If the housing crisis was simply the result of not building enough private sector homes, one would expect market rents for homes to have increased against incomes over the past 50 years.

In fact the market rent-to-income ratio has remained around 30% (panel A).

In fact the market rent-to-income ratio has remained around 30% (panel A).

https://twitter.com/JamesInCity/status/1629782151301419008

It is the privatisation of- and collapse in the provision of socially rented homes, removal of rent regulation & subsidies that has made renting unaffordable as @ianmulheirn and colleagues show in this report.

jrf.org.uk/report/housing…

jrf.org.uk/report/housing…

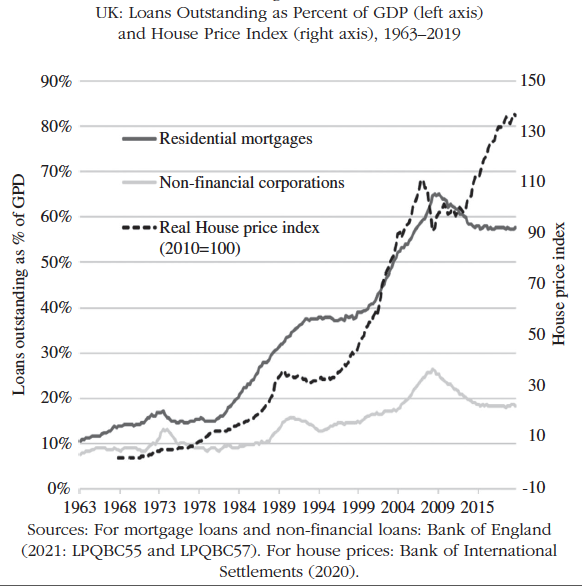

The explosive rise in house prices (c.f. rents) v income is explained by the explosive increase in mortgage credit creation during the same period following financial liberalisation. Since the fin. crisis, low i-rates have seen non-bank investors swarm in to the housing market.

Estimates consistently show a 1% increase in housing stock per household delivers a 1–2% reduction in house prices (Auterson, 2014; Oxford Economics, 2016; MHCLG, 2018).

This is negligible in the context of a 181% increase in English house prices from 2000 to 2020.

This is negligible in the context of a 181% increase in English house prices from 2000 to 2020.

Furthermore, we cannot hope to meet our net-zero carbon commitments with enormous new home building programs. Current government plans would consume 104% of England's carbon budget by 2050 as we show in this paper lead by @sophusticated .

sciencedirect.com/science/articl…

sciencedirect.com/science/articl…

There is no doubt we need more *affordable* housing in this country and some of that need can be met with a massive social housing building program.

But we also have to reduce the demand for housing as a financial asset via property tax reform.

ft.com/content/fadfbd…

But we also have to reduce the demand for housing as a financial asset via property tax reform.

ft.com/content/fadfbd…

Local government should also been given powers to set the rules about who buys homes in areas of high housing pressure, prohibiting speculative purchases completely standard.co.uk/homesandproper…

The above is one of many good ideas in this excellent report for JRF by @tobylloyd @rosegrayston and @resi_analyst that faces up on to need to deal with the demand-side drivers of house prices and the problems in the dysfunctional rental sector.

jrf.org.uk/report/reboot-…

jrf.org.uk/report/reboot-…

Let's please not give politicians the excuse to make the politically easy call for "more (private sector) supply" whilst completely neglecting the much more difficult policy of spending money on building affordable housing and reforming the property tax system.

• • •

Missing some Tweet in this thread? You can try to

force a refresh