[🧵THREAD] ICT Forex Trading entry strategy - Improve your winrate 🧠💎

In this thread i will explain my ICT Forex entry trading strategy in detail. This is all based on @I_Am_The_ICT concepts and i will simplify it for you in this thread.

In this thread i will explain my ICT Forex entry trading strategy in detail. This is all based on @I_Am_The_ICT concepts and i will simplify it for you in this thread.

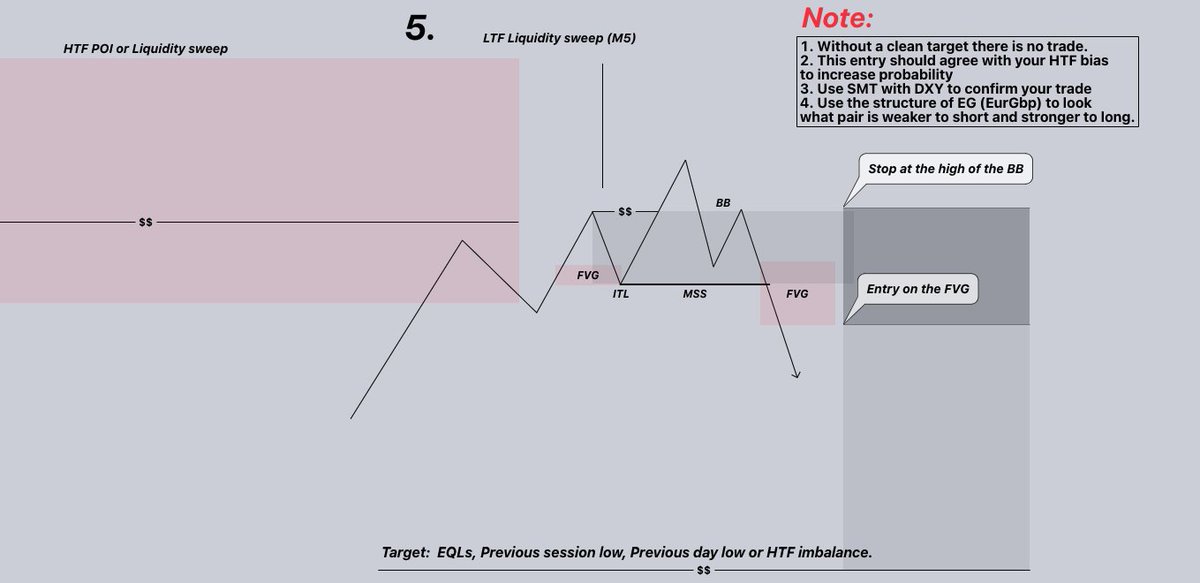

2. Wait for a M5 Liquidity sweep. (this will trap retail trader in the wrong direction) Without a liquidity sweep there is NO trade. (I mainly trade >M5 TF in FX)

3. Wait for M5 mss after the liquidity sweep.

I always check for entry confluence by checking the SMT between EU and GU and use the market structure of DXY and EG to confirm the mss.

⏭️I will explain this further in step 6.

I always check for entry confluence by checking the SMT between EU and GU and use the market structure of DXY and EG to confirm the mss.

⏭️I will explain this further in step 6.

4. I want to see a strong move with Displacement to the downside.

Price needs to leave a FVG by breaking the market structure (mss). No FVG means no trade for me.

Price needs to leave a FVG by breaking the market structure (mss). No FVG means no trade for me.

5. Entry, Stoploss, Take profit 🎯

- Enter inside the M5 FVG

- Place the Stop above the BB (breaker block)

- Target opposing liquidity

- I always take a partial at first liquidity sweep

- Place Stoploss to or around entry after the sweep and let the trade run to final target

- Enter inside the M5 FVG

- Place the Stop above the BB (breaker block)

- Target opposing liquidity

- I always take a partial at first liquidity sweep

- Place Stoploss to or around entry after the sweep and let the trade run to final target

6. I always check if DXY support my trading idea and check EG (EurGBP) what pair to trade. DXY needs to confirm my idea, if DXY is not support my trade idea i take NO trade.

I really hope this helped you guys! ❤️🔥➕ Show some love and share this with your community and friends.

Note: Backtest this strategy yourself before you start trading it. All this is NOT financial advise :)

Note: Backtest this strategy yourself before you start trading it. All this is NOT financial advise :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh