Many conflicting prophecies on economy and markets. A 🧵on how they could fit:

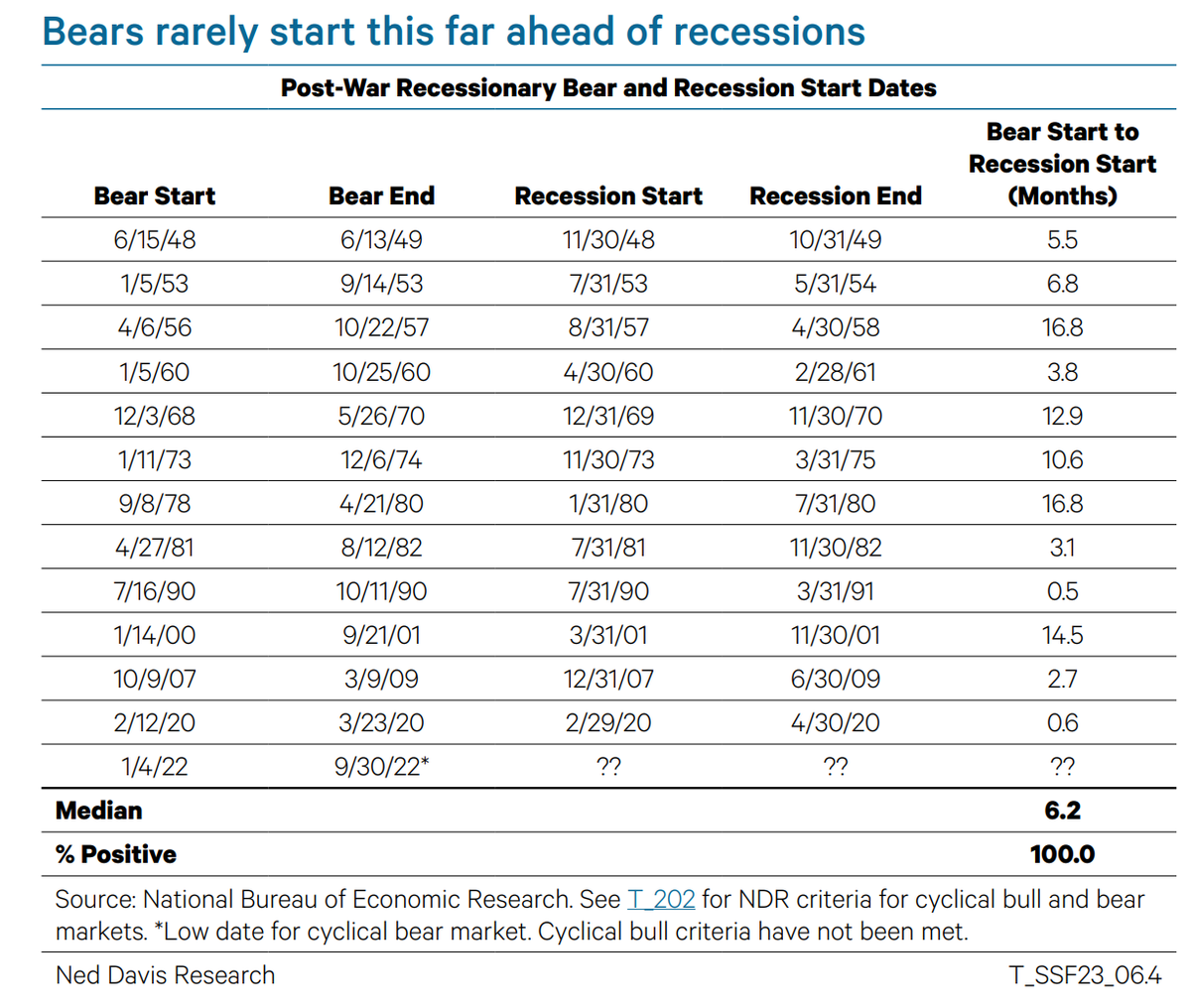

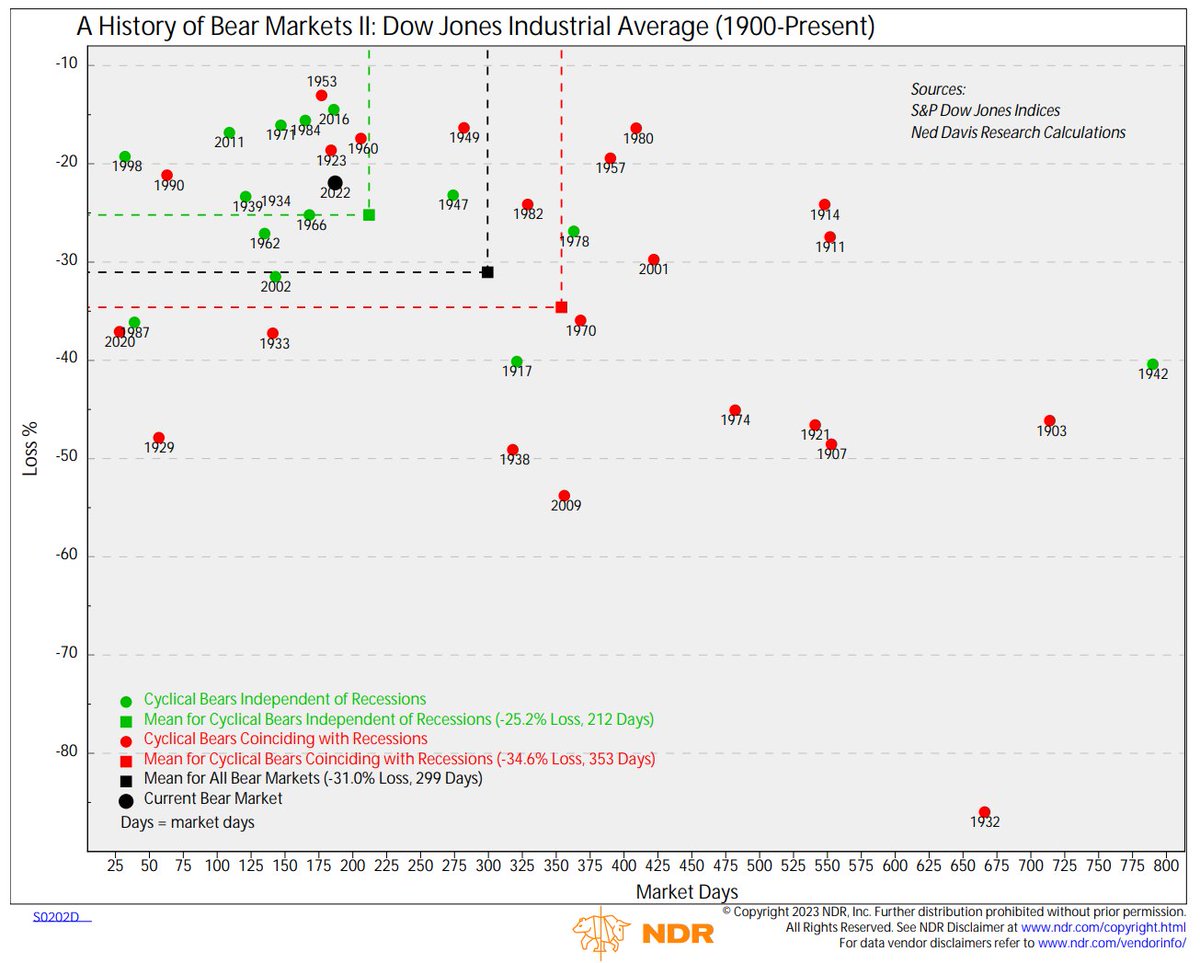

A bear market has never ended before the start of a recession. Most economists say US is not in recession but it's likely so logical conclusion is lows are not in place. Makes sense. @NDR_RESEARCH 1/9

