What's the big deal about IPOR?

How does bringing a $450 trillion TradFi market to DeFi help the industry as a whole mature, bring liquidity, and build long-term utility?

The importance of benchmarks, the IRD market, and protocol growth

a 🧵

1/n

How does bringing a $450 trillion TradFi market to DeFi help the industry as a whole mature, bring liquidity, and build long-term utility?

The importance of benchmarks, the IRD market, and protocol growth

a 🧵

1/n

2/n

First, the interest rate derivatives market is comically large. We're talking over 400X larger than the entire market cap of all cryptos.

First, the interest rate derivatives market is comically large. We're talking over 400X larger than the entire market cap of all cryptos.

https://twitter.com/ipor_io/status/1628001917409394689?s=20

3/n

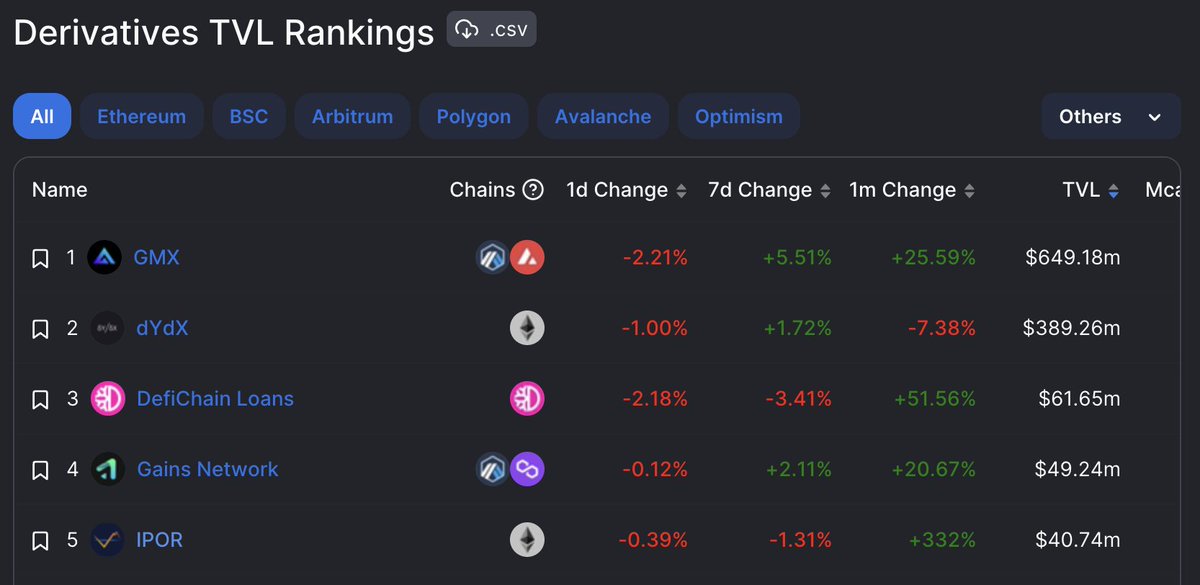

In DeFi everyone knows perps such as GMX and dYdX. These are derivatives of the crypto assets, where around 1/2 of all assets are locked in DEXes.

But what about the other half of the TVL? What about the credit markets? What about derivatives for credit markets?

In DeFi everyone knows perps such as GMX and dYdX. These are derivatives of the crypto assets, where around 1/2 of all assets are locked in DEXes.

But what about the other half of the TVL? What about the credit markets? What about derivatives for credit markets?

4/n

The Interest Rate Derivatives market in DeFi is completely untapped.

IRDs bring predictability and stability for lenders and borrowers. This ultimately leads to liquidity. More capital can flow into DeFi credit markets with a liquid IRD market

The Interest Rate Derivatives market in DeFi is completely untapped.

IRDs bring predictability and stability for lenders and borrowers. This ultimately leads to liquidity. More capital can flow into DeFi credit markets with a liquid IRD market

https://twitter.com/CoinDesk/status/1559550579743105025?s=20

5/n

So what is IPOR?

A benchmark rate

Interest rate derivatives DEXES

A platform on which to build composable credit for DeFi

Think of it as the base lego on which to build structured products

So what is IPOR?

A benchmark rate

Interest rate derivatives DEXES

A platform on which to build composable credit for DeFi

Think of it as the base lego on which to build structured products

7/n

The protocol saw exponential growth thanks to the Power Token launch.

There have also been over $3.6 billion in notional value traded

What's the big deal? Read on for a thread by the fearless IPOR Intern

The protocol saw exponential growth thanks to the Power Token launch.

There have also been over $3.6 billion in notional value traded

What's the big deal? Read on for a thread by the fearless IPOR Intern

https://twitter.com/ipor_intern/status/1625509288549707776?s=20

8/n

Long story short, as an IPOR LP the pools currently have the highest single-sided stablecoin yield in DeFi

There's no IL, and income is derived from multiple yield sources

Long story short, as an IPOR LP the pools currently have the highest single-sided stablecoin yield in DeFi

There's no IL, and income is derived from multiple yield sources

9/n

The base APR comes from protocol fees, SOAP (net PnL), and Asset management. The stablecoin on stablecoin yield has averaged over 7% since inception across USDC, USDT, and DAI pools

The base APR comes from protocol fees, SOAP (net PnL), and Asset management. The stablecoin on stablecoin yield has averaged over 7% since inception across USDC, USDT, and DAI pools

10/n

Now the Power Token yield is a different beast. Master pwIPOR, optimize your LP

pwIPOR levels the playing field between whales, minnows, and all sizes in between.

If you check out the leaderboard, there are many whales

app.ipor.io/leaderboard

Now the Power Token yield is a different beast. Master pwIPOR, optimize your LP

pwIPOR levels the playing field between whales, minnows, and all sizes in between.

If you check out the leaderboard, there are many whales

app.ipor.io/leaderboard

11/n

But the highest boost is being achieved by smaller players who know how the power token dynamic works

But the highest boost is being achieved by smaller players who know how the power token dynamic works

12/n

LPs who have found the right balance between providing liquidity and powering up by delegating pwIPOR have achieved 2-3X multiples on APR by understanding how the boost mechanism works

LPs who have found the right balance between providing liquidity and powering up by delegating pwIPOR have achieved 2-3X multiples on APR by understanding how the boost mechanism works

13/n

In fact the pwIPOR LM curve was updated even more in favor of those delegating pwIPOR

In fact the pwIPOR LM curve was updated even more in favor of those delegating pwIPOR

https://twitter.com/ipor_io/status/1625485371063652353?s=20

14/n

Here's a few examples of community flexing their pwIPOR boosts, some at 2-5X the average APR

#powerup #pwflex

Here's a few examples of community flexing their pwIPOR boosts, some at 2-5X the average APR

#powerup #pwflex

https://twitter.com/andrewback280/status/1625518540445851650

https://twitter.com/PhiloMig21/status/1625522471788072961

https://twitter.com/sharkboy1125/status/1625690153065799681

https://twitter.com/tnr_woof/status/1625767072780193793

15/n

An unforeseen added benefit to pwIPOR is the 50% unstaking fee. If you want to unstake pwIPOR for IPOR you can start a 14 day cooldown, or pay a 50% immediate unstake fee which returns to those who are still staking.

This is now known as 💎👐 bonus, currently 40% APR extra

An unforeseen added benefit to pwIPOR is the 50% unstaking fee. If you want to unstake pwIPOR for IPOR you can start a 14 day cooldown, or pay a 50% immediate unstake fee which returns to those who are still staking.

This is now known as 💎👐 bonus, currently 40% APR extra

16/n

So what about the TVL? LPs underwrite IRDs, which allow fixed-income players to manage their rate risk. With mature credit markets and proper risk management tools this will allow larger players to enter the markets, meaning more liquidity in DeFi

So what about the TVL? LPs underwrite IRDs, which allow fixed-income players to manage their rate risk. With mature credit markets and proper risk management tools this will allow larger players to enter the markets, meaning more liquidity in DeFi

17/n

So what's the big deal about IPOR?

Derivatives in DeFi credit markets bring stability and help the market mature. This will benefit the entire industry. Different instruments can be built on top of the Index and IRDs. IPOR is the base of the DeFi credit markets

So what's the big deal about IPOR?

Derivatives in DeFi credit markets bring stability and help the market mature. This will benefit the entire industry. Different instruments can be built on top of the Index and IRDs. IPOR is the base of the DeFi credit markets

And thanks to all the amazing DeFi threadoors who have covered IPOR such as

@DefiIgnas

@rektdiomedes

@crypto_linn

@Chinchillah_

@deusexdao

@0xTindorr

@DAdvisoor

@0xFitz

@Dynamo_Patrick

@BarryFried1

@thedefiedge

@crypto_linn

@DeFi_Cheetah

@blocmatesdotcom

any many more

@DefiIgnas

@rektdiomedes

@crypto_linn

@Chinchillah_

@deusexdao

@0xTindorr

@DAdvisoor

@0xFitz

@Dynamo_Patrick

@BarryFried1

@thedefiedge

@crypto_linn

@DeFi_Cheetah

@blocmatesdotcom

any many more

• • •

Missing some Tweet in this thread? You can try to

force a refresh