The #SVBCollapse is showing us how corrupt the legacy financial system is.

It's stacked against the working class.

Let me explain:

It's stacked against the working class.

Let me explain:

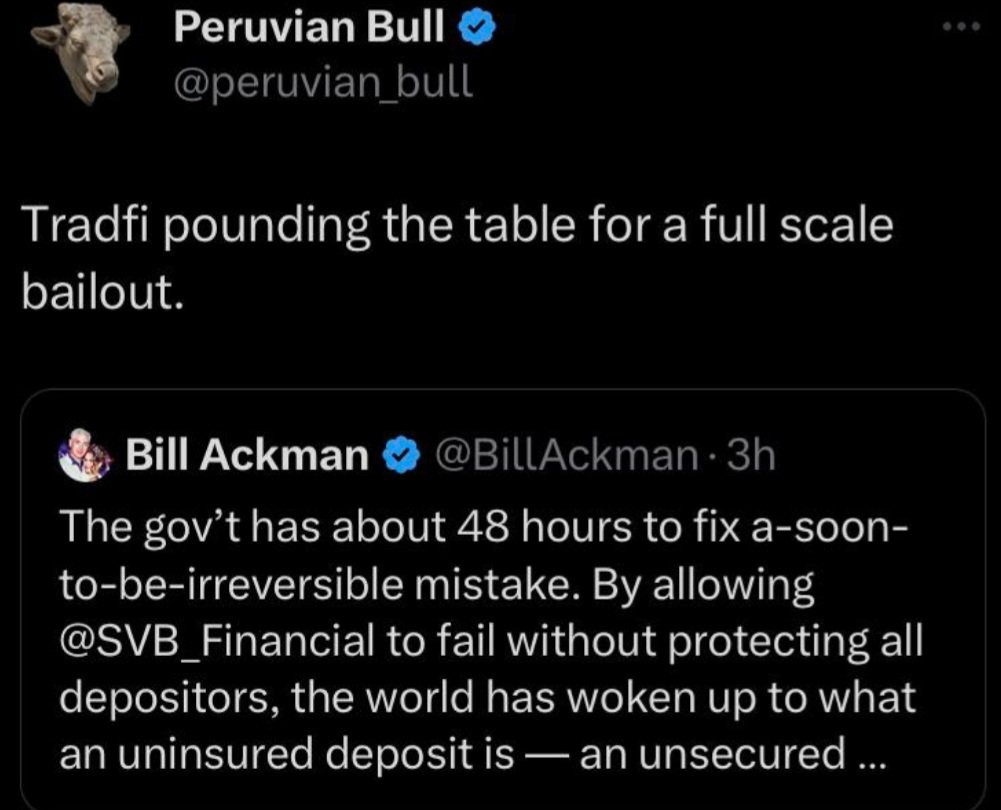

In traditional markets, high value investors always try to get bailed out.

Fixing a "soon to be irreversible mistake" means bailing out Silicon Valley Bank.

Fixing a "soon to be irreversible mistake" means bailing out Silicon Valley Bank.

Why?

Likely because they would lose significant amounts of money if financial institutions aren't bailed out.

They may have the right intentions, but they make money from predicting where the market is going.

Likely because they would lose significant amounts of money if financial institutions aren't bailed out.

They may have the right intentions, but they make money from predicting where the market is going.

A lot of venture capitalists will say certain things in public to make money in private.

The issue is that these bailouts aren't free.

They cost the taxpayer and they cost anybody that holds US Dollars.

We are STILL seeing the issues from the great financial crash that lasted from 2007-2009.

They cost the taxpayer and they cost anybody that holds US Dollars.

We are STILL seeing the issues from the great financial crash that lasted from 2007-2009.

Back then, the banking system was bailed out.

But the people who lost their life savings weren't.

During good times, bank executives were paid huge bonuses to take risks.

During the GFC the USA shared losses of highly leveraged banks with people who took no risks whatsoever.

But the people who lost their life savings weren't.

During good times, bank executives were paid huge bonuses to take risks.

During the GFC the USA shared losses of highly leveraged banks with people who took no risks whatsoever.

Did you know during the great financial crash only one banker was sent to prison?

People in the working class lost their life savings, but nobody was blamed except for this guy:

People in the working class lost their life savings, but nobody was blamed except for this guy:

What are the chances that only one person did something like this?

Pretty low in my opinion.

Pretty low in my opinion.

In 2009, Bitcoin was created to counter all of this.

You don't need to rely on a third party to hold your btc.

You don't need banks that will risk your money to make a tiny profit.

You can hold it in your own wallet at your own house.

You don't need to rely on a third party to hold your btc.

You don't need banks that will risk your money to make a tiny profit.

You can hold it in your own wallet at your own house.

Taking responsibility for your own assets means that, if you don't lose them somehow, they will never leave your possession.

1BTC will always be 1BTC.

If you have 1 BTC in your your wallet TODAY and you don't sell, your wallet will hold 1 BTC 10, 20, 50, or 100 years from now.

1BTC will always be 1BTC.

If you have 1 BTC in your your wallet TODAY and you don't sell, your wallet will hold 1 BTC 10, 20, 50, or 100 years from now.

In November, we saw contagion after FTX, Terra Luna, and a bunch of other crypto projects failed.

Nobody bailed out investors in those situations.

And you know what?

The people who didn't risk their btc weren't punished.

Nobody bailed out investors in those situations.

And you know what?

The people who didn't risk their btc weren't punished.

Anybody that did their due diligence and held their own crypto, still holds the same number of coins as they did before.

Anybody that took a risk, didn't do their due diligence, and didn't withdraw their crypto to their own wallet, lost everything.

Anybody that took a risk, didn't do their due diligence, and didn't withdraw their crypto to their own wallet, lost everything.

If Silicon Valley Bank is bailed out, the long term negative impact on the average person will be HUGE.

Financial industries will be incentivised to take more risk with fewer repercussions.

Financial industries will be incentivised to take more risk with fewer repercussions.

You know how housing became so unaffordable?

Part of it was because investment firms (like Blackrock) were buying single family homes to make a profit, because their algorithm told them to.

They took risks, to transfer wealth from people in the working class to elites.

Part of it was because investment firms (like Blackrock) were buying single family homes to make a profit, because their algorithm told them to.

They took risks, to transfer wealth from people in the working class to elites.

I highly recommend keeping up with this situation as it unfolds.

The tweet below will give you a summary of why Silicon Valley Bank collapsed, and you can also learn about how fractional reserve banking and bank runs work:

The tweet below will give you a summary of why Silicon Valley Bank collapsed, and you can also learn about how fractional reserve banking and bank runs work:

https://twitter.com/rajatsonifnance/status/1634379916379664391?t=nRpXDBBZrdkUKLzN1j3YPA&s=19

Learn how recessions work and what causes them:

https://twitter.com/rajatsonifnance/status/1616232559888801792?t=sNfFW_9VTtxluHsHRJl3Bg&s=19

Finally, learn how bitcoin works:

https://twitter.com/rajatsonifnance/status/1619456814332141568?t=cDwfF8AIHDDWj2EYZwcAXQ&s=19

I'm passionate about helping more people become financially literate, but these threads take a long time to write.

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.substack.com

Thanks for reading!

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.substack.com

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh