We just had the biggest bank collapse in America since 2008.

And it happened because of a bank run.

Let me explain how this will impact YOU:

And it happened because of a bank run.

Let me explain how this will impact YOU:

Let's start with some background info:

Before March 26, 2020, the US financial system was based on fractional reserve banking.

Fractional reserve banking is a system that allows banks to only keep a certain portion of client deposits.

Before March 26, 2020, the US financial system was based on fractional reserve banking.

Fractional reserve banking is a system that allows banks to only keep a certain portion of client deposits.

Fractional reserve banking allows banks to do whatever they want with client deposits in order to make a profit.

For example, they can lend the money or invest it in assets.

For example, they can lend the money or invest it in assets.

A lot of the growth in our current system comes from lending.

When banks lend money more easily, it means businesses are able to invest in operations and hire employees.

When banks lend money more easily, it means businesses are able to invest in operations and hire employees.

On March 15, 2020, the Board of Governors of the Federal Reserve System announced a change to reserve requirements.

On March 26, 2020, the US banking system would be changed to NO RESERVE banking.

Simply put, banks could start doing whatever they want with ALL client deposits.

On March 26, 2020, the US banking system would be changed to NO RESERVE banking.

Simply put, banks could start doing whatever they want with ALL client deposits.

Over the pandemic, demand for loans dropped, so banks needed a different way to make money.

They started buying assets with client deposits.

They started buying assets with client deposits.

The issue is that asset prices are volatile, while deposit amounts are fixed.

Decreases in asset prices could mean banks can't satisfy client withdrawal requests.

Decreases in asset prices could mean banks can't satisfy client withdrawal requests.

A bank run happens when a large number of clients start withdrawing their deposits very quickly.

Since banks don't hold enough deposits, they can't handle a large influx of withdrawals.

This leads to banks not being able to satisfy short-term liabilities (client withdrawals).

Since banks don't hold enough deposits, they can't handle a large influx of withdrawals.

This leads to banks not being able to satisfy short-term liabilities (client withdrawals).

Client bank deposits at US Banks are covered by Federal Deposit Insurance Corporation.

FDIC covers up to $250,000 in deposits.

Anyone with less than $250,000 can recover their funds by March 13, 2023.

FDIC covers up to $250,000 in deposits.

Anyone with less than $250,000 can recover their funds by March 13, 2023.

Let's get back to the largest bank collapse since 2008:

Silicon Valley Bank (SVB) was a commercial bank in California.

It was one of the largest banks in the US based on deposits.

Silicon Valley Bank (SVB) was a commercial bank in California.

It was one of the largest banks in the US based on deposits.

From 2020 to 2021, SVB received large deposits.

SVB bought assets using most of these deposits.

SVB bought assets using most of these deposits.

The increase of interest rates over the last year and a half effected asset markets significantly.

This means the assets SVB bought using client deposits lost significant amounts of value.

This means the assets SVB bought using client deposits lost significant amounts of value.

If SVB faced a bank run, it wouldn't be able to fulfill the withdrawal requests.

On March 10th, $42 billion in deposits left the bank and led to a bank collapse.

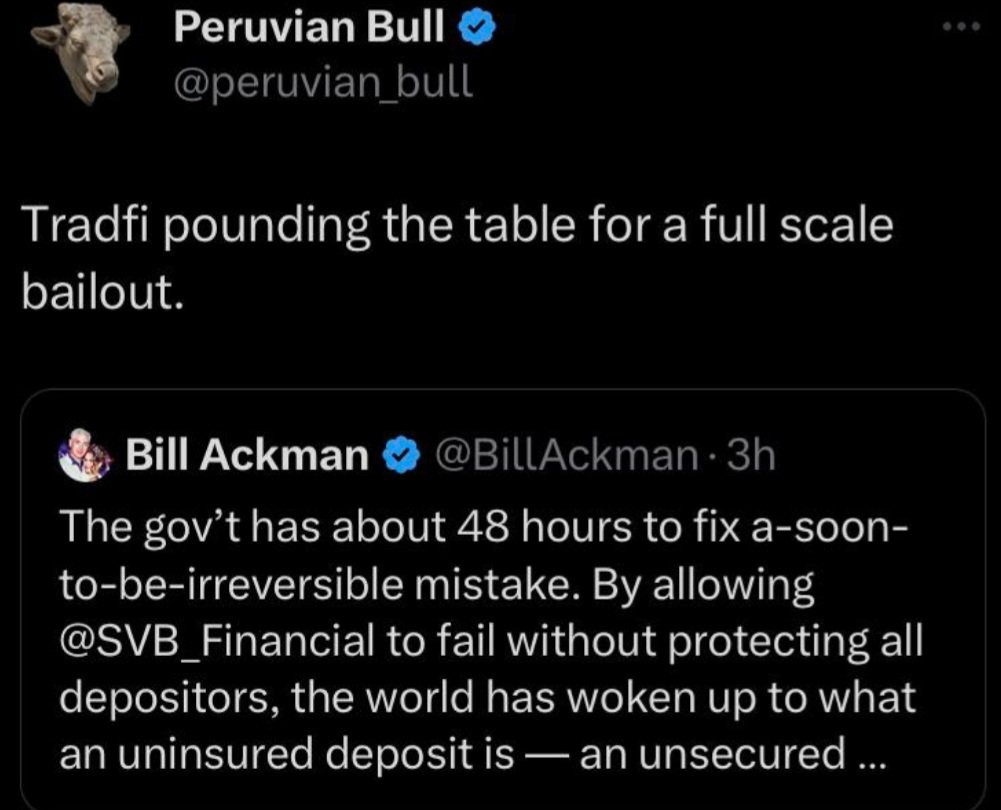

SVB was taken over by FDIC in the second largest bank failure in American financial history.

On March 10th, $42 billion in deposits left the bank and led to a bank collapse.

SVB was taken over by FDIC in the second largest bank failure in American financial history.

A big problem: SVB holds cash deposits of large tech companies.

For example, Roku holds 26% of its cash with SVB.

This cash may not be accessible for a long time, meaning if Roku has short-term liabilities of its own, it may not be able to cover them.

For example, Roku holds 26% of its cash with SVB.

This cash may not be accessible for a long time, meaning if Roku has short-term liabilities of its own, it may not be able to cover them.

This could lead to ripple effects across various industries.

Companies holding more than $250,000 with SVB won't be able to access their cash until a future date.

It could lead to liquidations of business assets to pay creditors, bankruptcies, and job losses.

Companies holding more than $250,000 with SVB won't be able to access their cash until a future date.

It could lead to liquidations of business assets to pay creditors, bankruptcies, and job losses.

One company defaulting on its liabilities leads to a chain of events.

Since companies that deposited money at SVB were large corporations, defaults and bankruptcies could lead to widespread losses.

Since companies that deposited money at SVB were large corporations, defaults and bankruptcies could lead to widespread losses.

The deposits that SVB used to invest were in "transaction accounts" (like checking accounts) where the money could be withdrawn at will, whenever the depositor needs it.

SVB was offering high interest on these deposits, so it purchased bonds to fund the higher interest payouts.

SVB was offering high interest on these deposits, so it purchased bonds to fund the higher interest payouts.

The increase in interest rates over the last 1.5 years led to a decrease in the market value of SVBs bond holdings.

This means even if SVB sold all its bonds, it wouldn't be able to satisfy the withdrawal requests.

This means even if SVB sold all its bonds, it wouldn't be able to satisfy the withdrawal requests.

We're probably going to deal with this for a while.

This is what the federal reserve was attempting to interest rates were going up.

They needed to break something in the financial markets to trigger job losses and a recession.

This is what the federal reserve was attempting to interest rates were going up.

They needed to break something in the financial markets to trigger job losses and a recession.

Interest rate increases explained in depth:

https://twitter.com/rajatsonifnance/status/1620907194693861377?s=20

PAIN IS COMING.

This bank failure could lead to bankruptcies when companies with all their cash at SVB can't pay their debts.

Layoffs will follow, and nobody knows how bad the impact will be.

This bank failure could lead to bankruptcies when companies with all their cash at SVB can't pay their debts.

Layoffs will follow, and nobody knows how bad the impact will be.

People may have to sell assets to pay for day to day expenses, so assets prices will drop.

Risky assets are the first to drop (bitcoin, growth stocks, short term rental properties).

Less risky assets (long term real estate, value stocks) are the slowest to get impacted.

Risky assets are the first to drop (bitcoin, growth stocks, short term rental properties).

Less risky assets (long term real estate, value stocks) are the slowest to get impacted.

With everything happening all at once (high inflation, increased rates, defaults, potential mortgage issues) the best thing you can do right now is protect your income.

Your goal right now is to protect yourself.

This is where your emergency fund will come in handy.

Having cash set aside can help you avoid bankruptcy and homelessness.

This is where your emergency fund will come in handy.

Having cash set aside can help you avoid bankruptcy and homelessness.

If you're prepared, there's a silver lining:

Over the next few months we will probably see deals in asset prices.

Prices of stocks, real estate, and bitcoin will probably see drops.

Over the next few months we will probably see deals in asset prices.

Prices of stocks, real estate, and bitcoin will probably see drops.

While your income is safe BUILD MORE STREAMS OF CASH FLOW.

Don't take a chance.

Don't take a chance.

I'm passionate about helping more people become financially literate, but these threads take a long time to write.

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.substack.com

Thanks for reading!

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.substack.com

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh