.@fraxfinance just passed a near-unanimous vote to increase CR to 100% over time

Is the algo-stable dream dead?

What’s in store for $FRAX and $FXS long term?

An overview👇

Is the algo-stable dream dead?

What’s in store for $FRAX and $FXS long term?

An overview👇

This thread will cover:

1️⃣What Frax’s proposal entails

2️⃣Implications for $FRAX and $FXS

3️⃣My thoughts

1️⃣What Frax’s proposal entails

2️⃣Implications for $FRAX and $FXS

3️⃣My thoughts

If you aren't familiar with $FRAX or how it works, I've linked a good thread by @WinterSoldierxz to get you up to speed:

https://twitter.com/WinterSoldierxz/status/1598665288819433472

The proposal entails three things:

1. Increasing target CR to 100%, retiring the algorithmic backing of FRAX

2. Retain protocol revenue to fund the increased CR, including pausing FXS buybacks.

3. Authorize up to 3M per month in frxETH purchases to increase the CR

1/

1. Increasing target CR to 100%, retiring the algorithmic backing of FRAX

2. Retain protocol revenue to fund the increased CR, including pausing FXS buybacks.

3. Authorize up to 3M per month in frxETH purchases to increase the CR

1/

This doesn't fundamentally change $FRAX (as much as you think)

Prior to this, FRAX was partially backed by $FXS. However since AMOs were introduced in Frax V2, a majority of collateral has been deployed for FRAX denominated LP tokens.

3/

Prior to this, FRAX was partially backed by $FXS. However since AMOs were introduced in Frax V2, a majority of collateral has been deployed for FRAX denominated LP tokens.

3/

This:

a. Diversifies overall collateral backing FRAX

b. Generates protocol revenue from trading fees, convex bribes, and emissions

c. effectively 'buys back' outstanding FRAX as protocol owned liquidity

d. Creates deep liquidity for secondary markets

4/

a. Diversifies overall collateral backing FRAX

b. Generates protocol revenue from trading fees, convex bribes, and emissions

c. effectively 'buys back' outstanding FRAX as protocol owned liquidity

d. Creates deep liquidity for secondary markets

4/

Without getting too much into it, while FRAX is fractionally collateralized, AMOs have allowed it to accumulate sufficient non exogenous collateral, surpassing outstanding FRAX.

While the numbers are outdated, this thread explains the concept very well👇

5/

While the numbers are outdated, this thread explains the concept very well👇

5/

https://twitter.com/OuroborosCap8/status/1534773872779993088

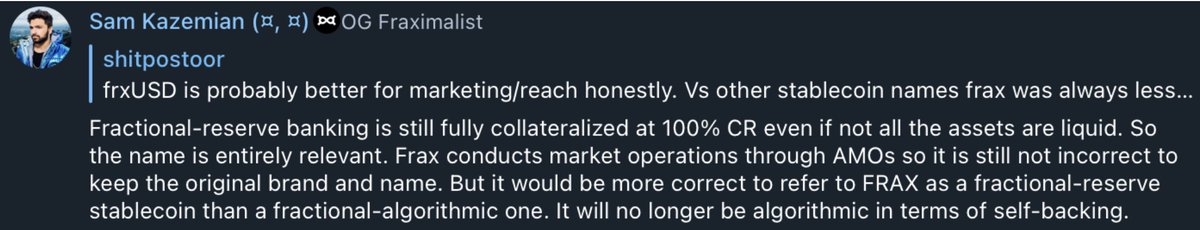

This means that at 100% CR, Frax can still deploy collateral via AMOs to accumulate POL to create liquidity and revenue for the protocol. This makes it more akin to Fractional reserve banking

But don't take my word for it, take @samkazemian's

6/

But don't take my word for it, take @samkazemian's

6/

What this means for algo stables:

Sadly, the collapse of Terra has made it a lot harder for the general public to trust algo-stables, for good reason.

Frax's transition could be beneficial for branding in the long term, and make it less of a target for regulators.

7/

Sadly, the collapse of Terra has made it a lot harder for the general public to trust algo-stables, for good reason.

Frax's transition could be beneficial for branding in the long term, and make it less of a target for regulators.

7/

The proposal cited a general direction towards making FRAX an asset users are comfortable holding as a long term store of value.

I would argue that this move is more motivated by political practicality rather than whether a fractional-algorithmic model is truly sustainable

8/

I would argue that this move is more motivated by political practicality rather than whether a fractional-algorithmic model is truly sustainable

8/

For the decentralization maxi this may mean we won't see a solution to the stablecoin trilemma in the near future.

9/

9/

However, for the #Fraximalist I think this is good news:

✅ Removes regulation tailrisk

✅ Allows for additional collateral to be deployed to AMOs

✅ Buyback of frxETH is bullish for $sfrxETH and Frax's position in the LSD wars

10/

✅ Removes regulation tailrisk

✅ Allows for additional collateral to be deployed to AMOs

✅ Buyback of frxETH is bullish for $sfrxETH and Frax's position in the LSD wars

10/

cc'ing my favorite CT threadors

@defi_mochi

@DeFiMinty

@TheDeFinvestor

@VirtualKenji

@0xCrypto_doctor

@rektdiomedes

@crypto_linn

@Slappjakke

@midoji7

@crypto_condom

@eli5_defi

@WinterSoldierxz

@DegenCamp

@defiprincess_

@Chinchillah_

@CryptoShiro_

@defi_mochi

@DeFiMinty

@TheDeFinvestor

@VirtualKenji

@0xCrypto_doctor

@rektdiomedes

@crypto_linn

@Slappjakke

@midoji7

@crypto_condom

@eli5_defi

@WinterSoldierxz

@DegenCamp

@defiprincess_

@Chinchillah_

@CryptoShiro_

@DeFi_Cheetah

@DAdvisoor

@cryptodetweiler

@HaowiWang

@schizoxbt

@Subli_Defi

@0xsurferboy

@thelearningpill

@Louround_

@CryptoDeFiGuy

@0xJamesXXX

@ThorHartvigsen

@eek637

@charlie_defi

@VoldiemortEth

@0xShinChannn

@DAdvisoor

@cryptodetweiler

@HaowiWang

@schizoxbt

@Subli_Defi

@0xsurferboy

@thelearningpill

@Louround_

@CryptoDeFiGuy

@0xJamesXXX

@ThorHartvigsen

@eek637

@charlie_defi

@VoldiemortEth

@0xShinChannn

If I missed anything, let me know. Always open to a good debate.

Likes and RTs on my original post would be very much appreciated!

Likes and RTs on my original post would be very much appreciated!

https://twitter.com/0xFindingNemo/status/1630150939418976258

• • •

Missing some Tweet in this thread? You can try to

force a refresh