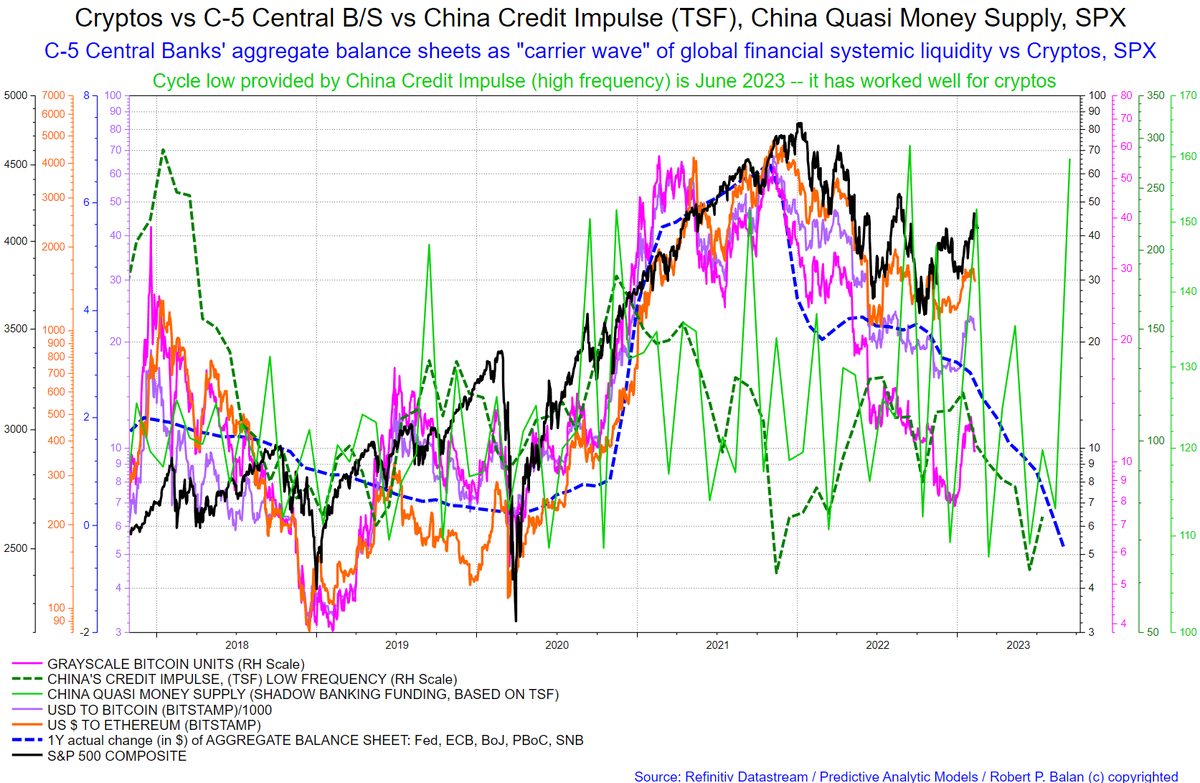

I am getting a sense from the China TSF Model that the weakness in cryptos and equities extends to February 15/17 (short-term), and in the longer term, the current bear phase may go as far as the first two weeks of March . .

robert.p.balan (PAM)

Feb 13, 2023 11:08 AM

I am getting a sense from the China TSF Model that the weakness in cryptos and equities extends to February 15/17 (short-term), and in the longer term, the current bear phase may go as far as the first two weeks of March . .

5/X . . . But with CPI upcoming data, we will square up/hedge up all short positioning by Monday NY session. If we get further declines from here before then, then we may have to buy back some short positioning, if profitable.

6/X

robert.p.balan (PAM)

Feb 13, 2023 11:49 AM

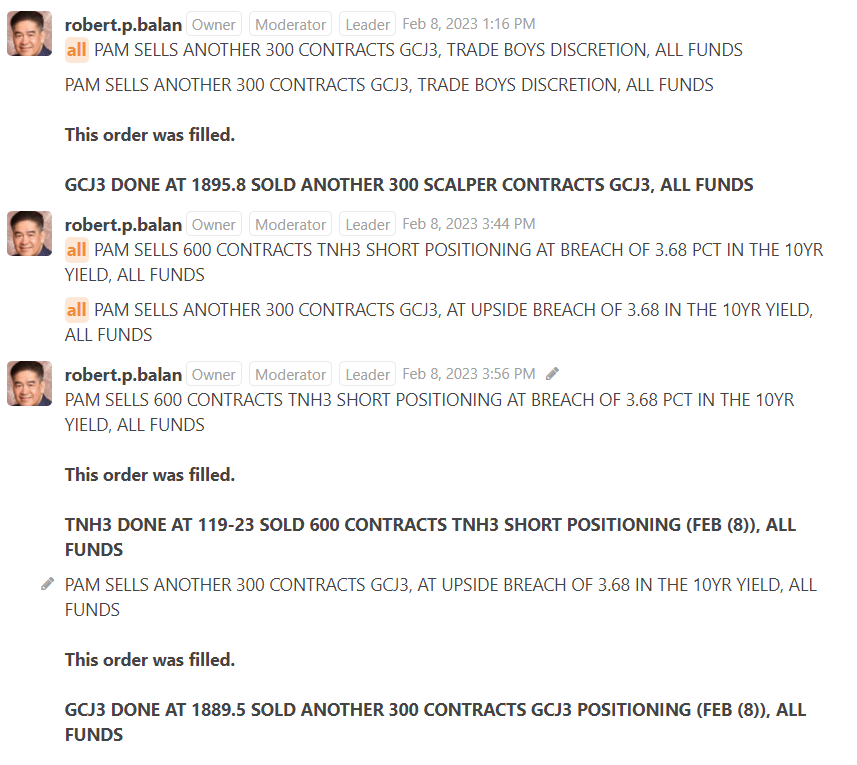

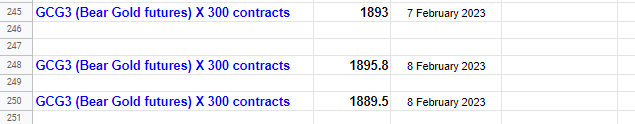

We buy back the 900 contract short Gold scalpers. I asked the Trade Boys to see if the PB is willing to offset these short GC trades from its orders books, but if not possible, then to go to the market in small packets of orders.

robert.p.balan (PAM)

Feb 13, 2023 11:49 AM

We buy back the 900 contract short Gold scalpers. I asked the Trade Boys to see if the PB is willing to offset these short GC trades from its orders books, but if not possible, then to go to the market in small packets of orders.

8/X

robert.p.balan (PAM)

Feb 13, 2023 1:27 PM

As I just told John, I think DXY will decline and pullback to 103.52 and the 10Yr Yield to 3.72 -- that's why I just want to get rid of these large GC positions, which are making money anyway, and so then we start fresh.

robert.p.balan (PAM)

Feb 13, 2023 1:27 PM

As I just told John, I think DXY will decline and pullback to 103.52 and the 10Yr Yield to 3.72 -- that's why I just want to get rid of these large GC positions, which are making money anyway, and so then we start fresh.

9/X

robert.p.balan (PAM)

Feb 13, 2023 1:32 PM

So here comes the DXY falling out of bed. Aren't you glad you bought back your short GCJ3 trades? We are!

robert.p.balan (PAM)

Feb 13, 2023 1:32 PM

So here comes the DXY falling out of bed. Aren't you glad you bought back your short GCJ3 trades? We are!

10/X

robert.p.balan

Feb 13, 2023 4:45 PM

DXY was hammered hard and has been to as low as 103.375 -- but Gold (XAU) remains in the cellar. Strange. The MOTUs aren't allowing Gold to rally . . .

robert.p.balan

Feb 13, 2023 4:45 PM

DXY was hammered hard and has been to as low as 103.375 -- but Gold (XAU) remains in the cellar. Strange. The MOTUs aren't allowing Gold to rally . . .

11/X

robert.p.balan (PAM)

Feb 13, 2023 4:51 PM

These are machinations, realignments ahead of CPI data tomorrow -- which could induce some strange moves. These may mean nothing and the market re-realigns just before release -- unless someone already knows what CPI data would be.

robert.p.balan (PAM)

Feb 13, 2023 4:51 PM

These are machinations, realignments ahead of CPI data tomorrow -- which could induce some strange moves. These may mean nothing and the market re-realigns just before release -- unless someone already knows what CPI data would be.

12/X

robert.p.balan (PAM)

Feb 13, 2023 5:02 PM

It seems apparent that the correction lower in the 10Yr yield may have already bottomed. If there is no new breakthrough upside this time around -- its time for us to buy back the 900 contract short TN trades.

robert.p.balan (PAM)

Feb 13, 2023 5:02 PM

It seems apparent that the correction lower in the 10Yr yield may have already bottomed. If there is no new breakthrough upside this time around -- its time for us to buy back the 900 contract short TN trades.

13/X

robert.p.balan (PAM)

Feb 13, 2023 5:20 PM

DXY will recover in about half an hour, and follow the 10Yr Yield higher. But equities are rallying in the meanwhile because equity retail has the indexes mapped to DXY. Let's see what happens next.

robert.p.balan (PAM)

Feb 13, 2023 5:20 PM

DXY will recover in about half an hour, and follow the 10Yr Yield higher. But equities are rallying in the meanwhile because equity retail has the indexes mapped to DXY. Let's see what happens next.

14/X

robert.p.balan (PAM)

Feb 13, 2023 6:17 PM

I was DMed and asked if I plan to reset the short Gold trades. I am sorely tempted to do so (given that the MOTUs seem unwilling to let Gold rise). But today, we are in the risk mitigation mode, and anyway . . .

robert.p.balan (PAM)

Feb 13, 2023 6:17 PM

I was DMed and asked if I plan to reset the short Gold trades. I am sorely tempted to do so (given that the MOTUs seem unwilling to let Gold rise). But today, we are in the risk mitigation mode, and anyway . . .

15/X . . . we still have 300 contracts short GCJ3 that is just about to break even. So no -- unless we see DXY pirouette-ing smartly higher. Mr. TK shakes his head.

• • •

Missing some Tweet in this thread? You can try to

force a refresh