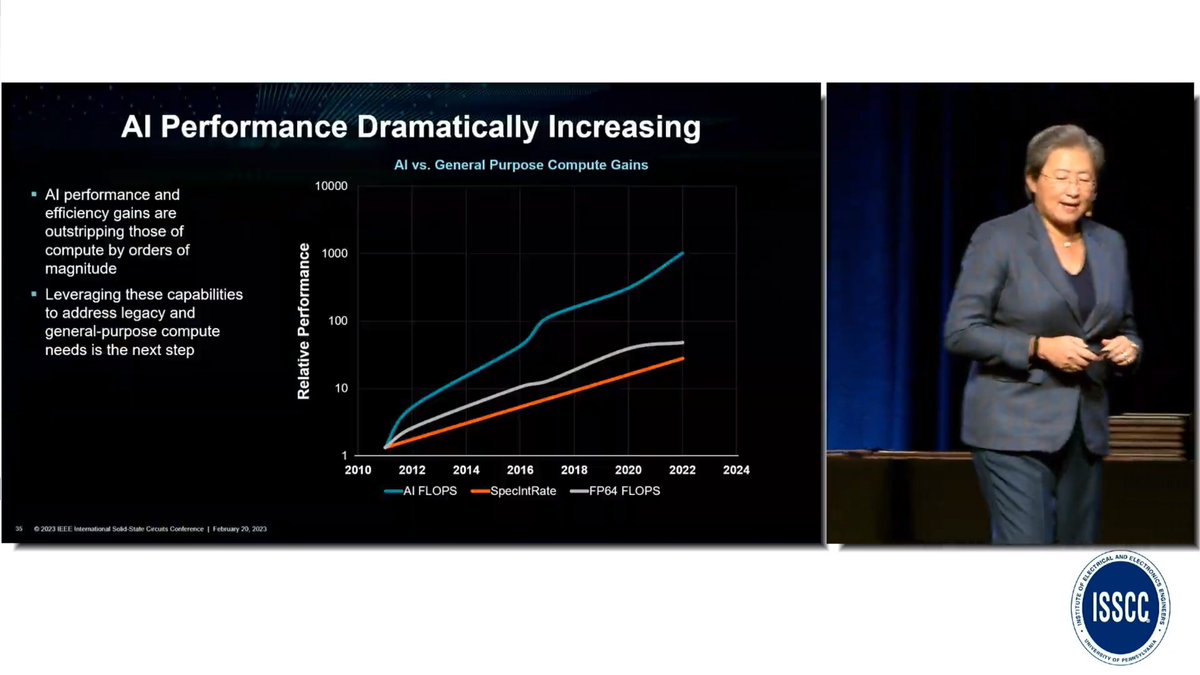

@AMD @LisaSu Mainstream Server Performance - 2P SpecInt Rate. Includes AMD, Intel, Arm. Doubling every 2.4yrs.

@AMD @LisaSu CPUs are 2x perf every 2.4 years

Supercomputers 2x perf every 1.2 years

Systems aren't small, systems aren't cheap!

Supercomputers 2x perf every 1.2 years

Systems aren't small, systems aren't cheap!

@AMD @LisaSu Performance is all well and good, but efficiency matters more. Efficiency isn't increasing at the same pace. It's a harder problem to solve

@AMD @LisaSu Given constant efficiency gain, Zettascale will need 500MW in 2034. Not going to be possible

@AMD @LisaSu That's scaling from 52 GF/watt today to 2140 GF/watt in that time. It means in the next decade, efficiency matters more than perf to continue scaling

@AMD @LisaSu Process technology continues to be important, harder to get density and efficiency perf

@AMD @LisaSu IO doesn't scale. Energy per bit is reducing, but not when normalised to channel quality

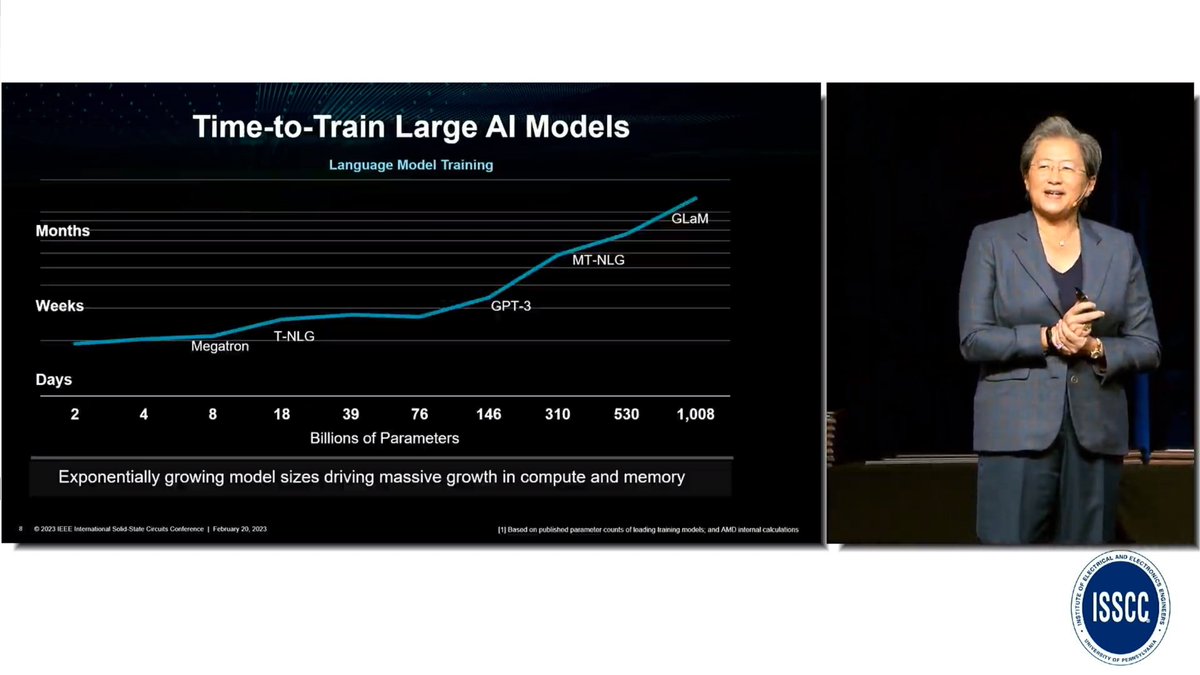

@AMD @LisaSu Memory power also going up substantially due to bandwidth and capacity requirements of the new workloads

@AMD @LisaSu AMD focuses on efficiency through advanced architecture. Using the right technology for the right node. Heterogeneous compute with the right solution

@AMD @LisaSu Exploit arch innovations, packaging advances, and silicon advances. MI250 systems power 4 out of top 5 Green500 spots. 2.5D integration with HBM, blended HPC and AI perf

@AMD @LisaSu 3D integration technology still maturing for high volume. Logic on logic would be a massive breakthrough. Reducing the cost of communication

@AMD @LisaSu Next gen GPU accelerator

HPC and AI

MI300

CPU+GPU in one package

5nm, 3D Stacking

Quantized format support

Unified memory APU architecture

HPC and AI

MI300

CPU+GPU in one package

5nm, 3D Stacking

Quantized format support

Unified memory APU architecture

@AMD @LisaSu 'Need to leverage AI more holistically, not just menial tasks.'

Basically use AI to get the best power/perf/area/cost on chips. Insert EDA vendors

Basically use AI to get the best power/perf/area/cost on chips. Insert EDA vendors

@AMD @LisaSu AI accelerated HPC. Lots of work to be done in the algorithms. @FelixCLC_ this is your bag

@AMD @LisaSu @FelixCLC_ 'Coming to ISSCC is like coming to speak to the smartest people on the planet'

What about Hot Chips Lisa 🥹😢

What about Hot Chips Lisa 🥹😢

@AMD @LisaSu @FelixCLC_ 5-10yr vision on semiconductor R&D for US needs all disciplines to work together, no silver bullet, lots of work on arch, materials, process, system innovation. Need to bring all together to solve large challenges. Brings out the best in all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh