I think folks are sleeping on one of the biggest and most obvious "zero interest rate phenomena" that's going to get vaporized slowly and then all at once: Andreessen Horowitz

Here's my thesis:

Here's my thesis:

In recent years a16z built an incredible machine to accumulate "assets under management" (AUM) to the tune of tens of billions of dollars. Nominally they were supposed to be doing venture capital—investing in startups and entrepreneurs—but really they were making a different play

As I laid out in 2021, they (along w hedge funds like Tiger) identified there were vast pools of capital searching for *any* returns in the zero-interest-rate wasteland and came up with a fundamentally different strategy from the traditional VC model

https://twitter.com/tylertringas/status/1454102038539866117?s=20

Instead of seeking "home run" returns, they'd move giant piles of cash into growth-stage tech companies. Instead of trying to get a sensible valuation so they could get a huge return, they'd just try to put in 10s/100s of millions at whatever valuation got the deal done quickly

They led the charge on the "lol valuations don't matter" approach that defined 2019-2022 venture capital with deals like the one valuing Clubhouse at $4B or Hopin at $6B. businessinsider.com/clubhouse-andr…

Along the way, they probably nuked the returns of just about every seed fund as well, which is another story entirely

https://twitter.com/tylertringas/status/1454102041488510982?s=20

But now they face two massive risks (1) their most recent vintage funds (which represent the vast majority of all capital ever invested by the firm) are probably in huge trouble & (2) their AUM aggregation pitch makes zero sense when you can get 4% yield on savings accounts again

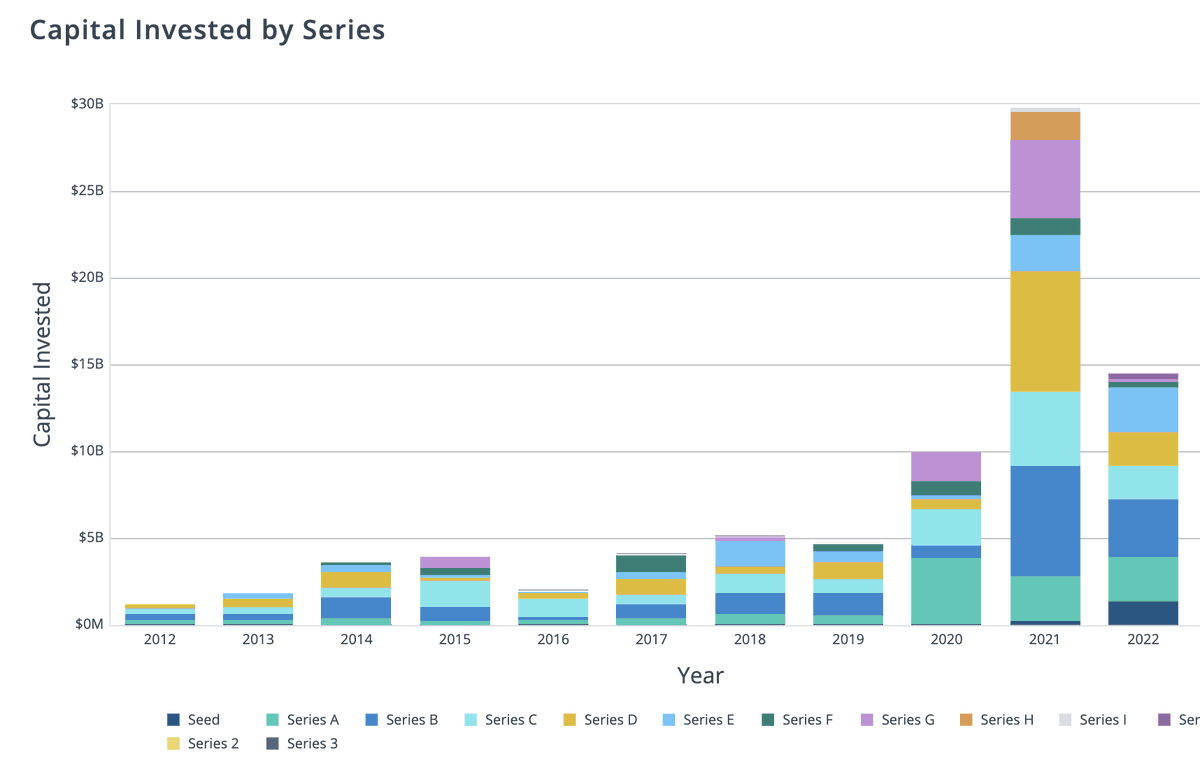

In the chart above (from Pitchbook) you can see the vast majority of all the capital ever raised by the firm spans 2019-2022, with much of that likely invested over that period. Those funds contain huge bets on (1) crypto (2) late-stage tech "unicorns"

a16z was early and all-in on crypto. Their first $300m crypto fund, invested at the start of the bubble, was reported to have generated eye-popping returns, which they parlayed into raising and investing $7B+ more in crypto funds in a giant double-or-nothing bet

Time will tell, but personally, I think those massive crypto funds are toast. web3 is dead, and now that we've had the super bowl ads phase of the hype cycle, there just isn't another wave of greater fools coming to pump up prices and end the crypto winter.

Second, you can see in this chart, they massively shifted their allocation to investing in later-stage Series B-G venture rounds, meaning they took huge positions in startups valued at billions or tens of billions.

It's now consensus that those valuations made no sense & equity in similar startups are regularly trading in secondary markets at huge 50%+ discounts to their last VC round. Only the fact that these are private market portfolios will delay the actual realization of those losses.

The nature of private markets means it will take some time for this to all shake out, but the fate of the billions invested in these two strategies (which again is the vast majority of all capital ever invested by the firm) is probably locked in.

At the same time, demand is cooling for the style of money-firehosing the firm developed a specialization in. Less risky assets offer attractive yields again, and mega pools of capital are likely souring on this model as interest rates rise.

Case in point: a16z's two closest peers in the mega-VC strategy...

Tiger is scaling back its venture fundraising wsj.com/articles/tiger…

And Sequoia voluntarily cut management fees in anticipation of a much slower market: reuters.com/business/finan…

Tiger is scaling back its venture fundraising wsj.com/articles/tiger…

And Sequoia voluntarily cut management fees in anticipation of a much slower market: reuters.com/business/finan…

The massive stream of fees they've accumulated from tens of billions in AUM can certainly sustain the firm for a very long time, but it's hard for me to see how this doesn't end, like so many aspects of the fever dream of zero interest rates, gradually then suddenly

that being said, they have the most valuable asset in venture capital: being considered a name brand "tier 1" firm. Which in a world of very slow feedback loops, matters more than anything else.

So maybe I'll be right about the facts but wrong about the outcome. We'll see.

So maybe I'll be right about the facts but wrong about the outcome. We'll see.

• • •

Missing some Tweet in this thread? You can try to

force a refresh