One of the most important lessons I have taken from the ICT mentorship was from month 1, which was identifying HRLR and LRLR

Here's a thread on why they are so important to ones trading 🧵

Here's a thread on why they are so important to ones trading 🧵

Firstly, lets define the terms

HRLR = High Resistance Liquidity Run

LRLR= Low Resistance Liquidity Run

HRLR = High Resistance Liquidity Run

LRLR= Low Resistance Liquidity Run

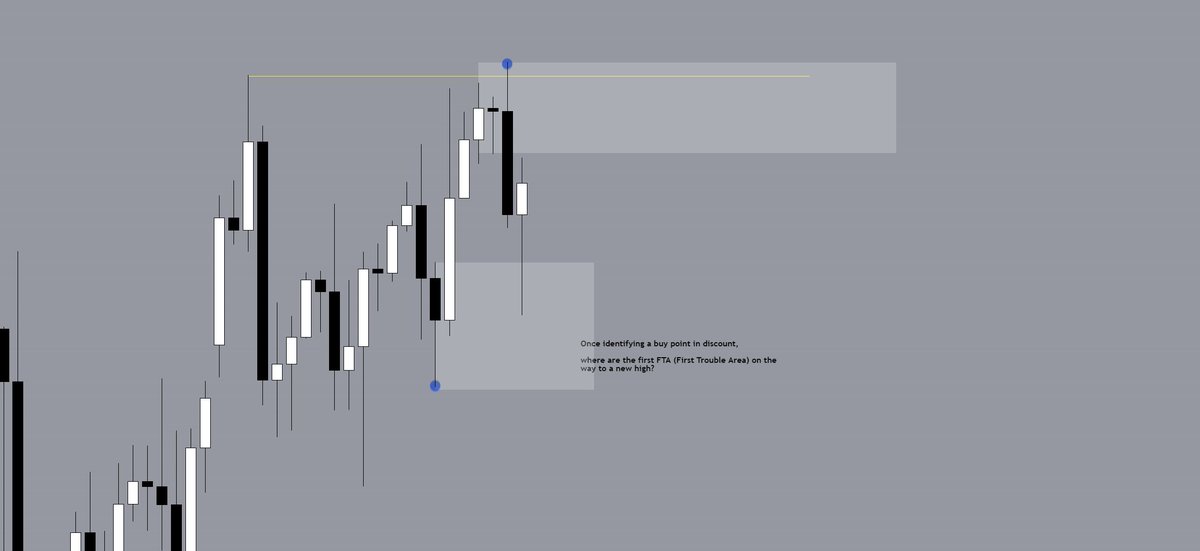

🔹 A HRLR Is a scenario, where the market may have to fight multiple resistance points to reach up into an objective, these conditions are typically less favorable

🔸Inversely, LRLR are scenarios where the market will have an easier time to run out an area of liqidity

🔸Inversely, LRLR are scenarios where the market will have an easier time to run out an area of liqidity

Now, lets use this football illustration as an analogy

In this scenario, if you have 7 defenders guarding the goal post, it'll make it that much more difficult for the offense to score, as the path to the goal is met with "resistance"

This is similar to a HRLR signature

In this scenario, if you have 7 defenders guarding the goal post, it'll make it that much more difficult for the offense to score, as the path to the goal is met with "resistance"

This is similar to a HRLR signature

However, in this scenario, lets say the offense is only met with 3 defenders back guarding the goal post

In this event, the path to the goal is met with less "resistance" and it makes it that much easier for the offense to score

This is similar to a LRLR signature

In this event, the path to the goal is met with less "resistance" and it makes it that much easier for the offense to score

This is similar to a LRLR signature

Now, we typically want to be in a position, where the market is showing signs of LRLR, as our trades would move faster, and more effectively

In this NEW video, I go in depth on the concepts using a trade example I took this week

In this NEW video, I go in depth on the concepts using a trade example I took this week

• • •

Missing some Tweet in this thread? You can try to

force a refresh