1/ New paper from ReSolve explores methods for replicating trend-following managed futures, with simulated results and performance statistics. 📊

investresolve.com/peering-around…

investresolve.com/peering-around…

2/ 💹 Trend-following managed futures is a hedge-fund strategy that involves trading futures contracts to identify and capitalize on trends in financial markets, producing returns with low correlation to traditional portfolios.

3/ 🎯 Managed futures are an excellent diversifying strategy for traditional portfolios, historically producing returns with low correlation to major stock and bond benchmarks. 📈

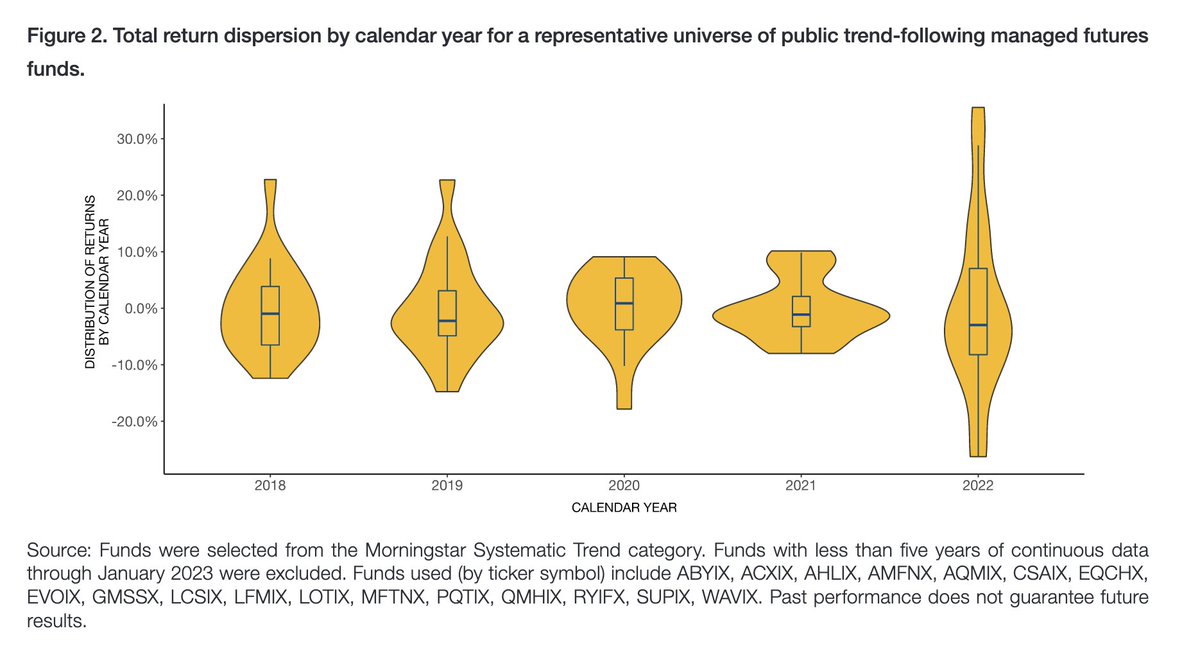

4/ ↔️ However, there is large dispersion from year-to-year due to the great deal of variation in how funds express a trend-following strategy.

5/ 🪞 To gain exposure to the underlying theme of trend-following with minimal tracking error, replication strategies have been developed for trend-following managed futures.

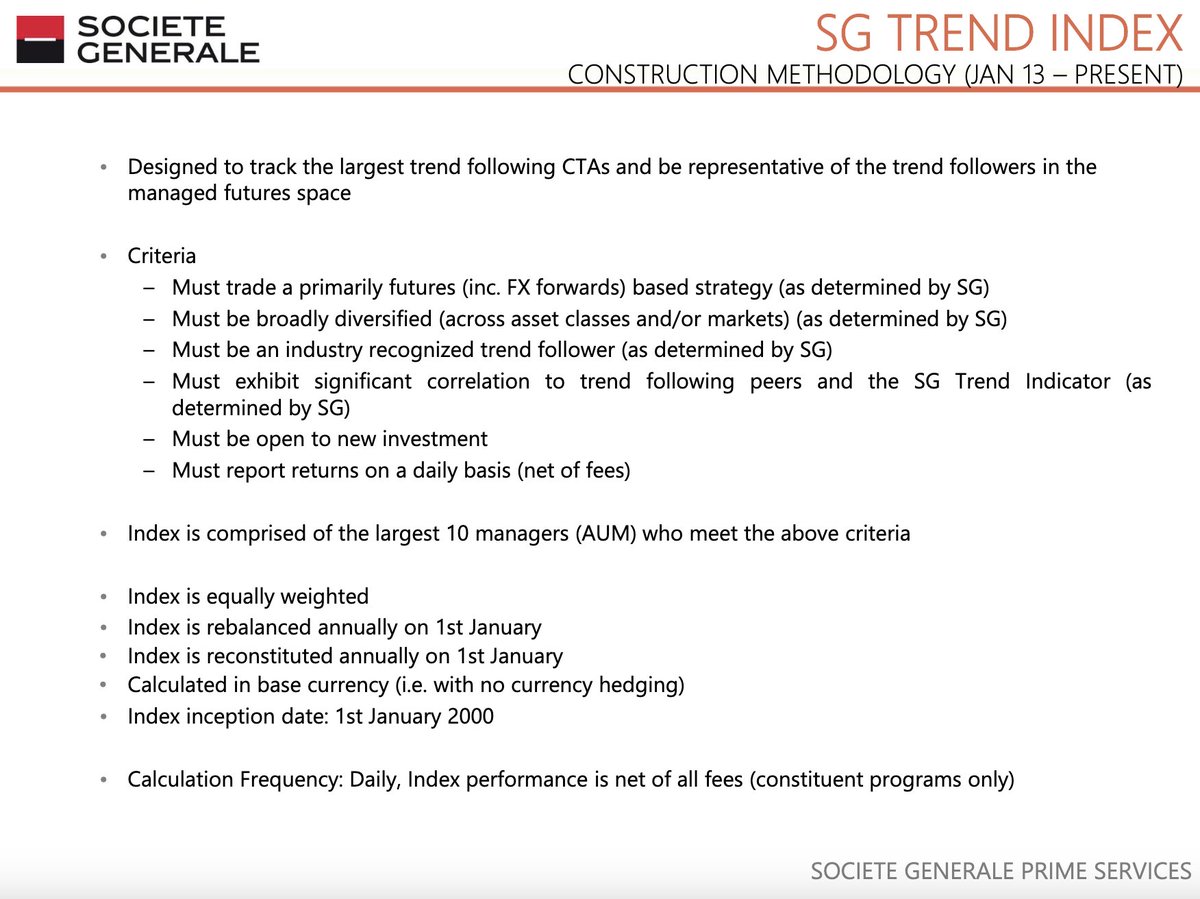

6/ 💼 The Société Générale Trend Index is a suitable benchmark for trend-following managed futures replication strategies, tracking the 10 largest trend-following managed futures funds. ✔️

7/ ⚙️ To replicate the Trend Index, this paper proposes both "top-down" and "bottom-up" replication approaches.🔽🔼

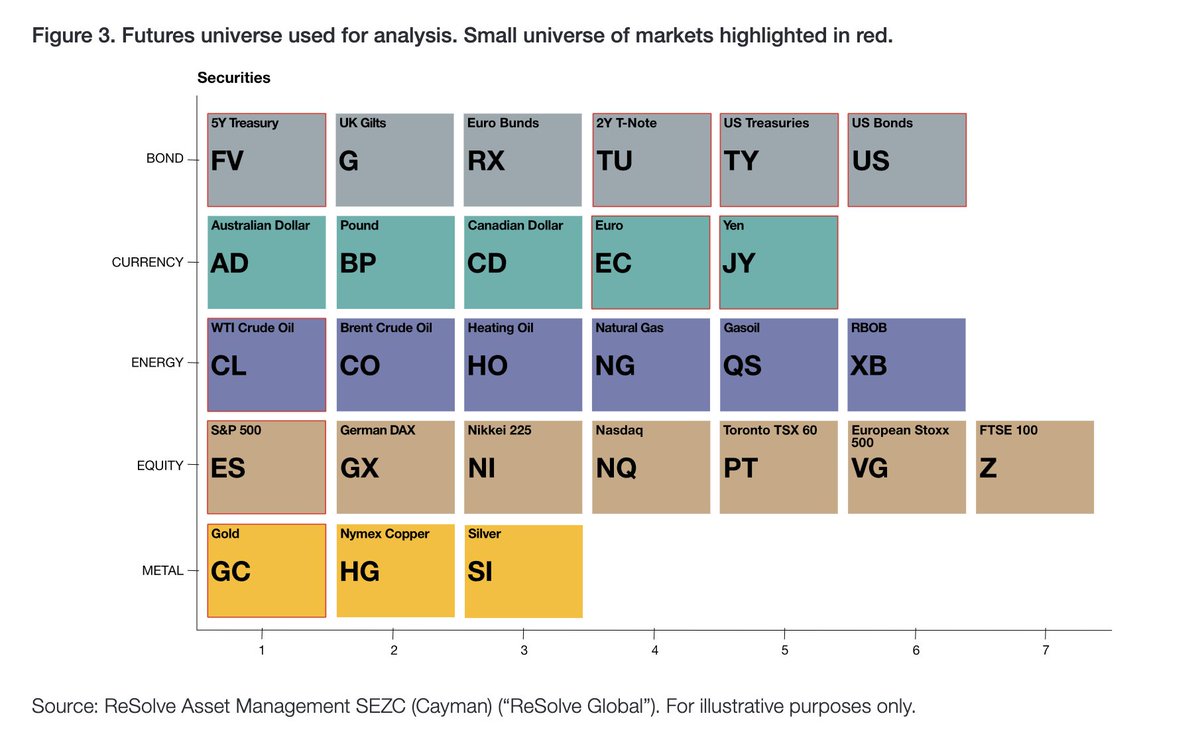

8/ 🔢 Two investment universes were utilized for modeling purposes: a medium-sized universe of 27 liquid futures markets and a small universe of 9 liquid futures markets.

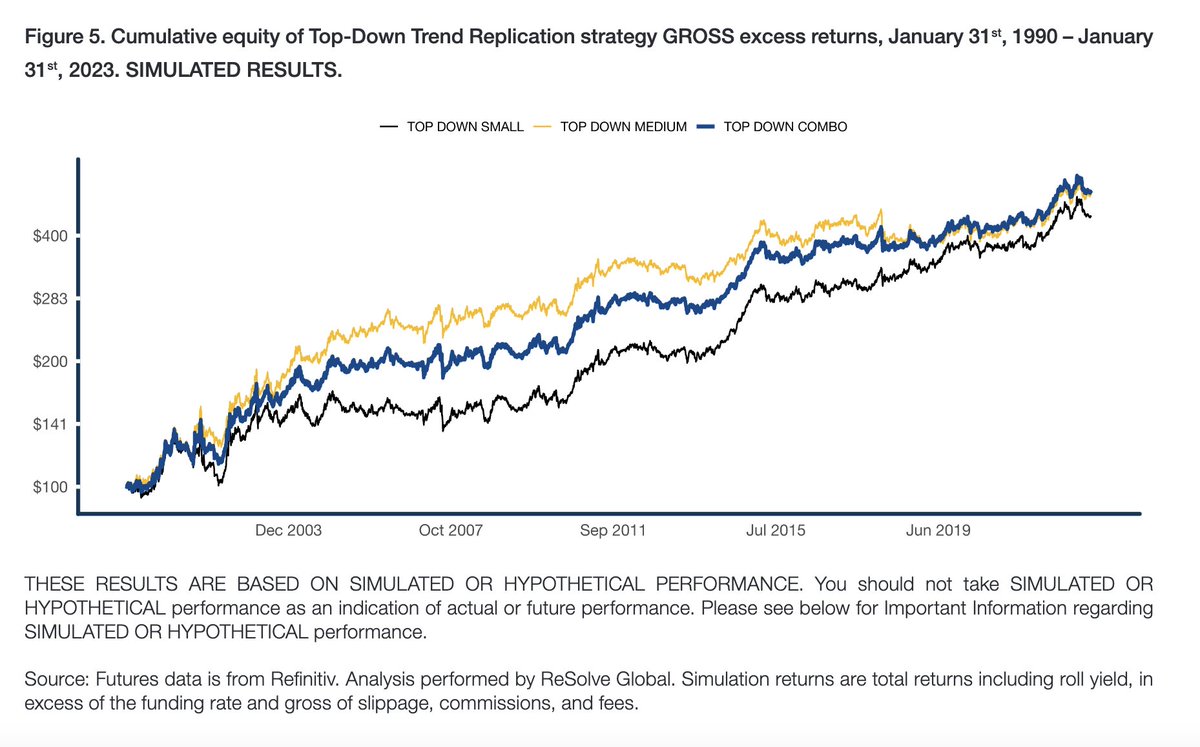

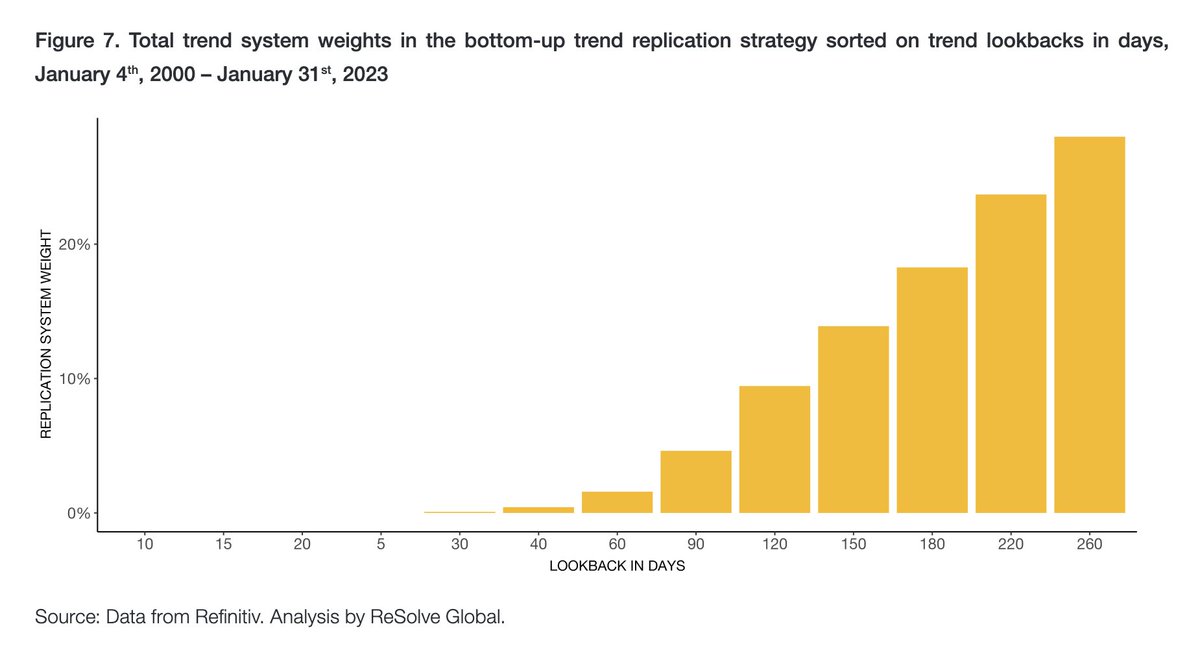

9/ 🔽 Top-down replication uses Elastic Net regression to identify the most important markets in each period and minimize the tracking error. Results show a better tracking portfolio was produced by combining small and large universes. ➕

10/ 🔼 Bottom-up replication aims to uncover underlying strategies used by funds in the index to form portfolios. Ridge regression was used to fit the returns from 351 trend strategies, producing a replication portfolio that exceeds 0.8 correlation with the SG Trend Index.

11/ 🔼 Bottom-up replication analysis revealed that trend managers on average assign monotonically increasing weight to longer trend strategies, and trends with lookbacks less than 30 days are not commonly traded. ⚖️

12/ 🔽🔼 By using a combination of top-down and bottom-up replication methods, the final replication model captures broad exposures while identifying the underlying strategies used by trend-following managed futures funds. 🤝

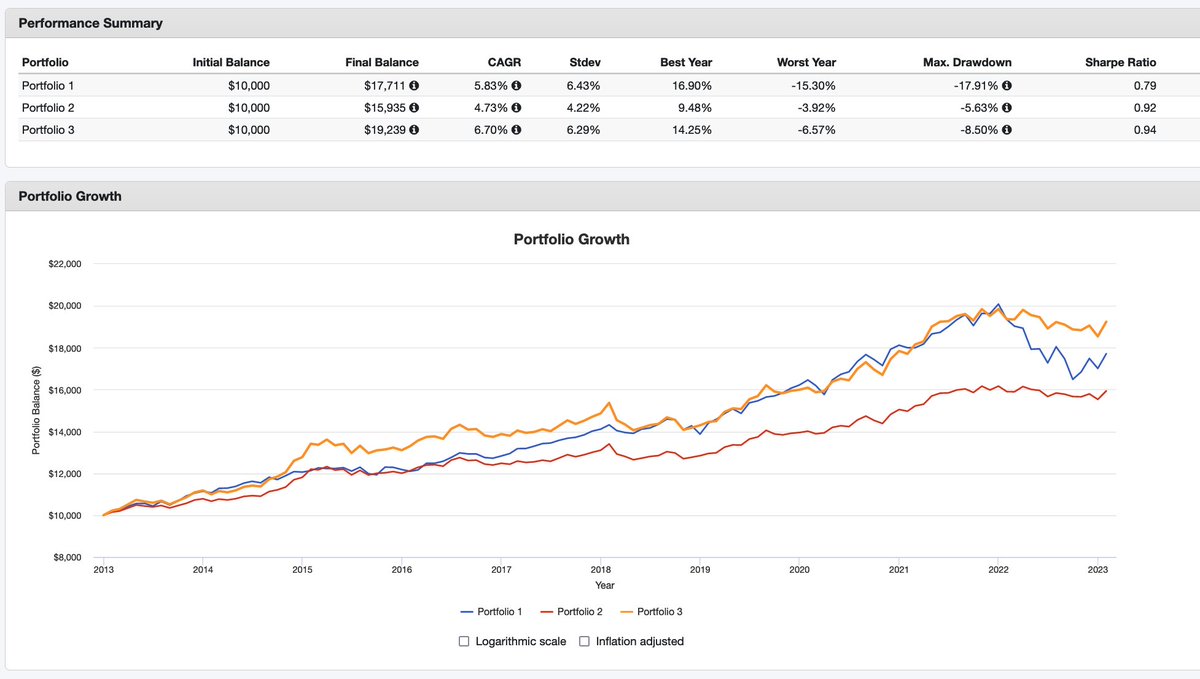

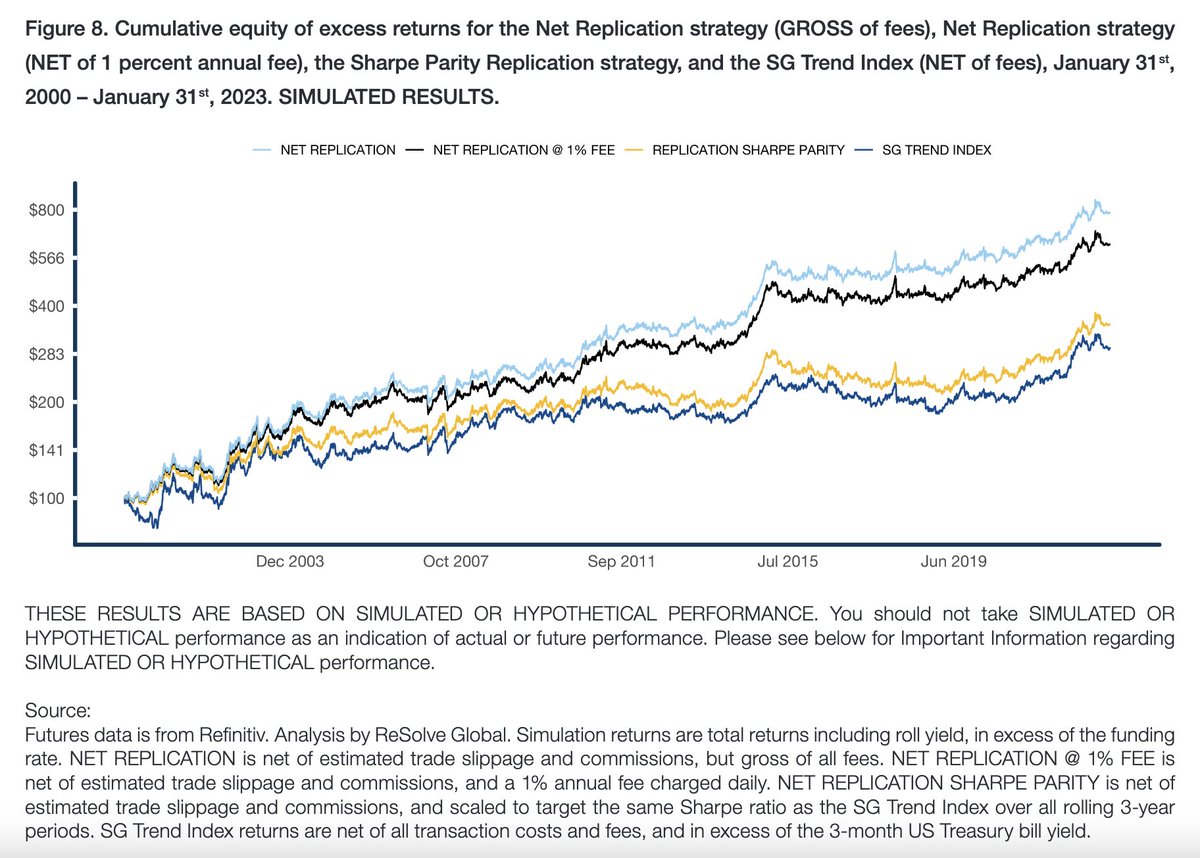

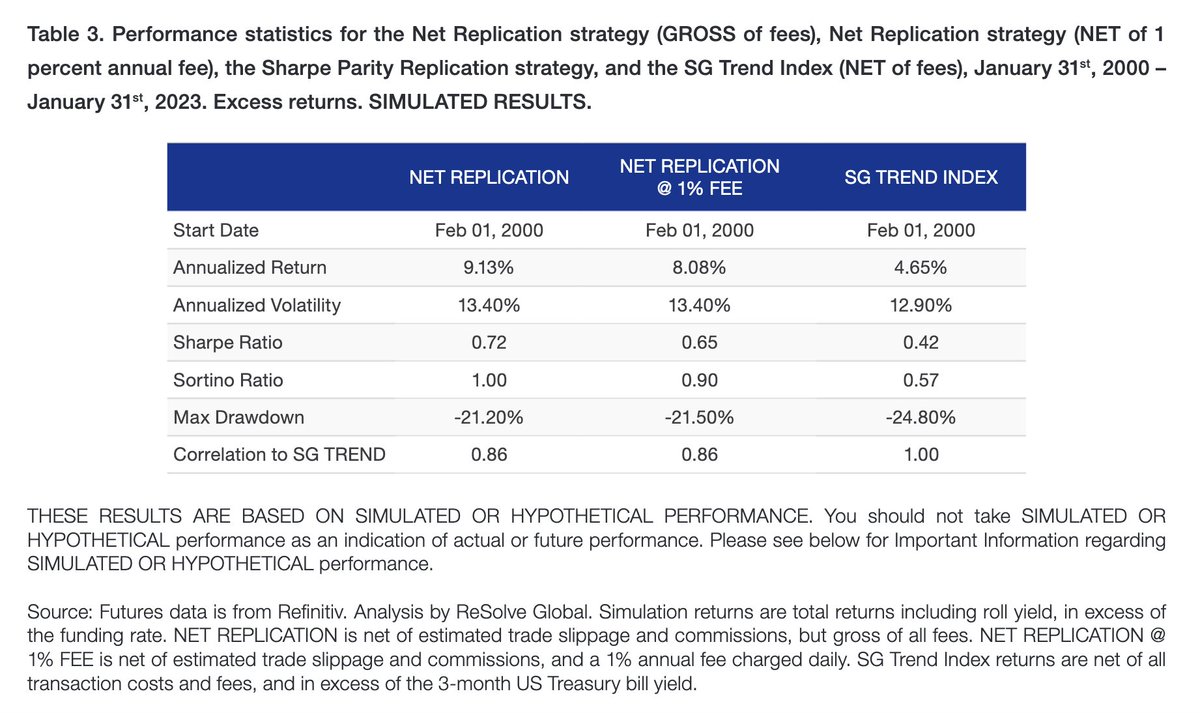

13/ 📊 Simulated results show that the replication strategy has an annualized return of 9.13% before fees and 5.59% net of fees, suggesting a 3.5 percentage point per year advantage for the replication strategy. 📈

14/ 🔢 The final replication model gives 70% weight to the bottom-up replication method, reflecting the belief that the underlying strategies used by trend-following managed futures funds are the primary drivers of returns to the Trend Index. 🧮

15/ 📈 With a correlation of 0.86 with the Société Générale Trend Index, the final replication model shows good potential to accurately capture the performance of benchmark trend indices while minimizing idiosyncratic manager risk. 🎯

16/ 🔎 Check out the simulated performance statistics and figures in the paper. Learn how to replicate trend-following strategies and improve your portfolio diversification! Download the paper now! 🫡

investresolve.com/peering-around…

investresolve.com/peering-around…

P.S./ Tweet 14 should say 50/50, not 70/30.

P.P.S./

One of the benefits of the bottom up approach is that even if it does a bad job replicating the index, it's still implementing a diversified trend following strategy.

One of the benefits of the bottom up approach is that even if it does a bad job replicating the index, it's still implementing a diversified trend following strategy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh