20 financial rules to learn before 30 to retire in your 40s:

1) The stock market is not the same as the economy - they can move in different directions

1) The stock market is not the same as the economy - they can move in different directions

2) Be prepared for volatility and fluctuations in the market - don't panic and sell off your investments during a downturn

3) Take advantage of dollar-cost averaging - investing a fixed amount of money on a regular schedule can help smooth out market fluctuations

3) Take advantage of dollar-cost averaging - investing a fixed amount of money on a regular schedule can help smooth out market fluctuations

4) Don't overlook the power of compound interest - reinvesting your earnings will help your investments grow exponentially over time

5) Always prioritize paying off high-interest debt before investing in riskier assets

5) Always prioritize paying off high-interest debt before investing in riskier assets

6) Don't overlook the benefits of a good credit score - it can save you money on interest rates and help you qualify for better loan terms

7) Consider refinancing your mortgage if interest rates have dropped significantly since you took out your loan

7) Consider refinancing your mortgage if interest rates have dropped significantly since you took out your loan

8) Don't let fear of losses prevent you from investing - the biggest risk in investing is not taking any risk

9) Use tax-advantaged retirement accounts like IRAs and Roth IRAs to save for retirement and lower your tax bill

9) Use tax-advantaged retirement accounts like IRAs and Roth IRAs to save for retirement and lower your tax bill

10) Invest in yourself to develop skills and knowledge to increase your earning potential

11) Create a budget and track your spending to ensure that you are living within your means, avoiding lifestyle inflation, and investing enough for retirement

11) Create a budget and track your spending to ensure that you are living within your means, avoiding lifestyle inflation, and investing enough for retirement

12) Use debt strategically to build wealth and avoid debt traps

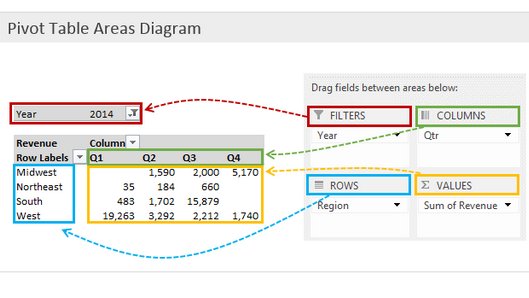

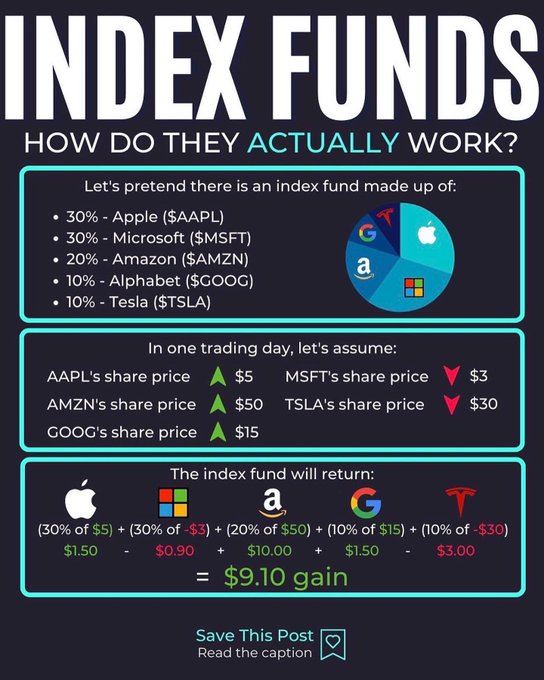

13) Diversification will minimize risk in your investment portfolio, don't put all your eggs in one basket

14 ) Be patient and disciplined when it comes to investing - success often requires a long-term perspective

13) Diversification will minimize risk in your investment portfolio, don't put all your eggs in one basket

14 ) Be patient and disciplined when it comes to investing - success often requires a long-term perspective

15) Avoid making emotional investment decisions - always stay objective and focused on the facts

16) Avoid making investment decisions based solely on the recommendations of friends, family, or social media influencers

16) Avoid making investment decisions based solely on the recommendations of friends, family, or social media influencers

17) Avoid chasing hot investment trends or trying to time the market - stick to a disciplined, long-term investment strategy

18) Avoid making investments based solely on past performance - always do your own research and evaluate the fundamentals of the investment

18) Avoid making investments based solely on past performance - always do your own research and evaluate the fundamentals of the investment

19) Be prepared for unexpected expenses or emergencies by maintaining a 3-month emergency fund

20) Take advantage of compound interest by starting to save and invest as early as possible

20) Take advantage of compound interest by starting to save and invest as early as possible

Remember:

The stock market is a device for transferring money from the impatient to the patient.

The best time to start investing was yesterday, the next best time is today.

A penny saved is a penny earned, but a penny invested is a penny multiplied.

The stock market is a device for transferring money from the impatient to the patient.

The best time to start investing was yesterday, the next best time is today.

A penny saved is a penny earned, but a penny invested is a penny multiplied.

Investing is a tool to achieve financial freedom & independence. If you found this thread helpful:

• RT the FIRST tweet🔁

• Follow me @FluentInFinance

• Sign-up for my FREE newsletter to master your money: FluentInFinance.Substack.com!

• RT the FIRST tweet🔁

• Follow me @FluentInFinance

• Sign-up for my FREE newsletter to master your money: FluentInFinance.Substack.com!

• • •

Missing some Tweet in this thread? You can try to

force a refresh