1/x

robert.p.balan (PAM)

Mar 24, 2023 9:45 AM

EUROPEAN OPEN BRIEF:

10YR YIELD IS ON WAY TO 3.30 (FINALLY) -- WE WAIT TO SEE IF A DOWNWARD REACH OF 3.30 SUPPORT HAPPENS; IT LOOKS LIKE THE COVARIANCE OF ASSET CLASSES ARE SHIFTING AGAIN, AS MARKET SENTIMENT TURNS FRAGILE AGAIN

robert.p.balan (PAM)

Mar 24, 2023 9:45 AM

EUROPEAN OPEN BRIEF:

10YR YIELD IS ON WAY TO 3.30 (FINALLY) -- WE WAIT TO SEE IF A DOWNWARD REACH OF 3.30 SUPPORT HAPPENS; IT LOOKS LIKE THE COVARIANCE OF ASSET CLASSES ARE SHIFTING AGAIN, AS MARKET SENTIMENT TURNS FRAGILE AGAIN

2/x

robert.p.balan (PAM)

Mar 24, 2023 10:38 AM

DXY rising sharply even as 10Yr Yield falls sharply (with equities alongside) -- this still looks like flight to safe haven. Gold (still mapped to Yield) also rising -- another sign of capital flight to traditional safe harbours.

robert.p.balan (PAM)

Mar 24, 2023 10:38 AM

DXY rising sharply even as 10Yr Yield falls sharply (with equities alongside) -- this still looks like flight to safe haven. Gold (still mapped to Yield) also rising -- another sign of capital flight to traditional safe harbours.

3/X

robert.p.balan

Owner

Moderator

Leader

Mar 24, 2023 10:44 AM

We will very like see the 3.30 support tested hard -- my new thesis, given the still very fragile market sentiment, is 3.30 support gives way -- and there goes equities. . . .

robert.p.balan

Owner

Moderator

Leader

Mar 24, 2023 10:44 AM

We will very like see the 3.30 support tested hard -- my new thesis, given the still very fragile market sentiment, is 3.30 support gives way -- and there goes equities. . . .

4/X . . . Gold should respond higher in this scenario. Keep those long gold hedgers in place, even overhedge long gold if 3.30 is breached.

5/X

robert.p.balan (PAM)

Mar 24, 2023 10:50 AM

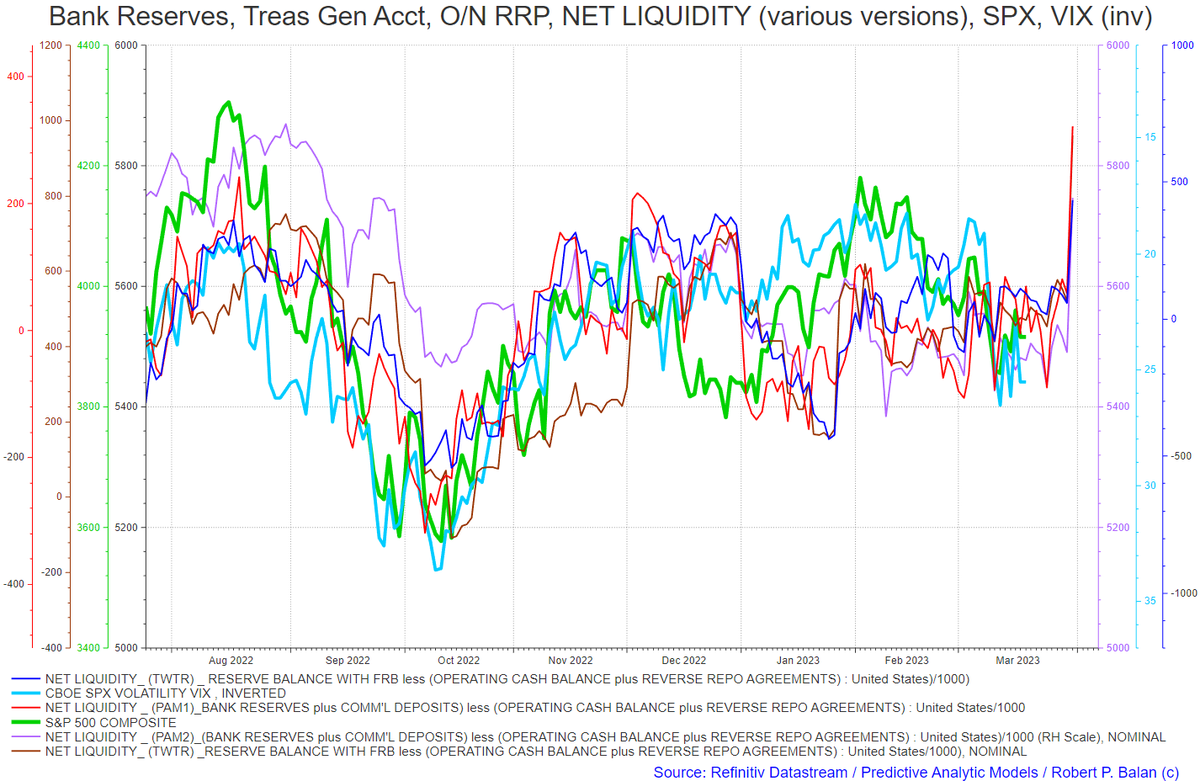

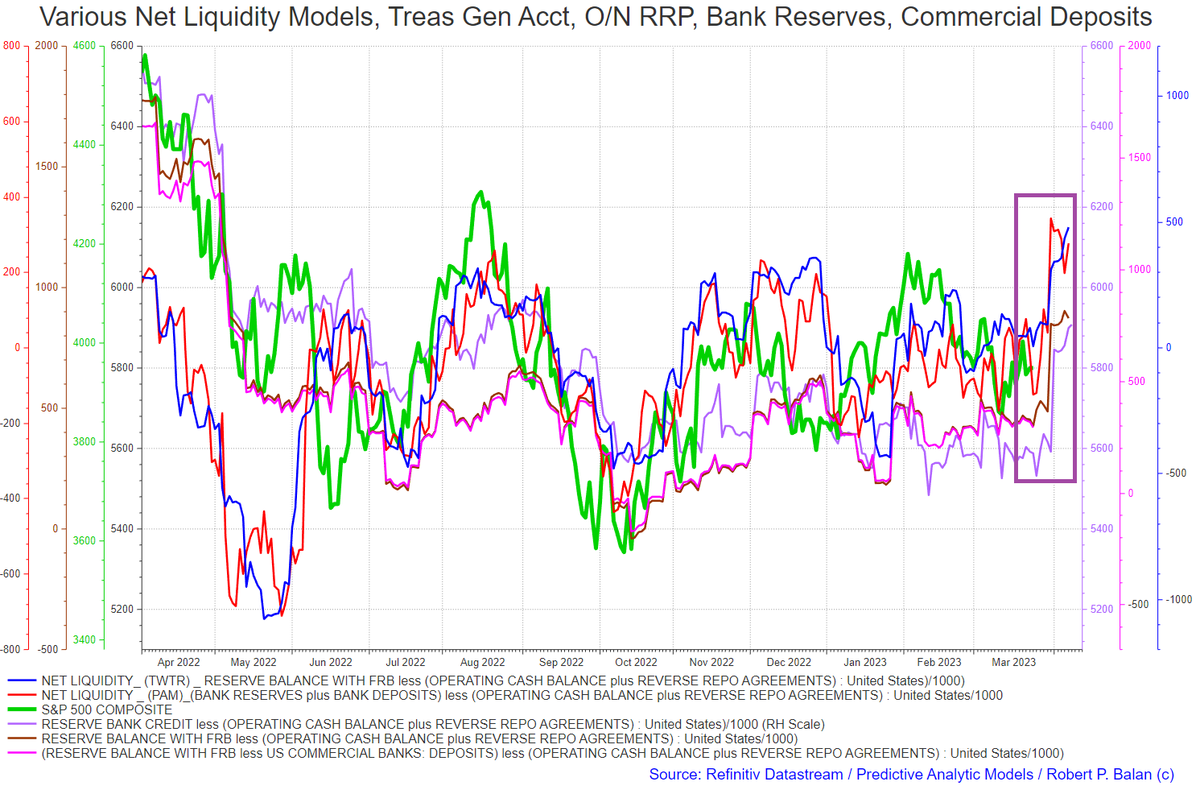

Further, sharper declines in equities and the Yield are implicit in the various Net Liquidity Models, and especially in the PAM's version. Nonetheless, all the Net Liquidity models also highlight the forecast . . .

robert.p.balan (PAM)

Mar 24, 2023 10:50 AM

Further, sharper declines in equities and the Yield are implicit in the various Net Liquidity Models, and especially in the PAM's version. Nonetheless, all the Net Liquidity models also highlight the forecast . . .

6/X . . . of a large equity market and Yield recovery early next week.

New measures to be announced during the week-end?

New measures to be announced during the week-end?

7/X

robert.p.balan (PAM)

Mar 24, 2023 10:58 AM

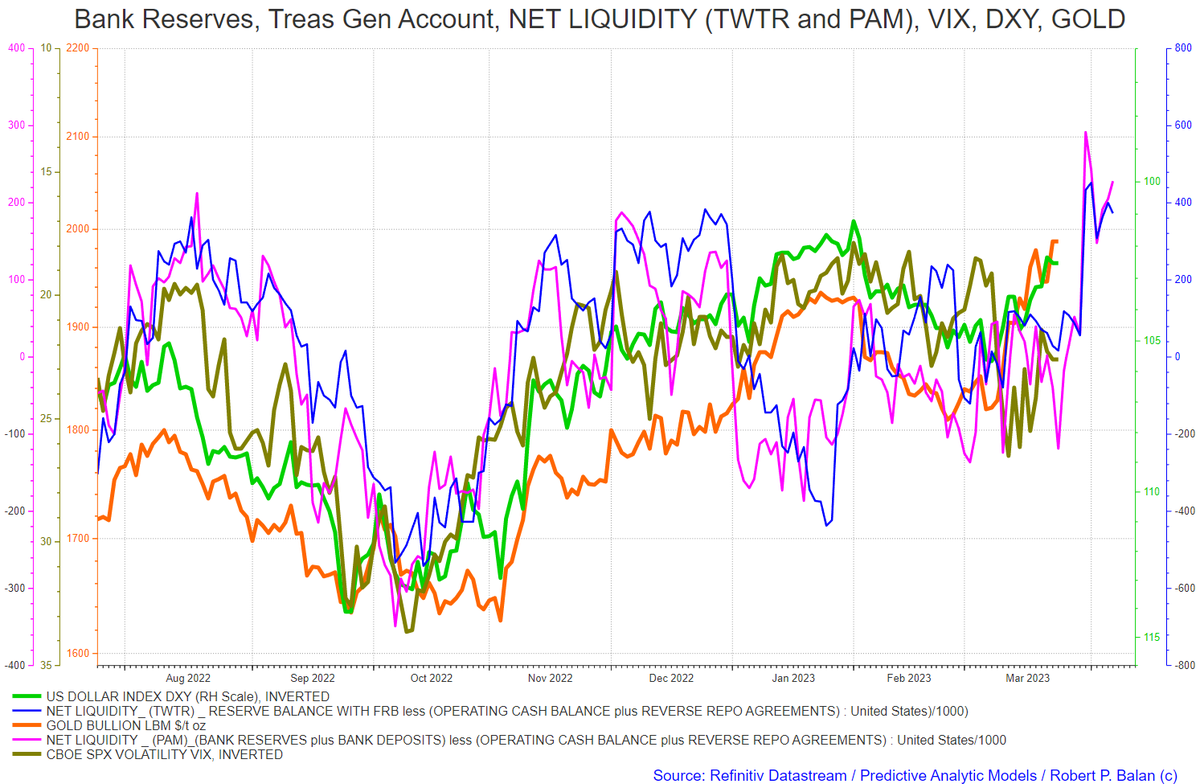

Here's the Net Liquidity models (TWTR and PAM), showing possible large moves for Gold, DXY and VIX over the next fews days -- coming and going.

robert.p.balan (PAM)

Mar 24, 2023 10:58 AM

Here's the Net Liquidity models (TWTR and PAM), showing possible large moves for Gold, DXY and VIX over the next fews days -- coming and going.

8/X

robert.p.balan (PAM)

Mar 24, 2023 11:08 AM

Jeez -- look at DXY go berserk -- this is capital flight indeed.

robert.p.balan (PAM)

Mar 24, 2023 11:08 AM

Jeez -- look at DXY go berserk -- this is capital flight indeed.

9/X

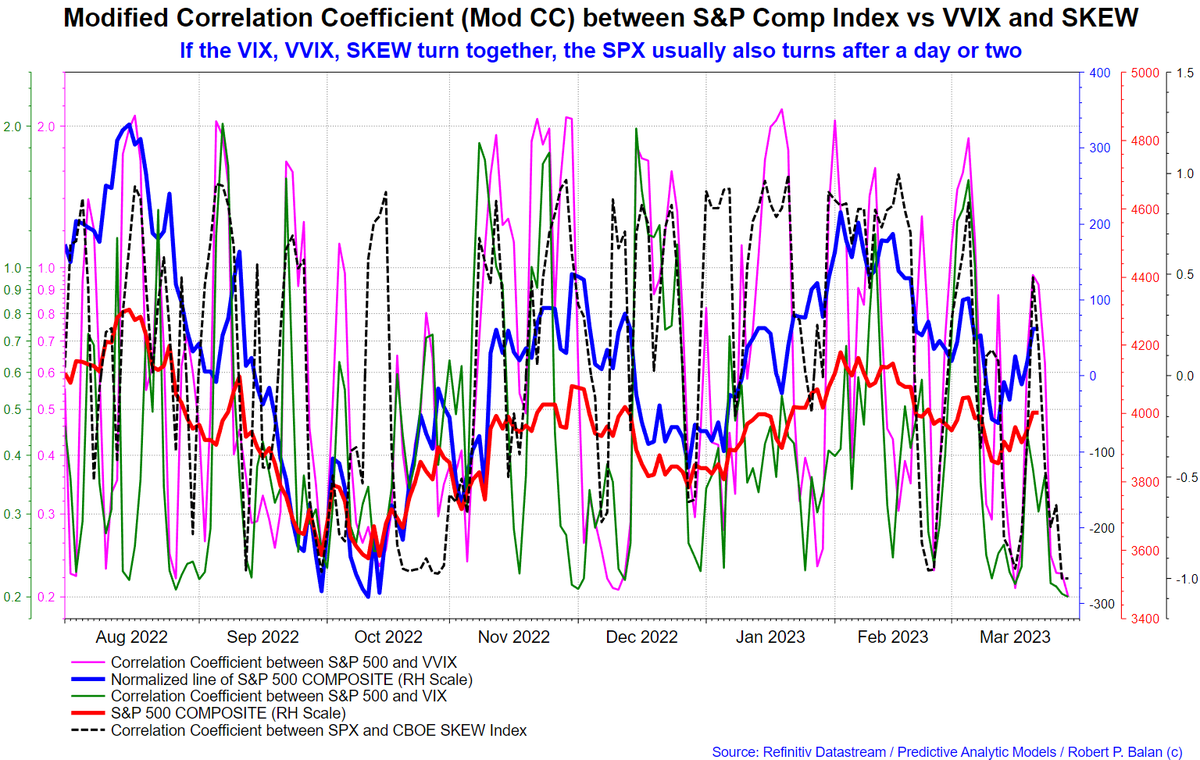

robert.p.balan (PAM)

Mar 24, 2023 11:55 AM

Our old reliable, the Mod Corr Coeff Model, also still suggests a hard, lower NY close today (Friday), and then recovery thereafter to at least Friday March 31 (the model is dynamic, this datapoint value will change).

robert.p.balan (PAM)

Mar 24, 2023 11:55 AM

Our old reliable, the Mod Corr Coeff Model, also still suggests a hard, lower NY close today (Friday), and then recovery thereafter to at least Friday March 31 (the model is dynamic, this datapoint value will change).

10/X

asblue9022 (PAM)

Mar 24, 2023 12:42 PM

Since 3.3 was hit, further equity weakness would require even lower than 3.3. Roughly where are we targeting now on yield?

skali (PAM)

Mar 24, 2023 12:57 PM

3.22 - 3.21?

asblue9022 (PAM)

Mar 24, 2023 12:42 PM

Since 3.3 was hit, further equity weakness would require even lower than 3.3. Roughly where are we targeting now on yield?

skali (PAM)

Mar 24, 2023 12:57 PM

3.22 - 3.21?

11/X

gosume (PAM)

Mar 24, 2023 1:01 PM

Arent equities a little lagged from the treasury yield? aka 3.3 = 3900-3915 range as posted?

gosume (PAM)

Mar 24, 2023 1:01 PM

Arent equities a little lagged from the treasury yield? aka 3.3 = 3900-3915 range as posted?

12/X

robert.p.balan (PAM)

Mar 24, 2023 1:14 PM

Just sit tight -- no technical masurement works when the market panics. Please don't ask where the asset prices are going __ at this point, its anyone's guess; that's a polite way of saying I have no fucking clue (yet).

😂 7

robert.p.balan (PAM)

Mar 24, 2023 1:14 PM

Just sit tight -- no technical masurement works when the market panics. Please don't ask where the asset prices are going __ at this point, its anyone's guess; that's a polite way of saying I have no fucking clue (yet).

😂 7

13/X

ellsbells (PAM)

Mar 24, 2023 1:14 PM

Will you be looking to unload shorts for greens today RB? Equity shorts^

robert.p.balan (PAM)

Mar 24, 2023 1:15 PM

I won't have an excuse to get drunk over the weekend if we don't do that. LOL.

😂 8

ellsbells (PAM)

Mar 24, 2023 1:14 PM

Will you be looking to unload shorts for greens today RB? Equity shorts^

robert.p.balan (PAM)

Mar 24, 2023 1:15 PM

I won't have an excuse to get drunk over the weekend if we don't do that. LOL.

😂 8

14/X

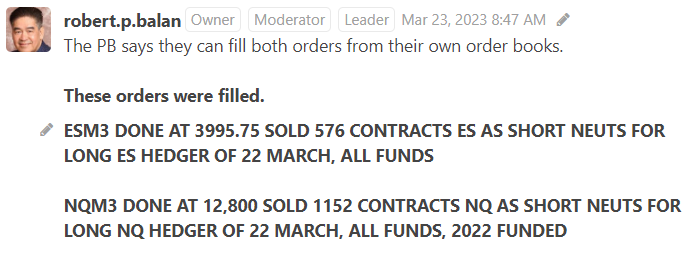

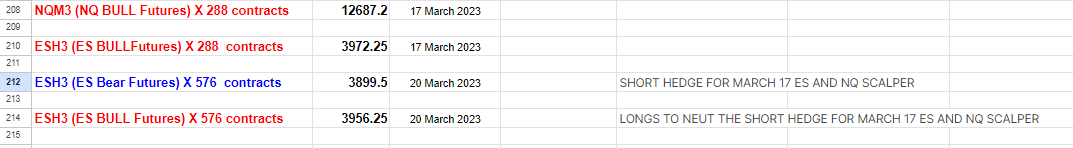

robert.p.balan (PAM)

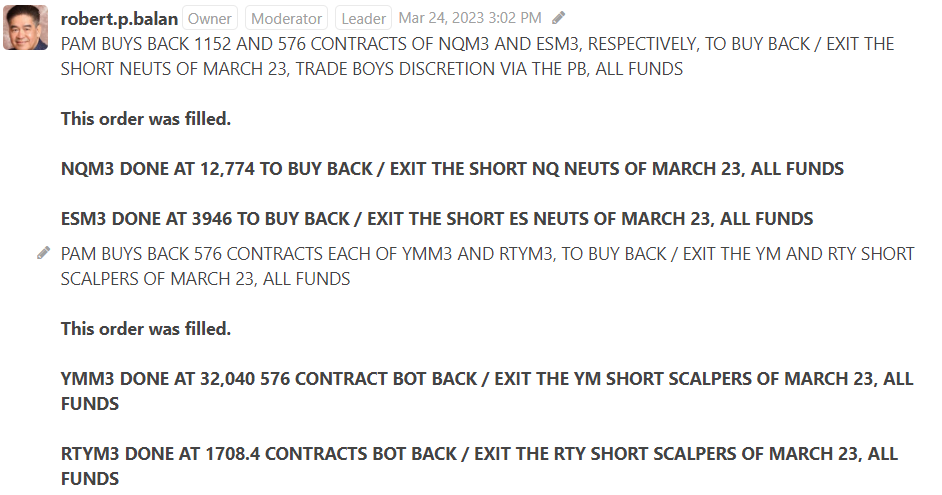

Mar 24, 2023 2:03 PM

When we start buying back the short positions, we start with the YM and RTY scalpers.

Then we exit the short Neuts to the long hedges of March 22

Once done, that leaves the fully hedged NQ (1152) and ES (576) pairs. . . .

robert.p.balan (PAM)

Mar 24, 2023 2:03 PM

When we start buying back the short positions, we start with the YM and RTY scalpers.

Then we exit the short Neuts to the long hedges of March 22

Once done, that leaves the fully hedged NQ (1152) and ES (576) pairs. . . .

15/X . . . This two hedged pairs should be of no concern unless we really have a massive equity sell-off -- in which case, we can buy back the short hedgers.

I am laying this out now, so that there won't be a lot of questions when we are trading -- in which case, I ignore . . .

I am laying this out now, so that there won't be a lot of questions when we are trading -- in which case, I ignore . . .

16/X . . . the queries until I am done trading -- so better parse these and ask questions now. I hope we get rid of the short hedgers with good profits. If we do get a humongous rally next week, then we may get a chance to offload the long underlying, in turn. Then we start anew.

17/x

robert.p.balan (PAM)

Mar 24, 2023 2:52 PM

ALERT!!

We exit the short neuts first instead, then the short scalpers -- and do it now. I am not liking the Yeld uptick above 3.33. Yield recovers from here. We are out of the naked short trades.

robert.p.balan (PAM)

Mar 24, 2023 2:52 PM

ALERT!!

We exit the short neuts first instead, then the short scalpers -- and do it now. I am not liking the Yeld uptick above 3.33. Yield recovers from here. We are out of the naked short trades.

18/X

robert.p.balan (PM)

Mar 24, 2023 3:27 PM

Whew, that short trade was exhilaratingly profitable! However, I was DMed -- excoriated why PAM bailed out of short positioning when there was just a small uptick in equities. OK, maybe I was too panicky too abt the rising Yield . .

robert.p.balan (PM)

Mar 24, 2023 3:27 PM

Whew, that short trade was exhilaratingly profitable! However, I was DMed -- excoriated why PAM bailed out of short positioning when there was just a small uptick in equities. OK, maybe I was too panicky too abt the rising Yield . .

19/x . . . But note that DXY is flagging, as well.

What I learned in 50 year trading -- you don't have to be shot in the head to see that the battle is turning against you. So we got out at what I thought was max possible profits (I hope).

What I learned in 50 year trading -- you don't have to be shot in the head to see that the battle is turning against you. So we got out at what I thought was max possible profits (I hope).

20/X

robert.p.balan (PAM)

Mar 24, 2023 3:49 PM

Accountant made quick calculations -- actual profits, and clawed back acct valuations -- little more than $10 Million. Yehaa! There's my excuse to get soused during the weekend (can do this becuz my wife is in Canada). LOL.

robert.p.balan (PAM)

Mar 24, 2023 3:49 PM

Accountant made quick calculations -- actual profits, and clawed back acct valuations -- little more than $10 Million. Yehaa! There's my excuse to get soused during the weekend (can do this becuz my wife is in Canada). LOL.

21/X

lilfish (PAM)

Mar 24, 2023 3:17 PM

Exited equities and rolling in green - but I'm wondering if we've plans for that last large gold long ?

robert.p.balan (PAM)

Mar 24, 2023 3:18 PM

So far, Gold disbelieving the Yield. No worries, I'm on watch--we'll land this biggie too.

lilfish (PAM)

Mar 24, 2023 3:17 PM

Exited equities and rolling in green - but I'm wondering if we've plans for that last large gold long ?

robert.p.balan (PAM)

Mar 24, 2023 3:18 PM

So far, Gold disbelieving the Yield. No worries, I'm on watch--we'll land this biggie too.

22/X

robert.p.balan (PAM)

Mar 24, 2023 5:09 PM

If the sell-off is ending, it may trace a book-perfect descending wedge. It may do one more trip to a slightly lower low to, say, 3930/25. I favor this schemata. But above 3990 suggest we a have a breakout recovery . . .

robert.p.balan (PAM)

Mar 24, 2023 5:09 PM

If the sell-off is ending, it may trace a book-perfect descending wedge. It may do one more trip to a slightly lower low to, say, 3930/25. I favor this schemata. But above 3990 suggest we a have a breakout recovery . . .

23/X . . . We will take the long trades if/when either target (low or high) happens.

24/X

robert.p.balan (PAM)

Mar 24, 2023 8:57 PM

ES breakout will test the upper trendline on wave 2 pullback. Could go lower than the trendline. We will do it then. That should be by Monday late Asia - early Europe. No worries this weekend (and besides, I will be soused, LOL)

robert.p.balan (PAM)

Mar 24, 2023 8:57 PM

ES breakout will test the upper trendline on wave 2 pullback. Could go lower than the trendline. We will do it then. That should be by Monday late Asia - early Europe. No worries this weekend (and besides, I will be soused, LOL)

25/25

GN and GL -- I will see you during Asian trade Monday,

GN and GL -- I will see you during Asian trade Monday,

• • •

Missing some Tweet in this thread? You can try to

force a refresh