1/ Account Abstraction will enable you to recover your private keys, setup automatic payments, setup new wallet within 30 secs, and so many things.

It's the most important development in Web3 right now.

Here's everything you should know about it.

🧵🧵🧵🧵

#AccountAbstraction

It's the most important development in Web3 right now.

Here's everything you should know about it.

🧵🧵🧵🧵

#AccountAbstraction

2/ You can't become your own bank even if you want.

The experience of using a crypto wallet or web3 application has always been so painful. More than 15% supply of bitcoin has been lost because people forgot their private keys.

The experience of using a crypto wallet or web3 application has always been so painful. More than 15% supply of bitcoin has been lost because people forgot their private keys.

3/ Web3 User Onboarding Experience Sucks

Web3 Onboarding Involves 4 Steps:

- Setting up wallet

- Saving Seed Phrases

- Sending funds to wallet

- Connect wallet to Web3

New users take 15-30 mins to figure out these steps.

Web3 Onboarding Involves 4 Steps:

- Setting up wallet

- Saving Seed Phrases

- Sending funds to wallet

- Connect wallet to Web3

New users take 15-30 mins to figure out these steps.

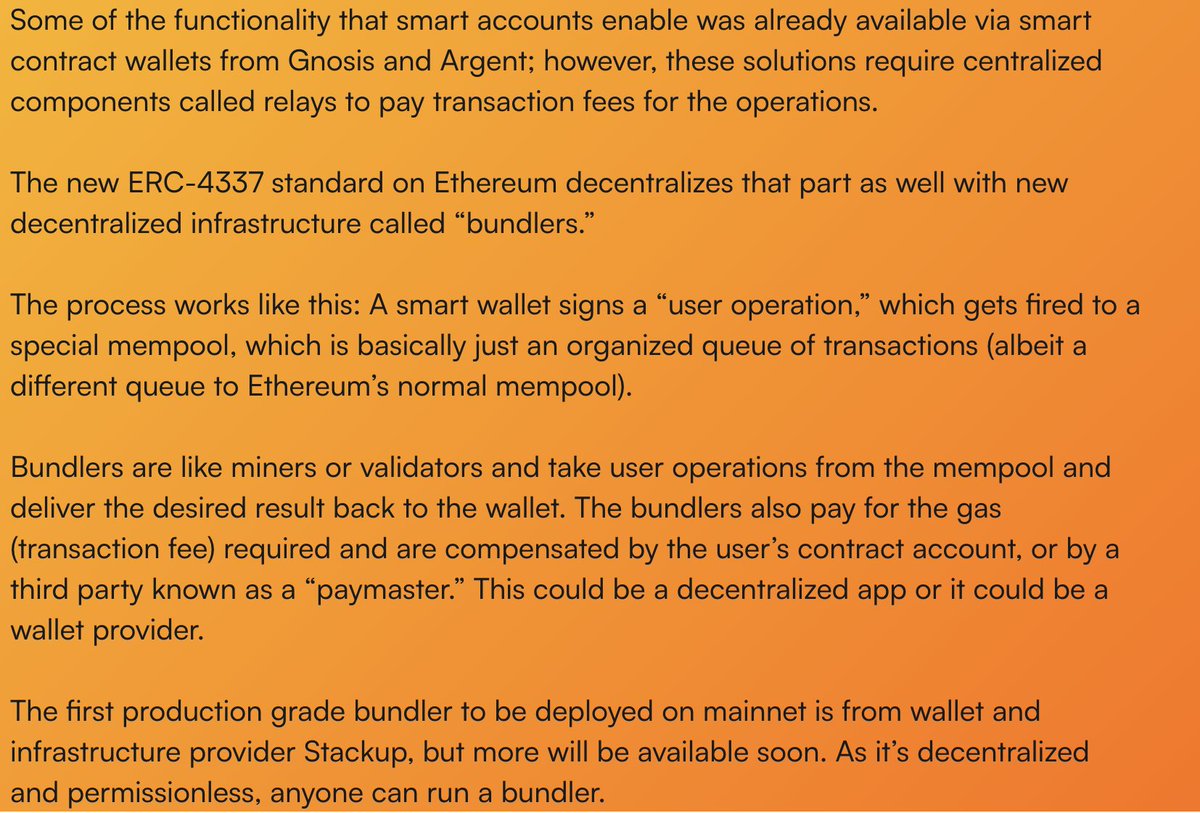

4/ What is Account Abstraction

"Account Abstraction" is a confusing word, lets call it "Smart wallets".

Smart wallets are designed to do specific things by providing a great user experience.

The new ERC-4337 standard on Ethereum will make this possible.

"Account Abstraction" is a confusing word, lets call it "Smart wallets".

Smart wallets are designed to do specific things by providing a great user experience.

The new ERC-4337 standard on Ethereum will make this possible.

5/ How ERC-4337 Works?

There are three participants involve in an account abstraction process.

- Smart Wallet

- Bundler(Validator)

- Paymaster(Dapps)

Smart wallet signs Tx, Bundlers include them in Mempool, They pas Gas fees from their end, and Paymaster compensate them.

There are three participants involve in an account abstraction process.

- Smart Wallet

- Bundler(Validator)

- Paymaster(Dapps)

Smart wallet signs Tx, Bundlers include them in Mempool, They pas Gas fees from their end, and Paymaster compensate them.

6/ Benefits of Smart Wallets

- No need of seed pharses, You can open a new wallet using fingerscan/QR Code/Face Scan in 30 sec.

- You could setup 2FA for your wallet

- You could setup daily spending limits

- You could enable monthly auto payment using crypto for subscriptions.

- No need of seed pharses, You can open a new wallet using fingerscan/QR Code/Face Scan in 30 sec.

- You could setup 2FA for your wallet

- You could setup daily spending limits

- You could enable monthly auto payment using crypto for subscriptions.

7/ Seamless Gaming Experience

Smart wallets are designed for Web3 Games, You could set a session keys, and auto approve number of transactions which will improve the overall gameplay experience of web3 games.

Smart wallets are designed for Web3 Games, You could set a session keys, and auto approve number of transactions which will improve the overall gameplay experience of web3 games.

8/ You could Recover your Account

If you lose your phone than you can recover your wallet using social and commercial recovery services. It's almost like recovering your PIN/Password of Net Banking Account.

If you lose your phone than you can recover your wallet using social and commercial recovery services. It's almost like recovering your PIN/Password of Net Banking Account.

9/ Technical Implementation

EVM Compatible Chains can now take advantage of smart accounts include Polygon, Optimism, Arbitrum, BSC, Avalanche and Gnosis Chain.

L2s Like ZKSync and Starknet are using Modified version of ERC-4337

VISA also partnered with Starknet to explore AA

EVM Compatible Chains can now take advantage of smart accounts include Polygon, Optimism, Arbitrum, BSC, Avalanche and Gnosis Chain.

L2s Like ZKSync and Starknet are using Modified version of ERC-4337

VISA also partnered with Starknet to explore AA

10/ Example of Smart Wallets

@argentHQ & @myBraavos

Both these wallets have implemented some of the features of ERC-4337. Try to make a new account on Argent on your phone, you will see the difference. It's the best mobile wallet on both security, and user experience wise.

@argentHQ & @myBraavos

Both these wallets have implemented some of the features of ERC-4337. Try to make a new account on Argent on your phone, you will see the difference. It's the best mobile wallet on both security, and user experience wise.

12/ Key Accounts to Follow for more updates

@yoavw

@VitalikButerin

@zksync

@Starknet

@argentHQ

@myBraavos

@Cointelegraph

@yoavw

@VitalikButerin

@zksync

@Starknet

@argentHQ

@myBraavos

@Cointelegraph

11/ TLDR;

1) Problems with Self Custody

2) Web3 Onboarding Experience

3) What is Account Abstraction

4) ERC-4337

5) Smart Wallets Benefits

6) Seamless Gaming

7) Wallet Recovery

8) Technical Implementation

9) Examples

10) Key Accounts

1) Problems with Self Custody

2) Web3 Onboarding Experience

3) What is Account Abstraction

4) ERC-4337

5) Smart Wallets Benefits

6) Seamless Gaming

7) Wallet Recovery

8) Technical Implementation

9) Examples

10) Key Accounts

Thanks for reading this thread 🙏

I hope you enjoyed reading 🙂

Please Follow my Account for more content on Crypto & NFTs.

Please Like, Share and RT the first tweet.

I hope you enjoyed reading 🙂

Please Follow my Account for more content on Crypto & NFTs.

Please Like, Share and RT the first tweet.

Shout out to some amazing people who write great threads.

🫡🫡

@davincithreads

@waleswoosh

@ElenaaETH

@0xMughal

@TheDeFinvestor

@crypthoem

@blocmatesdotcom

@rektfencer

@DeFi_Taha

@CryptoShiro_

@dyorcryptoapp

🫡🫡

@davincithreads

@waleswoosh

@ElenaaETH

@0xMughal

@TheDeFinvestor

@crypthoem

@blocmatesdotcom

@rektfencer

@DeFi_Taha

@CryptoShiro_

@dyorcryptoapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh