It is becoming increasingly clear that the US is pushing for war with China within the next few years.

But to understand why, we first need to understand how the US came to be the global financial power it is today. 🧵

But to understand why, we first need to understand how the US came to be the global financial power it is today. 🧵

When the world emerged devastated from WW2, the US strode through not only entirely unscathed, but with half the world's remaining industrial productive capacity.

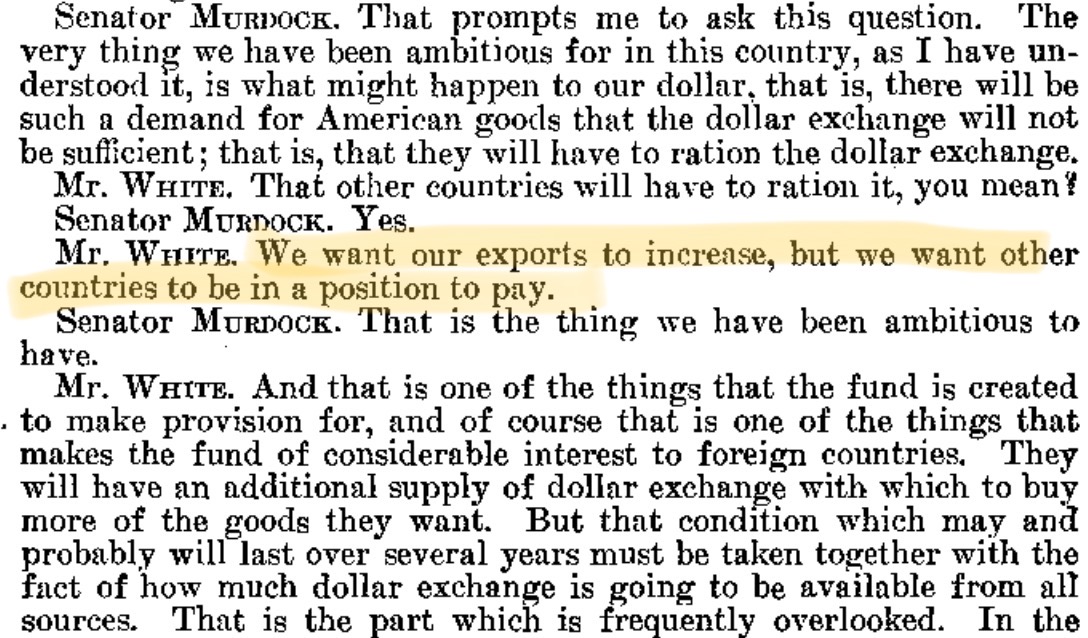

But there was a problem: the devastated allies had few means of paying for US exports to begin reconstruction.

But there was a problem: the devastated allies had few means of paying for US exports to begin reconstruction.

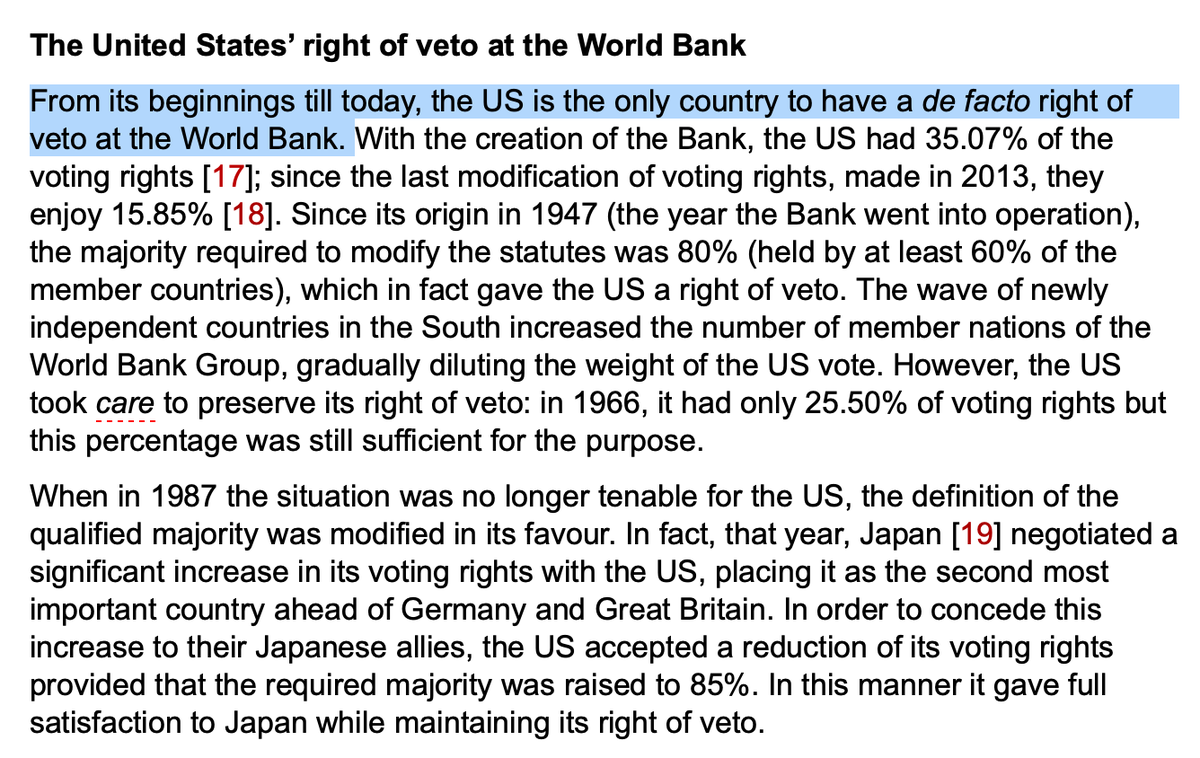

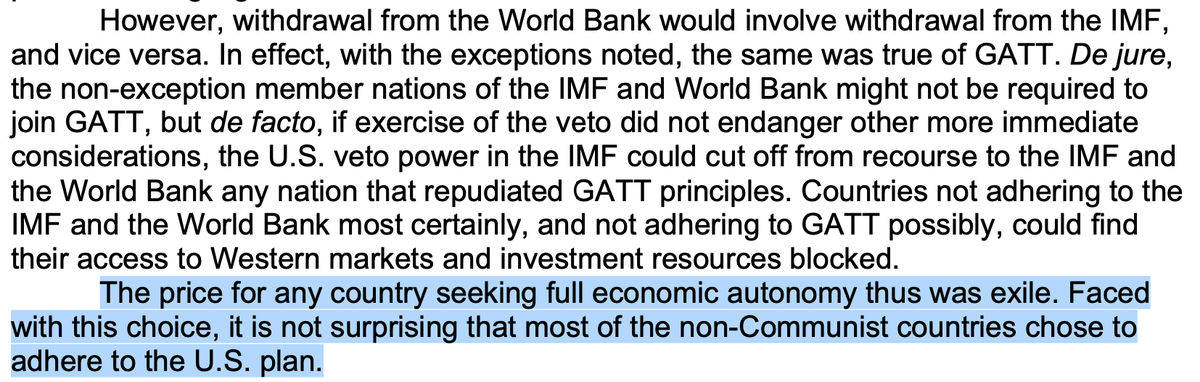

To address this, the US created the IMF and World Bank, and through their unilateral veto power, began dismantling old colonial spheres of influence, particularly the British empire, simultaneously preventing the remilitarization of Europe, and clearing the way for US exports.

These two institutions were leveraged to create a global financial framework that concentrated tremendous power in US hands, cementing itself as the world’s creditor under the guise of multilateralism, and establishing the dollar as the global reserve currency.

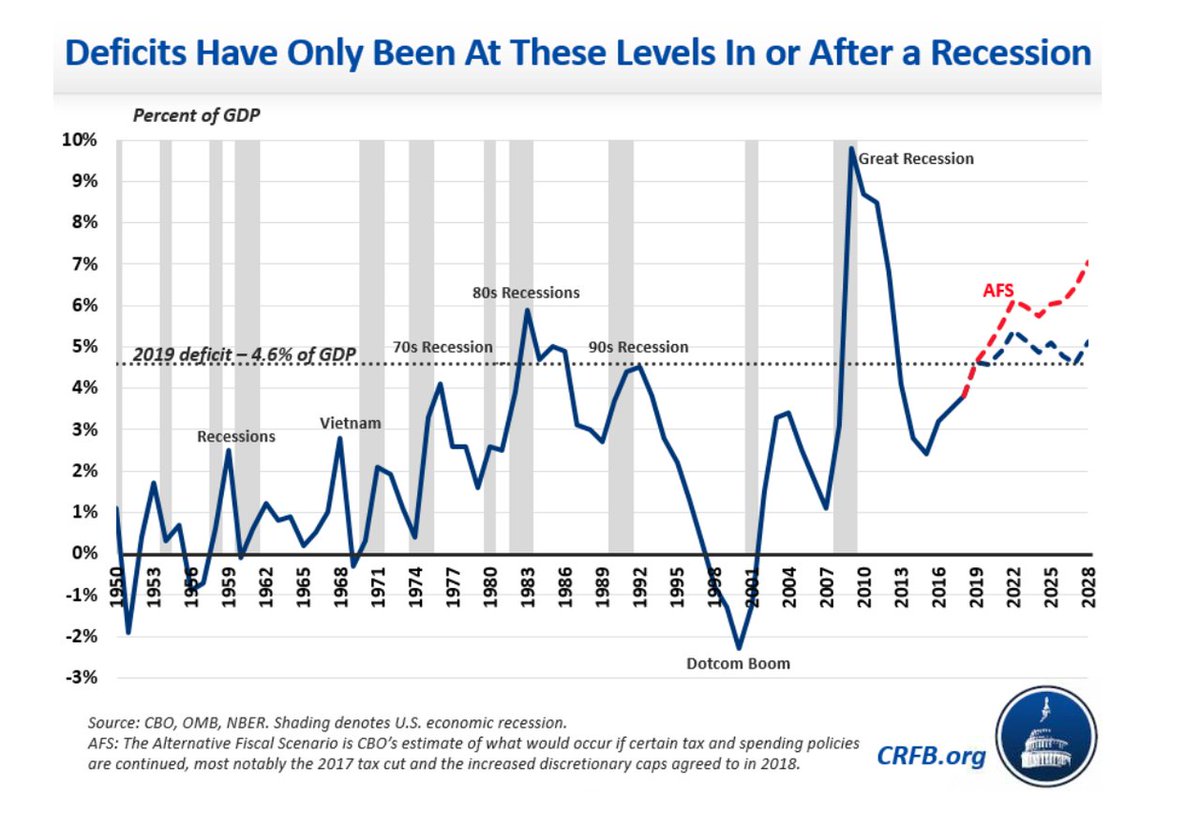

In the years that followed, US budget deficits began to grow as a result of the massive military spending it was using to violently suppress burgeoning struggles for national sovereignty around the world, which were seen as obstacles to US capital expansion into foreign markets.

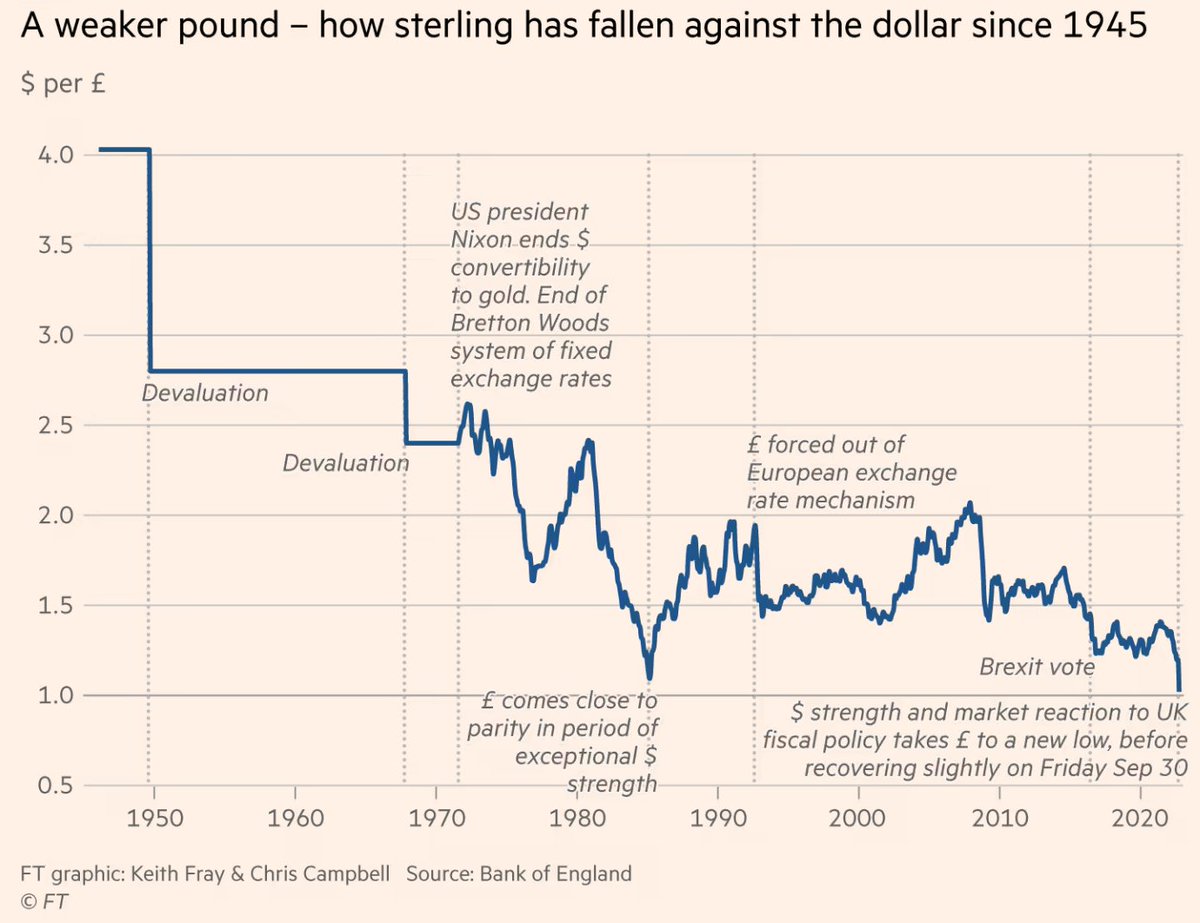

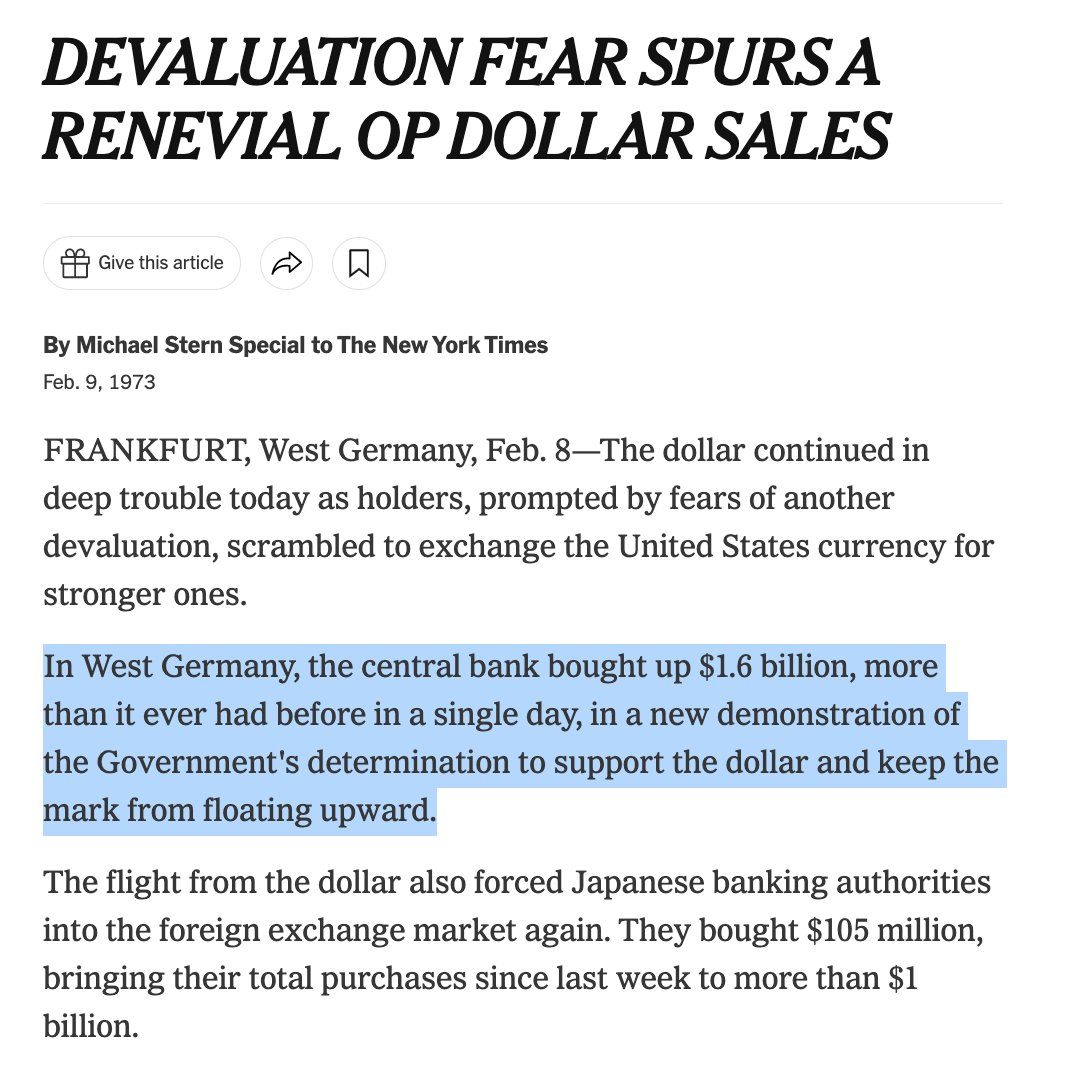

When this ballooning trade deficit caused gold to begin flowing back to Europe, the US broke the dollar-gold link in ’71. At the time, no country was willing to call the US’s financial bluff, since crashing the dollar would have devastated the export industry in surplus countries

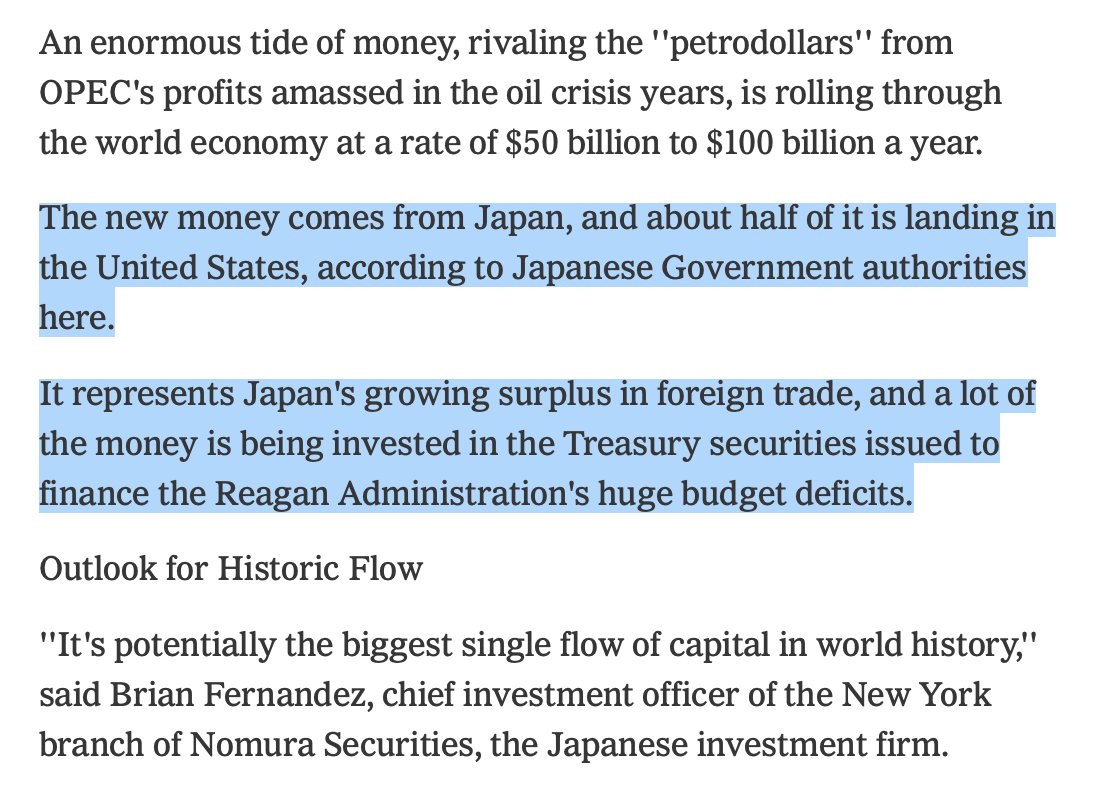

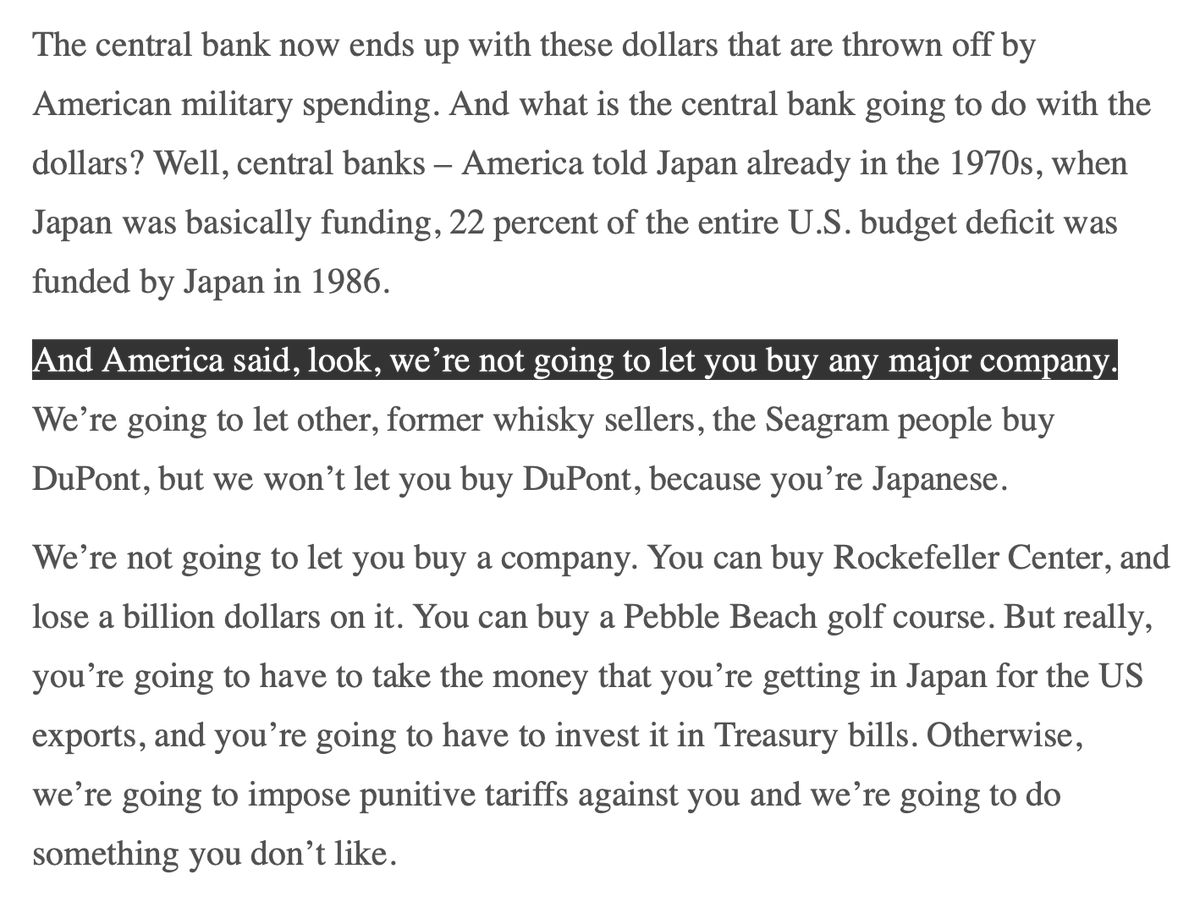

This left co-imperial vassal states like Japan, Germany, and the UK only one option: to recycle their excess dollars back into the US to buy Treasury securities—impotent financial IOUs that would never yield any meaningful leverage over American enterprise.

Why didn’t these creditor countries use their surplus dollars to buy up major American companies like Ford or General Electric or to dismantle the Postal Service or Social Security? Unlike the reciprocal, US dominance allowed them to dictate the terms with their creditors.

This further solidified the dollar as the world’s reserve currency, granting the US the exorbitant privilege to run budget and trade deficits seemingly without consequence, and removed the hard cap on going to war, since gold was no longer needed to support spending.

As a result, dollar recycling meant there was more profit to be made by exporting capital than investing in industry domestically. Industrial capital gave way to financial capital, which multiplied by hunting for existing productive industries to asset strip and extract rent from

Dollar recycling in turn allowed the Fed to keep their interest rates low, incentivizing US investors to borrow huge sums, which they then turned around and lent to developing countries in desperate need of capital while leveraging their near-monopoly position on credit.

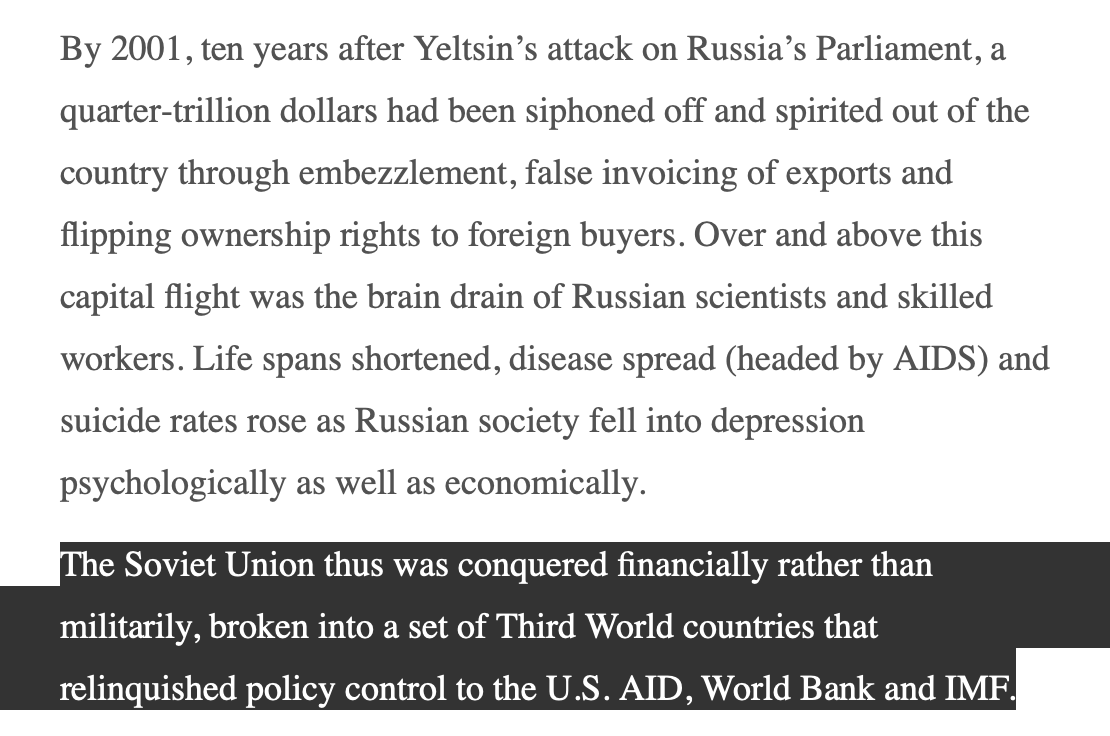

Western capital was made available to developing countries as high-interest loans structured to lead to default, forcing countries into enacting the “Washington Consensus”—anti-labor austerity measures pushing foreign govts into a vicious class war against their own working class

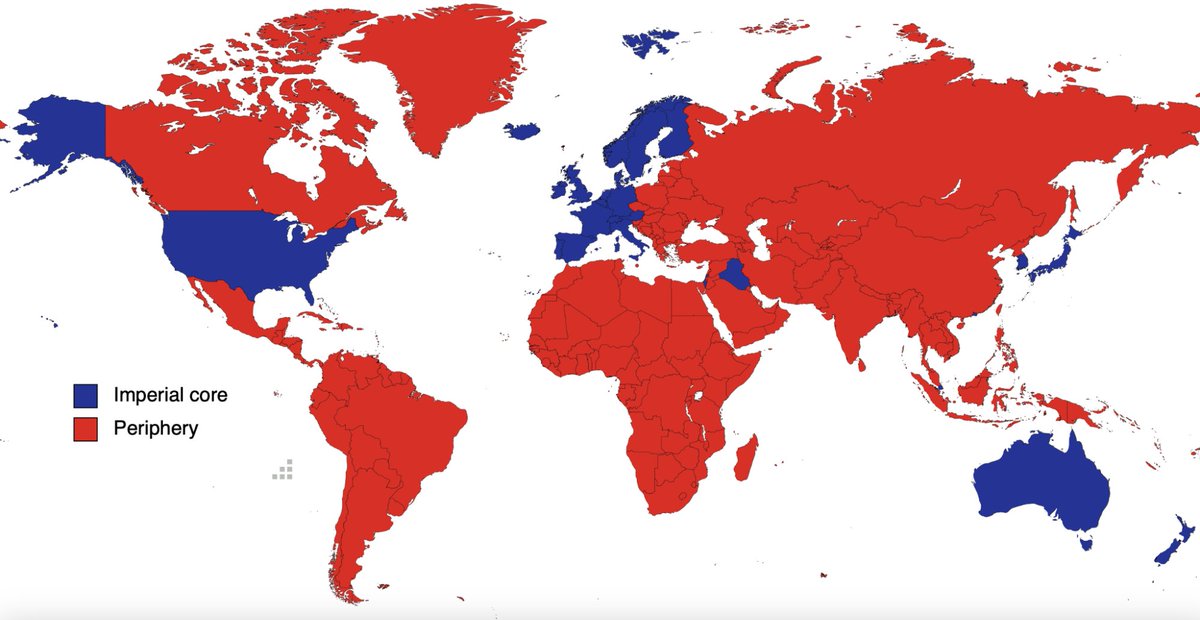

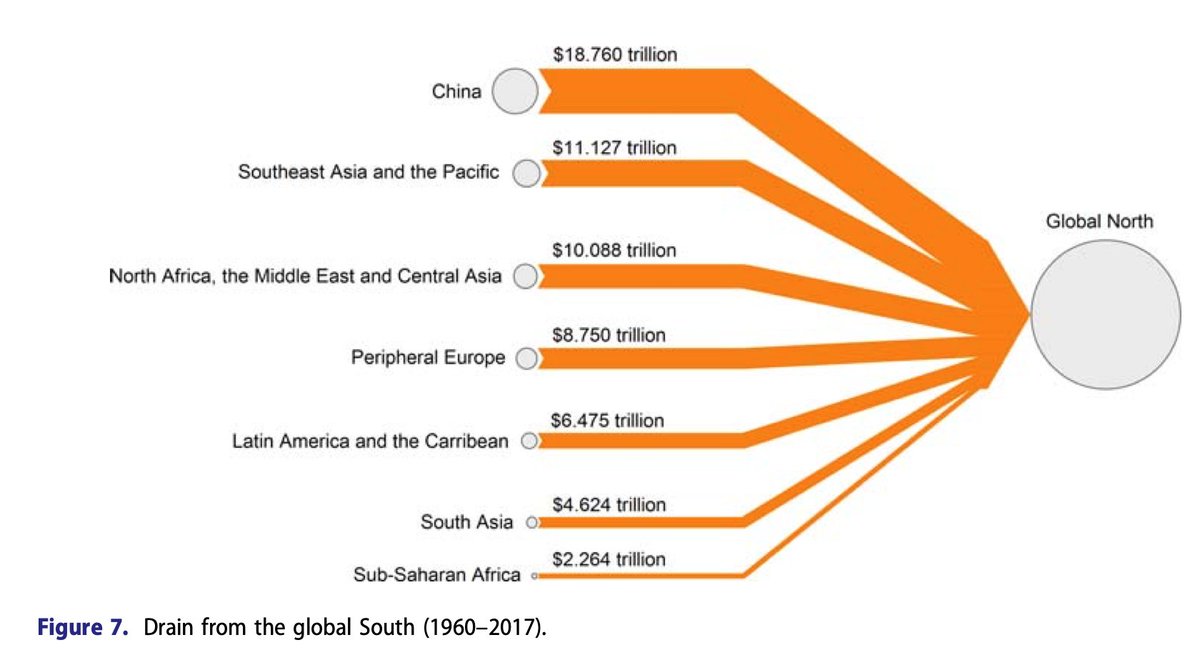

While the mechanisms can appear convoluted and opaque, the ultimate goal of all of this imposed economic reorganization was very simple: to enable the perpetual siphoning of natural resources and labor value from the periphery to the core at far below fair value.

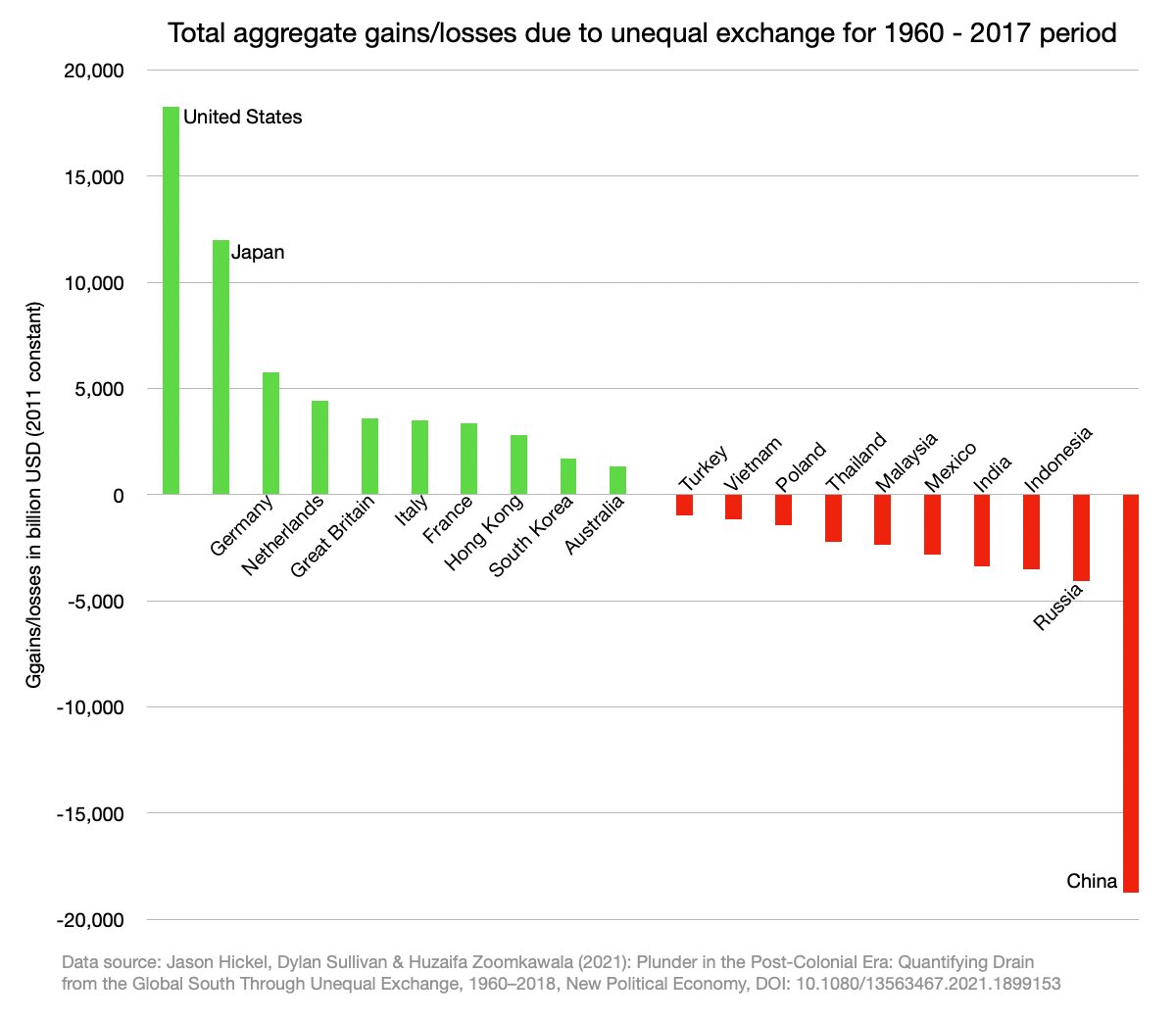

This enormous wealth transfer from periphery to core is in part recorded in the aggregate gains/losses of unequal exchange, which is an objective measure of the value that has been bled from the periphery via suppression of currency exchange rates through US financial dominance.

Through dollar supremacy, the financial class has been freed from having to balance trade flows or budgetary deficits and can instead pour money into non-productive rent-seeking endeavors like the privatization of public industry, real-estate monopolies, and the stock market.

Thus the growth of the US economy over the past several decades has been financed directly by foreign central banks.

But how does this all relate to China? What is China doing that is deemed such a threat by the US financial class?

But how does this all relate to China? What is China doing that is deemed such a threat by the US financial class?

When the US and much of the west deindustrialized in the 1980s as a means of both breaking the power of their own labor and capitalizing on the cheap and abundant labor of the developing world, China had the largest and one of the cheapest labor forces in the world.

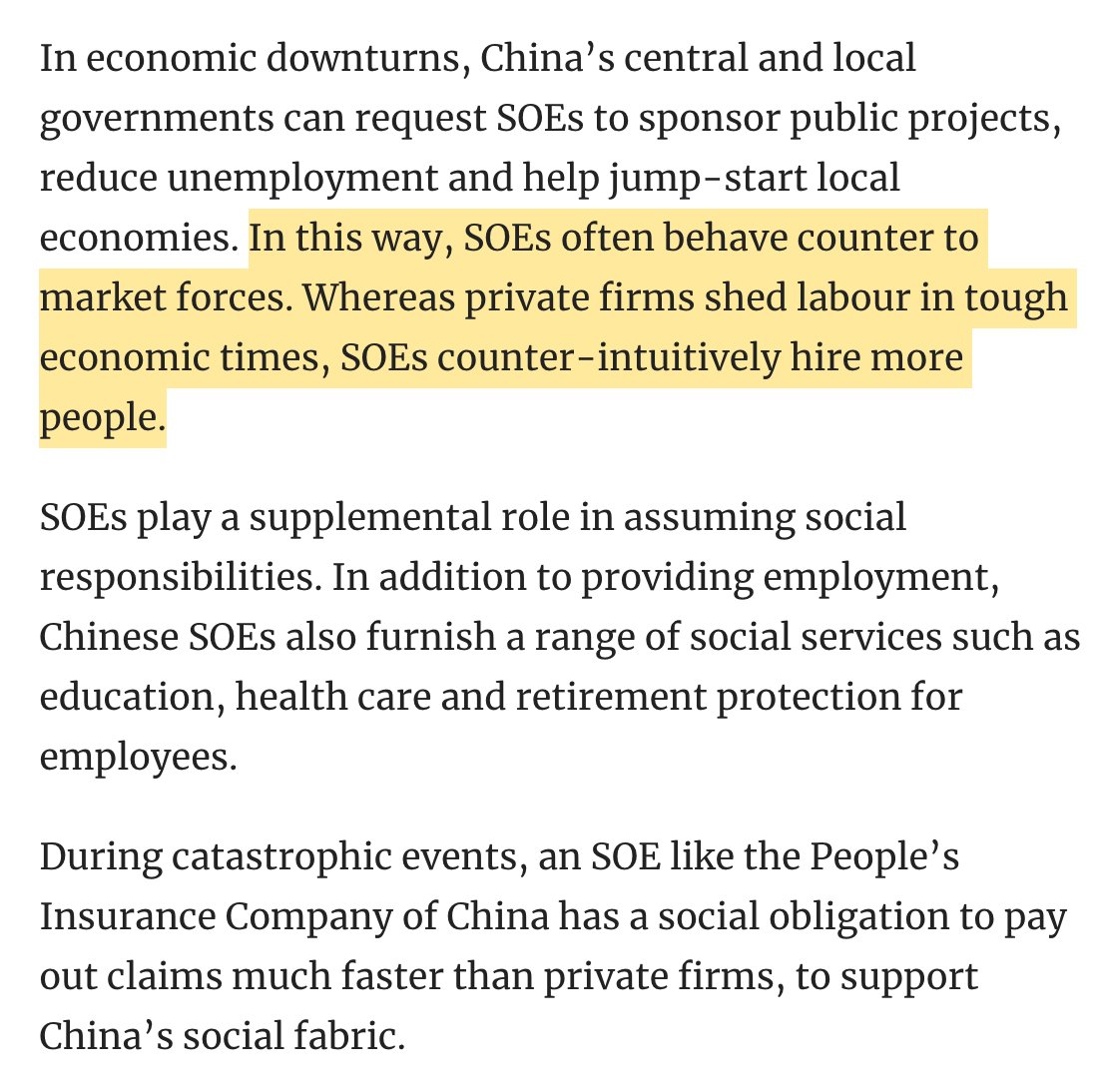

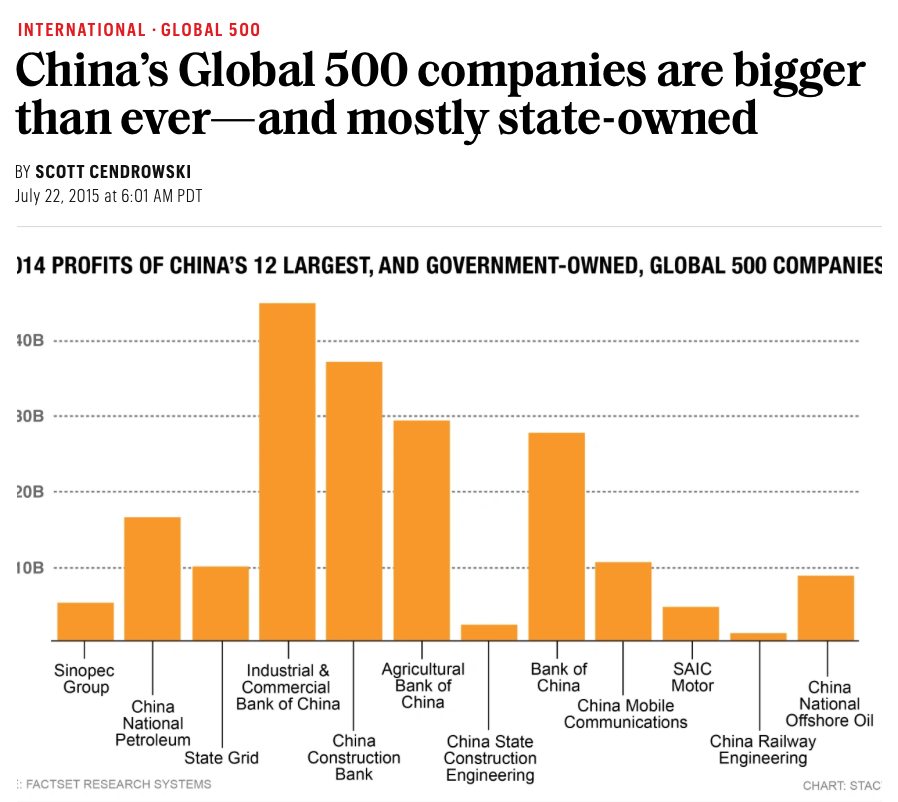

And while mismanagement in the USSR led to a rapid, haphazard liberalization of both their political and economic spheres, China charted a path of controlled opening up to western capital while vigorously maintaining the primacy of the CPC and control of critical sectors via SOEs

The result was that the USSR underwent a period of financial colonization by the west, in which their economy was dismantled and sold off for scrap leading to a plummet in living standards, while China built an enormous productive base and dramatically raised living standards.

But in the process of trading industrialization for cheap labor abroad, the US made the mistake of undercutting their own means of economic dominance: the dollar system was stable only as long as it remained the sole game in town, yet it was funding the birth of an alternative.

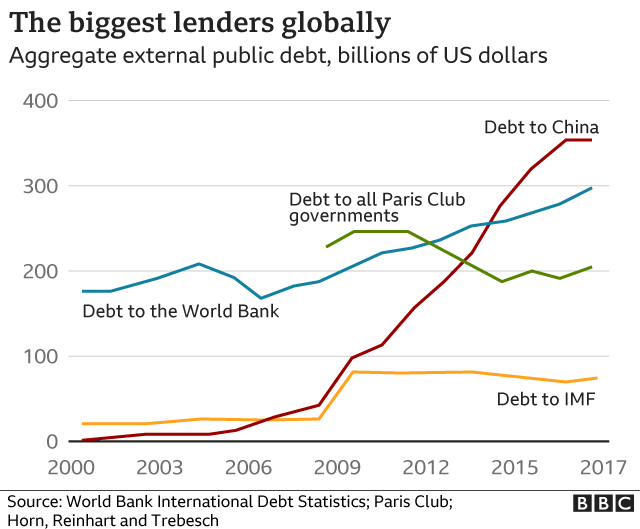

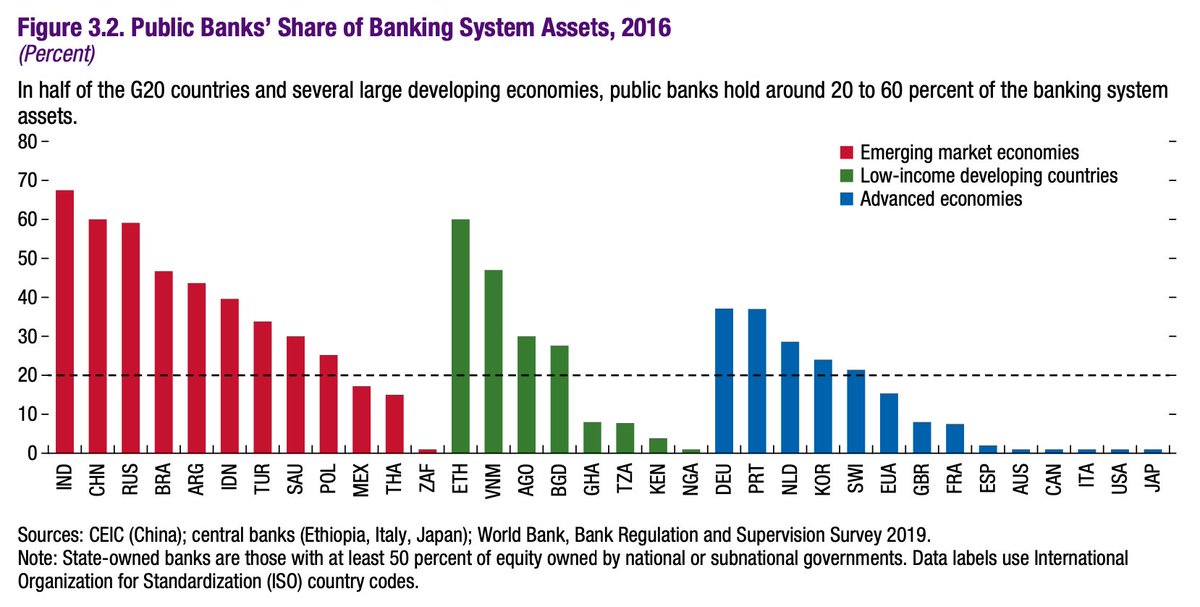

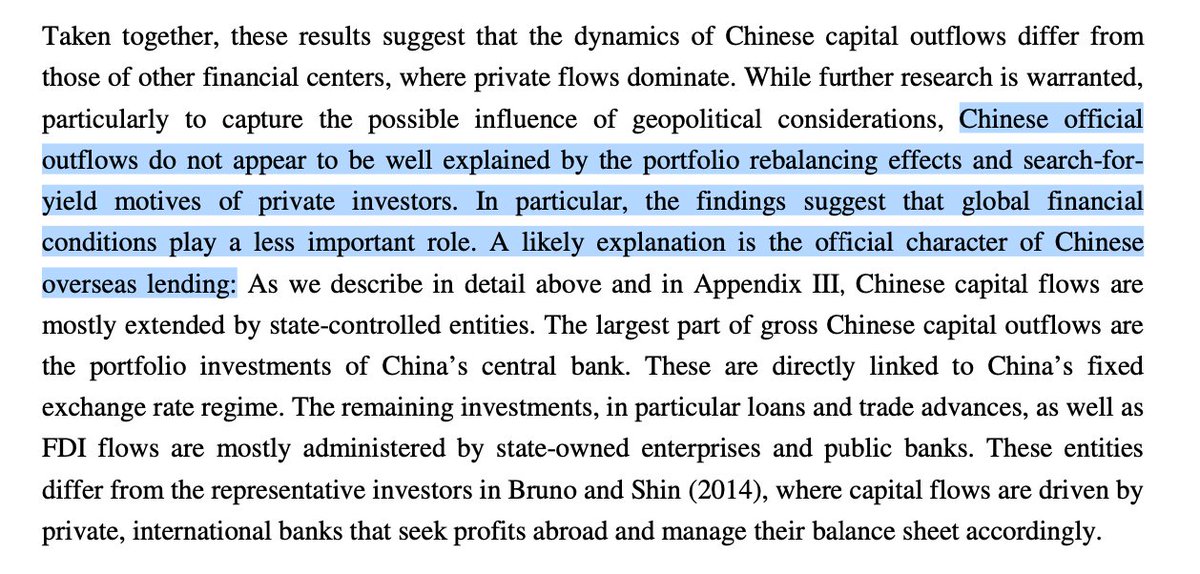

As China’s productive power and economic integration with the world grew, so too did its ability to lend to developing countries. However, unlike the IMF and World Bank loans, credit creation in China is treated as a public utility and is nearly entirely subservient to the state.

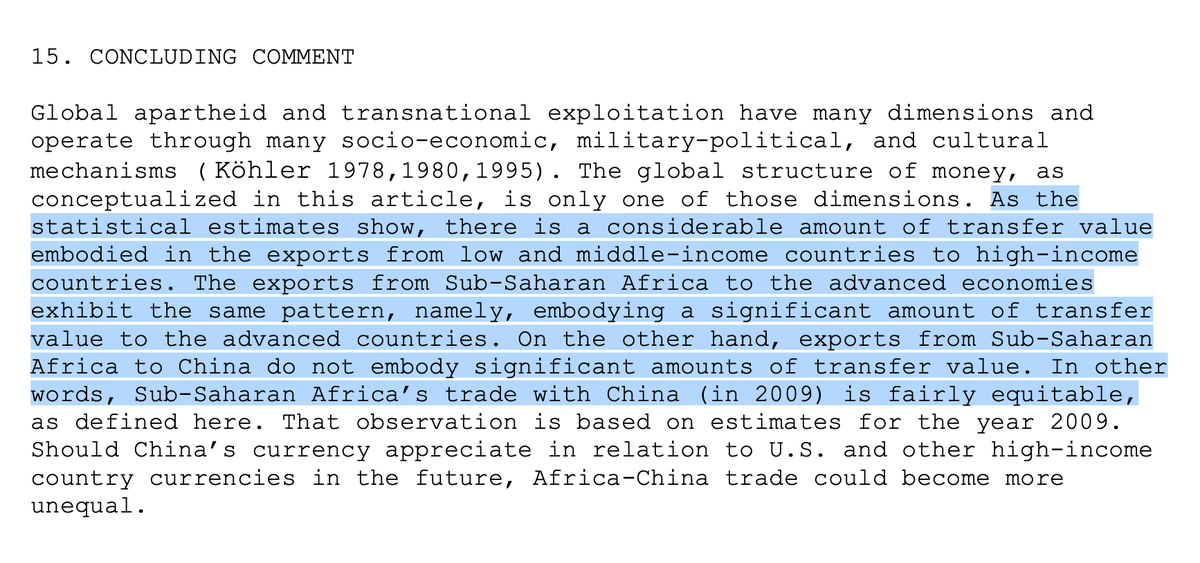

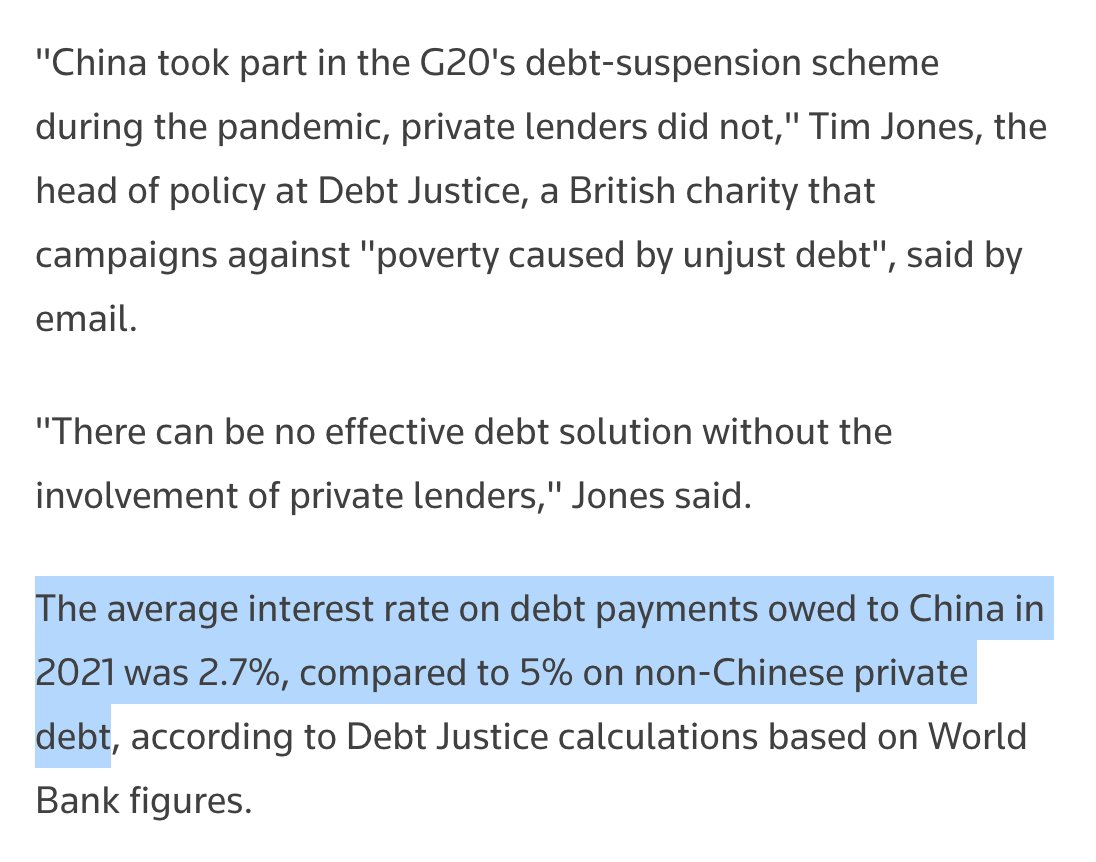

Intergovernmental loans by China’s state-owned banks are not made with the same requirements to generate profit. Nor are countries seeking loans from Chinese lenders forced to undergo structural adjustments, and it’s not uncommon for debts to be renegotiated or written off.

As a result of China's rise, for the first time since the fall of the USSR, there exists a pathway for countries to truly develop that doesn't require a choice between complete subservience to foreign capital or brutal isolation and attack.

If developing countries can circumvent the west to build a base level of self-sufficiency and freely trade with other countries for the goods they need in their own currencies, the global dichotomy of small wealthy imperial core and vast exploited periphery will dissolve away.

This is why the rise of China is an existential threat to the US. Not because China has goals to militarily dominate the world, export their ideology, or subsume all competition, but because the US *does* and China represents the first viable alternative to US financial monopoly.

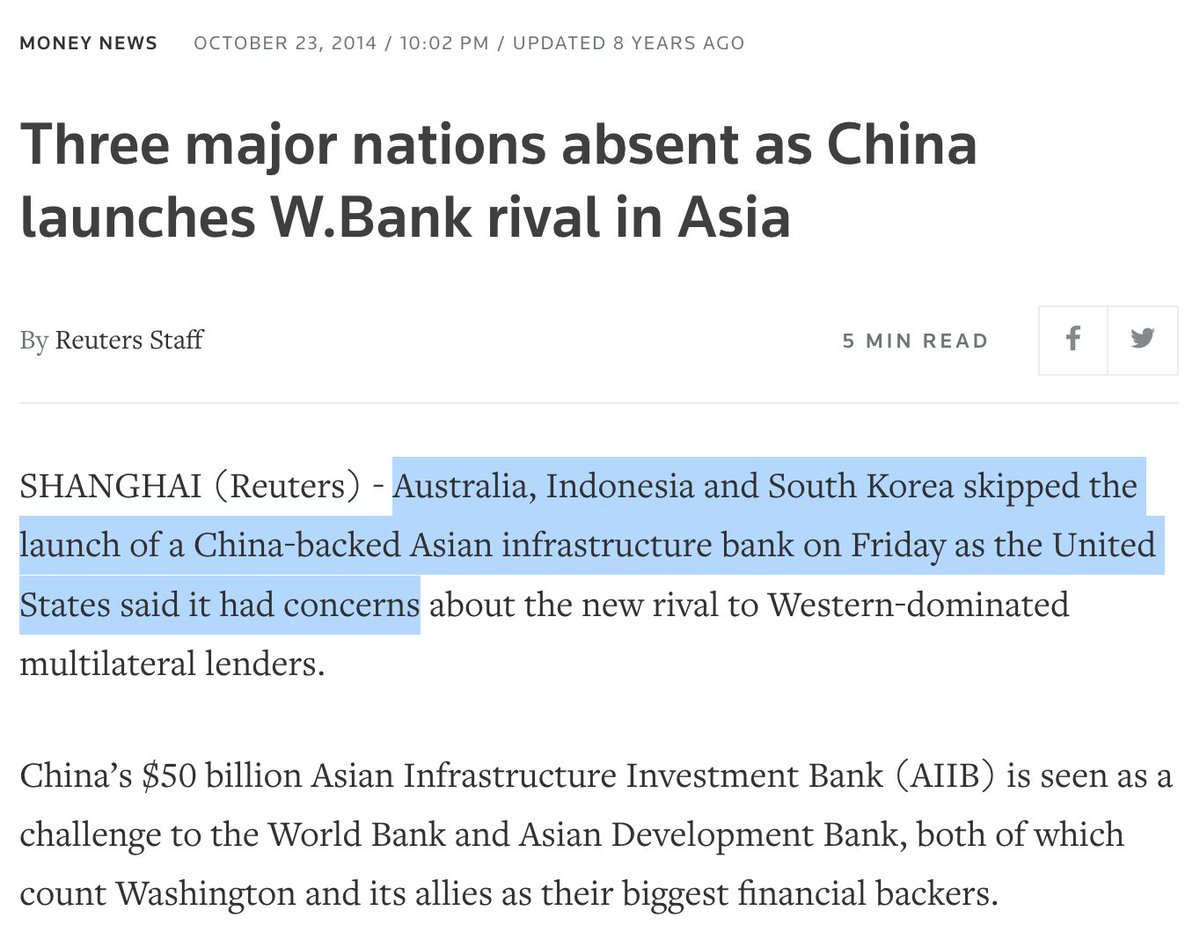

The US-led campaign to isolate China has been underway for years now, as clear signs of the China-led economic alternative emerged over a decade ago. But a recent series of converging historic shifts have begun compressing the timeline for the prospect of war.

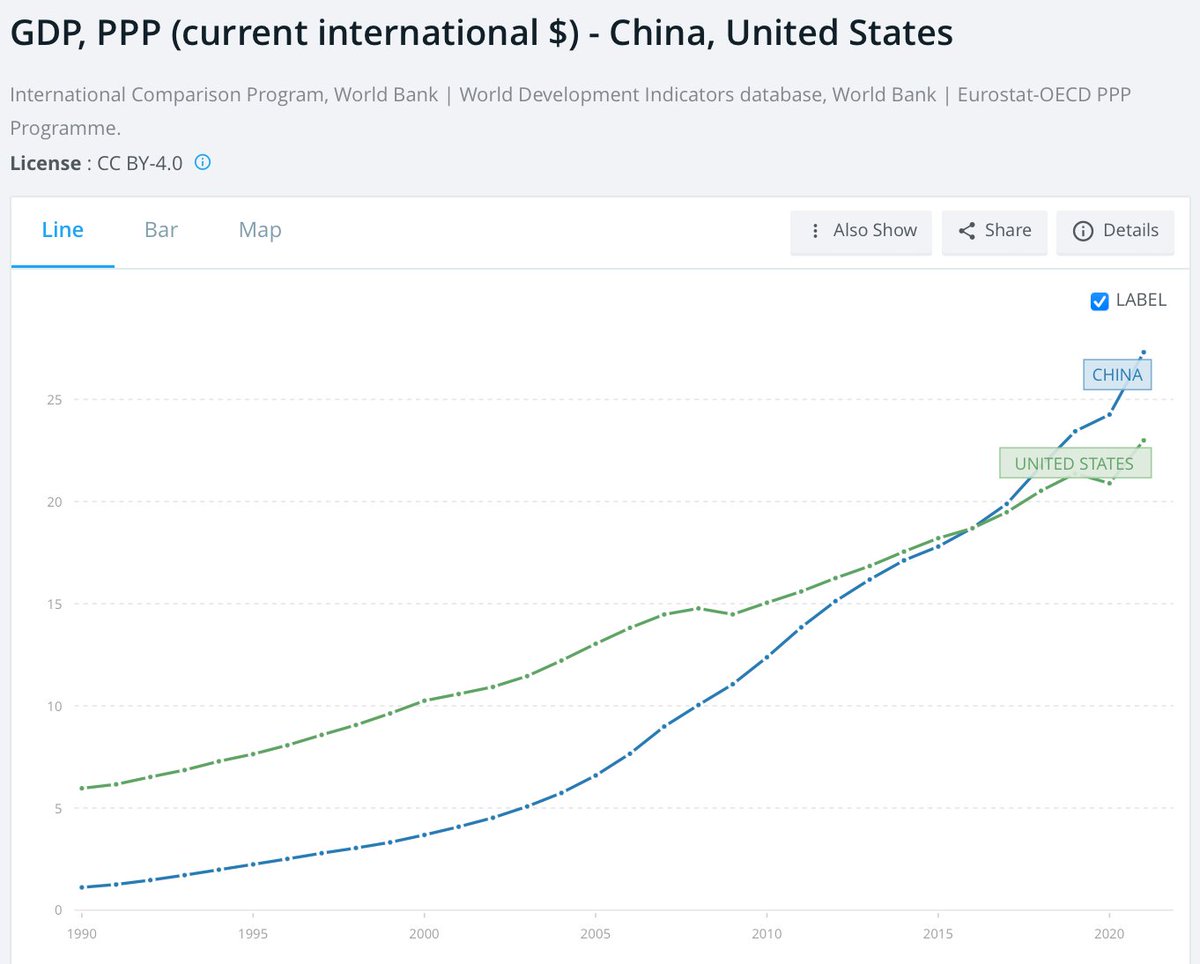

Firstly, China surpassed the US back in 2016 to become the largest economy when GDP is adjusted for purchasing power, and will likely surpass raw GDP sometime this decade. Additionally, America’s true GDP is already heavily inflated as a result of its overly financialized economy

Secondly, China and Russia are growing closer by the day. And while Russia is often dismissed as the husk of a former superpower, its productive output during the Ukraine proxy war with NATO indicates that the real power of Russia’s economy is being significantly underestimated.

Third, China’s military is fast reaching near-peer status with the US, particularly when considering the massive defensive advantage China would have in repelling any US-led attack, which would necessitate the US extend their naval forces across the entire Pacific Ocean.

Fourth, BRICS, the SCO, and the BRI—orgs focused on self-directed investment into industrialization and public infrastructure without forcing austerity or fostering dependency—are all gaining traction amongst developing countries at an accelerating rate.

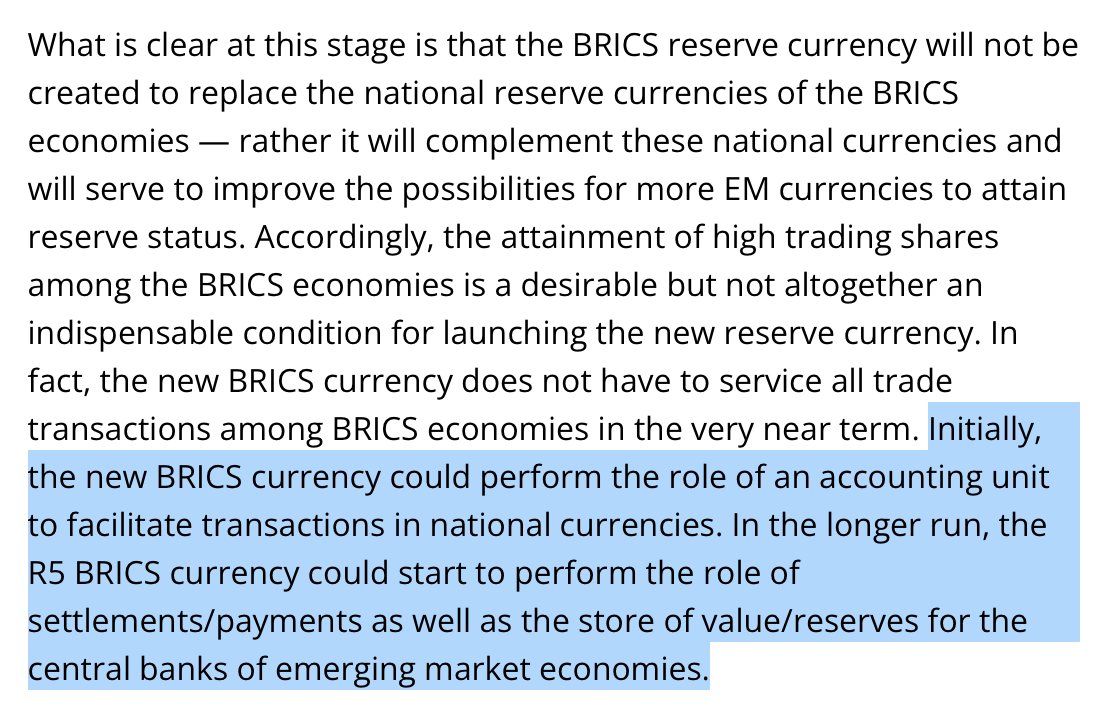

And most critically, BRICS countries have begun moving to replace the US dollar with a basket currency for trade, with pathways for new member states to join the scheme. The rate of transition to this new more equitable global currency system is likely to be anything but linear.

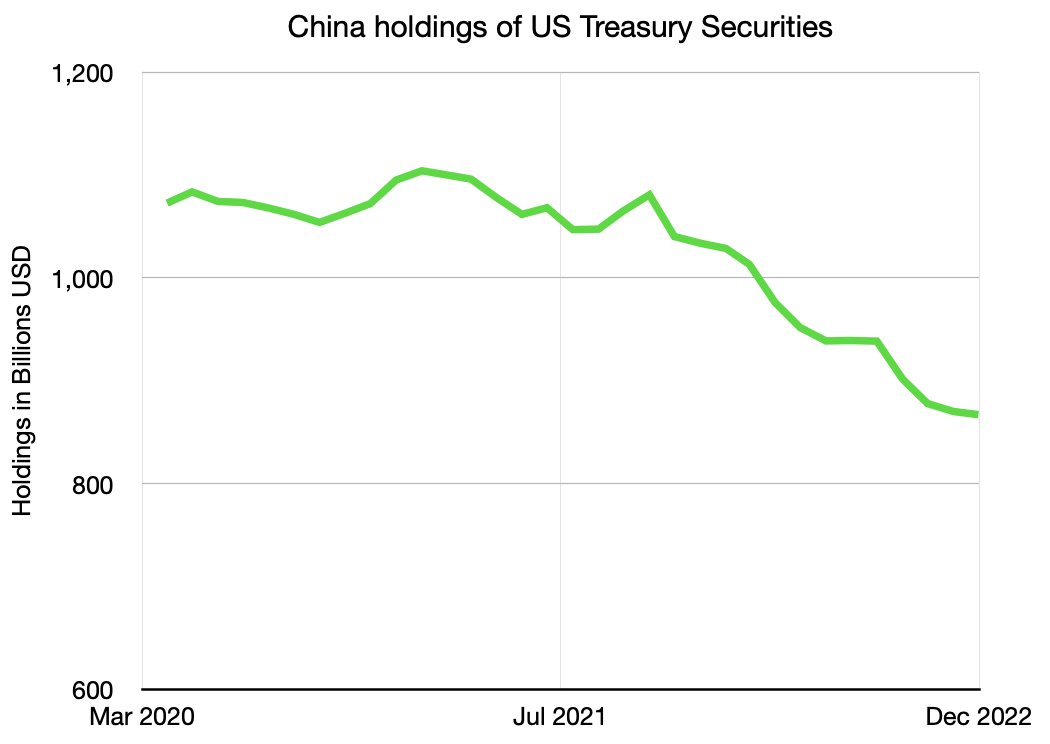

Fully aware of US plans to isolate China, the CPC has been steadily undertaking the gargantuan process of decoupling from the US economy for at least a decade, but decoupling efforts have accelerated since the US’s recent bellicose trade tariffs and sanctions began.

Dumping of the dollar in favor of dollar-alternatives will bring an end to the era of exorbitant privilege in which the US can deficit spend both domestically and on its almost 800 foreign military bases, upon which its empire depends. The effects will be without precedent.

Ironically enough, the world seems to have arrived back at the Bancor system, proposed by John Maynard Keynes at Bretton Woods in 194 as a supranational currency system not under the control of any one country. Instead, the dollar won out, leading to 80 years of dollar hegemony.

The US is now accusing China of disrupting the rules based int’l order and betraying western values. What’s omitted is that the “rules” require perpetuating the exploitation of the developing world and the “values” are pursuit of private profit at the expense of human well-being.

The window for the US to have any chance of slowing China’s rise is rapidly closing.

But does this really mean the US is laying the groundwork for a military confrontation with China? And if this confrontation is inevitable, how does the US plan to proceed?

But does this really mean the US is laying the groundwork for a military confrontation with China? And if this confrontation is inevitable, how does the US plan to proceed?

• • •

Missing some Tweet in this thread? You can try to

force a refresh