Giant @LidoFinance is SHUTTING DOWN liquid staking for $DOT on $GLMR.🤯

While this is bad for $LDO, you can easily capitalize on this opportunity.

Besides $ETH Shanghai upgrade, @BifrostFinance positioned itself to gain this market share as well. $BNC

A quick thread 🧵

While this is bad for $LDO, you can easily capitalize on this opportunity.

Besides $ETH Shanghai upgrade, @BifrostFinance positioned itself to gain this market share as well. $BNC

A quick thread 🧵

1️⃣Reasons:

Lido and @MixBytes stated:

⚠️ Unsustainability

⚠️ Slow protocol adoption

⚠️ Current market conditions

⚠️ Lack of liquidity in @Polkadot DeFi ecosystem

⚠️ $ETH is given more priority than $DOT and $KSM

So the question comes:

Who will benefit from $DOT liquidity?🤔

Lido and @MixBytes stated:

⚠️ Unsustainability

⚠️ Slow protocol adoption

⚠️ Current market conditions

⚠️ Lack of liquidity in @Polkadot DeFi ecosystem

⚠️ $ETH is given more priority than $DOT and $KSM

So the question comes:

Who will benefit from $DOT liquidity?🤔

2️⃣How bad is this?

$LDO is a liquid staking giant.

It's a leader on most chains it deployed.

Currently, they have 3,3M $DOT staked.

This is worth $20M.

All this liquidity will have to go somewhere.

Your goal should be to position yourself for this transition.

Here's how:

$LDO is a liquid staking giant.

It's a leader on most chains it deployed.

Currently, they have 3,3M $DOT staked.

This is worth $20M.

All this liquidity will have to go somewhere.

Your goal should be to position yourself for this transition.

Here's how:

3️⃣Potential winners

We'll exclude liquidity pools and lending platforms that give small APY.

Also, staking alone is complex and requires constant monitoring.

Let's focus only on liquid staking solutions:

• @StaFi_Protocol $FIS

• @BifrostFinance $BNC

• @AcalaNetwork $ACA

We'll exclude liquidity pools and lending platforms that give small APY.

Also, staking alone is complex and requires constant monitoring.

Let's focus only on liquid staking solutions:

• @StaFi_Protocol $FIS

• @BifrostFinance $BNC

• @AcalaNetwork $ACA

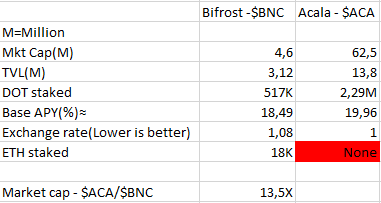

4️⃣Comparison

Let's compare the most important metrics:

✅ TVL

✅ APY

✅ Market cap

✅ $DOT staked

We clearly see $FIS is the worst performer...

In terms of metrics, it doesn't have any advantages over the other two.

Let's narrow it down to only $BNC and $ACA👇

Let's compare the most important metrics:

✅ TVL

✅ APY

✅ Market cap

✅ $DOT staked

We clearly see $FIS is the worst performer...

In terms of metrics, it doesn't have any advantages over the other two.

Let's narrow it down to only $BNC and $ACA👇

5️⃣Comparison

We can see that $ACA beats $BNC in every metric.

However, $BNC is well positioned for $ETH Shanghai upgrade while $ACA isn't.

To not conclude the winner too quickly, let's look at liquid $DOT charts:⬇️

We can see that $ACA beats $BNC in every metric.

However, $BNC is well positioned for $ETH Shanghai upgrade while $ACA isn't.

To not conclude the winner too quickly, let's look at liquid $DOT charts:⬇️

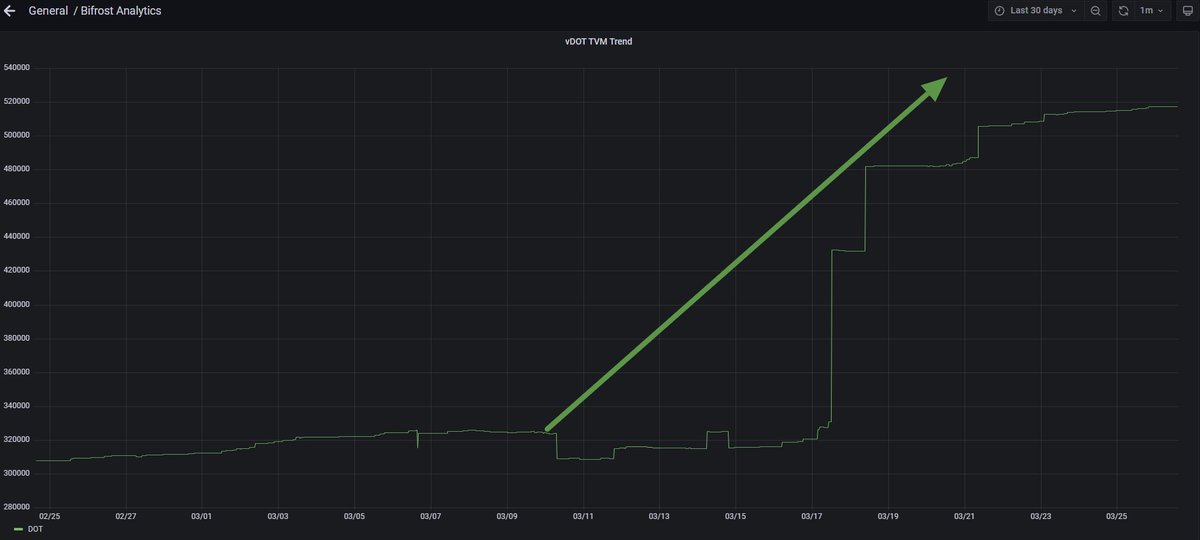

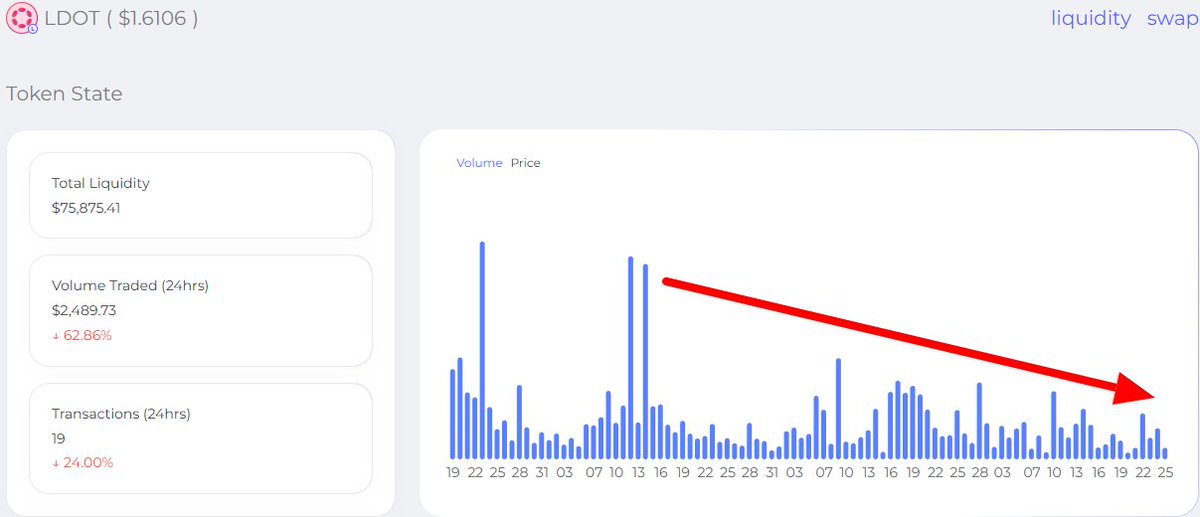

6️⃣ $DOT Staked

Stats from the last 30 Days:📊

• $vDOT from $BNC is on a rapid incline

• $LDOT (volume)from $ACA is on a constant decline

$DOT from $LDO is surely flowing into $BNC.

*Found only volume stats for $LDOT*

Now, this is where $BNC really shines👇

Stats from the last 30 Days:📊

• $vDOT from $BNC is on a rapid incline

• $LDOT (volume)from $ACA is on a constant decline

$DOT from $LDO is surely flowing into $BNC.

*Found only volume stats for $LDOT*

Now, this is where $BNC really shines👇

https://twitter.com/1154348832903200768/status/1638195142908694530

7️⃣ $LDO vs $BNC

$BNC has higher:

•APY

•Base APY

•30d avg. APY

At 414x smaller Market cap!🤯

It's unlikely it will flip $LDO, but the stats are amazing.

