Over the last month, the bond market has been sending important messages.

A thread.

1/

A thread.

1/

Investing without properly understanding the bond market is like eating soup with a fork.

Exhausting and counterproductive.

So, let's pay attention to the important signals it's been sending recently.

2/

Exhausting and counterproductive.

So, let's pay attention to the important signals it's been sending recently.

2/

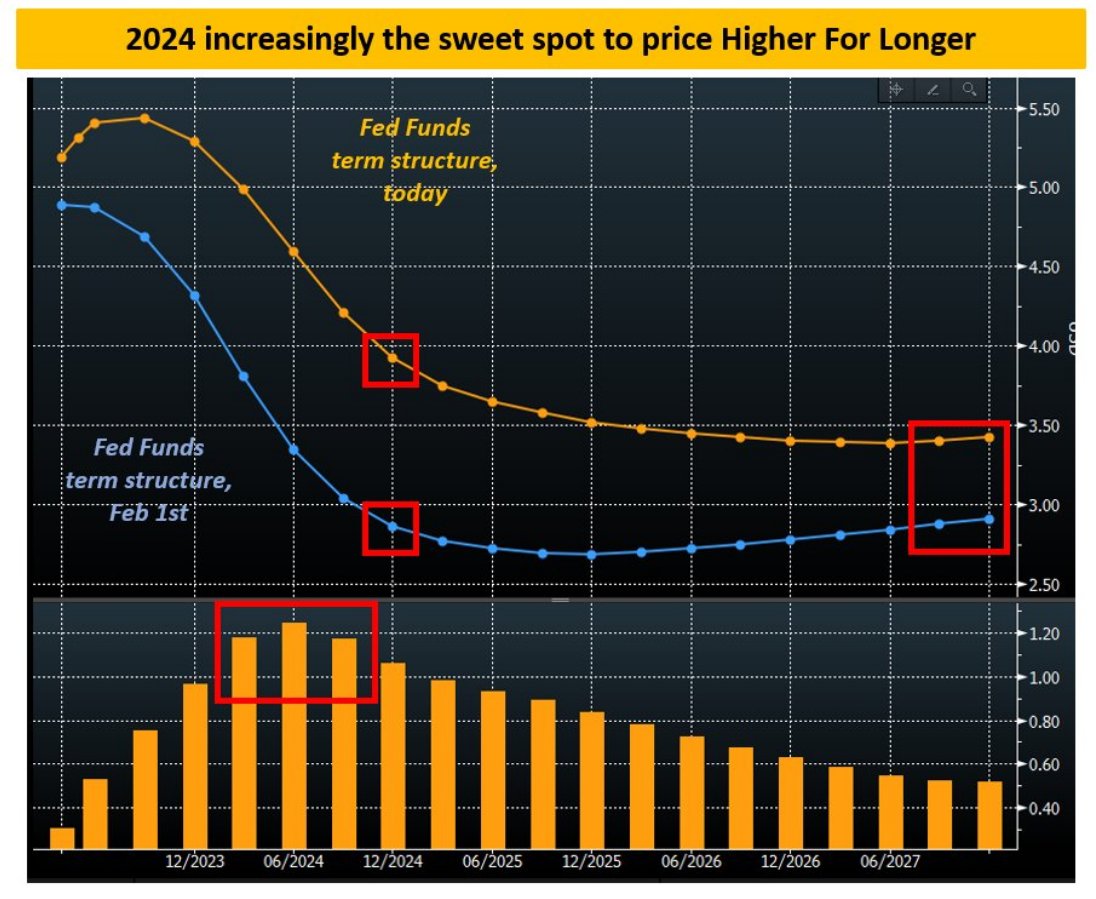

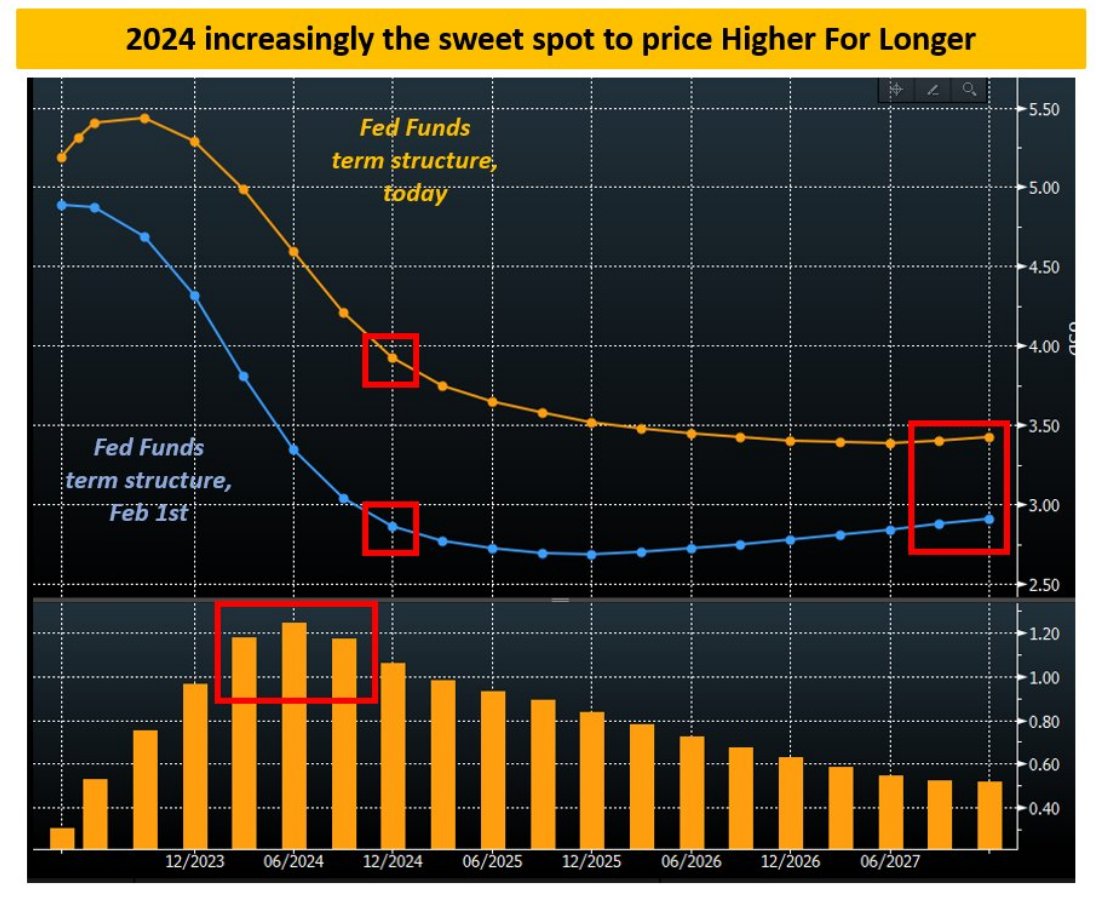

The SOFR future market offers the possibility to observe the market-implied Fed Funds at different dates in the future.

The chart below shows Fed Funds priced in between 2023 and 2027 by fixed income investors today (orange) vs Feb 1st (blue).

Two important points here:

3/

The chart below shows Fed Funds priced in between 2023 and 2027 by fixed income investors today (orange) vs Feb 1st (blue).

Two important points here:

3/

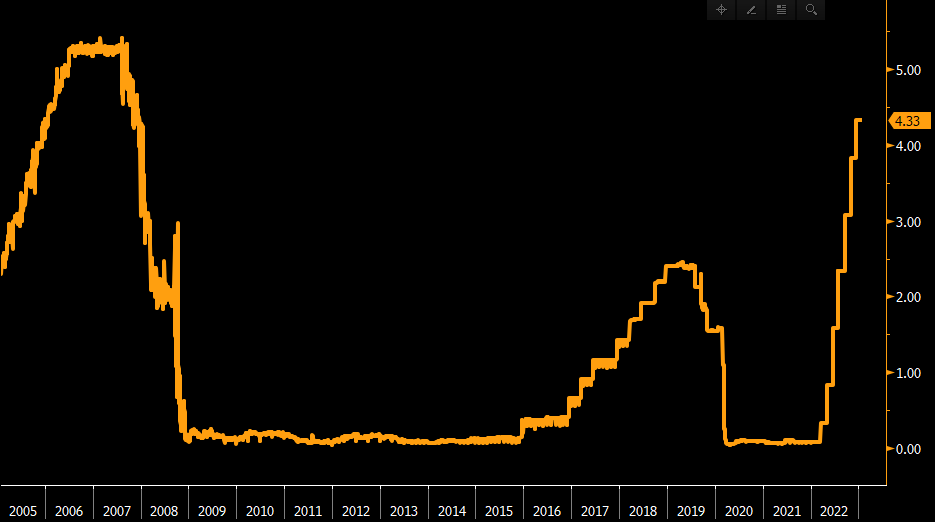

1. By December 2024, Fed Funds are priced to be still at over 4%

Only a month ago, investors were expecting the Fed to embark in rapid cuts to 2.75% as the perfect disinflationary soft landing was priced in.

These expectations have been revised a whopping 120 bps higher.

4/

Only a month ago, investors were expecting the Fed to embark in rapid cuts to 2.75% as the perfect disinflationary soft landing was priced in.

These expectations have been revised a whopping 120 bps higher.

4/

This matters because tighter monetary policy works through two main channels:

A) Shock (2022): rapid rise in interest rates with subsequent repricing of valuations

B) Length (2023): companies and households must reprice their medium-term expectations for the cost of capital

5/

A) Shock (2022): rapid rise in interest rates with subsequent repricing of valuations

B) Length (2023): companies and households must reprice their medium-term expectations for the cost of capital

5/

Take the housing market to understand this.

Mortgage rates moving from 3% to 7% was a severe shock to the housing market in 2022.

But keeping mortgage rates at 7% for a long period of time is the second and most underappreciated source of tightening.

And it's happening.

6/

Mortgage rates moving from 3% to 7% was a severe shock to the housing market in 2022.

But keeping mortgage rates at 7% for a long period of time is the second and most underappreciated source of tightening.

And it's happening.

6/

2. Even in 5 years from now, Fed Funds are still priced to be at 3.50%.

These might be an initial attempt towards repricing a higher equilibrium interest rate - a total game changer.

If the US economy can sustain 3.5% risk-free rates and still produce ~2% real GDP growth...

7/

These might be an initial attempt towards repricing a higher equilibrium interest rate - a total game changer.

If the US economy can sustain 3.5% risk-free rates and still produce ~2% real GDP growth...

7/

...the world has really changed with the pandemic.

In other words, the US bond market has moved from pricing a perfect disinflationary soft landing to hinting at two potential tectonic shifts:

A) Tighter policy for longer

B) Maybe higher equilibrium rates for the economy

8/

In other words, the US bond market has moved from pricing a perfect disinflationary soft landing to hinting at two potential tectonic shifts:

A) Tighter policy for longer

B) Maybe higher equilibrium rates for the economy

8/

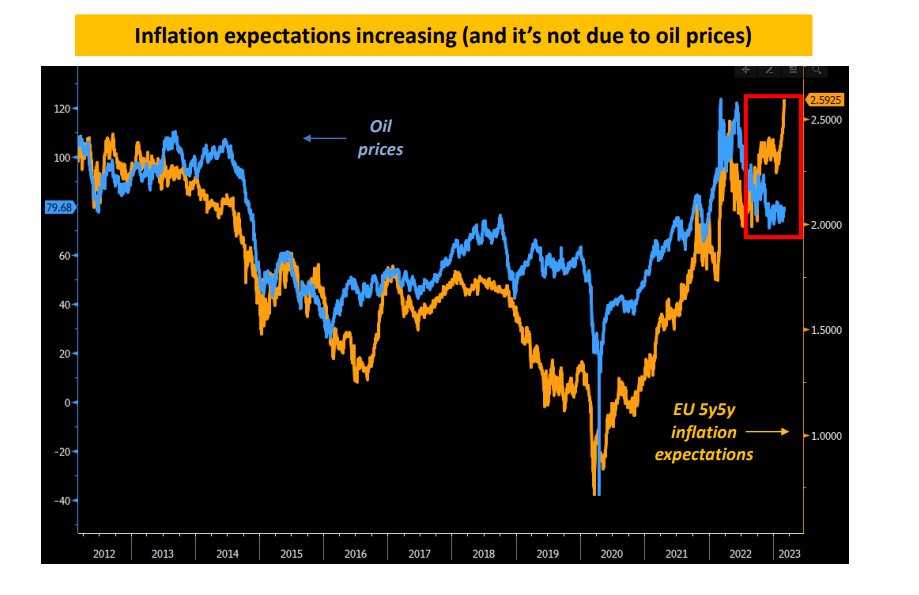

This is even more visible in Europe - yes, exactly the place where you wouldn't expect this.

Long-dated inflation expectations just hit a 10y+ high.

And no, it's not due to higher oil prices this time.

Look at this chart...

9/

Long-dated inflation expectations just hit a 10y+ high.

And no, it's not due to higher oil prices this time.

Look at this chart...

9/

In the past, large moves in EU inflation expectations coincided with large swings in oil prices.

This time though 5-year forward, 5-year European inflation expectations hit 2.60% even with energy prices going nowhere.

Most importantly, this is happening exactly when...

10/

This time though 5-year forward, 5-year European inflation expectations hit 2.60% even with energy prices going nowhere.

Most importantly, this is happening exactly when...

10/

...the ECB is becoming more vocally hawkish and bond markets are pricing in a 4% terminal rate in Europe.

So: higher inflation expectations DESPITE a tighter monetary policy and no rally in energy prices.

What happens if commodities start to rally here?

11/

So: higher inflation expectations DESPITE a tighter monetary policy and no rally in energy prices.

What happens if commodities start to rally here?

11/

The bottoming out of leading indicators for growth and inflation couldn't come at a trickier point for Central Banks.

Over the last month, bond markets in both Europe and the US have started challenging key assumptions, and in particular...

12/

Over the last month, bond markets in both Europe and the US have started challenging key assumptions, and in particular...

12/

- Central Banks will credibly bring inflation down to 2% quick: are we really sure about that?

- The economy cannot sustain equilibrium interest rates north of 2% (Europe) and 3% (US): are we really sure about that?

The answers to these questions are vital...

13/

- The economy cannot sustain equilibrium interest rates north of 2% (Europe) and 3% (US): are we really sure about that?

The answers to these questions are vital...

13/

...for long-term investors, as the bond market is key to all other asset classes.

I was born and raised in bond markets, and got my hands dirty by running a large institutional portfolio focused on this asset class.

Week in and week out, I do my best to break down...

14/

I was born and raised in bond markets, and got my hands dirty by running a large institutional portfolio focused on this asset class.

Week in and week out, I do my best to break down...

14/

...the bond market dynamics and all things global macro on The Macro Compass

My aim is to deliver institutional-level macro analysis and portfolio strategy in plain English and accessible to everybody

Check it out here: TheMacroCompass.com

Enjoy your weekend, guys!

15/15

My aim is to deliver institutional-level macro analysis and portfolio strategy in plain English and accessible to everybody

Check it out here: TheMacroCompass.com

Enjoy your weekend, guys!

15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh