GMX 和 SNX Perp 的新版本都不约而同的借鉴了一个项目 - GNS,GNS 从去年 Luna 危机至今上涨 10倍有余,交易量和费用收入也屡创新高,这离不开其在机制上的不断创新。本文将为你详细介绍 GNS 的机制,发展历史及其竞争优势。可以说看懂 GNS 就能一眼看穿诸多 DEX PERP👇(1/n)

capitalismlab.substack.com/p/gns-defi?utm…

capitalismlab.substack.com/p/gns-defi?utm…

特别提醒:本文较为复杂,建议在阅读本文时主要看我提炼的要点。(2/n)

A. GNS 的机制

如果你对 GNS 缺少基本的了解,简单来说其为一个去中心化永续合约平台:

1. 预言机定价,LP 和 Trader 对赌

2. LP 为纯稳定币,支持 外汇/ 股票/ 加密货币 交易

3. 双向资金费率,一方向另一方支付费用

另外可以阅读下面我此前写的 GNS 中文百科(3/n)

如果你对 GNS 缺少基本的了解,简单来说其为一个去中心化永续合约平台:

1. 预言机定价,LP 和 Trader 对赌

2. LP 为纯稳定币,支持 外汇/ 股票/ 加密货币 交易

3. 双向资金费率,一方向另一方支付费用

另外可以阅读下面我此前写的 GNS 中文百科(3/n)

https://twitter.com/NintendoDoomed/status/1582734943775444992?s=20

对赌模式的核心是风险控制,我们之前讨论过GMX是全额保障模式,即每 1ETH 多仓GLP底层均有 1ETH 现货支持这一点,让 GMX 可以安然度过狂暴大牛市。那底层只有稳定币的 GNS 是如何应对风险的呢? (4/n)

https://twitter.com/NintendoDoomed/status/1623986825303044097?s=20

GNS 在交易侧和LP侧各设有三重机制控制风险,其核心为:

1. 资产现货流动性决定场内交易滑点,防止价格操纵

2. 资产价格波动性和多空比决定持续持仓成本,应对单边行情

3. 净值模式加上流动性调节以及现金流循环,构建稳健的 LP (5/n)

1. 资产现货流动性决定场内交易滑点,防止价格操纵

2. 资产价格波动性和多空比决定持续持仓成本,应对单边行情

3. 净值模式加上流动性调节以及现金流循环,构建稳健的 LP (5/n)

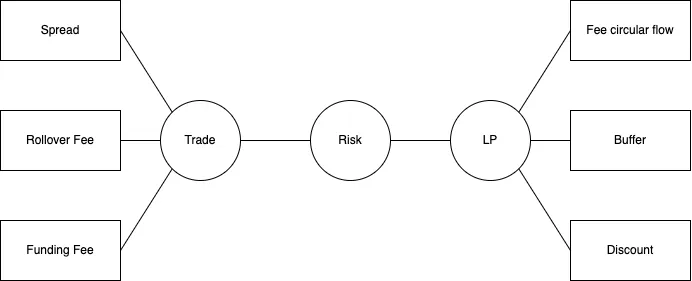

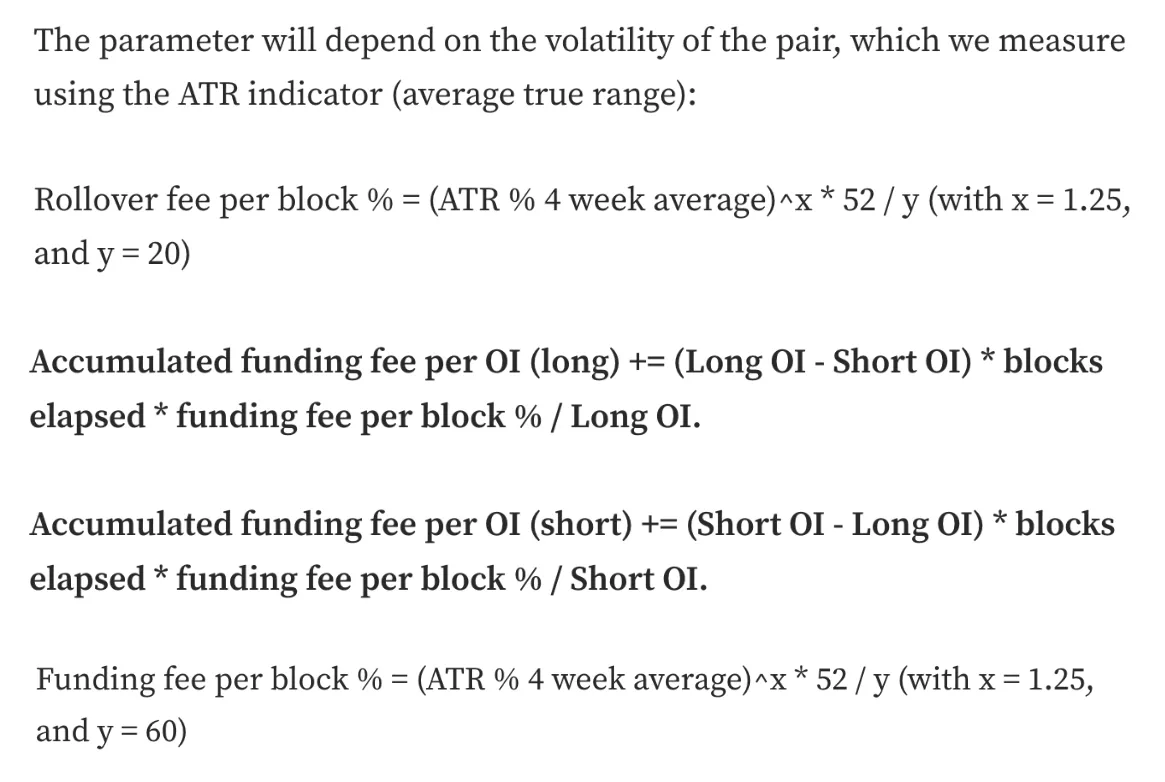

GNS 使用了 Spread, Rollover Fee, Funding Fee 三重机制来进行交易侧的风险控制。

1. Spread: 额外的开仓费用,开仓头寸越大,资产流动性越差,费用就越高。用于预防价格攻击,便于上架小币种。

2. Rollover Fee: 现货波动率来定价,用于控制交易者的杠杆和风险 (6/n)

1. Spread: 额外的开仓费用,开仓头寸越大,资产流动性越差,费用就越高。用于预防价格攻击,便于上架小币种。

2. Rollover Fee: 现货波动率来定价,用于控制交易者的杠杆和风险 (6/n)

Funding Fee: 多空头寸之差和现货波动率来定价,多/空>1 时多头支付空头,反之亦然,用于平衡多空比,避免单边敞口过大。

详情参见👇 (7/n)

medium.com/gains-network/…

详情参见👇 (7/n)

medium.com/gains-network/…

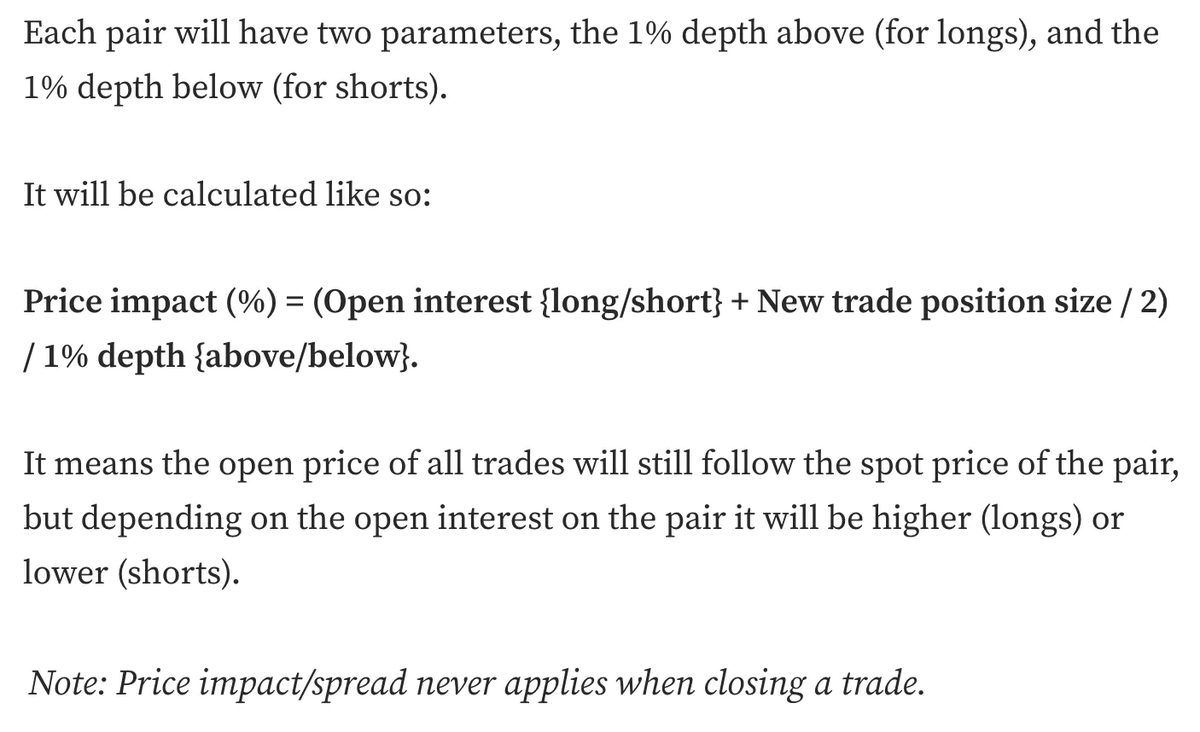

Spread 是开仓时需要付出的额外滑点。对于预言机定价而言,其滑点应该根据预言机来源(CEX)的交易对的深度而动态调整,使得在场外操纵价格的成本始终高于在场内的盈利。所以 Spread 正相关开仓规模和场内OI影响,而负相关于场外现货深度。公式参见下图 (8/n)

Rollover Fee / Funding Fee 根据近期波动性计算, Rollover Fee多空均要缴纳,而 Fung Fee 则由多空比例决定由一方支付给另一方,具体公式参见下图。在狂暴大牛市下,波动性和多空比的加大将会让多方支付的费用快速上涨,以此回补作为对手方的损失以及控制多空比。(9/n)

当然,这些也造成了其不菲的交易成本,所以在加密货币这种可以做 Index Asset LP 的资产类别上,体量会逊于GMX。而对于股票/外汇这种没有链上资产的类别,其就极具优势。(10/n)

所谓 Rollover Fee 仅作用在抵押物上,就是你拿 $1k 开 $10k 的头寸,只按你 $1k 收利息, 而Funding Fee 作用在头寸上, 按$10k 收 41%。比如下图 $1k 开空 $10k BTC, Funding Fee (s) = -0.0005%, Rollover Fee = 0.0043%。(11/n)

那么最终需要支付的 Fee = ($1k *0.0043% - $10k 0.0005%)/$10k = -0.00007%/h, 就是这时候开空还是可以赚利息的。 (12/n)

LP 侧- gDAI 也有三重机制使其稳健运行:

1. 类似 GLP 的净值型产品,不保本

2. 费用收入 / Trader 盈亏为 gDAI 创造出一层buffer,避免价格下跌

3. 激励长期锁仓资金,动态调节进出时间,避免极端情况流动性问题 (13/n)

1. 类似 GLP 的净值型产品,不保本

2. 费用收入 / Trader 盈亏为 gDAI 创造出一层buffer,避免价格下跌

3. 激励长期锁仓资金,动态调节进出时间,避免极端情况流动性问题 (13/n)

所谓净值型产品的优势在于,公平对待所有质押者,极端情况共同承担。而老的 LP 模式是所谓保本的,但是赤字下,最后一个跑路的拿不到一分钱,是的,就跟 FTX 是一个道理,那么在危机关头自然更容易恐慌。(14/n)

所谓 Buffer 是 ,GNS 的费用收入中,有一部分会 Mint 新的 GNS 支付给用户,而原本作为收入的 DAI 则进入 gDAI 中构成超额抵押的 Buffer,Trader 的盈亏在超额抵押情况下也会进入 Buffer,这使得 gDAI 虽然名义上不保本,但实际上大部分时间价格都不会下降,可见深知大众“损失厌恶”心理。 (15/n)

