Investing .com isn't just a charting website

It's much more powerful than you think

9 things @Investingcom can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

It's much more powerful than you think

9 things @Investingcom can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

1/ Stock Screeners

One of the most powerful tools of @Investingcom is the Stock Screener tool which is absolutely free.

Go to the Stock screener tab. Click on India and you will see this page as in the screenshot below.

Link 🔗 t.ly/Y8pa

One of the most powerful tools of @Investingcom is the Stock Screener tool which is absolutely free.

Go to the Stock screener tab. Click on India and you will see this page as in the screenshot below.

Link 🔗 t.ly/Y8pa

Amazing Filters

Then Segregate the stocks by Market Cap.

Investors and Traders would be able to filter the small-cap stocks easily as well if they want.

Next, you can add "Technical and Chart Patterns" filters to it as well.

Then Segregate the stocks by Market Cap.

Investors and Traders would be able to filter the small-cap stocks easily as well if they want.

Next, you can add "Technical and Chart Patterns" filters to it as well.

Combining filters

People who use "Techno-funda analysis" can use both the Fundamental and Technical filters.

You can filter stocks with the P.E. Ratio, ROCE as well as technical parameters such as 50 DMA, 100 DMA, etc.

Combining both parameters makes this very powerful.

People who use "Techno-funda analysis" can use both the Fundamental and Technical filters.

You can filter stocks with the P.E. Ratio, ROCE as well as technical parameters such as 50 DMA, 100 DMA, etc.

Combining both parameters makes this very powerful.

Candlestick Filters

Once you've done this you can further add another filter which is "Candlestick Patterns".

For eg:

If the market has come down and you want to invest, you can look for Bullish patterns:

1. Double Bottom and

2. Bullish Engulfing

and so on.

Once you've done this you can further add another filter which is "Candlestick Patterns".

For eg:

If the market has come down and you want to invest, you can look for Bullish patterns:

1. Double Bottom and

2. Bullish Engulfing

and so on.

Reliability of Pattern:

The Reliability of the pattern will be ranked beside the name of the stock.

This way you can filter out the most powerful patterns which are reliable.

In the second image I have filtered by Daily chart and only the most reliable patterns.

The Reliability of the pattern will be ranked beside the name of the stock.

This way you can filter out the most powerful patterns which are reliable.

In the second image I have filtered by Daily chart and only the most reliable patterns.

Filter according to Performance:

You can easily see here the best p[performing stocks in the past 3 years, 1 year, YTD, 1 month, 1 week and even daily.

You can use it on the type of shares you want whether small cap or mid cap.

You can easily see here the best p[performing stocks in the past 3 years, 1 year, YTD, 1 month, 1 week and even daily.

You can use it on the type of shares you want whether small cap or mid cap.

2/ Unlimited Free Alerts:

You can set Unlimited alerts for an Unlimited number of scripts.

How? Type the SYMBOL name on their website and you'll find the alerts icon.

Click on it and place the alert:

1. In percentage

2. Price Level breach

For chartists who analyze stocks.

You can set Unlimited alerts for an Unlimited number of scripts.

How? Type the SYMBOL name on their website and you'll find the alerts icon.

Click on it and place the alert:

1. In percentage

2. Price Level breach

For chartists who analyze stocks.

In tradingview also you can get alerts but that would cost you a premium subscription which costs approximately Rs 50,000.

On Investing.com you can get them for Free absolutely on your mobile & your email.

Don't need to open Demat accounts with any broker.

On Investing.com you can get them for Free absolutely on your mobile & your email.

Don't need to open Demat accounts with any broker.

3/ Create your own watchlists

You can analyze a portfolio via your watchlist.

🔗 investing.com/portfolio

Then add your stocks and can track your investments here.

I have divided my watchlists into:

1. FNO stocks

2. Nifty 50

3. Small Cap

and so on...

You can analyze a portfolio via your watchlist.

🔗 investing.com/portfolio

Then add your stocks and can track your investments here.

I have divided my watchlists into:

1. FNO stocks

2. Nifty 50

3. Small Cap

and so on...

4/ All Futures of all Indices

Post-market many of us like to check Dow Futures or Sgx Nifty or other world market futures.

If you click on the link below you will have a birds eye view of all the global indices Futures.

in.investing.com/indices/indice…

Post-market many of us like to check Dow Futures or Sgx Nifty or other world market futures.

