Trader Joe Liquidity Book - A Beginner's Guide Part 2

In this thread, we will be deploying your first position, using the 'spot' strategy.

Let's get to it! 🧵

In this thread, we will be deploying your first position, using the 'spot' strategy.

Let's get to it! 🧵

https://twitter.com/bubee82/status/1637577432541671427

We will try the new $ARB / $USDC pool so have these tokens ready or follow the guide and apply accordingly.

Locate the pool: rb.gy/naavcw

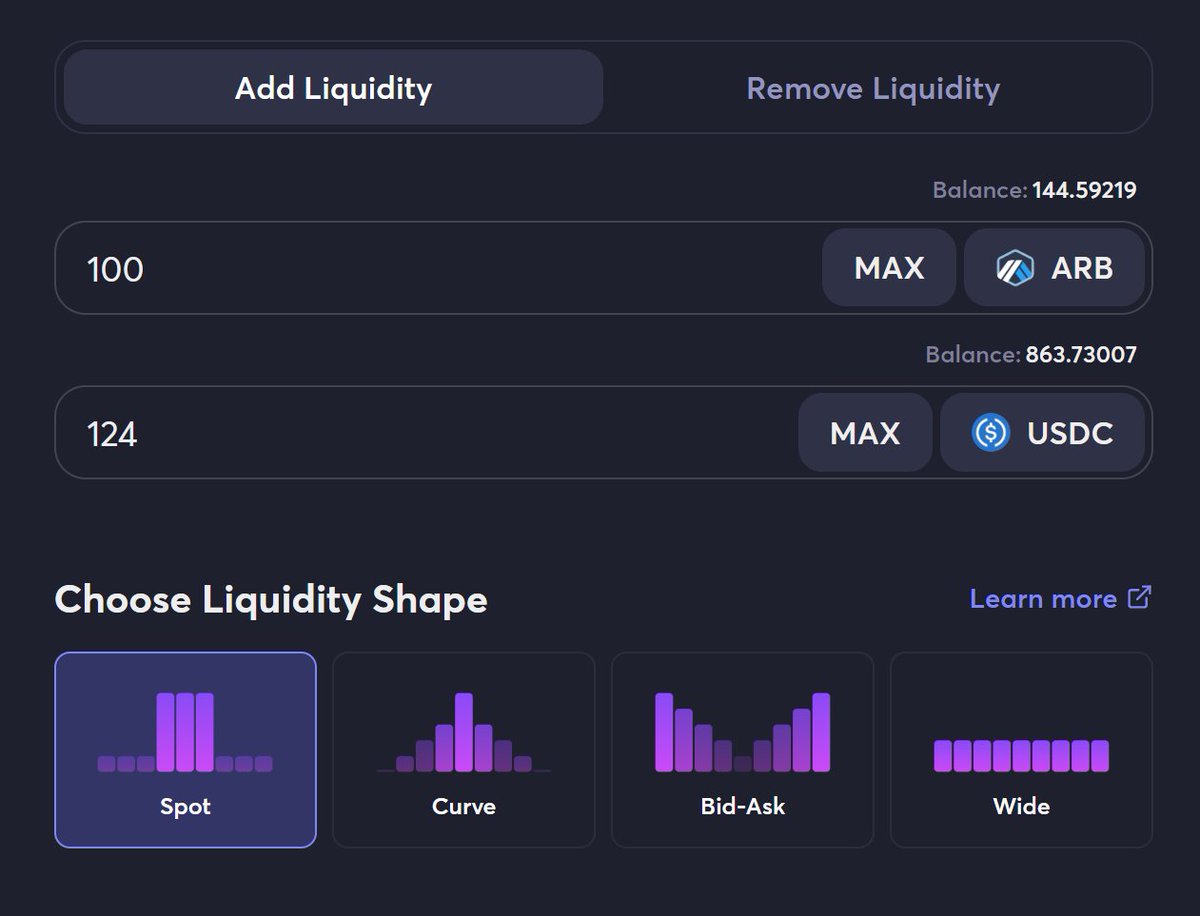

➡️Head to the "Add Liquidity" section.

➡️Spot strategy is selected by default.

➡️Add 100 $ARB and 124 $USDC

Locate the pool: rb.gy/naavcw

➡️Head to the "Add Liquidity" section.

➡️Spot strategy is selected by default.

➡️Add 100 $ARB and 124 $USDC

In this example, we'll go with a 50/50 ratio but you can use any amount of both tokens to enter a position!

From here, you have two options:

1⃣Price Range

2⃣Bin radius

Let's start with #2.

Bin Radius will deploy your capital around the target price that you can set manually.

From here, you have two options:

1⃣Price Range

2⃣Bin radius

Let's start with #2.

Bin Radius will deploy your capital around the target price that you can set manually.

Let's set up and deploy the position:

➡️100 $ARB + 120 $USDC (price moved)

➡️Target price (centre): $1.20

➡️6 bins for $USDC

➡️6 bins for $ARB

➡️Price range covered: $1.13-$1.28

You're now set. As long as the price of $ARB remains in your range, you'll be earning fees.

➡️100 $ARB + 120 $USDC (price moved)

➡️Target price (centre): $1.20

➡️6 bins for $USDC

➡️6 bins for $ARB

➡️Price range covered: $1.13-$1.28

You're now set. As long as the price of $ARB remains in your range, you'll be earning fees.

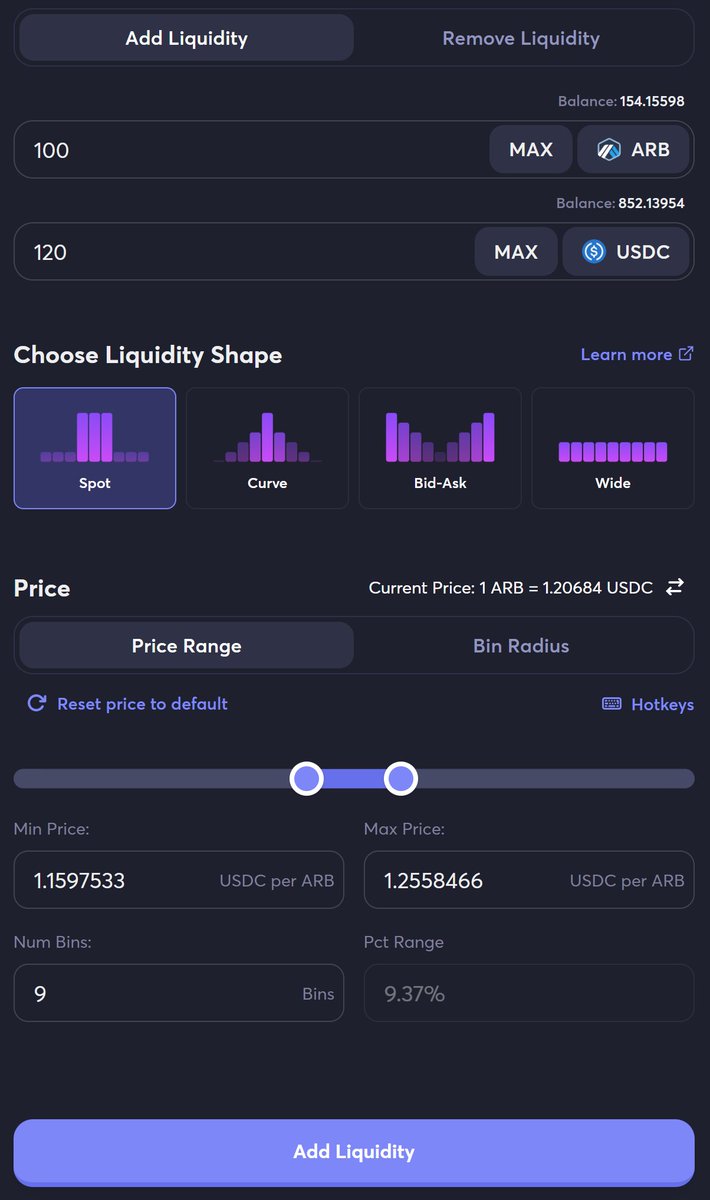

Let's try #1 (Price Range).

This gives you more freedom and control over your capital.

In this example, I chose the price range to be $1.15-$1.25 which will deploy 9 bins in total.

Use the slider to set the range or you can manually input the price you want.

This gives you more freedom and control over your capital.

In this example, I chose the price range to be $1.15-$1.25 which will deploy 9 bins in total.

Use the slider to set the range or you can manually input the price you want.

Congratulations!

You have now deployed your first position in the #LiquidityBook.

Few more things to wrap up:

The active bin

✅is the current price;

✅is where the swaps occur;

✅is the only bin that earns you fees;

✅contains both tokens

You have now deployed your first position in the #LiquidityBook.

Few more things to wrap up:

The active bin

✅is the current price;

✅is where the swaps occur;

✅is the only bin that earns you fees;

✅contains both tokens

A bin

✅is a fungible token (FT);

✅is a "mini" liquidity pool;

✅covers one specific price point (i.e. $1.2189124);

Upon deployment or withdrawal, you will see NFTs mentioned in your wallet. As mentioned above, those are FTs and each bin is an FT.

✅is a fungible token (FT);

✅is a "mini" liquidity pool;

✅covers one specific price point (i.e. $1.2189124);

Upon deployment or withdrawal, you will see NFTs mentioned in your wallet. As mentioned above, those are FTs and each bin is an FT.

How to be a successful market maker:

✅keep your liquidity in range at all times;

✅keep as much as you can in the ACTIVE bin;

✅keep it there as long as you can;

✅avoid using assets you want to hodl;

✅focus on the $ value and the ROI;

✅practice patience;

✅use charts;

✅keep your liquidity in range at all times;

✅keep as much as you can in the ACTIVE bin;

✅keep it there as long as you can;

✅avoid using assets you want to hodl;

✅focus on the $ value and the ROI;

✅practice patience;

✅use charts;

Managing concentrated liquidity and operating the Liquidity Book is not easy and it's a fairly active job.

It requires constant monitoring of your position, re-evaluation, and forming strategies.

There isn't "THE" strategy.

Markets change. Sentiment changes. You must adapt.

It requires constant monitoring of your position, re-evaluation, and forming strategies.

There isn't "THE" strategy.

Markets change. Sentiment changes. You must adapt.

That's all for now.

Next time, we'll discuss:

✅The Rewards Program

✅Single-sided deployment

✅Strategies for certain scenarios

Until then: practice, practice, and practice some more 📘

Next time, we'll discuss:

✅The Rewards Program

✅Single-sided deployment

✅Strategies for certain scenarios

Until then: practice, practice, and practice some more 📘

Note:

You will need to approve the tokens before the deployment of your position. You can approve just once or permanently.

You will also need to approve before the first withdrawal.

You will need to approve the tokens before the deployment of your position. You can approve just once or permanently.

You will also need to approve before the first withdrawal.

• • •

Missing some Tweet in this thread? You can try to

force a refresh