Trader Joe Liquidity Book - A Beginner's Guide Part 1

So you wanna be a market maker, huh?

If so, this guide is for you. Learn how to use @traderjoe_xyz's novel AMM called #LiquidityBook .

🚨 Warning: this isn't your usual LP pool!

Interested? Read on! 🧵

So you wanna be a market maker, huh?

If so, this guide is for you. Learn how to use @traderjoe_xyz's novel AMM called #LiquidityBook .

🚨 Warning: this isn't your usual LP pool!

Interested? Read on! 🧵

Before deploying your first position, let's go over the user interface (UI).

In this example, we'll go over the UI on the Arbitrum network. Note: Trader Joe DEX is also available on Avalanche and BNB.

Let's head over to traderjoexyz.com/arbitrum/pool

This is where the action is! 💥

In this example, we'll go over the UI on the Arbitrum network. Note: Trader Joe DEX is also available on Avalanche and BNB.

Let's head over to traderjoexyz.com/arbitrum/pool

This is where the action is! 💥

Let's choose a 'v2 pool'.

Let's have a look at the ETH-USDC pool.

As a market maker, your favorite metrics will be:

Fees: how much money market makers have made in the past 24h.

Volume: how much liquidity has passed through the pool in the past 24h.

Volume is fees 🧠

Let's have a look at the ETH-USDC pool.

As a market maker, your favorite metrics will be:

Fees: how much money market makers have made in the past 24h.

Volume: how much liquidity has passed through the pool in the past 24h.

Volume is fees 🧠

We are now in the ETH-USDC v2 pool.

If you see the "Rewards" highlighted in green, that means the market makers are incentivised to bring their liquidity (tokens) to a specific pool.

More on that in Part 2.

Let's breakdown the pool view into sections:

If you see the "Rewards" highlighted in green, that means the market makers are incentivised to bring their liquidity (tokens) to a specific pool.

More on that in Part 2.

Let's breakdown the pool view into sections:

'My Liquidity'

On the 'Manage' tab, you will see your position once it's deployed.

The 'Deposit Balance' will show your deposited tokens in the ratio that you deployed them. Later, the ratio will change as the market moves and the token prices go up or down.

On the 'Manage' tab, you will see your position once it's deployed.

The 'Deposit Balance' will show your deposited tokens in the ratio that you deployed them. Later, the ratio will change as the market moves and the token prices go up or down.

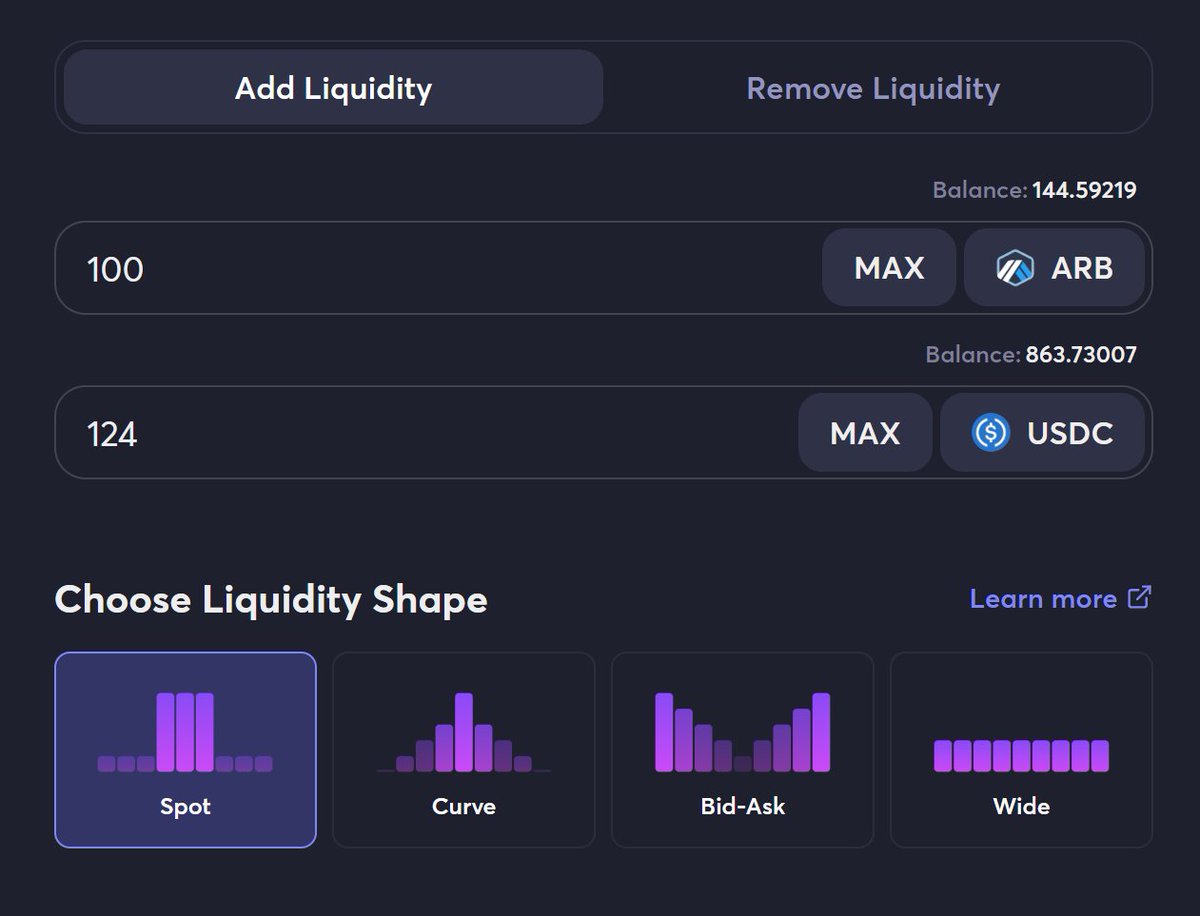

'Add/remove liquidity'

This is where you add or remove your tokens/position.

You can add any amount of either token. You can also supply just one token.

Even withdrawing your position can be customised to an extent; token A/B or both - all or just from the selected range.

This is where you add or remove your tokens/position.

You can add any amount of either token. You can also supply just one token.

Even withdrawing your position can be customised to an extent; token A/B or both - all or just from the selected range.

'Liquidity Shape' aka Strategies.

Here you can select 3 preset shapes that don't require manual adjustment; curve, bid-ask and wide.

The 'spot' shape gives you more control over your capital as you can customise your position.

In this example, we will go with 'spot'.

Here you can select 3 preset shapes that don't require manual adjustment; curve, bid-ask and wide.

The 'spot' shape gives you more control over your capital as you can customise your position.

In this example, we will go with 'spot'.

'Price' and 'Price Range'

The core feature of v2 pools is the opportunity to manage your capital (money) more efficiently by giving you the freedom to strategise.

In v1 LP pools, you could only deploy your capital in a defined 50:50 ratio, in the price range of 0 to infinity.

The core feature of v2 pools is the opportunity to manage your capital (money) more efficiently by giving you the freedom to strategise.

In v1 LP pools, you could only deploy your capital in a defined 50:50 ratio, in the price range of 0 to infinity.

You are free to select your desired price range by moving the slider or you can also enter the prices manually.

This gives you total control over how you supply your token(s).

This gives you total control over how you supply your token(s).

'Price' and 'Bin radius'

In other words, the radius around the active bin aka current price. Radius means bins "to the left" (token A) and "to the right" (token B).

Active bin = the only bin that matters; contains both tokens and where the swap happens and you collect fees.

In other words, the radius around the active bin aka current price. Radius means bins "to the left" (token A) and "to the right" (token B).

Active bin = the only bin that matters; contains both tokens and where the swap happens and you collect fees.

These are the basics of the UI without much jargon and technicalities.

In Part 2, we will roll up the sleeves and deploy your first position. Trust me, there's a lot to learn!

But until then, here's some homework for you:

joecontent.substack.com/p/introducing-…

In Part 2, we will roll up the sleeves and deploy your first position. Trust me, there's a lot to learn!

But until then, here's some homework for you:

joecontent.substack.com/p/introducing-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh