#ArbitrumAirdrop $ARB claim will start very soon

Here are 8 key points you should know to get yourself ready for ALPHA💡🧵

Here are 8 key points you should know to get yourself ready for ALPHA💡🧵

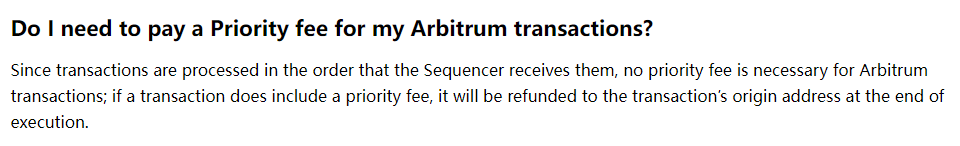

1/ Arbitrum's gas pricing varies from Ethereum🤔

Arbitrum solely relies on a base fee with no option for a priority fee.

Your transactions won't be prioritized with a high tip.

Arbitrum solely relies on a base fee with no option for a priority fee.

Your transactions won't be prioritized with a high tip.

2/ Increase base fee to prepare for unprecedented gas price spikes🚁

Eligible airdrop addresses are ~625k, 2.6x the ATH of Arbitrum's daily active addresses(~240k) .

The gigantic flow will push base fee way above the 0.1 GWEI floor, aiming to break the 166m daily tx ATH.

Eligible airdrop addresses are ~625k, 2.6x the ATH of Arbitrum's daily active addresses(~240k) .

The gigantic flow will push base fee way above the 0.1 GWEI floor, aiming to break the 166m daily tx ATH.

3/ Increase the gas limit🙌

Gas unit cost on Arbitrum not only includes EVM computation/storage cost like Ethereum.

But also L1 resource fees & L2 specific precompile execution fees.

Avoid decreasing the gas limit to the number of same operations on Ethereum.

Gas unit cost on Arbitrum not only includes EVM computation/storage cost like Ethereum.

But also L1 resource fees & L2 specific precompile execution fees.

Avoid decreasing the gas limit to the number of same operations on Ethereum.

4/ Use reliable RPC 💻

Txs are processed on a first come first serve basis, sequencer processes txs chronologically.

Success in broadcasting tx to the sequencer guarantees its execution ASAP.

A dependable RPC also provides accurate gas info to improve your tx's success rate.

Txs are processed on a first come first serve basis, sequencer processes txs chronologically.

Success in broadcasting tx to the sequencer guarantees its execution ASAP.

A dependable RPC also provides accurate gas info to improve your tx's success rate.

5/ Be ready for possible delays in L2 🚦 🕰️ 🕑

$ARB claim opens at L1 block number 16890400, but it's not updated in real-time on L2, causing a potential delay of <1 minute (5 L1 blocks).

This may result in failed claim txs if L2 is not updated to the latest L1 block number.

$ARB claim opens at L1 block number 16890400, but it's not updated in real-time on L2, causing a potential delay of <1 minute (5 L1 blocks).

This may result in failed claim txs if L2 is not updated to the latest L1 block number.

6/ Be extra prepared for potential disruptions 🐢 🤦

The increase in demand from users will be a stress test for Arbitrum and relevant service providers(nodes, explorers...).

This may cause more casualties and even edge cases.

The increase in demand from users will be a stress test for Arbitrum and relevant service providers(nodes, explorers...).

This may cause more casualties and even edge cases.

https://twitter.com/CoinbaseAssets/status/1638579554523439104

7/ Make sure to leverage current low gas fees 📡

Since the base fee is cheap(0.1GWEI as of writing) now, make sure you have:

- deposited sufficient ETH gas fee

- pre-approved DEXs

- switched to a reliable RPC

- comprehend the information & knowledge mentioned in this thread

Since the base fee is cheap(0.1GWEI as of writing) now, make sure you have:

- deposited sufficient ETH gas fee

- pre-approved DEXs

- switched to a reliable RPC

- comprehend the information & knowledge mentioned in this thread

8/ Stay cautious and avoid phishing 🔍

Only click links from official websites to ensure your safety.

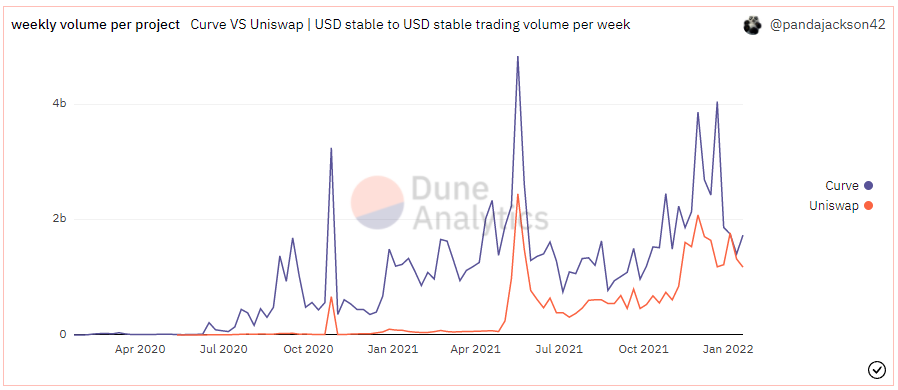

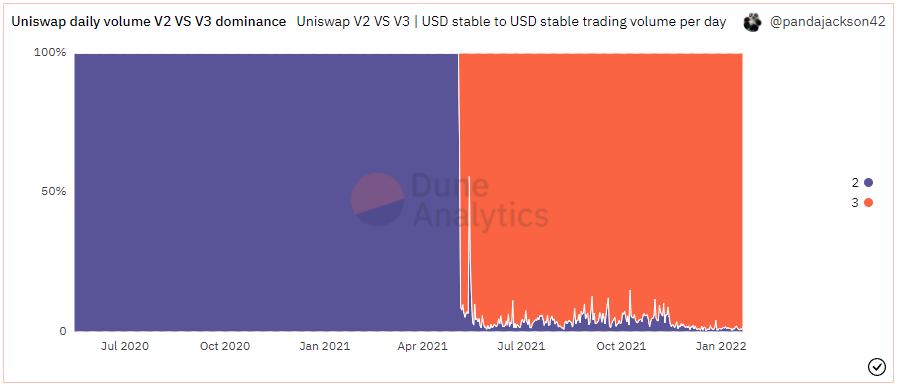

More info about Arbitrum airdrop at dune.com/pandajackson42…

Stay up to date for more ALPHA by following @pandajackson42

Only click links from official websites to ensure your safety.

More info about Arbitrum airdrop at dune.com/pandajackson42…

Stay up to date for more ALPHA by following @pandajackson42

• • •

Missing some Tweet in this thread? You can try to

force a refresh