1/x

robert.p.balan (PAM)

Mar 16, 2023 9:38 AM

EUROPE OPEN BRIEF:

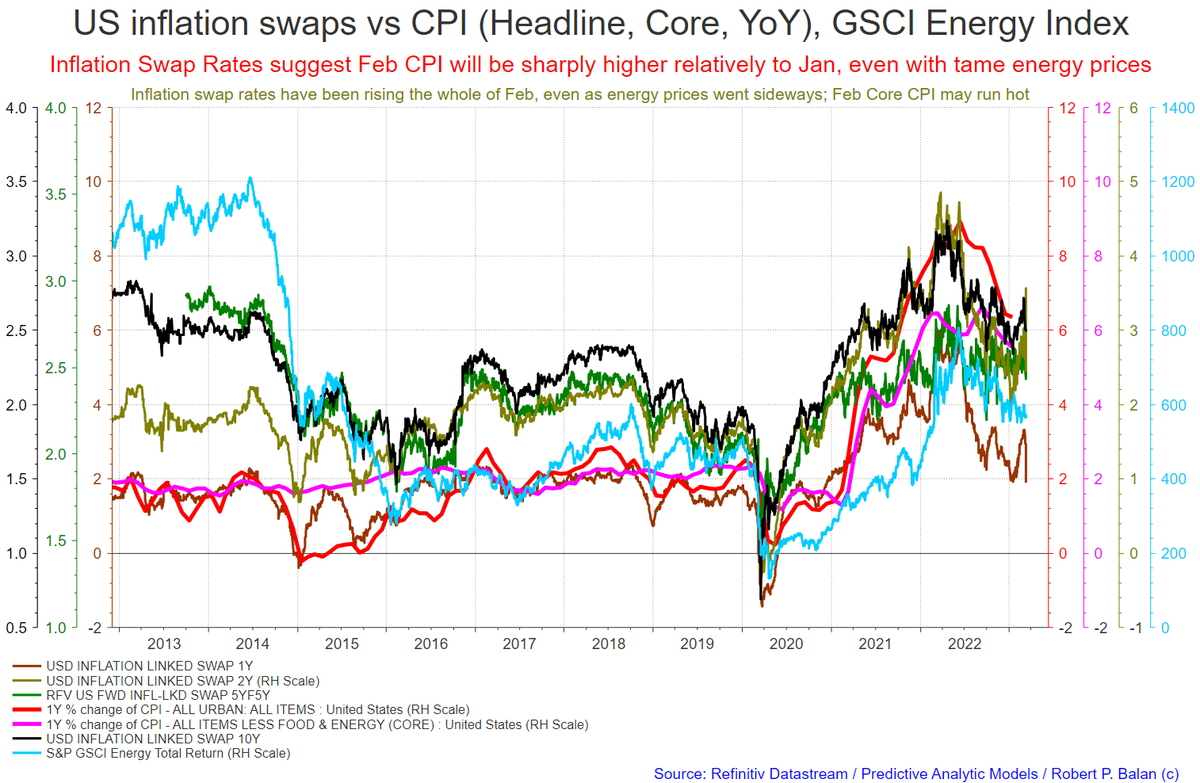

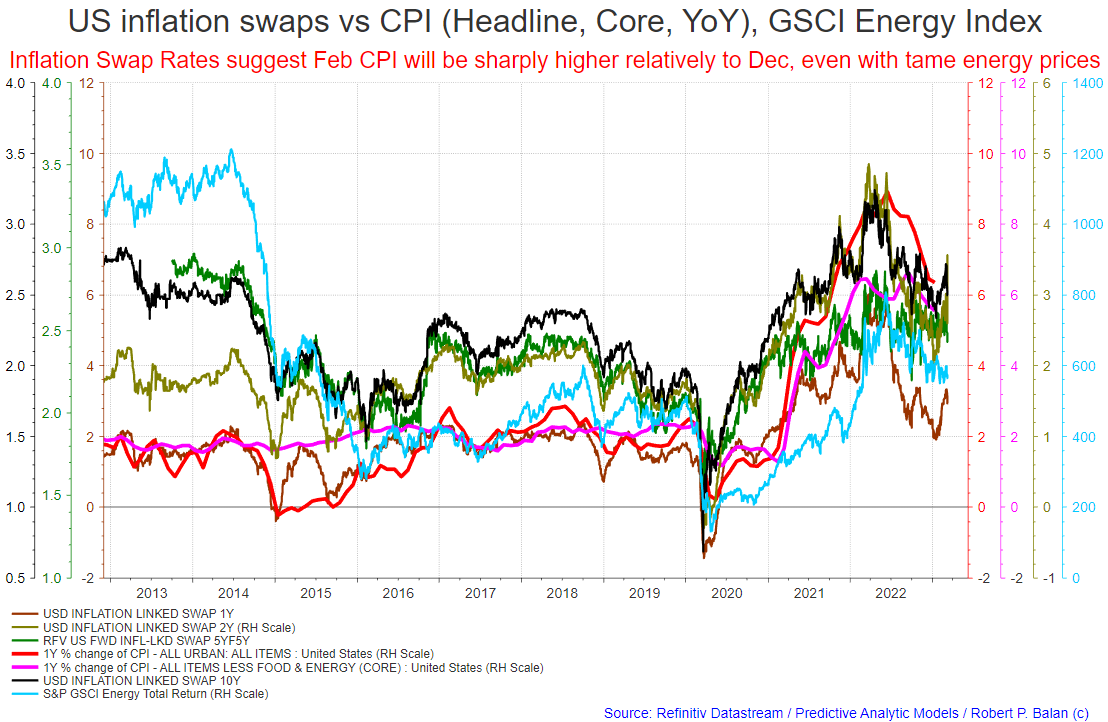

DXY FALLS AND THE 10YR YIELD RISES -- SO FAR EQUITIES RISE WITH THE YIELD, WHILE GOLD FALLS; WE MAY YET SEE ANOTHER RALLY IN YIELD AND EQUITIES TODAY, ALLOWING EXIT OF REMAINING ORPHANED LONG HEDGERS (FINALLY)

robert.p.balan (PAM)

Mar 16, 2023 9:38 AM

EUROPE OPEN BRIEF:

DXY FALLS AND THE 10YR YIELD RISES -- SO FAR EQUITIES RISE WITH THE YIELD, WHILE GOLD FALLS; WE MAY YET SEE ANOTHER RALLY IN YIELD AND EQUITIES TODAY, ALLOWING EXIT OF REMAINING ORPHANED LONG HEDGERS (FINALLY)

2/x

robert.p.balan (PAM)

Mar 16, 2023 9:39 AM

DXY is falling while the 10Yr Yield rises -- so tactically, equities will rise with the Yield, while Gold and TN futures fall.

robert.p.balan (PAM)

Mar 16, 2023 9:39 AM

DXY is falling while the 10Yr Yield rises -- so tactically, equities will rise with the Yield, while Gold and TN futures fall.

3/X

robert.p.balan (PAM)

Mar 16, 2023 9:45 AM

We still have 3,465 contracts long ES and 1152 long NQ which we have to offload. We are desirous of exiting this massive long positioning because the models will start turning unfriendly over the next few days.

robert.p.balan (PAM)

Mar 16, 2023 9:45 AM

We still have 3,465 contracts long ES and 1152 long NQ which we have to offload. We are desirous of exiting this massive long positioning because the models will start turning unfriendly over the next few days.

4/X

robert.p.balan (PAM)

Mar 16, 2023 11:20 AM

@john.Der and I have been discussing market structure. John is seeing terminal wave 5s in TN and Gold, which to me is also evident. However, I am waiting for market reaction to the FOMC next week to make conclusions . . .

robert.p.balan (PAM)

Mar 16, 2023 11:20 AM

@john.Der and I have been discussing market structure. John is seeing terminal wave 5s in TN and Gold, which to me is also evident. However, I am waiting for market reaction to the FOMC next week to make conclusions . . .

5/X . . . about a market regime shift back to normalcy. Underyling sentiment is still fearful, despite (small) rise in Yield and small fall in DXY. I believe that the FOMC will raise by 25 bp, may make no changes to QT schedule, opt for longer. That pushes Yields higher, and . .

6/X . . .equities lower -- THEN, that brings the market back to normal, IMHO. John suggests the process to normalcy starts with the ECB raising rates today (likely by 50 bp). That should provide the 10Yr Yield a kick in the ass effect.

7/X

robert.p.balan (PAM)

Mar 16, 2023 11:53 AM

If the Yield rises today, equities will also rise, and DXY, TNs fall. We are looking for levels to exit the GCJ3 long hedgers at appropriate (i.e, profitable) levels. And just leave the short GC underlying and short GC neuts . . .

robert.p.balan (PAM)

Mar 16, 2023 11:53 AM

If the Yield rises today, equities will also rise, and DXY, TNs fall. We are looking for levels to exit the GCJ3 long hedgers at appropriate (i.e, profitable) levels. And just leave the short GC underlying and short GC neuts . . .

8/X . . . You don't have to follow our lead -- with the short neuts, we are now net short GCJ3. Maybe you are too -- in which case, you don't have to follow our lead. It might be better for most of the community to wait until after after FOMC to unwind the Gold long/short hedge.

9/X

robert.p.balan (PAM)

Mar 16, 2023 12:24 PM

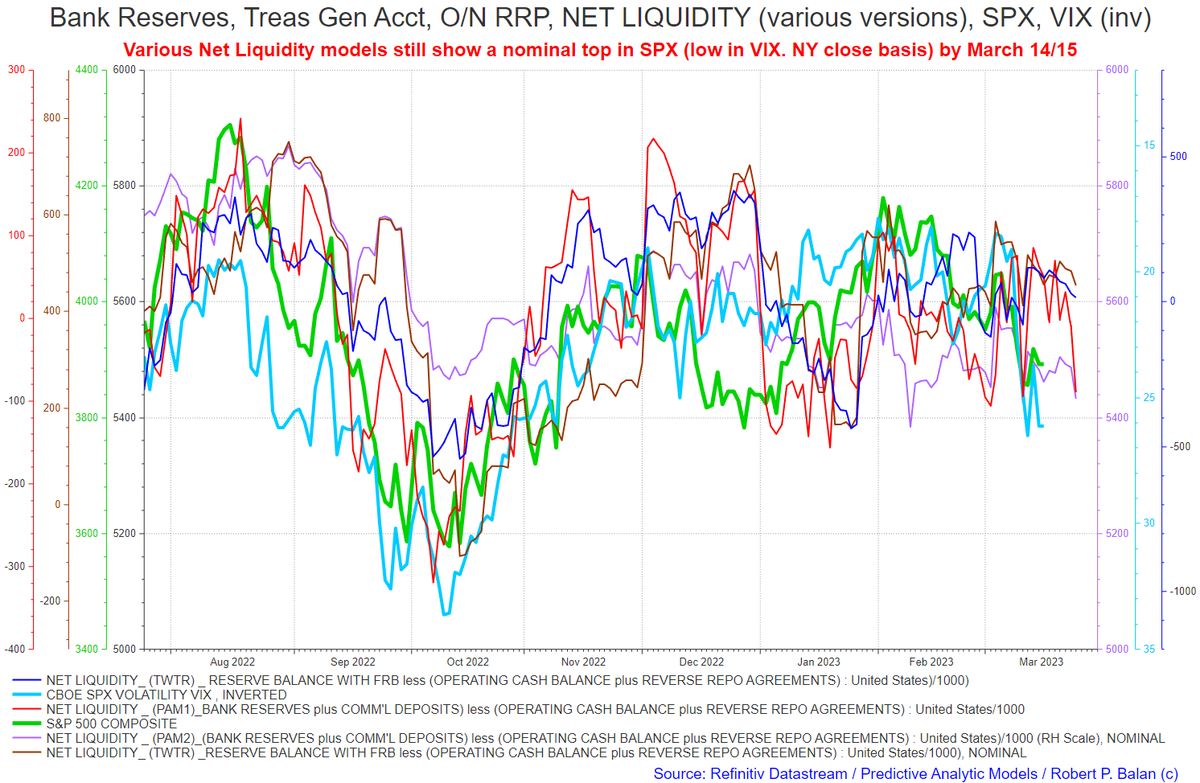

This is how the models look like today.

There is a cue that equities may pullback lower (NY close basis) ahead of the FOMC, although that could just be by Friday/Monday.

robert.p.balan (PAM)

Mar 16, 2023 12:24 PM

This is how the models look like today.

There is a cue that equities may pullback lower (NY close basis) ahead of the FOMC, although that could just be by Friday/Monday.

10/X

robert.p.balan (PAM)

Mar 16, 2023 12:29 PM

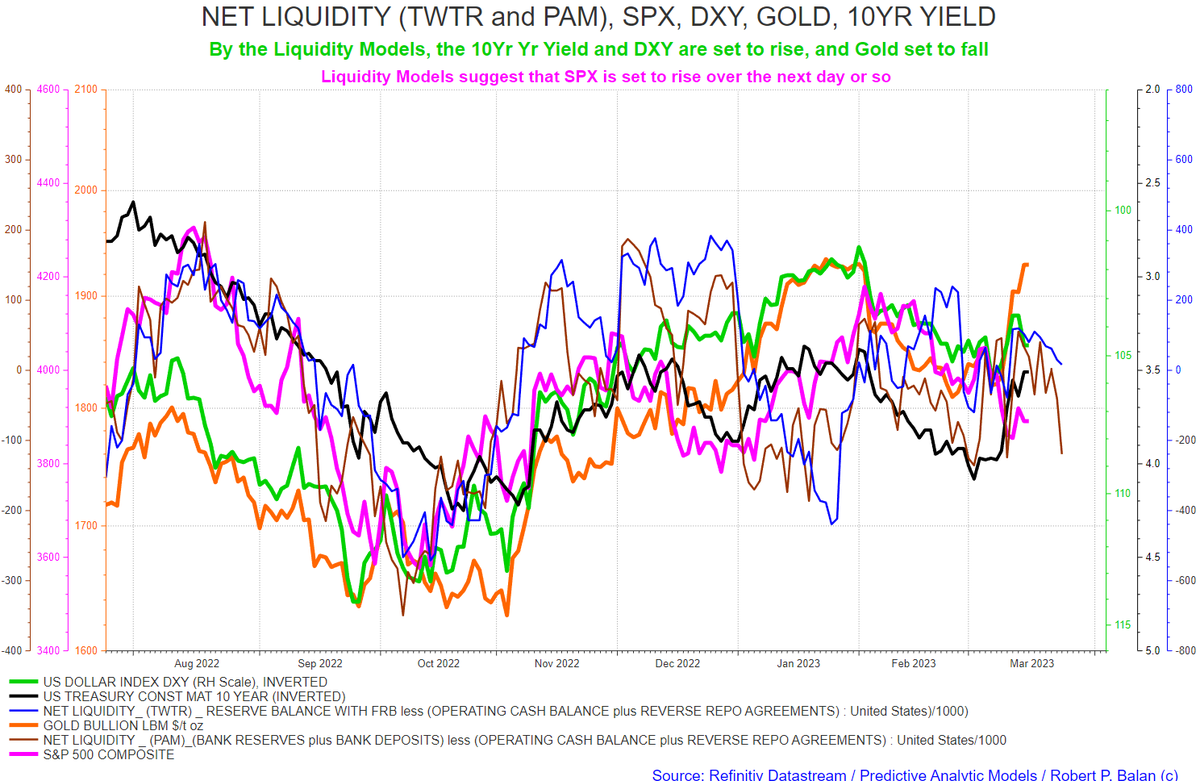

This model suggest unambigously that the 10Yr Yield and DXY will rise (both inverted in the chart), while Gold will fall as from today.

robert.p.balan (PAM)

Mar 16, 2023 12:29 PM

This model suggest unambigously that the 10Yr Yield and DXY will rise (both inverted in the chart), while Gold will fall as from today.

11/X

robert.p.balan (PAM)

Mar 16, 2023 12:32 PM

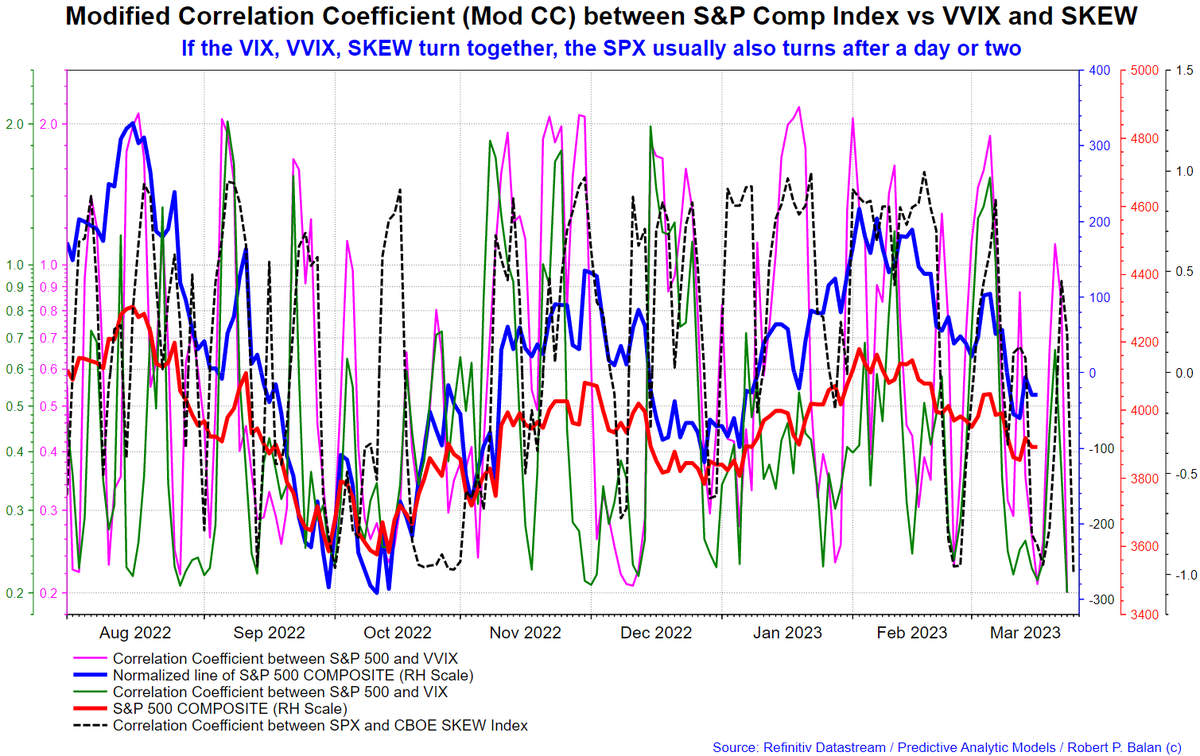

Mod Correlation Coefficient Model featuring SPX vs VIX, VVIX, SKEW Indexes also suggest a lower low by Friday. But SPX should be up two days before FOMC policy decision, then falls thereafter for a few days (forecast horizon limit).

robert.p.balan (PAM)

Mar 16, 2023 12:32 PM

Mod Correlation Coefficient Model featuring SPX vs VIX, VVIX, SKEW Indexes also suggest a lower low by Friday. But SPX should be up two days before FOMC policy decision, then falls thereafter for a few days (forecast horizon limit).

robert.p.balan (PAM)

Mar 16, 2023 2:16 PM

ECB did it. We are on the way to normal markets, which happens if the Fed does 25 bp and does not mitigate the QT schedule. I suspect they may even announce longer and higher top rate.

Mar 16, 2023 2:16 PM

ECB did it. We are on the way to normal markets, which happens if the Fed does 25 bp and does not mitigate the QT schedule. I suspect they may even announce longer and higher top rate.

13/X

robert.p.balan (PAM)

Mar 16, 2023 3:54 PM

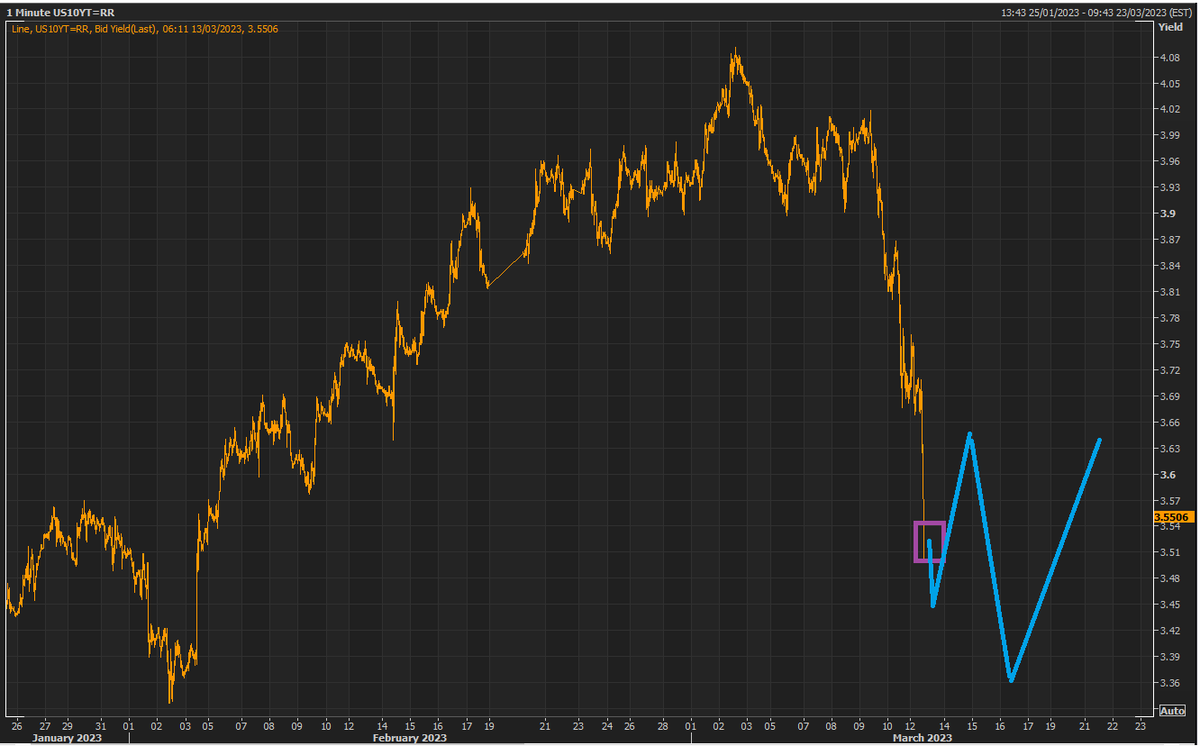

The Yield reversed after NQ got bid by 0DTE meme traders soon as the cash market opened. If indeed we have make a Yield low for the day, a rally back to 3.55 pct (higher) allows us to finally exit the massive orphaned long hedges.

robert.p.balan (PAM)

Mar 16, 2023 3:54 PM

The Yield reversed after NQ got bid by 0DTE meme traders soon as the cash market opened. If indeed we have make a Yield low for the day, a rally back to 3.55 pct (higher) allows us to finally exit the massive orphaned long hedges.

14/X

robert.p.balan (PAM)

Mar 16, 2023 4:12 PM

I hope 0DTE meme traders focus on ES as well -- first time that I'm appreciative of their shenanigans.

These degens provides good exit strategy as well, if we can time their activity. I won't bad mouth these degens ever again. LOL

robert.p.balan (PAM)

Mar 16, 2023 4:12 PM

I hope 0DTE meme traders focus on ES as well -- first time that I'm appreciative of their shenanigans.

These degens provides good exit strategy as well, if we can time their activity. I won't bad mouth these degens ever again. LOL

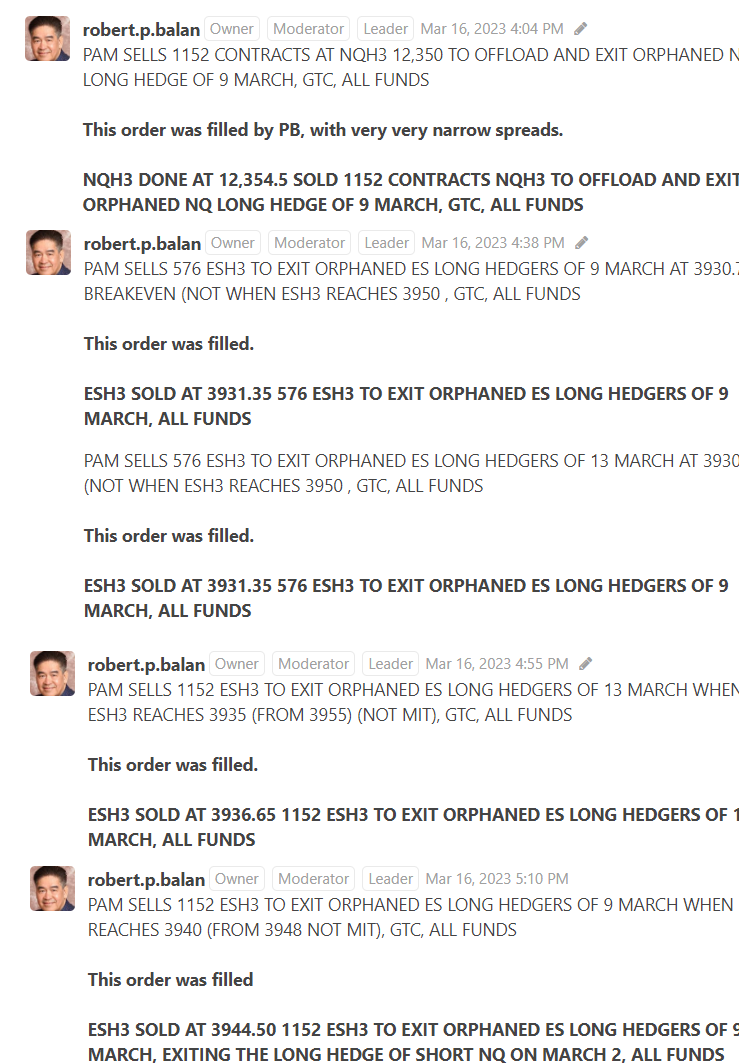

15/X

robert.p.balan (PAM)

Mar 16, 2023 5:18 PM

We're finally done! Took a while for all written confo; its xtremely busy day for the Trade Boys. They tell me Bossman been steadily peeling off long Gold spec trades -- as well as selling some short hedgers for Bullion holdings.

robert.p.balan (PAM)

Mar 16, 2023 5:18 PM

We're finally done! Took a while for all written confo; its xtremely busy day for the Trade Boys. They tell me Bossman been steadily peeling off long Gold spec trades -- as well as selling some short hedgers for Bullion holdings.

16/X

All long ES and EQ orphaned long hedgers were all offloaded at very nice profits! Thanks to the ODTE meme degens! LOL.

All long ES and EQ orphaned long hedgers were all offloaded at very nice profits! Thanks to the ODTE meme degens! LOL.

17/X

robert.p.balan (PAM)

Mar 16, 2023 5:29 PM

And we start a new triple bladed trading project, later today, if the downside has good potential.

If not, then we just get to chase the market up and down, as is usual.

robert.p.balan (PAM)

Mar 16, 2023 5:29 PM

And we start a new triple bladed trading project, later today, if the downside has good potential.

If not, then we just get to chase the market up and down, as is usual.

18/X

robert.p.balan (PAM)

Mar 16, 2023 5:45 PM

Accountant pointed out that we had 57 equity trades since January, with 56 of those completed, and closed. We ONLY had TWO LOSING equity futures trades so far, and two breakeven trades. Those two losses were NOT due to SVB and CS.

robert.p.balan (PAM)

Mar 16, 2023 5:45 PM

Accountant pointed out that we had 57 equity trades since January, with 56 of those completed, and closed. We ONLY had TWO LOSING equity futures trades so far, and two breakeven trades. Those two losses were NOT due to SVB and CS.

19/X

robert.p.balan (PAM)

Mar 16, 2023 8:18 PM

We start looking for levels to do some short scalpers before the NY day is over. So make sure you are getting the alerts without any glitches.

robert.p.balan (PAM)

Mar 16, 2023 8:18 PM

We start looking for levels to do some short scalpers before the NY day is over. So make sure you are getting the alerts without any glitches.

20/X

robert.p.balan (PAM)

Mar 16, 2023 8:31 PM

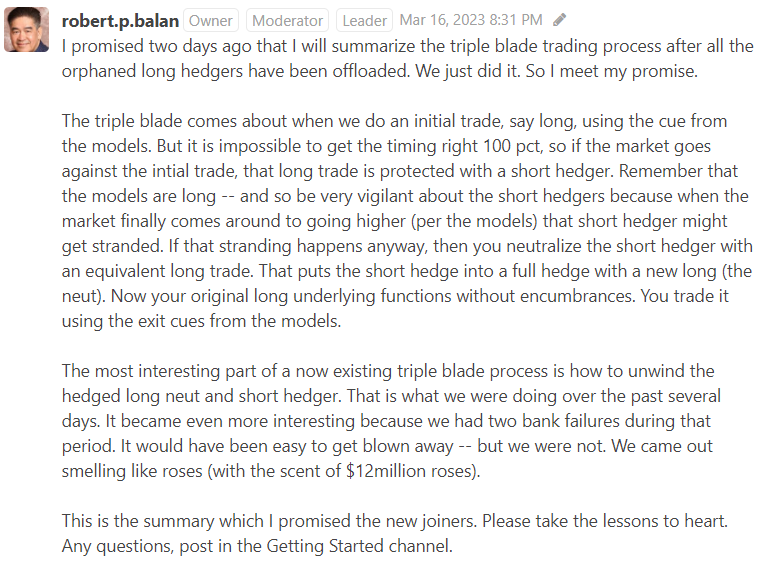

I promised two days ago that I will summarize the triple blade trading process after all the orphaned long hedgers have been offloaded. We just did it. So I meet my promise.

robert.p.balan (PAM)

Mar 16, 2023 8:31 PM

I promised two days ago that I will summarize the triple blade trading process after all the orphaned long hedgers have been offloaded. We just did it. So I meet my promise.

22/22

robert.p.balan (PAM)

Mar 16, 2023 9:46 PM

It's likely we'll see a follow thru higher overnite -- we get a good SELL level in late Asia-early Europe. So hit the sack early; expect some action during by early Europe, when MOTUs come out to play.

See you then. GN and GL.

robert.p.balan (PAM)

Mar 16, 2023 9:46 PM

It's likely we'll see a follow thru higher overnite -- we get a good SELL level in late Asia-early Europe. So hit the sack early; expect some action during by early Europe, when MOTUs come out to play.

See you then. GN and GL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh