During the $ARB airdrop launch, Arbiscan and homepage were down, while transactions failed.

What was happening behind the scenes?

Here is a summary of what happened on-chain, in under 5 min.⏳

A short thread you can't afford to miss🧵

What was happening behind the scenes?

Here is a summary of what happened on-chain, in under 5 min.⏳

A short thread you can't afford to miss🧵

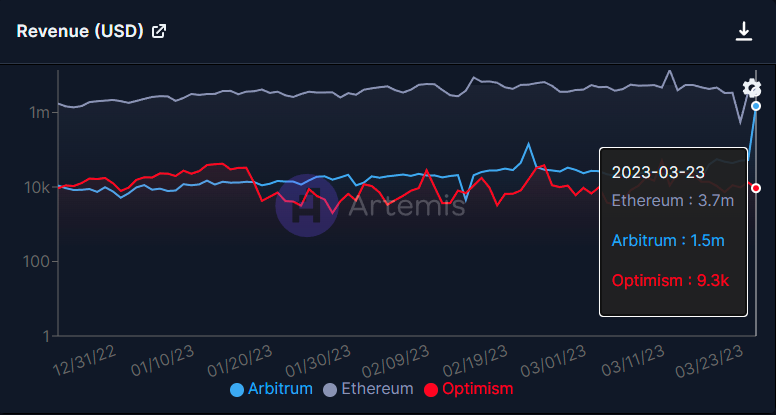

1️⃣ @DefiLlama

$ARB climbed to 3rd place among all chains by fees accrued.👀

Notice that $UNI flipped $ETH and took 1st place.🤯

Uniswap had the most volume among other DEXs=$888M

$ARB climbed to 3rd place among all chains by fees accrued.👀

Notice that $UNI flipped $ETH and took 1st place.🤯

Uniswap had the most volume among other DEXs=$888M

2️⃣DEX & stablecoin activity

Both experienced massive growth in volume.

Dex volume ⬆️

Stablecoin inflows⬆️

Both experienced massive growth in volume.

Dex volume ⬆️

Stablecoin inflows⬆️

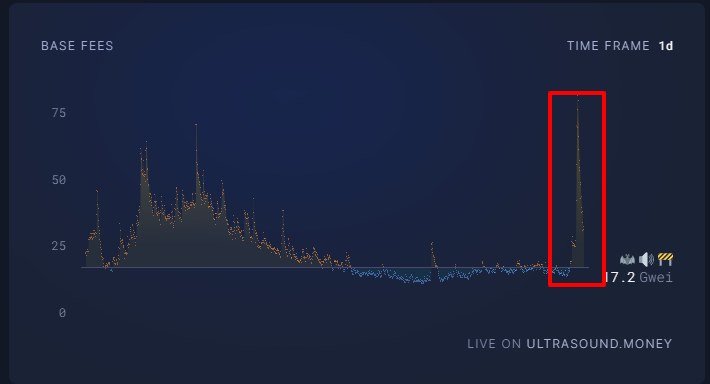

3️⃣ @ultrasoundmoney

Transaction fees skyrocketed.🚀

Some people paid 5-10$ tx fee just to claim $ARB airdrop.

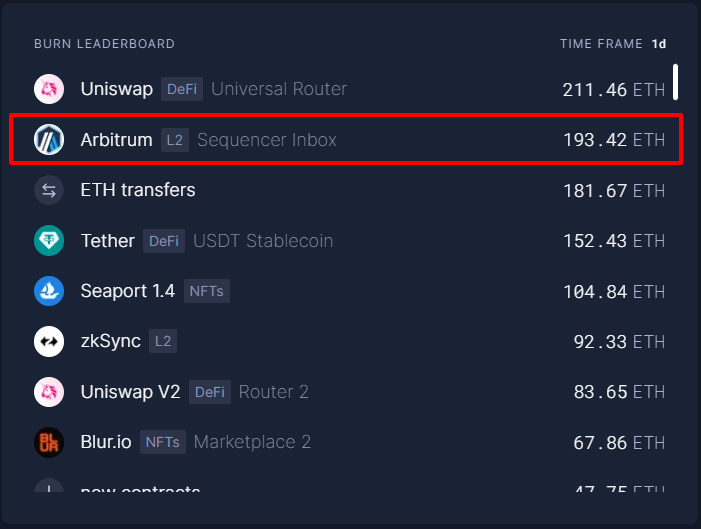

However, $ARB was the second biggest $ETH burner in the last 24h.

193.42 $ETH burned.🔥

They probably also contributed to $ETH transfers and $UNI burn.

Transaction fees skyrocketed.🚀

Some people paid 5-10$ tx fee just to claim $ARB airdrop.

However, $ARB was the second biggest $ETH burner in the last 24h.

193.42 $ETH burned.🔥

They probably also contributed to $ETH transfers and $UNI burn.

5️⃣Flippening

Txs and daily active addresses surpassed $ETH.

