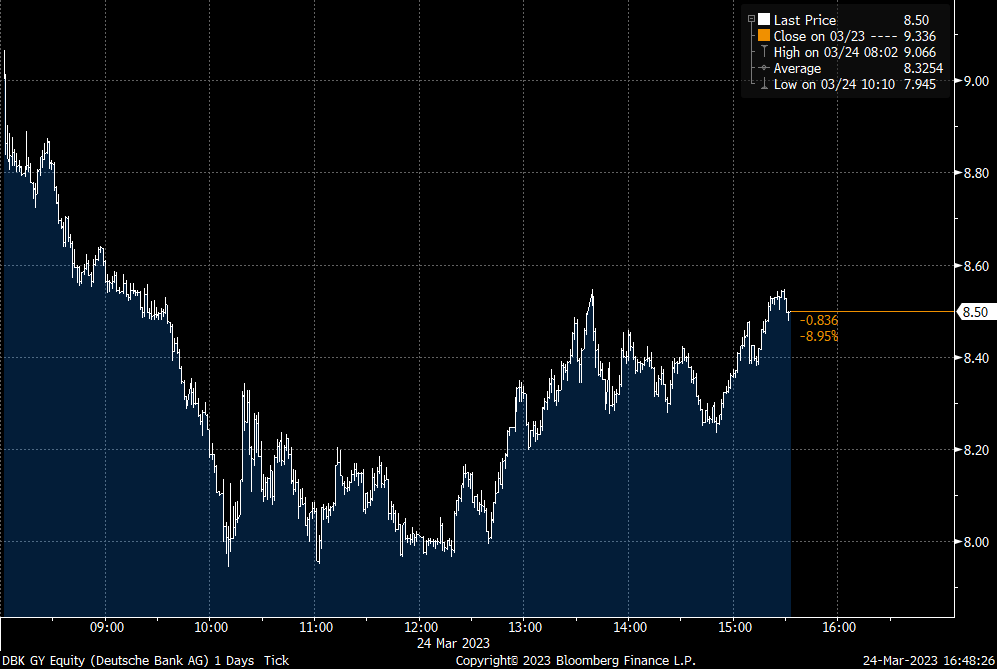

Tbf there’s probably not much to add to this, but the people have spoken, so a thread on Deutsche Bank and the market action today that's been pretty wild

https://twitter.com/jeuasommenulle/status/1639280481597374466

Q1: why DB?

I can’t believe you people ask. It’s always DB.

Ofc DB lost its top #1 rank in the bank shitshow index to CS a while ago, but when troubles arrive, people have a memory & remember DB.

A big IB, litigation, low ROE for years, the playbook.

I can’t believe you people ask. It’s always DB.

Ofc DB lost its top #1 rank in the bank shitshow index to CS a while ago, but when troubles arrive, people have a memory & remember DB.

A big IB, litigation, low ROE for years, the playbook.

Q2: why today?

That's more difficult. 3 theories.

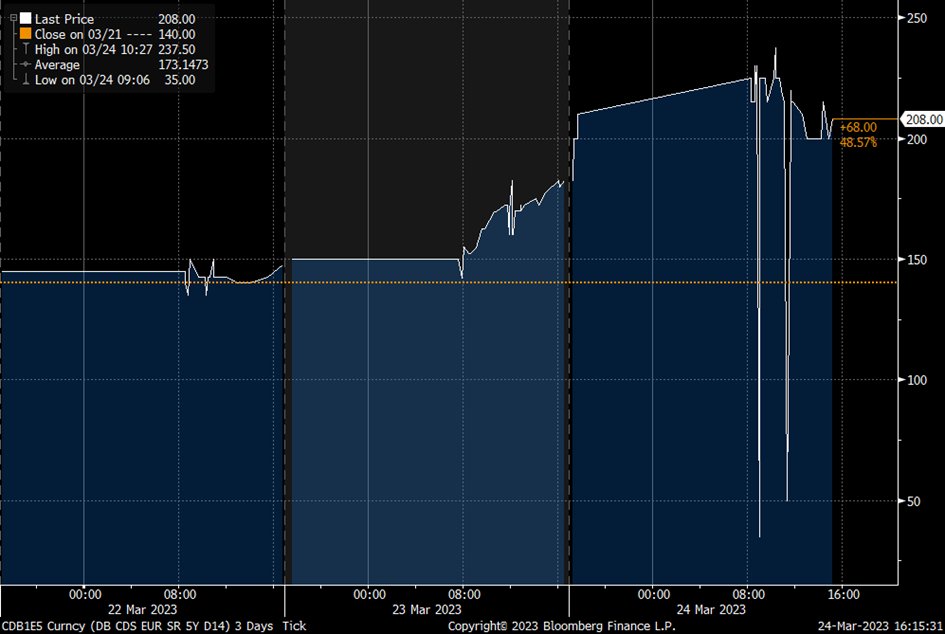

Obviously we had the wild CDS move yesterday. But careful, since FRTB introduced the holding 60-d period rule, single name CDS is very illiquid & it’s the only easy way of XVA/CCR hedging for desks. Small flows move price fast

That's more difficult. 3 theories.

Obviously we had the wild CDS move yesterday. But careful, since FRTB introduced the holding 60-d period rule, single name CDS is very illiquid & it’s the only easy way of XVA/CCR hedging for desks. Small flows move price fast

News that they called a T2?

That should normally be bullish BUT if you remember CS they LME’d b4 the crash so a twisted mind (like Twitter) cd say:

"show of force means you’re weak-> sell."

It doesn’t really add up because T2 calls are submitted to SSM weeks before, though

That should normally be bullish BUT if you remember CS they LME’d b4 the crash so a twisted mind (like Twitter) cd say:

"show of force means you’re weak-> sell."

It doesn’t really add up because T2 calls are submitted to SSM weeks before, though

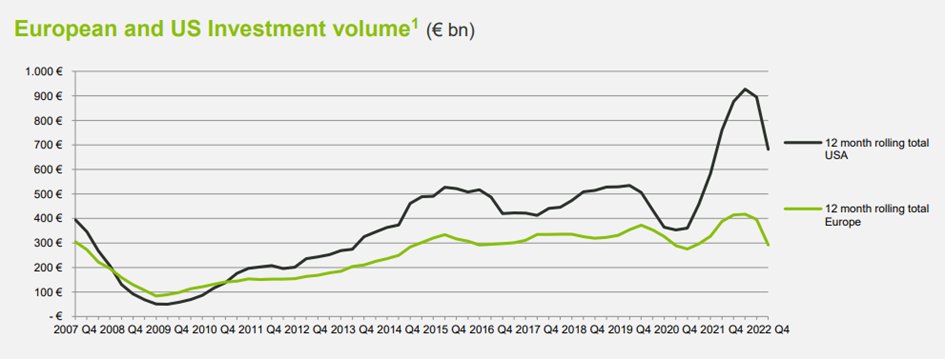

More importantly, the US regionals “duration” crisis isn’t over.

Yellen’s coms’ has been confusing at best on deposit gtee and First Republic isn’t solved yet. I guess there’s not much appetite going long risk in this weekend after such a rebound (DB is just back at post CS lows

Yellen’s coms’ has been confusing at best on deposit gtee and First Republic isn’t solved yet. I guess there’s not much appetite going long risk in this weekend after such a rebound (DB is just back at post CS lows

Q3 what do fundamentals look like?

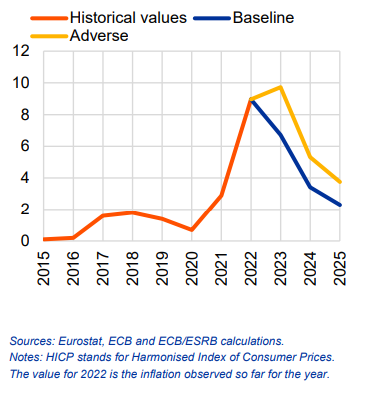

A.Solvency: high CET1, lowest leverage in *decades*. Risk to solvency from AFS/HTM bonds is almost zilch. IRRBB risk is 4.5bn in +200bps shock from FY 2022 (actual change is -25bps on 5Y swap)

B.Asset quality: main area of concern is US CRE book. It’s 17bn, well flagged with avg 60% LTV, diversified. SSM imposed addt’l cap requirements recently to mitigate risk. There’s also the lev lending book ofc.

C.Fair value marks; it’s been the running joke about DB and their huge Level 3 assets books. This one is more difficult & I’m sure some will disagree with me, but let me share one of the biggest LOL of the decade in banking.

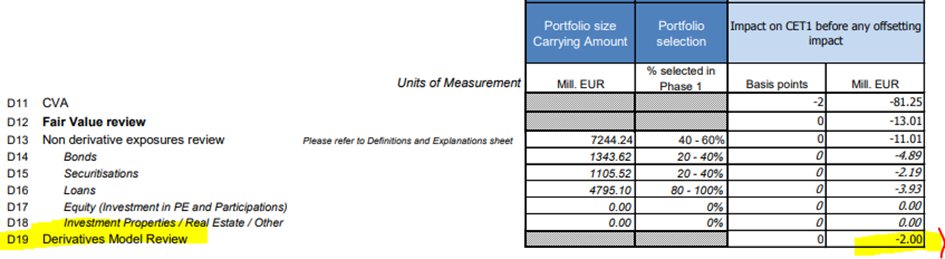

In 2014 when they took over bank supervision, the ECB hired thousands of consultants to do the “asset quality review” of banks. Ofc one big team had to review the fair value of DB’s hard to price assets. That’s what they came up with.

You're reading this correctly.

All they could find was a 2m fair value change on the entire derivatives book. I mean that’s not even what a day count basis error would give you 😊 Anyway, the point is that I don’t think this is an opaque toxic waste people want to believe it is.

All they could find was a 2m fair value change on the entire derivatives book. I mean that’s not even what a day count basis error would give you 😊 Anyway, the point is that I don’t think this is an opaque toxic waste people want to believe it is.

D.Liquidity. The LCR is on the EU average at 140%. Unlike CS which had 0% of stable deposits (yes, 0%) they have 2/3. In 2016 when shit already hit the fan, deposits barely moved. 70% of their retail depos are insured & a lot of the corp is transactional so hard to move.

They also have a big chunck of unencumbered assets ready to use for ECB funding.

E.P&L : they made 5.5bn last year, best since 2009 iirc. Higher rates are mana from heaven for their German retail bk.

Litigation is really going down (no, no, I mean it really is. Yes, it’s awkward).

They are huge in FICC.

Litigation is really going down (no, no, I mean it really is. Yes, it’s awkward).

They are huge in FICC.

So I mean, self-fulfilling prophecies can happen, but this would be a very tough nut to crack.

Still, feel free to read their prospectuses! Some are extremely interesting!

Still, feel free to read their prospectuses! Some are extremely interesting!

And final thing: ask me anything, I’ll try to answer if I have time and have the info.

• • •

Missing some Tweet in this thread? You can try to

force a refresh