" Power of 3 "

The ICT Concept that Elevated my Trading

A Thread 🧵

The ICT Concept that Elevated my Trading

A Thread 🧵

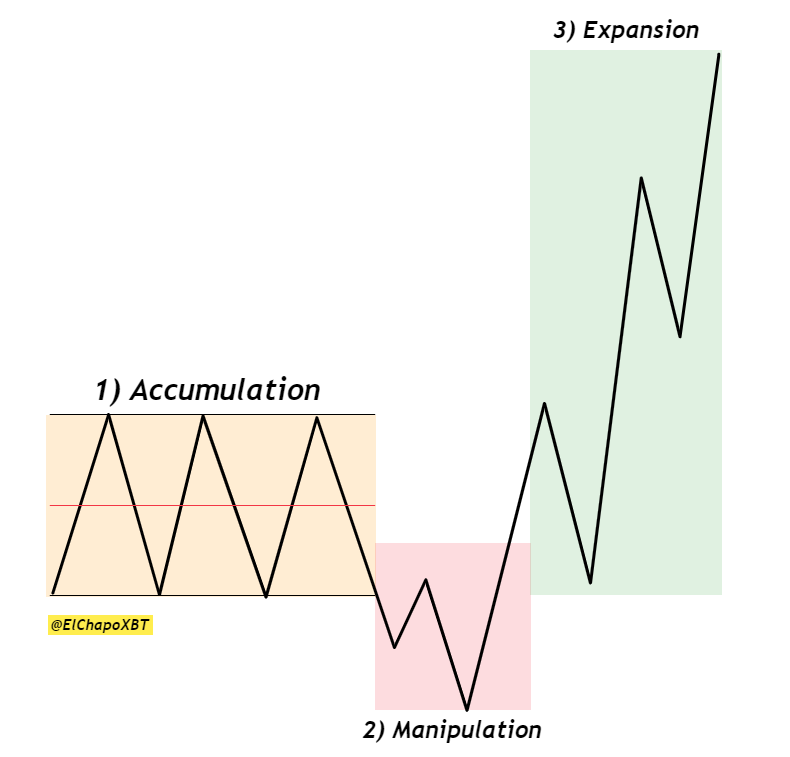

1) Power of 3 (Po3), also referred to as Accumulation, Manipulation, Distribution / Expansion (AMD), is a concept taught by ICT.

2) Bullish Po3

Accumulation = Longs build up

Manipulation = Engineering short liquidity, Neutralising Long Liquidity and sell stops paired with buy interest

Distribution = Pairing long exits with pending buy interest

Vice versa for a Bearish Po3

Accumulation = Longs build up

Manipulation = Engineering short liquidity, Neutralising Long Liquidity and sell stops paired with buy interest

Distribution = Pairing long exits with pending buy interest

Vice versa for a Bearish Po3

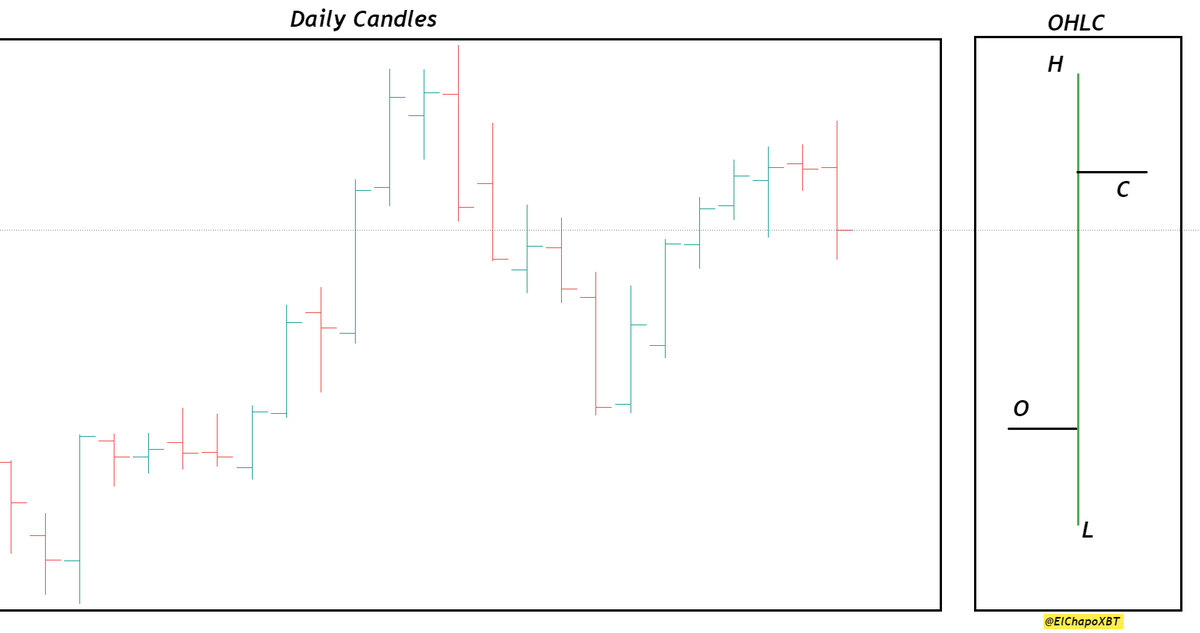

3) "Price Action is Fractal in Nature"

Time and Price Theory shows us that every candlestick, regardless of timeframe, is compiled of an open, high, low and close (OHLC).

Time and Price Theory shows us that every candlestick, regardless of timeframe, is compiled of an open, high, low and close (OHLC).

4) For me as a day trader I will establish bias (loosely held as more information is made available to me) from the Weekly and Daily

If PA is Bullish - Focus on buying at or below the daily opening price

If PA is Bearish - Focus on selling at or above the daily opening price

If PA is Bullish - Focus on buying at or below the daily opening price

If PA is Bearish - Focus on selling at or above the daily opening price

5) Manipulation Below the Daily Open is referred to as the ICT Judas Swing.

It is the "False Run" that trips traders up.

It Begins at Midnight New York Time

And Ends at 5:00am New York Time

It is the "False Run" that trips traders up.

It Begins at Midnight New York Time

And Ends at 5:00am New York Time

6) A easy trick is to compile the Trading Sessions into their own daily Po3

Accumulation = Asia

Manipulation / Judas Swing = London

Expansion = New York

Accumulation = Asia

Manipulation / Judas Swing = London

Expansion = New York

7) Weekly Po3 Profiles can also be key when Trading Intra-day.

In Bullish Conditions we can anticipate the Low of the week forming between Tuesday and Wednesday.

And During Bearish Conditions we can anticipate the high of the week forming between Tuesday and Wednesday.

In Bullish Conditions we can anticipate the Low of the week forming between Tuesday and Wednesday.

And During Bearish Conditions we can anticipate the high of the week forming between Tuesday and Wednesday.

8) Further Resources

1 -

2 -

3 -

1 -

2 -

3 -

9) Conclusion

Po3 is the anatomy of Price Action on ALL timeframes - OHLC.

Approaching it from a weekly and daily timeframe allows us to build context and narrative for our intra-day trading.

I hope you found this thread insightful 🫡

Po3 is the anatomy of Price Action on ALL timeframes - OHLC.

Approaching it from a weekly and daily timeframe allows us to build context and narrative for our intra-day trading.

I hope you found this thread insightful 🫡

• • •

Missing some Tweet in this thread? You can try to

force a refresh