Transactions managed to spike to 2x of Ethereum's.🚀

While daily active addresses were not much higher.

Txs and daily active addresses surpassed $ETH.

Transactions managed to spike to 2x of Ethereum's.🚀

While daily active addresses were not much higher.

6️⃣ @DuneAnalytics

Transactions hit ATH≈2 730 000🤯

$OP had≈486k on airdrop day

Although fees were high, they were nowhere near what they were when Odyssey began.

Nitro upgrade:

•Reduced tx fees

•Increased throughput

Transactions hit ATH≈2 730 000🤯

$OP had≈486k on airdrop day

Although fees were high, they were nowhere near what they were when Odyssey began.

Nitro upgrade:

•Reduced tx fees

•Increased throughput

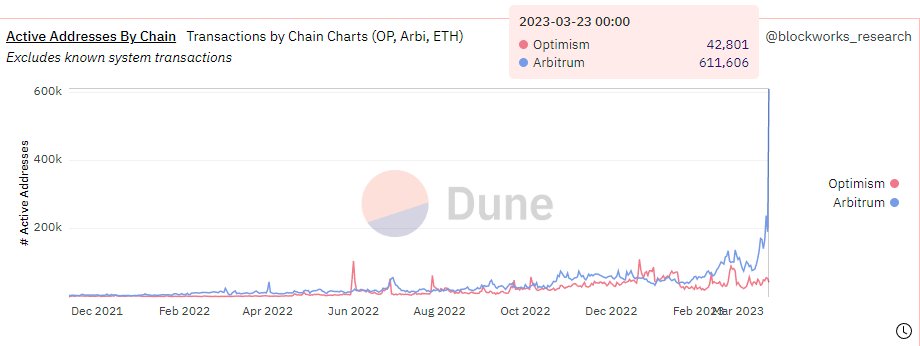

7️⃣Daily active addresses

Daily active addresses of $ARB were up almost 6x from $OP.

On airdrop day:

• $ARB≈611 000

• $OP≈106 000

Daily active addresses of $ARB were up almost 6x from $OP.

On airdrop day:

• $ARB≈611 000

• $OP≈106 000

8️⃣Airdrop stats📊

Only 625,143 addresses were eligible.

Average allocation=1,859 $ARB

Most people got the smallest amount of 625 $ARB

As of now, ≈ 80% of tokens are already claimed.

Only 625,143 addresses were eligible.

Average allocation=1,859 $ARB

Most people got the smallest amount of 625 $ARB

As of now, ≈ 80% of tokens are already claimed.

9️⃣A total of 1.275B $ARB tokens were allocated.

It's only 12,75% of the total airdrop allocation.

The total value of the airdrop is $1.94B.

FDV is $15.21B

Thanks to @blockworksres for providing this data.

It's only 12,75% of the total airdrop allocation.

The total value of the airdrop is $1.94B.

FDV is $15.21B

Thanks to @blockworksres for providing this data.

@blockworksres 1️⃣0️⃣CEXs deposits

Three biggest CEXs by $ARB deposits:

✔️Binance

✔️KuCoin

✔️OKX

Check @DefiIgnas thread for details:

Three biggest CEXs by $ARB deposits:

✔️Binance

✔️KuCoin

✔️OKX

Check @DefiIgnas thread for details:

https://twitter.com/831767219071754240/status/1639087111537315840

Threadors that may like this analysis:

@rektdiomedes

@CryptoStreamHub

@thedefiedge

@DeFi_Cheetah

@milesdeutscher

@LouisCooper_

@crypthoem

@resdegen

@Route2FI

@LandfSmile

@ArbiAlpha

@CryptoShiro_

@CryptoKoryo

@defi_mochi

@Louround_

@0xTindorr

@DeFiMinty

@Slappjakke

@0xFlips

@rektdiomedes

@CryptoStreamHub

@thedefiedge

@DeFi_Cheetah

@milesdeutscher

@LouisCooper_

@crypthoem

@resdegen

@Route2FI

@LandfSmile

@ArbiAlpha

@CryptoShiro_

@CryptoKoryo

@defi_mochi

@Louround_

@0xTindorr

@DeFiMinty

@Slappjakke

@0xFlips

@rektdiomedes @CryptoStreamHub @thedefiedge @DeFi_Cheetah @milesdeutscher @LouisCooper_ @crypthoem @resdegen @Route2FI @LandfSmile @ArbiAlpha @CryptoShiro_ @CryptoKoryo @defi_mochi @Louround_ @0xTindorr @DeFiMinty @Slappjakke @0xFlips Thanks for reading, you are a GEM.💎

If you enjoyed this thread:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

Hope you found this helpful.🙏

#1percentbetter @NFT_GOD

If you enjoyed this thread:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

Hope you found this helpful.🙏

#1percentbetter @NFT_GOD

https://twitter.com/CryptoGideon_/status/1639271064881561602

• • •

Missing some Tweet in this thread? You can try to

force a refresh