A bear market has never ended before the start of a recession. Most economists say US is not in recession but it's likely so logical conclusion is lows are not in place. Makes sense. @NDR_RESEARCH 1/9

Powell has repeatedly said he is willing to push the economy into recession to get inflation in check. Bears end a median of 14 months after the last hike. The Fed is expected to hike again on March 22, implying the bear could continue well into 2024. 2/9

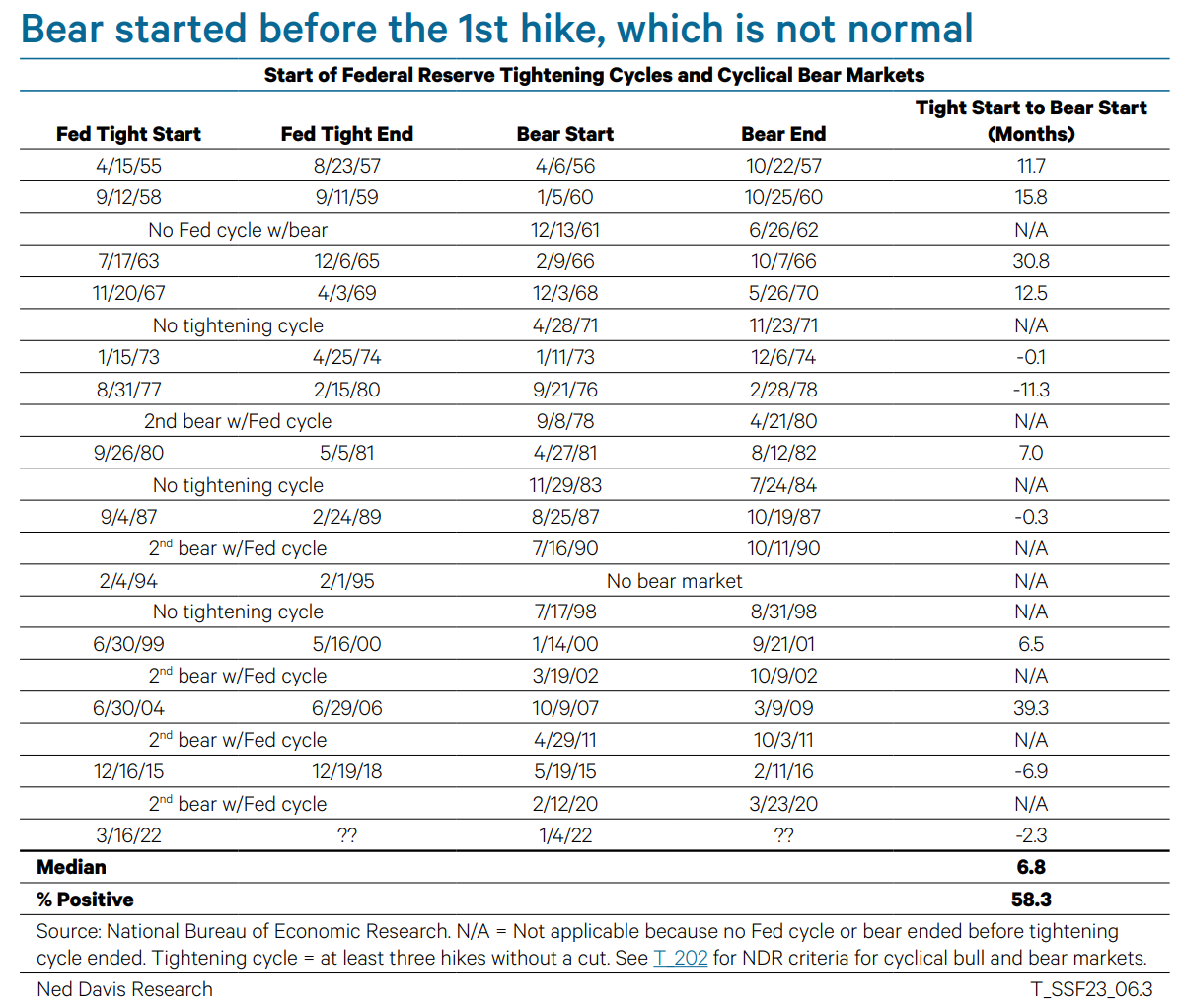

But…the stock market started pricing in the Fed and economic cycles earlier than normal. Bears start a median of 7 months after the 1st hike. This bear started 2.3 months before. The lead time was longer only twice before: 2015 (QE3 ended) and 1978 (we’ll come back to that). 3/9

The market was even further ahead of the economy. Bears start a median of 6 months before recessions. Longest is 17M (1956 & 1978). Recent data imply a recession is not imminent. If recession is pushed to late 2023 or 2024 there is no precedent for staying in a bear that long 4/9

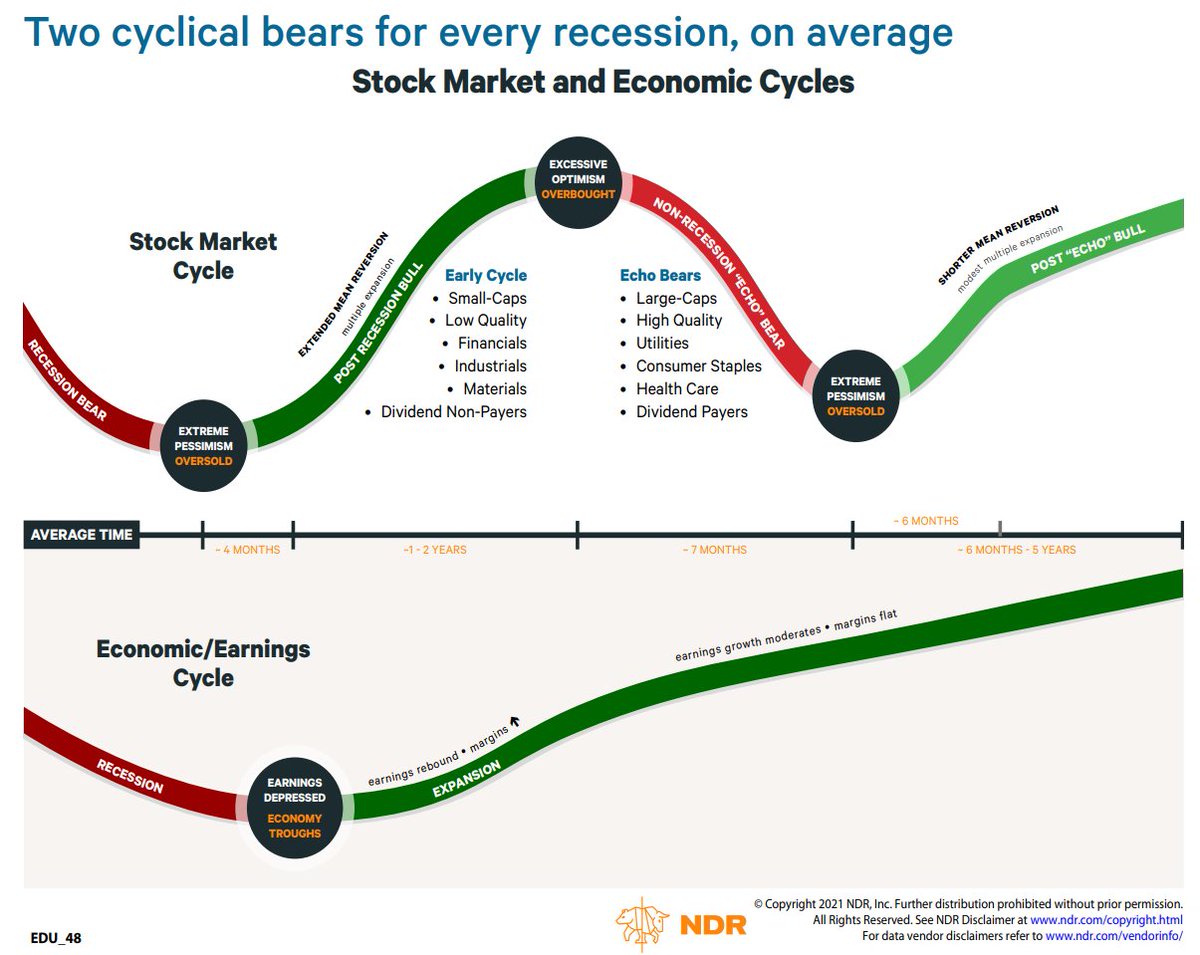

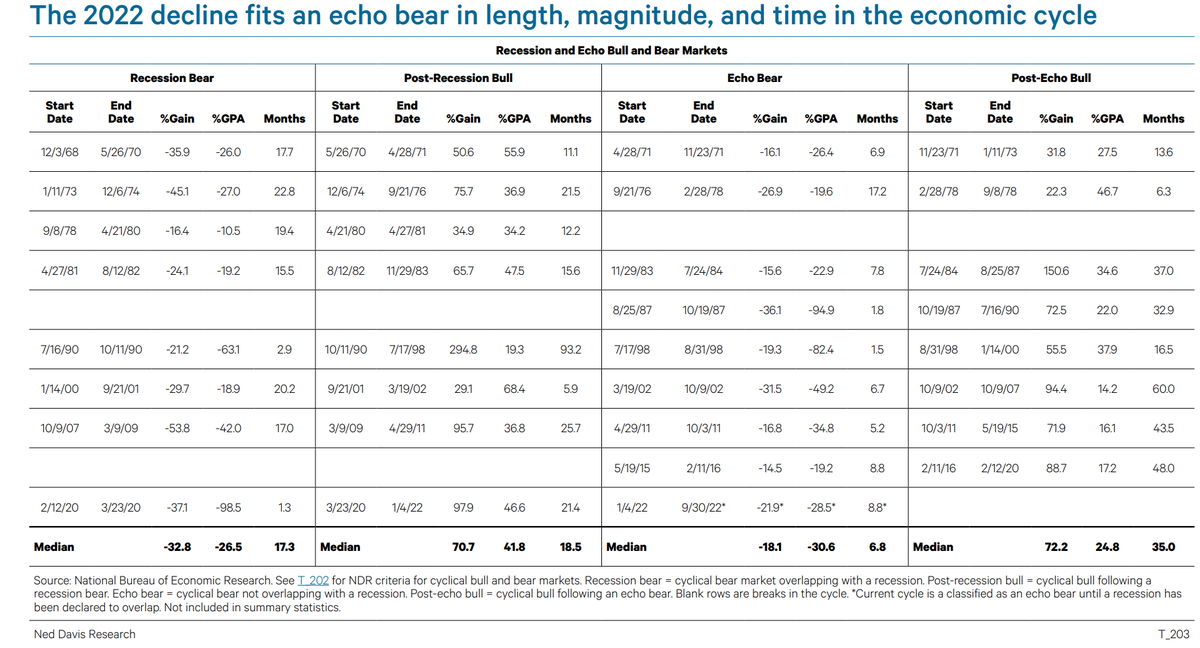

A non-recession bear in 2022 would fit with the typical cycle. For the past 60 years, the US has averaged 2 bear markets for every recession. The pattern is recession bear, post-recession bull, non-recession (or echo bear), and post-echo bull. 5/9

Post-recession bulls are the most powerful part of the cycle bc economy is surging. The US economy is so developed it can’t sustain high growth, so after about 2 years, growth slows. There are fears of a double-dip recession, but that has only happened once in 60 years. 6/9

As recession fears fade, the market enters a post-echo bull until the next recession. To date, the 2022 bear ~2yrs into the expansion and is close to the average echo bear. Perfectly normal cycle behavior! 7/9

The tricky part this cycle is the expansion could be shorter than normal, so a post-echo bull could be far less than the 3yr avg.

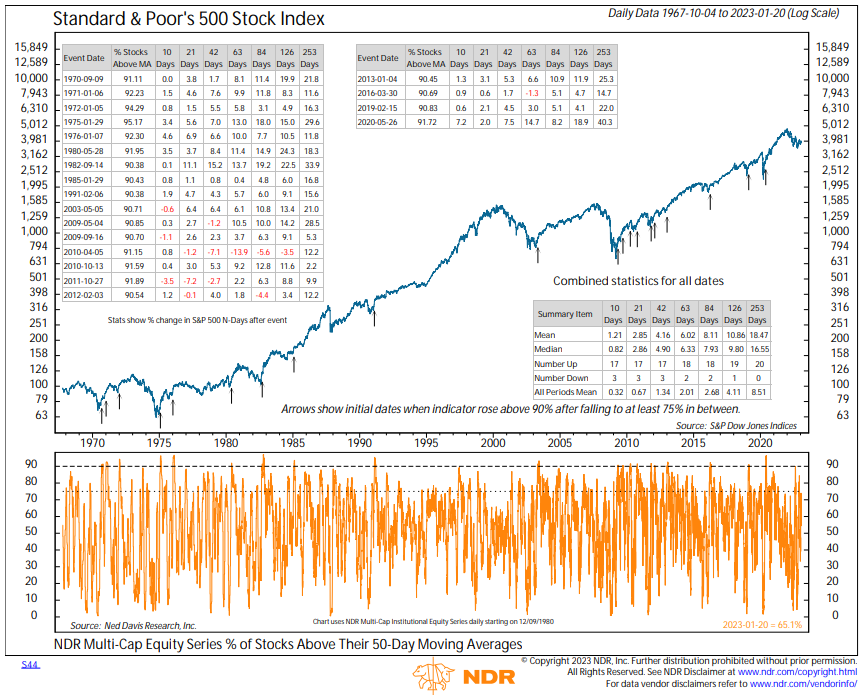

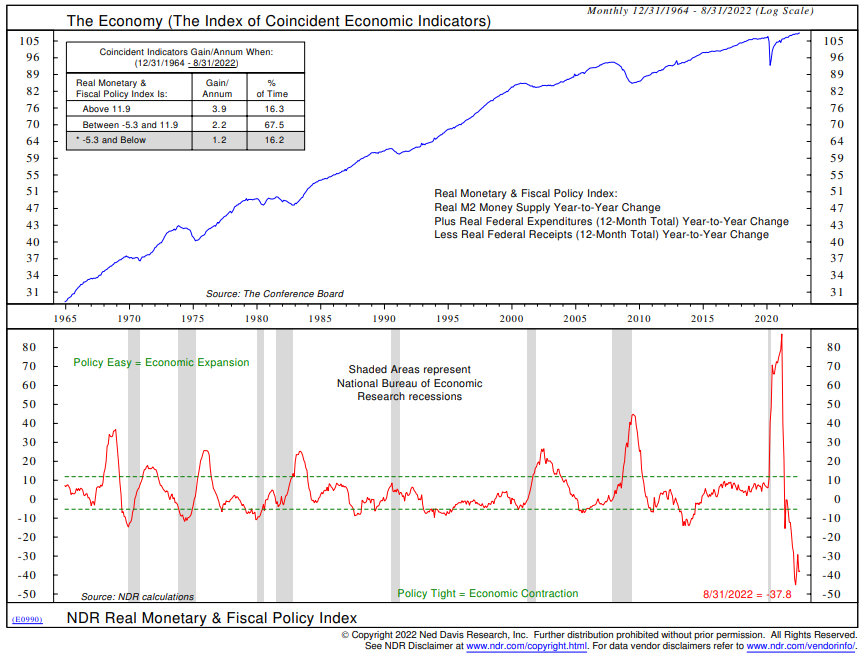

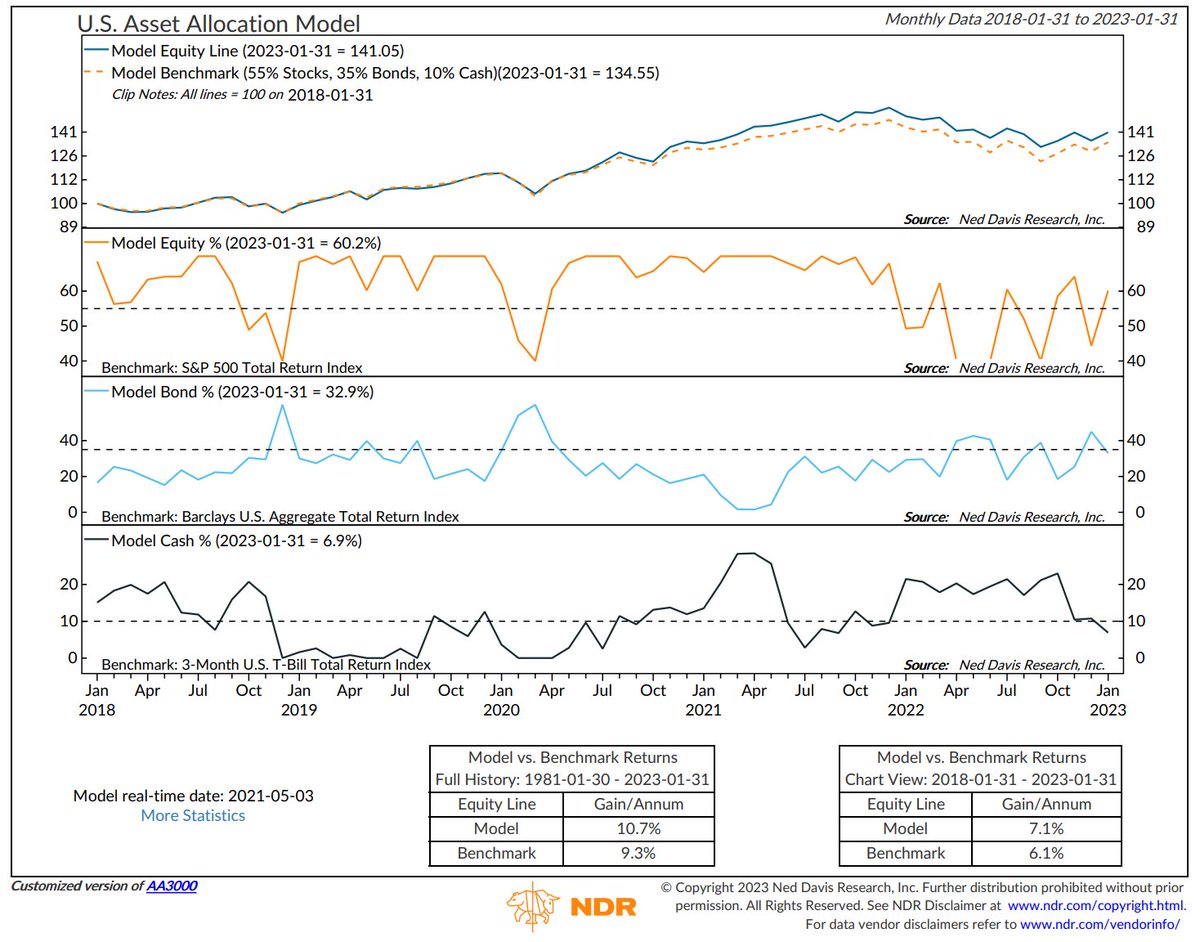

A (hopefully) interesting thought process, but at the end of the day, we focus on indicators. They lean bullish for now. 8/9

A (hopefully) interesting thought process, but at the end of the day, we focus on indicators. They lean bullish for now. 8/9

I had the privilege of discussing the echo bear/recession bear debate, markets pricing out rate cuts, and short-term overbought conditions with @RomaineBostick and @kgreifeld on @BloombergTV The Close. Interview starts at the 1hr 30min mark. bloomberg.com/news/videos/20…

• • •

Missing some Tweet in this thread? You can try to

force a refresh