GNS 同时在超额抵押的情况 从 Trader 亏损带来的盈利中抽取一部分用于回购 GNS, 保持超额抵押率在安全范围内波动,这样的话长期来看 GNS 不会因此持续增发。 (16/n)

LP 长期锁仓会给其一定的折扣,折扣的资金来源也是从这个 Buffer 中支出的。而所谓的动态调节,就是超额抵押率越低提款越慢,增加抗风险能力。虽然这么干有点怪,但是规则是提前公开透明的。(17/n)

是的,你可能没看懂上面这几段话,这是正常的,不然我怎么称之为史上最复杂呢。如果你实在想搞明白,可以先阅读完 gDAI 介绍原文👇 ,然后再回头再看上面这几段话,相信能解决你心中不少疑惑。(18/n)

medium.com/gains-network/…

medium.com/gains-network/…

B. 发展历史

参见下方推文,在 Luna 带来的崩盘中,GNS 的LP 一度陷入赤字僵局,被迫出售 GNS 换 DAI 来补缺口。后来 GNS 进行了多方改进,在 FTX 引起的恐慌中表现良好。(19/n)

参见下方推文,在 Luna 带来的崩盘中,GNS 的LP 一度陷入赤字僵局,被迫出售 GNS 换 DAI 来补缺口。后来 GNS 进行了多方改进,在 FTX 引起的恐慌中表现良好。(19/n)

https://twitter.com/NintendoDoomed/status/1590772763471798273?s=20

实际就在 6月,前文所述的交易侧三重风控机制就已上限,使其恢复了正常运营,并在9月 开始捕获到了当时外币对美元大贬值的热点,重回大众视野。在12月初,gDAI 上线,月底部署到了 Arbitrum,带来了今年初无论是币价还是业务数据的爆发。高效率的团队让 GNS 不断进化才有了如此凤凰涅槃之象。(20/n)

C. 竞争优势

核心就是在通过其复杂的风控机制,提供了一个体验合格的外汇/股票衍生品交易场所,在这些资产上交易体验独占鳌头,让其产品能够立的住。另一方面双向资金费率等又让其和 GMX 实现了差异化竞争,在加密货币方面也成功获取了部分客户。做到这些离不开 GNS 团队的优秀,这是最宝贵 (21/n)

核心就是在通过其复杂的风控机制,提供了一个体验合格的外汇/股票衍生品交易场所,在这些资产上交易体验独占鳌头,让其产品能够立的住。另一方面双向资金费率等又让其和 GMX 实现了差异化竞争,在加密货币方面也成功获取了部分客户。做到这些离不开 GNS 团队的优秀,这是最宝贵 (21/n)

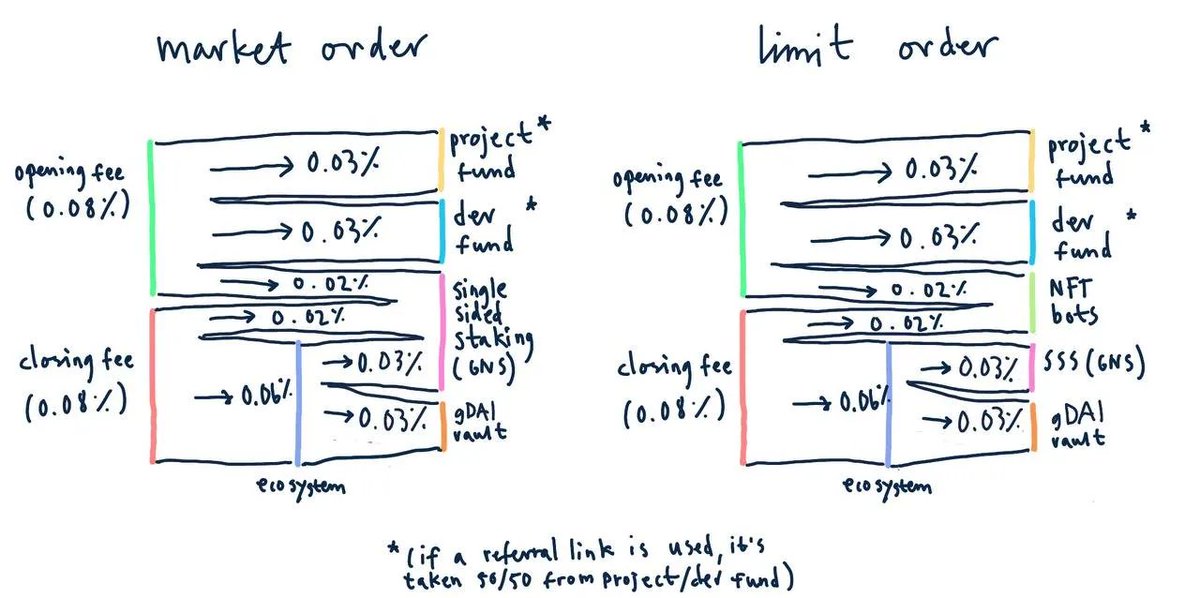

GNS 的费用去向明细如下图,考虑到市价单约占比 70%,因此 GNS Staking 分成约为 0.07/0.16x70%+0.03/0.16x70% = 36.25%, gDAI 分成约为 0.03/0.16 = 18.75% 。其中限价单中支付给 NFT Bots (执行机器人) 的部分即是上一条推文中进入 gDAI Buffer 的部分。(22/n)

是的,GNS 支付给 LP 的收入比例罕见的低,那么其为何能做到这一点呢?

1. 为了避免 Fork ,GNS 虽有审计但尚未完全开源

2. 如之前的推文所述,其机制极为复杂,挺难抄的,没抄好容易翻车

3. 非全额抵押模式的LP,让其可以在高资本效率下运作 (23/n)

1. 为了避免 Fork ,GNS 虽有审计但尚未完全开源

2. 如之前的推文所述,其机制极为复杂,挺难抄的,没抄好容易翻车

3. 非全额抵押模式的LP,让其可以在高资本效率下运作 (23/n)

虽然 GNS 看上去给团队分了一大部分收入,不过其实目前现在大部分项目,比如UNI, Maker , Lido 等,其国库收入也不能或着只能勉强覆盖团队支出,所以仍需要不断卖币,而 GNS 靠收入分成就能过活其实算蛮不错了,毕竟你也不能要求每个团队都跟 GMX 那种慈善团体一样。(24/n)

总结

读到这里,想比你也会感叹,实际上所谓 DEX Perp,远远不是一句 Trader 和 LP 互为对手方这么简单的。所以直到 GMX 使用了低风险的 Index Asset 全额抵押模式,加上优秀的细节打磨才终于出现一款有人用的产品。(25/n)

读到这里,想比你也会感叹,实际上所谓 DEX Perp,远远不是一句 Trader 和 LP 互为对手方这么简单的。所以直到 GMX 使用了低风险的 Index Asset 全额抵押模式,加上优秀的细节打磨才终于出现一款有人用的产品。(25/n)

然而要交易外汇/股票这些未上链的资产,进一步把蛋糕做大,必须使用 GNS 这种合成资产模式,也是迭代到今天我们才终于看到了曙光。

致敬 Builder。

(n/n)

致敬 Builder。

(n/n)

GNS 也有推荐计划, 比如: gains.trade/referred?by=po…。

不过至少需要 1k twitter 或 youtube 粉丝才能申请推荐链接,还要经过评估和审核,有需求可以来找我喵。

更多 GNS 资讯与讨论:

GNS 中文推特:twitter.com/gainsnetworkcn

GNS 中文官方社群地址:t.me/GNSChinese

不过至少需要 1k twitter 或 youtube 粉丝才能申请推荐链接,还要经过评估和审核,有需求可以来找我喵。

更多 GNS 资讯与讨论:

GNS 中文推特:twitter.com/gainsnetworkcn

GNS 中文官方社群地址:t.me/GNSChinese

关注妙蛙种子@NintendoDoomed 喵, 关注妙蛙种子谢谢喵。

问题太多不能逐一私信回答,有问题请进妙蛙种子的交流群提问喵:t.me/NintendoDoomed

如果你觉得有帮助,请点赞转发Thread第一条推文(先点进去再操作~)👇

问题太多不能逐一私信回答,有问题请进妙蛙种子的交流群提问喵:t.me/NintendoDoomed

如果你觉得有帮助,请点赞转发Thread第一条推文(先点进去再操作~)👇

https://twitter.com/NintendoDoomed/status/1626089972871876608?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh