1/ Pleased that the government finally appear to be listening mode 👇as to what will work (addressing root cause of the "doctors tax" as they call it - AA & LTA) rather than what wont work (massivley complex flexibility)

Some thoughts, please read & RT

Some thoughts, please read & RT

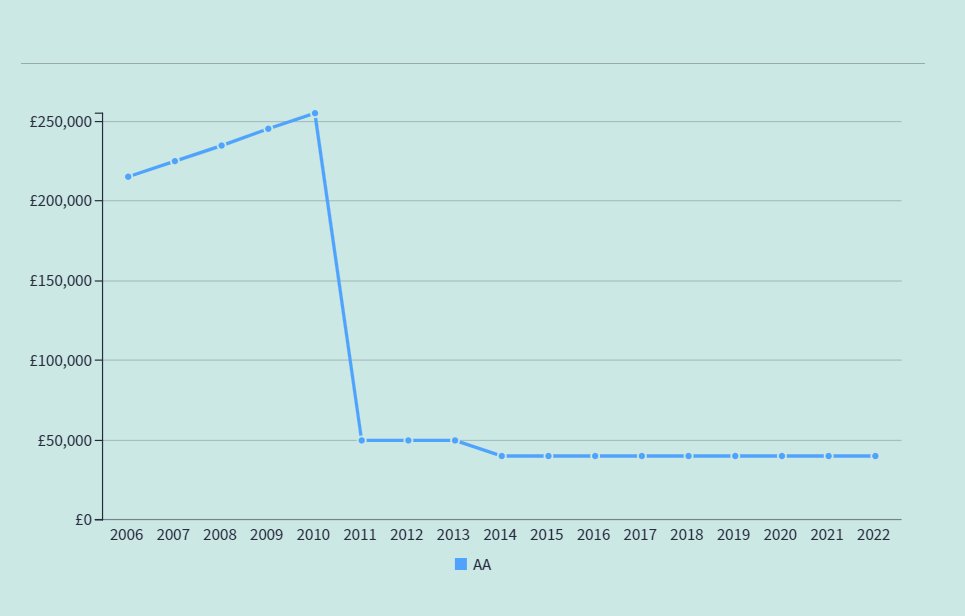

2/ First things first - the obvious point. Whilst both taxes (AA & LTA) important, AA is significantly more of an issue than the LTA (& also has complexity of tapering). But lets take them in turn

3/ Weve been hearing for a while that government know the LTA is a problem for higher earner in the NHS. @BorisJohnson hinted that he will "fix it" in 2019

4/ Far from fixing it, combined effect of freezing it, & then unexpected high inflation now due to Ukraine conflict & energy etc, the LTA has tumbled fast.

It was £1.8m in 2011 which would be £2.2m in real terms today, so the "rumours" of a rise closer to this level are welcome

It was £1.8m in 2011 which would be £2.2m in real terms today, so the "rumours" of a rise closer to this level are welcome

5/ But as I said certainly eyeing "doctors tax", the AA is significantly more of a problem

And its also dropped *much* more from a peak of £255,000 in 2010/11 (and thats without correcting for inflation, nor the addition of tapering).

And its also dropped *much* more from a peak of £255,000 in 2010/11 (and thats without correcting for inflation, nor the addition of tapering).

6/ With bumpy pay scales / promotonal pay increases etc, the reported level of £60,000, whilst a good step in right direction, will still causes problem - so why restore the LTA to near its peak, but AA to only a fraction of it?

7/ On tapering, I couldnt agree more with @PJTheEconomist's comment on the "ridiculous" tpaering rules "If you increase AA from £40k to £60k, but then taper it so people with high incomes cant use it, its probably not going to be massively effective".

I agree. Taper = car crash

I agree. Taper = car crash

8/ So I would strongly agree that the taper needs addressing too, either scrapping it entirely, or at least restoring or improving the prior minimum (£10k) and index linking that to get the highest (& often most senior / productive) back to the NHS

9/ Which brings me to another crucial point. INDEXATION.

A large component of #retention is lack of indexation. You cant have a CARE scheme on one hand (causing ever increasing PIAs) & then frozen allowances on another. Whatever AA/LTA is raised to, NEEDS indexing to maintain

A large component of #retention is lack of indexation. You cant have a CARE scheme on one hand (causing ever increasing PIAs) & then frozen allowances on another. Whatever AA/LTA is raised to, NEEDS indexing to maintain

10/ Penultimately, raising AA & LTA does not remove the hideous unfairness of negative PIAs. If you want to measure growth *really* above inflation, ignoring negative growth doesnt achieve that. Grateful gvmnt fixed CPI disconnect, but you *must* #FixNegativePIAs as well 👇

11/ Finally, don't give with one hand & take away with another to replicate problems elsewhere. Significant changes to tax free lump sums, or huge hikes in state pension ages (when mortality improvements slowing massivley) would take away a lot of the benefit

12/ So @Jeremy_Hunt has opportunity to address pension taxation issues that have cause so many problems. Would strongly urge

🔼LTA to where it was

⏫AA = bigger problem, so dont restore to a much lower level than prior peak

⚠️Dont ignore tapering

⚠️Index

⚠️FixNegativePIAs

RT!

🔼LTA to where it was

⏫AA = bigger problem, so dont restore to a much lower level than prior peak

⚠️Dont ignore tapering

⚠️Index

⚠️FixNegativePIAs

RT!

• • •

Missing some Tweet in this thread? You can try to

force a refresh