What happens 80% of the time when you analyze the M1 timeframe

Greater chance of false signals: Due to the increased noise, there is a greater chance of false signals or fake BOS, which can lead to losses for traders.

Too busy to edit it, Do Enjoy🙏

1/4 🧵

Greater chance of false signals: Due to the increased noise, there is a greater chance of false signals or fake BOS, which can lead to losses for traders.

Too busy to edit it, Do Enjoy🙏

1/4 🧵

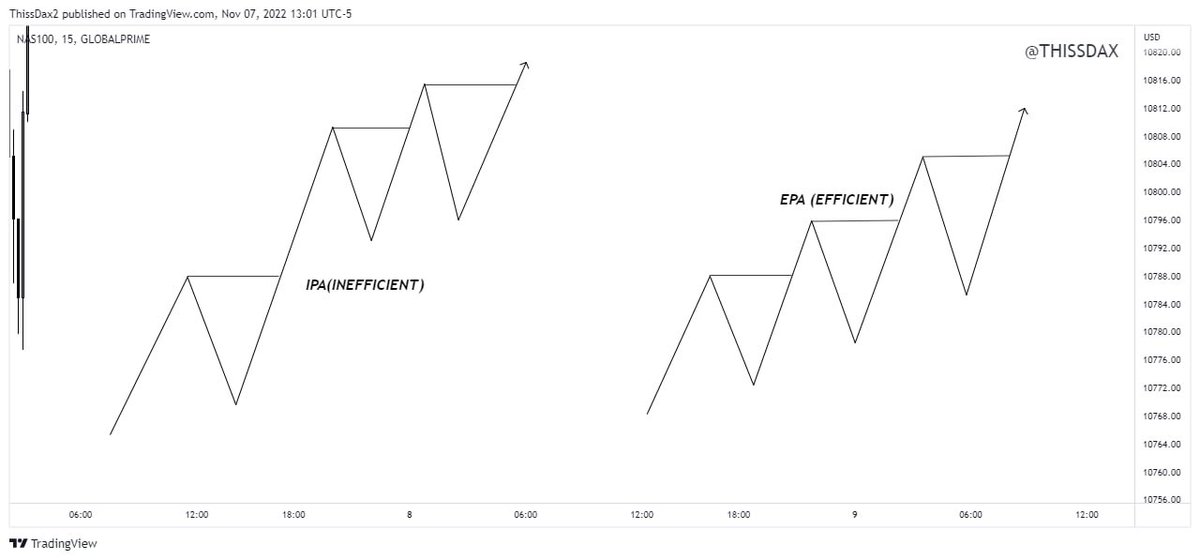

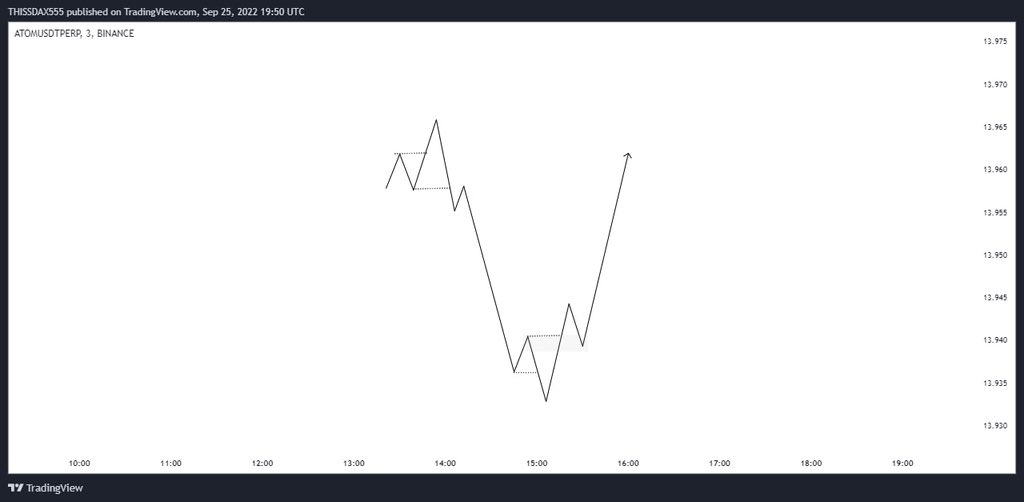

This is how I trade👇

Simple with no complexity

Structure, Liquidity and Entry 🤷♂️

Simple with no complexity

Structure, Liquidity and Entry 🤷♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh