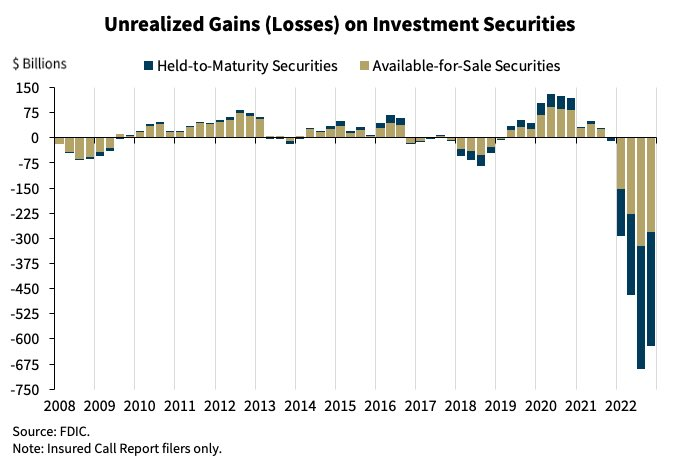

US banks are sitting on a $675B paper loss from their bond portfolios that they bought before interest rates began rising last year

#SVBCollapse was significant, but this is pretext for helping US banks recover their losses by socializing costs with Fed money printing.🧵

#SVBCollapse was significant, but this is pretext for helping US banks recover their losses by socializing costs with Fed money printing.🧵

How did banks lose all this money? They bought a lot of low-interest bonds last year, whose value decreased drastically when the Fed began raising interest rates.

Remember, existing bonds lose value when new bonds that pay more interest can be bought on the open market.

Remember, existing bonds lose value when new bonds that pay more interest can be bought on the open market.

SVB got into trouble because they used customer deposits to buy a bunch of long duration bonds last year to collect interest.

When customers began withdrawing, the value of the bonds they possessed no longer covered the deposits they owed.

When customers began withdrawing, the value of the bonds they possessed no longer covered the deposits they owed.

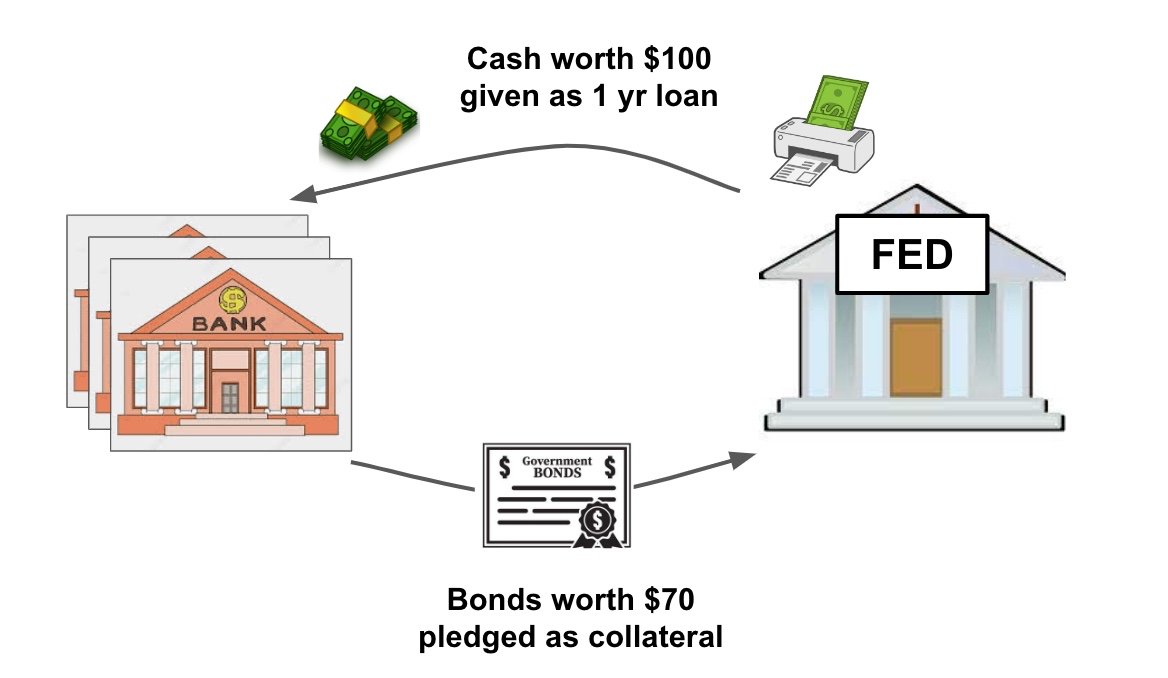

To save SVB, the Fed announced on Sunday that it would be setting up a Bank Term Funding Program (BTFP) to lend money to banks that pledge their bonds assets as collateral.

SVB can now use these loans to pay back depositors

zerohedge.com/markets/svb-la…

SVB can now use these loans to pay back depositors

zerohedge.com/markets/svb-la…

The key is you, as a bank, can borrow at "par-value" for bonds that are currently "marked-to-market" to lower prices due the rise in interest rates earlier this year.

E.g. even if your $100 bond if-held-to-maturity is only worth $70 now, you can borrow the full $100 from the Fed

E.g. even if your $100 bond if-held-to-maturity is only worth $70 now, you can borrow the full $100 from the Fed

While this loan facility was setup for SVB to pay depositors, it will be available to *ALL* US Banks.

If you're sitting on $675B loss as a bank, why wouldn't you use this Fed loan program to pledge your existing bond assets to buy *new* bonds that pay you way more interest?

If you're sitting on $675B loss as a bank, why wouldn't you use this Fed loan program to pledge your existing bond assets to buy *new* bonds that pay you way more interest?

In summary the Fed will be printing money for banks to replace their existing low-interest bearing bonds with high-interest bearing bonds for at least 1 year, maybe even more.

This is a bailout, making banks whole for paper down 30%.

This is a bailout, making banks whole for paper down 30%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh