How Oil Traders Fueled & Funded the Demise of Gaddafi in the Libyan Civil War 🛢️

How did a British commodity trader completely change the course of the Civil War in Libya and help usher in years of destabilization and endless bloodshed?

🧵

How did a British commodity trader completely change the course of the Civil War in Libya and help usher in years of destabilization and endless bloodshed?

🧵

To start, we need to talk about commodity trading. Commodity traders wield an enormous amount of power in the world - & we don’t realize it

The gas to fill up our car, the coffee we drink before work, the metals in our phone… all underpinned by a constant international trade

The gas to fill up our car, the coffee we drink before work, the metals in our phone… all underpinned by a constant international trade

Without commodity traders constantly exchanging, bartering and making deals, the world would come to a screeching halt

These are people who have control over our most essential goods and you don’t even know who they are

These are people who have control over our most essential goods and you don’t even know who they are

In early 2011, the Arab world was engulfed in revolution, dubbed as the “Arab Spring”

Libyan rebels were rising up against Muammar Gaddafi’s 40+ year reign. Rebels had even taken control of Benghazi, Libya’s most oil rich part of the country

Libyan rebels were rising up against Muammar Gaddafi’s 40+ year reign. Rebels had even taken control of Benghazi, Libya’s most oil rich part of the country

The rag-tag rebel group had a huge issue however. They were running out of oil desperately needed for their vehicles and power stations

Due to the war, Libya’s refineries had been severely disrupted leaving only a small amount fuel entering the country

Due to the war, Libya’s refineries had been severely disrupted leaving only a small amount fuel entering the country

In walks commodity trader and chief executive of Vitol, Ian Taylor

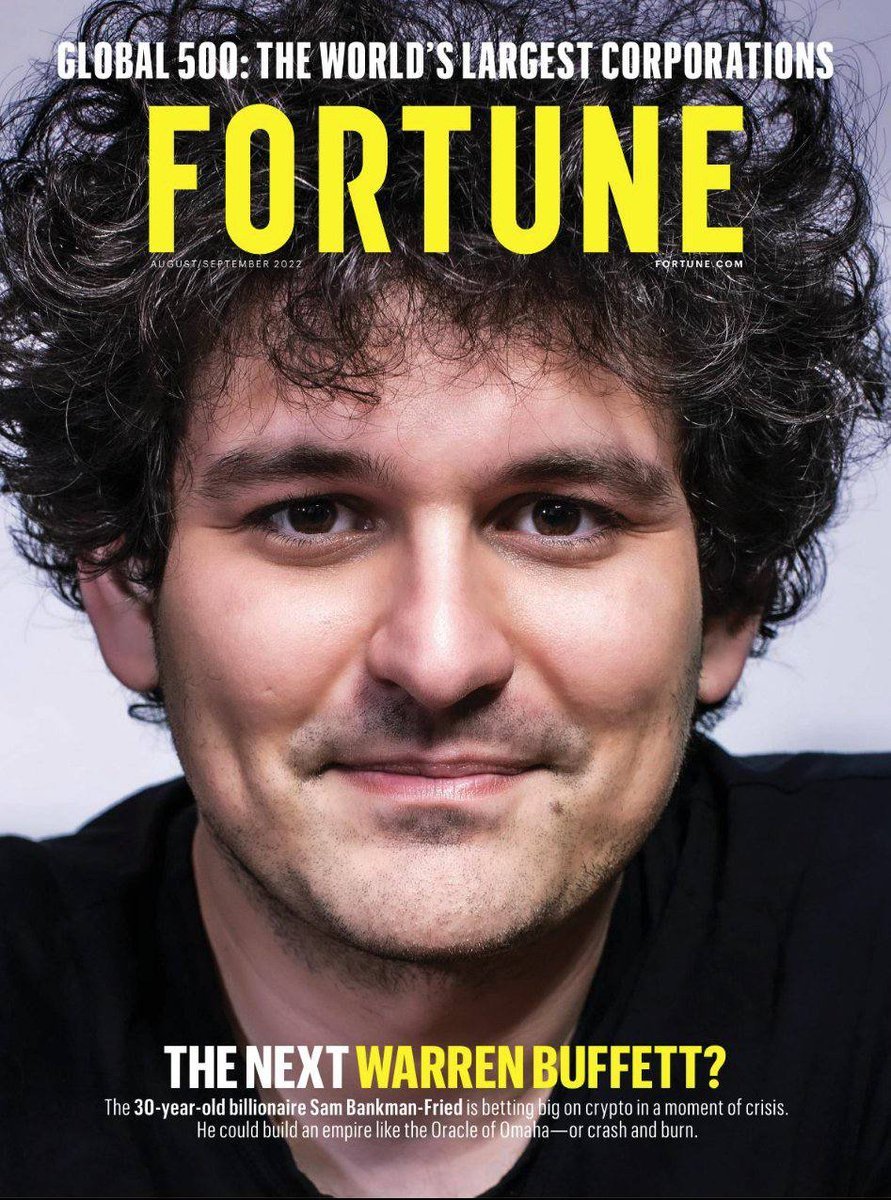

Vitol is the largest energy trader in the world & would be the second-largest company worldwide as measured by revenue on the Fortune list but due to the secrecy around its disclosures, it’s excluded from ranking

Vitol is the largest energy trader in the world & would be the second-largest company worldwide as measured by revenue on the Fortune list but due to the secrecy around its disclosures, it’s excluded from ranking

Taylor has been in war torn countries to cut deals before and was not afraid to take the risk of supplying the rebels with oil in the midst of Libya’s war

In a world where oil & money are closely tied in with power, Taylor was not afraid to cut deals that would enrich himself

In a world where oil & money are closely tied in with power, Taylor was not afraid to cut deals that would enrich himself

The Qatari government, who supported the rebels, helped broker a deal between Vitol and the rebels to barter

Vitol would supply refined diesel and gasoline and take payment in the form of crude oil from the few oilfields the rebels controlled

Vitol would supply refined diesel and gasoline and take payment in the form of crude oil from the few oilfields the rebels controlled

Essentially, Vitol would flow fuel across the Mediterranean to Benghazi while receiving crude oil via a pipeline (under rebel control) to a safe area to retrieve their payment

Not only did Vitol offer to barter with the rebels but they even offered to lend them money

Not only did Vitol offer to barter with the rebels but they even offered to lend them money

Since Taylor had friends in high places in Washington and London, he was able to prevent Gaddafi’s forces from obtaining fuel or selling oil internationally via sanctions

US sanctions allowed companies to buy Libyan oil from Vitol

US sanctions allowed companies to buy Libyan oil from Vitol

The deal marked a major turning point in the Libyan civil war

Despite Gaddafi’s forces catching wind of this deal & blowing up the pipeline that the rebel forces were using to make good on their end of the barter (effectively making the deal moot since the rebels could no longer hold up their end), Taylor still went through w/ supplying oil

Why? Many believe it’s bc Taylor felt comfortable with his deal since Qaddafi had billions of dollars frozen in western banks and if the war ended badly for Vitol’s deal, Taylor’s friends in government would simply unfreeze the assets and pay Taylor back

As time pressed on, the rebels found themselves indebted to Vitol - over 1B. Without this much fuel delivered to them, the rebels would have been defeated handily by Qaddafi’s forces

Despite the fall of Qaddafi, war waged on years after. The whole region would soon be destabilized as fighting would spill over into neighboring countries. Taylor in bc 2019 admitted regret for his decision…after he made billions

This isn’t the only time commodity traders finagled their way into tragedy in order to enrich themselves

I plan on doing a few more threads to share these stories with you

I plan on doing a few more threads to share these stories with you

• • •

Missing some Tweet in this thread? You can try to

force a refresh