If you click on the link below you will have a birds eye view of all the global indices Futures.

in.investing.com/indices/indice…

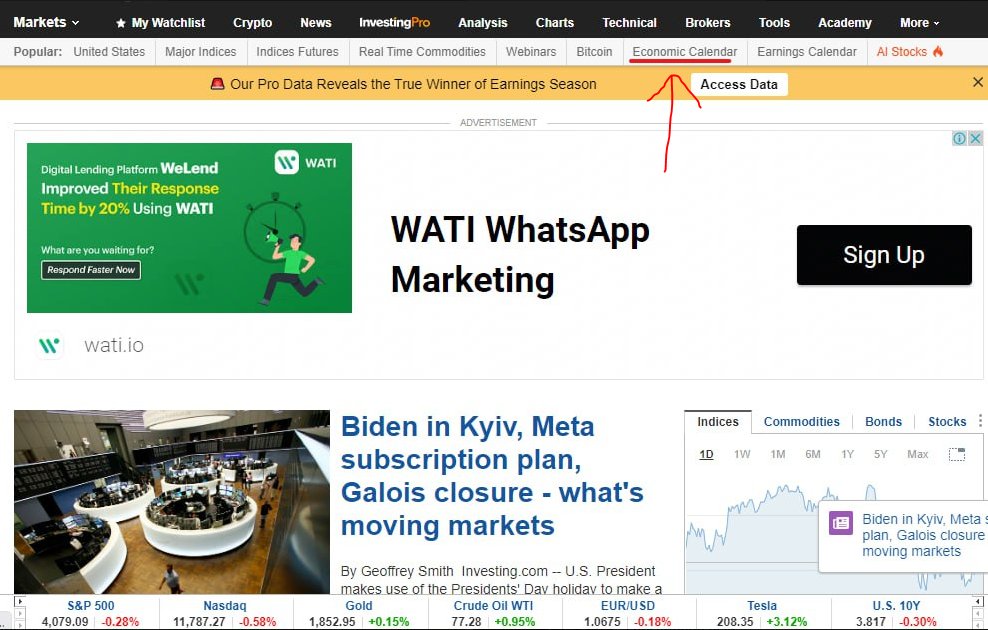

5/ Economic calendar

Tells you about the most important economic events taking place all over the world.

The more important the event the higher starts it gets beside it's name.

Only one star means not that important.

Check the pictures.

Tells you about the most important economic events taking place all over the world.

The more important the event the higher starts it gets beside it's name.

Only one star means not that important.

Check the pictures.

6/ Earnings Calendar

Gauging the results help investors whether to buy more or to sell a stock.

Every quarter traders look out for the dates and forecasts which you can find here.

You can find all the stocks that are going to declare results.

🔗 in.investing.com/earnings-calen…

Gauging the results help investors whether to buy more or to sell a stock.

Every quarter traders look out for the dates and forecasts which you can find here.

You can find all the stocks that are going to declare results.

🔗 in.investing.com/earnings-calen…

7/ Free charts & Multiple Indicators:

In trading view we can only add 3 indicators in the FREE version.

However, @investingcom has no restriction on the number of indicators you want to put.

The charting is completely free and no need to pay a dime.

🔗 investing.com/charts/live-ch…

In trading view we can only add 3 indicators in the FREE version.

However, @investingcom has no restriction on the number of indicators you want to put.

The charting is completely free and no need to pay a dime.

🔗 investing.com/charts/live-ch…

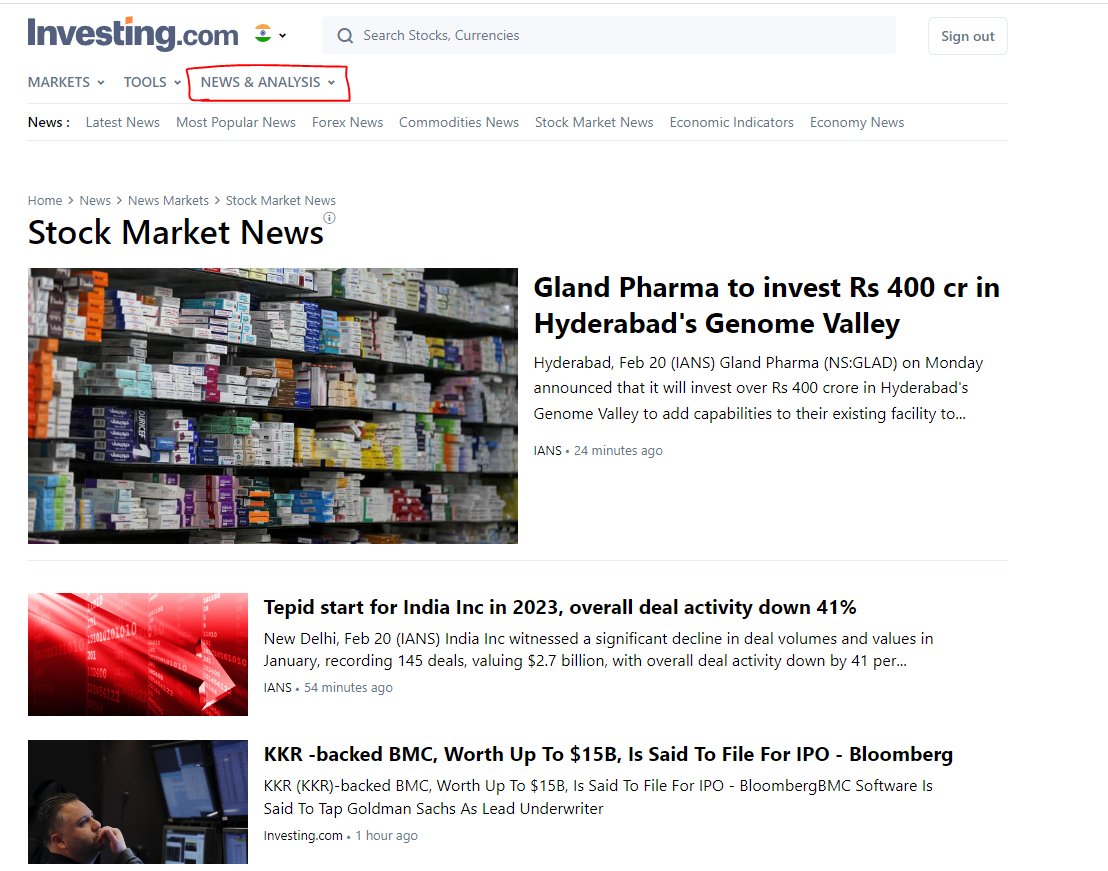

8/ News Articles:

Can check all Stock Market related news in one place.

No need to track your favorite stocks from other sources.

Covers commodities, cryptos, and everything.

🔗 in.investing.com/news/markets/s…

Can check all Stock Market related news in one place.

No need to track your favorite stocks from other sources.

Covers commodities, cryptos, and everything.

🔗 in.investing.com/news/markets/s…

All features in the Mobile app too:

Whatever you can do on a desktop on this website, you can just as easily do on the mobile application as well.

In fact, I set alerts for my levels, via my mobile itself.

Even monitor my watchlists for potential stocks on the mobile.

Whatever you can do on a desktop on this website, you can just as easily do on the mobile application as well.

In fact, I set alerts for my levels, via my mobile itself.

Even monitor my watchlists for potential stocks on the mobile.

9/ Free webinars

Live financial webinars by leading industry experts.

Registration is free and instant.

🔗 investing.com/education/webi…

Live financial webinars by leading industry experts.

Registration is free and instant.

🔗 investing.com/education/webi…

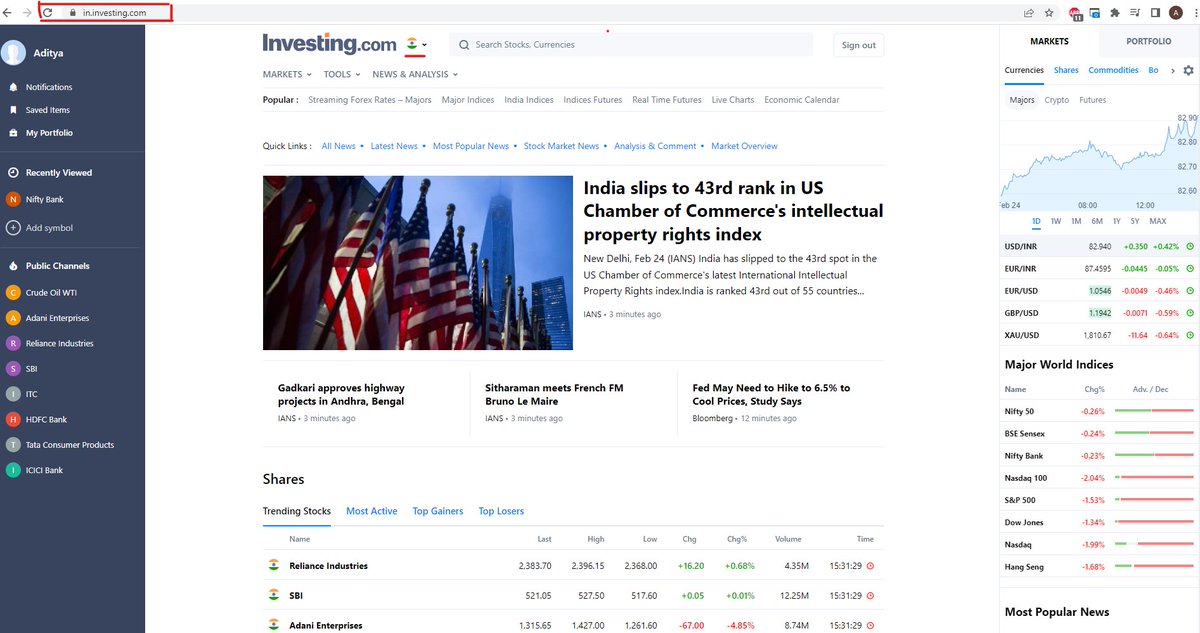

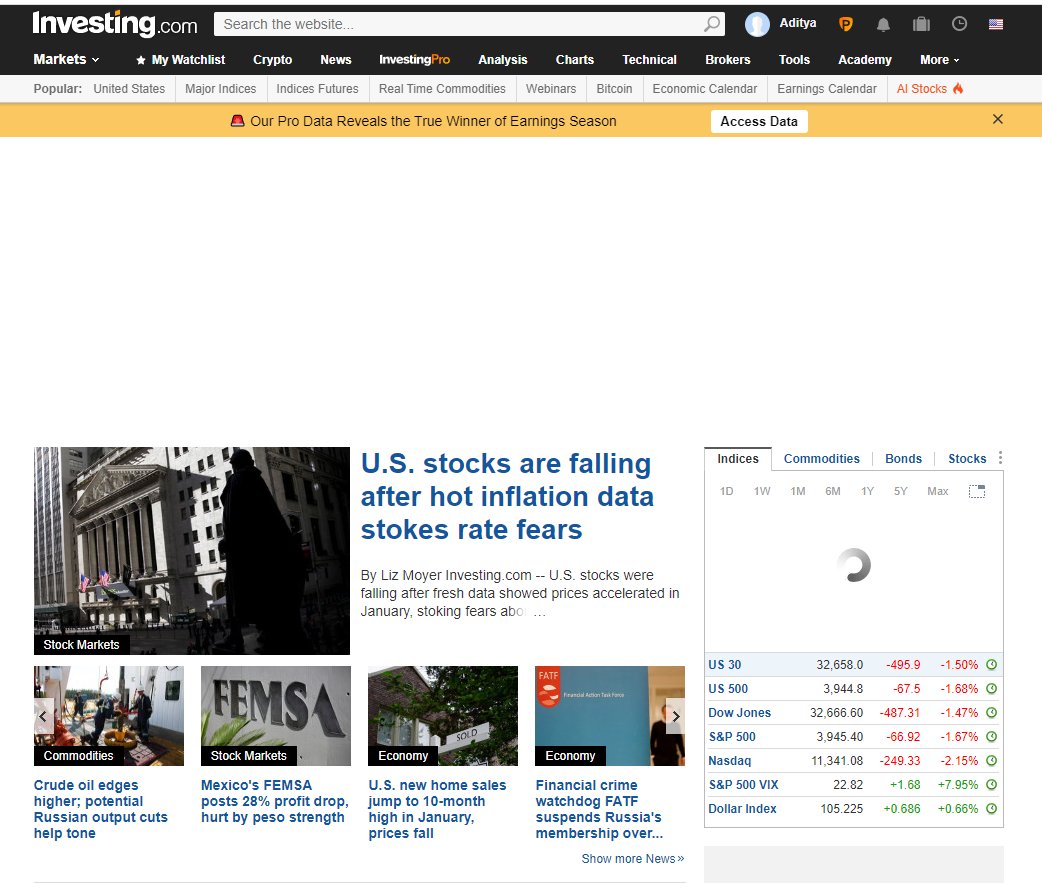

If you're from India you should be using in.investing.com.

Whereas traders from elsewhere mostly use investing.com.

The first picture is how the website looks for Indian traders.

The second one is the default one, and the one for US/UK traders mainly.

Whereas traders from elsewhere mostly use investing.com.

The first picture is how the website looks for Indian traders.

The second one is the default one, and the one for US/UK traders mainly.

Youtube channel Link:

We have a Youtube Channel where we cover our analysis and give our views of the markets.

If interested feel free to join using this link:

We have a Youtube Channel where we cover our analysis and give our views of the markets.

If interested feel free to join using this link:

That's a wrap!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

• • •

Missing some Tweet in this thread? You can try to

force a refresh