What we’ll cover in this thread👇:

🔷Overview

🔷Pumpamentals

🔷Narrative

🔷Integrations

🔷Valuation

Let’s begin🏃♂️

2/

🔷Overview

🔷Pumpamentals

🔷Narrative

🔷Integrations

🔷Valuation

Let’s begin🏃♂️

2/

Overview 🫣

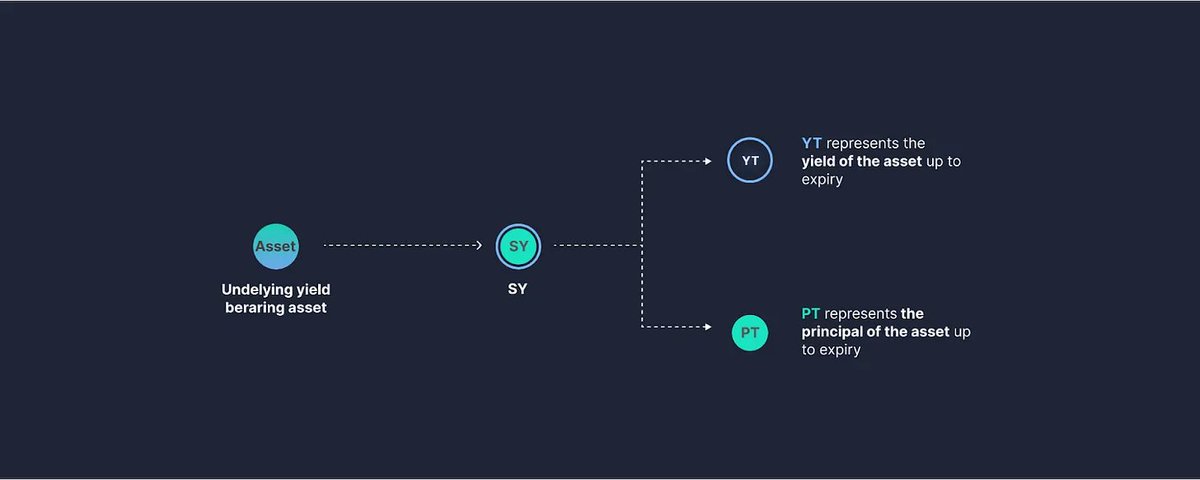

Pendle’s goal is to provide their users with the maximum amount of yield, by simply increasing your yield exposure in the bull market and hedge against yield downturns during the bear markets.

3/

Pendle’s goal is to provide their users with the maximum amount of yield, by simply increasing your yield exposure in the bull market and hedge against yield downturns during the bear markets.

3/

Users can execute various yield strategies through their dual yield bearing tokens. In Tradfi, institutional players rely on various hedges to protect their positions, such as future yield contracts.

4/

4/

Pumpamentals

Protocol simplicity is something that is frequently overlooked.

DeFi is a complex ecosystem with a high barrier to entry due to its technical nature. What I like best about Pendle is that I can read the whitepaper & understand the product in under an hour.

5/

Protocol simplicity is something that is frequently overlooked.

DeFi is a complex ecosystem with a high barrier to entry due to its technical nature. What I like best about Pendle is that I can read the whitepaper & understand the product in under an hour.

5/

A token isn’t entering my portfolio unless I believe it has pumpamentals.

Pendle collects a 3% fee from all yield accrued by YT. Currently, 100% of this fee is distributed to vePENDLE holders, while the team collects no revenue.

6/

Pendle collects a 3% fee from all yield accrued by YT. Currently, 100% of this fee is distributed to vePENDLE holders, while the team collects no revenue.

6/

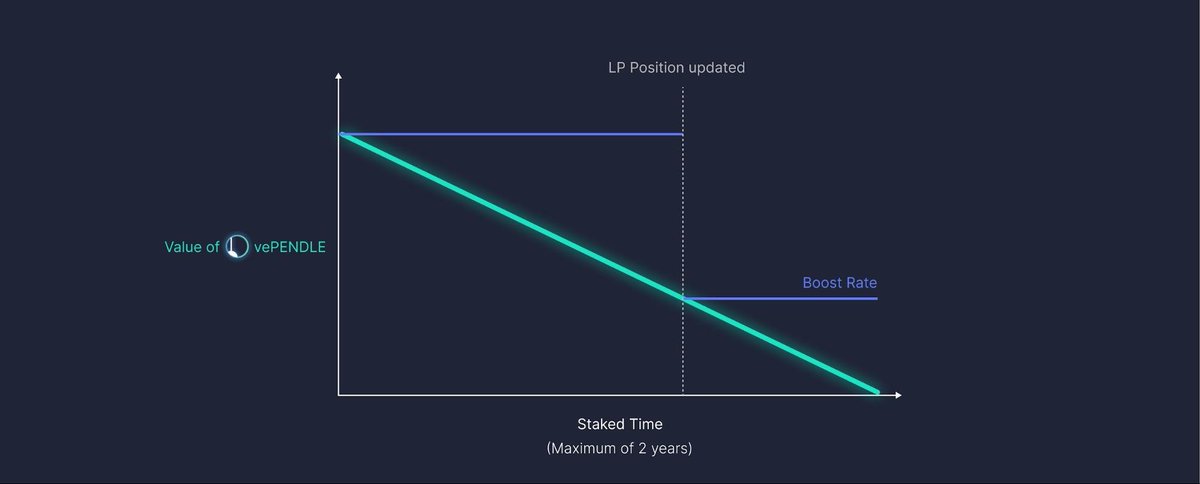

vePENDLE powers the incentive channeling mechanism on Pendle.

vePENDLE holders vote for and direct the flow of rewards to different pools, effectively incentivizing liquidity in the pool they vote for.

7/

vePENDLE holders vote for and direct the flow of rewards to different pools, effectively incentivizing liquidity in the pool they vote for.

7/

If you LP in a pool while you are holding vePENDLE, your PENDLE incentives and rewards for all of your LPs will be further boosted as well, by up to 250% based on your vePENDLE value.

8/

8/

This creates the revenue fly-wheel of more vePENDLE you staked, the more incentives you are entitled to channel.

With the locking of tokens, more supply is taken off the market and with the LP boost of up to 250%, wouldn't you want to stake as well?

9/

With the locking of tokens, more supply is taken off the market and with the LP boost of up to 250%, wouldn't you want to stake as well?

9/

Narratives🤔

My prediction is that LSD’s will begin to dominate the staked ETH ecosystem. My reasoning boils down to two options:

10/

My prediction is that LSD’s will begin to dominate the staked ETH ecosystem. My reasoning boils down to two options:

10/

1: LSD's have a high utility factor, as they can be used as depository collateral to earn interest or lent out using borrow/lend protocols to earn additive interest.

11/

11/

Being able to use this capital will allow for yield to be supercharged, and as time goes on, I believe we'll see some pretty interesting strategies emerge; I may even write a separate thread on this.

12/

12/

2: Users will demand liquidity; even after we unlock Shanghai, there will be a 27-hour wait time.

This creates illiquidity for assets, investors will prefer the extended solution of instant unlocks via LSD's.

13/

This creates illiquidity for assets, investors will prefer the extended solution of instant unlocks via LSD's.

13/

What does this mean for Pendle?

With LSDs dominating, most holders would probably like the opportunity to boost their ETH yield; with Pendle, users can now do so while leveraging double-digit APY for one of the safest assets in crypto.

14/

With LSDs dominating, most holders would probably like the opportunity to boost their ETH yield; with Pendle, users can now do so while leveraging double-digit APY for one of the safest assets in crypto.

14/

Integrations🔌

If you watch their announcements, the Pendle team has been crushing the integrations. Just to name a few:

@GMX_IO

@LayerZero_Labs

@Balancer

@AuraFinance

@Rocket_Pool

15/

If you watch their announcements, the Pendle team has been crushing the integrations. Just to name a few:

@GMX_IO

@LayerZero_Labs

@Balancer

@AuraFinance

@Rocket_Pool

15/

Business development will be critical in increasing Pendle's visibility and liquidity.

To see them execute to this level with their current valuations and following demonstrates that they understand what it takes to get to the top.

16/

To see them execute to this level with their current valuations and following demonstrates that they understand what it takes to get to the top.

16/

Valuations📊

When aiming for some moon targets, you need to consider what the current circulating and diluted market caps are.

For instance, if Pendle’s sitting around $20m circulating mc, a 100x would place it at $2B.

17/

When aiming for some moon targets, you need to consider what the current circulating and diluted market caps are.

For instance, if Pendle’s sitting around $20m circulating mc, a 100x would place it at $2B.

17/

Considering the time it may take, with unlocks, this could end up scaling to an additional 20% tokens released into supply.

Recognize what will allow this token to get there (LSD staking supercharged).

Is there enough rocket fuel to support those valuations?

18/

Recognize what will allow this token to get there (LSD staking supercharged).

Is there enough rocket fuel to support those valuations?

18/

Use previous DeFi protocols from the last bull run as an example.

What characteristic did they have which allowed them to be valued in the billions?

Did token holders receive revenue?

How did their product help users?

19/

What characteristic did they have which allowed them to be valued in the billions?

Did token holders receive revenue?

How did their product help users?

19/

Given the previous topics, hopefully you can see why I'm optimistic about this project.

Finally, Pendle has a lot of marketing power behind them. Several intelligent DeFi investors & writers are all extremely bullish, which is always reassuring.

20/

Finally, Pendle has a lot of marketing power behind them. Several intelligent DeFi investors & writers are all extremely bullish, which is always reassuring.

20/

If you enjoyed this thread and want to learn more, I’ve written an extensive deep dive covering all the needed areas to understand how Pendle works and where it thrives.

cryptotrissy.substack.com/p/pendle-finan…

21/

cryptotrissy.substack.com/p/pendle-finan…

21/

Here’s some other writers who give awesome alpha:

@crypto_linn

@TheDeFinvestor

@CrossChainAlex

@LouisCooper_

@bizyugo

@defisurfer808

@thedefiedge

@DefiIgnas

@Chinchillah_

@DeFi_educator

@ViktorDefi

@TheDeFISaint

@DeFiMinty

@RiddlerDeFi

@cryptodetweiler

@0xsurferboy

22/

@crypto_linn

@TheDeFinvestor

@CrossChainAlex

@LouisCooper_

@bizyugo

@defisurfer808

@thedefiedge

@DefiIgnas

@Chinchillah_

@DeFi_educator

@ViktorDefi

@TheDeFISaint

@DeFiMinty

@RiddlerDeFi

@cryptodetweiler

@0xsurferboy

22/

• • •

Missing some Tweet in this thread? You can try to

force a refresh