Brighton publish 21/22 accounts

🔑 Figures

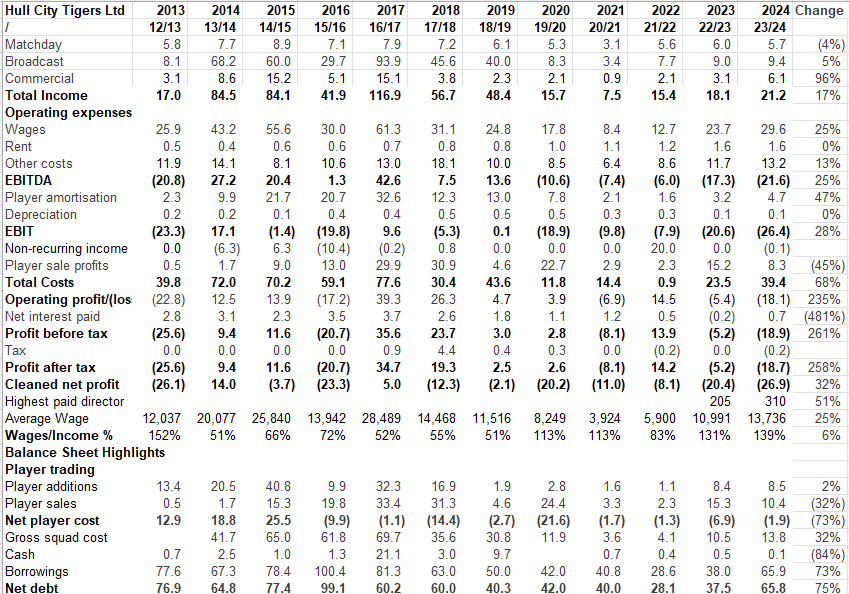

Revenue ⬆️ £29m to record £174m

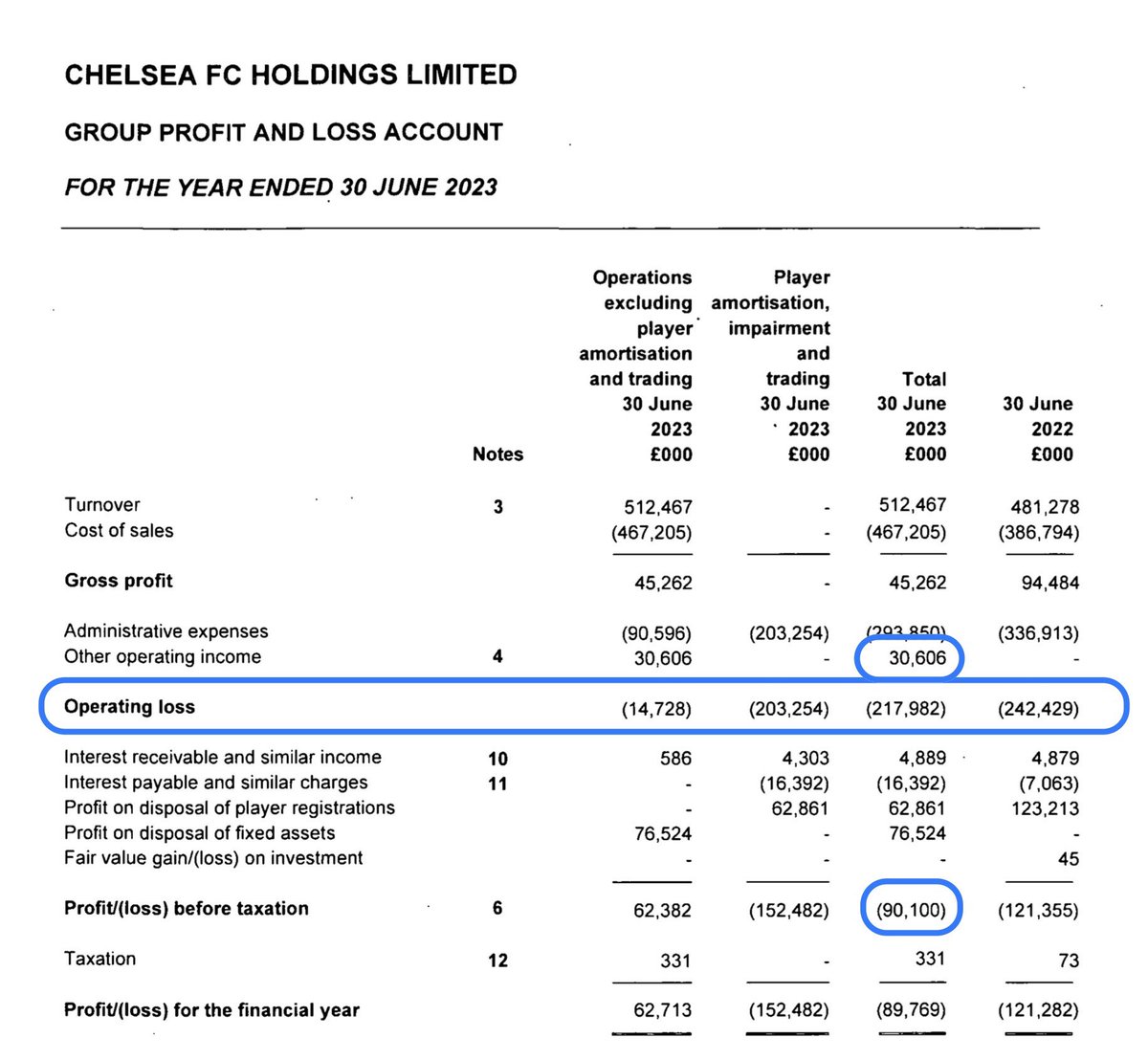

Day to day losses £32m but White & Burn sales convert this to £24m profit

Wages 2nd lowest in PL but finished 9th

Net transfer spend £1m

Tony Bloom total investment £499m

Potter compensation £21.5m #BHAFC

🔑 Figures

Revenue ⬆️ £29m to record £174m

Day to day losses £32m but White & Burn sales convert this to £24m profit

Wages 2nd lowest in PL but finished 9th

Net transfer spend £1m

Tony Bloom total investment £499m

Potter compensation £21.5m #BHAFC

Over £500m short term creditors but majority due to Tony Bloom who shows no sign of wanting repayment.

£18m cash in the bank

£18m cash in the bank

Brighton generated £9m cash from day to day operations.

Player sales significant but only £25m cash received as deals on instalments

Bloom lent club £70m which allowed it to repay bank loan

Player sales significant but only £25m cash received as deals on instalments

Bloom lent club £70m which allowed it to repay bank loan

Revenue up over £28m due to

Fans returning from lockdown (£20m)

Higher 📺 money linked to finishing 9th (2021 figs artificially high as 44 PL matches in year to 30/6/21)

Commercial income almost doubled following lockdown end

Mwepu retirement resulted in £8m write down

Fans returning from lockdown (£20m)

Higher 📺 money linked to finishing 9th (2021 figs artificially high as 44 PL matches in year to 30/6/21)

Commercial income almost doubled following lockdown end

Mwepu retirement resulted in £8m write down

Brighton paid £3m for consultation services of Star Lizard, the company that does the clever stuff analysing players and the game.

Since 30 June 2022 the net spend is MINUS £89m, in addition Chelsea paid £21.5m compensation for Graham Potter & other staff.

Since 30 June 2022 the net spend is MINUS £89m, in addition Chelsea paid £21.5m compensation for Graham Potter & other staff.

• • •

Missing some Tweet in this thread? You can try to

force a refresh