$BNC has higher:

•APY

•Base APY

•30d avg. APY

At 414x smaller Market cap!🤯

It's unlikely it will flip $LDO, but the stats are amazing.

8️⃣ $BNC Roadmap

Roadmap looks nice:

✅ $BNC 2.0

✅ $vETH 2.0

✅ Bifrost <> Ethereum XCM Bridge

✅ New LSDs like $ASTR, $ATOM, $FIL

✅Zk-rollup Layer2 vToken👀

If you are interested in details, check this thread from @Crypt0_Andrew

Roadmap looks nice:

✅ $BNC 2.0

✅ $vETH 2.0

✅ Bifrost <> Ethereum XCM Bridge

✅ New LSDs like $ASTR, $ATOM, $FIL

✅Zk-rollup Layer2 vToken👀

If you are interested in details, check this thread from @Crypt0_Andrew

https://twitter.com/Crypt0_Andrew/status/1617415655409553408

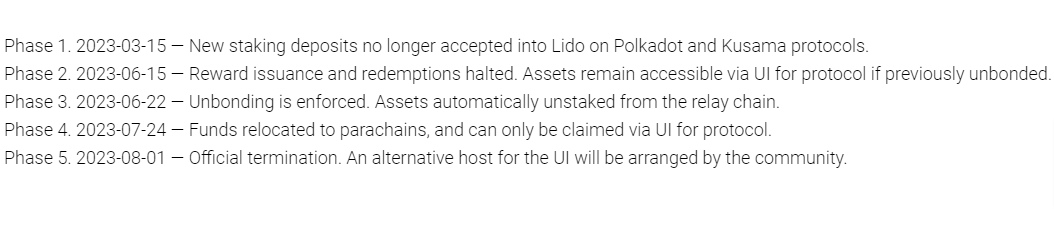

9️⃣Are you too late?

I don't think so.

LSD narrative is hot again.

Shanghai upgrade is just around the corner-April.

Phase 1 just started-deposits no longer accepted.

Unbonding will be enforced in June this year.

Official termination should be done until August.

I don't think so.

LSD narrative is hot again.

Shanghai upgrade is just around the corner-April.

Phase 1 just started-deposits no longer accepted.

Unbonding will be enforced in June this year.

Official termination should be done until August.

1️⃣0️⃣This is not financial advice

This is an example of how you should do your research.

Don't rely on influencers.

Position yourself for gains.

Opportunities are everywhere.

Just be open-minded to spot them.

Act responsibly.

This is an example of how you should do your research.

Don't rely on influencers.

Position yourself for gains.

Opportunities are everywhere.

Just be open-minded to spot them.

Act responsibly.

Giga brains that may like this analysis:

@rektdiomedes

@marwolwarl

@alice_und_bob

@LouisCooper_

@Govanisher

@KadunaGems

@CryptoKaduna

@PolkadotInsider

@DC_CryptoSniper

@LyLoi10

@bleckbehemoth

@CryptoIncline

@0xLurpis

@ThomasR_SupDup

@DeFiMayor

@polkadotnews

@DotParachains

@rektdiomedes

@marwolwarl

@alice_und_bob

@LouisCooper_

@Govanisher

@KadunaGems

@CryptoKaduna

@PolkadotInsider

@DC_CryptoSniper

@LyLoi10

@bleckbehemoth

@CryptoIncline

@0xLurpis

@ThomasR_SupDup

@DeFiMayor

@polkadotnews

@DotParachains

@rektdiomedes @marwolwarl @alice_und_bob @LouisCooper_ @Govanisher @KadunaGems @CryptoKaduna @PolkadotInsider @DC_CryptoSniper @LyLoi10 @bleckbehemoth @CryptoIncline @0xLurpis @ThomasR_SupDup @DeFiMayor @polkadotnews @DotParachains Thanks for reading, you are a GEM.💎

If you enjoyed this thread:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

Hope you found this helpful.🙏

#1percentbetter @NFT_GOD

If you enjoyed this thread:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

Hope you found this helpful.🙏

#1percentbetter @NFT_GOD

https://twitter.com/CryptoGideon_/status/1640095672857776129

• • •

Missing some Tweet in this thread? You can try to

force a refresh