The $ARB airdrop proves that the "Liquidity Book" invented by @traderjoe_xyz works perfectly.

It's attracted ~$16M liquidity and generated massive trading fee from >$100M volume within a week.

A 🧵 on Liquidity Book, advanced LP strategy, and my take on $JOE

It's attracted ~$16M liquidity and generated massive trading fee from >$100M volume within a week.

A 🧵 on Liquidity Book, advanced LP strategy, and my take on $JOE

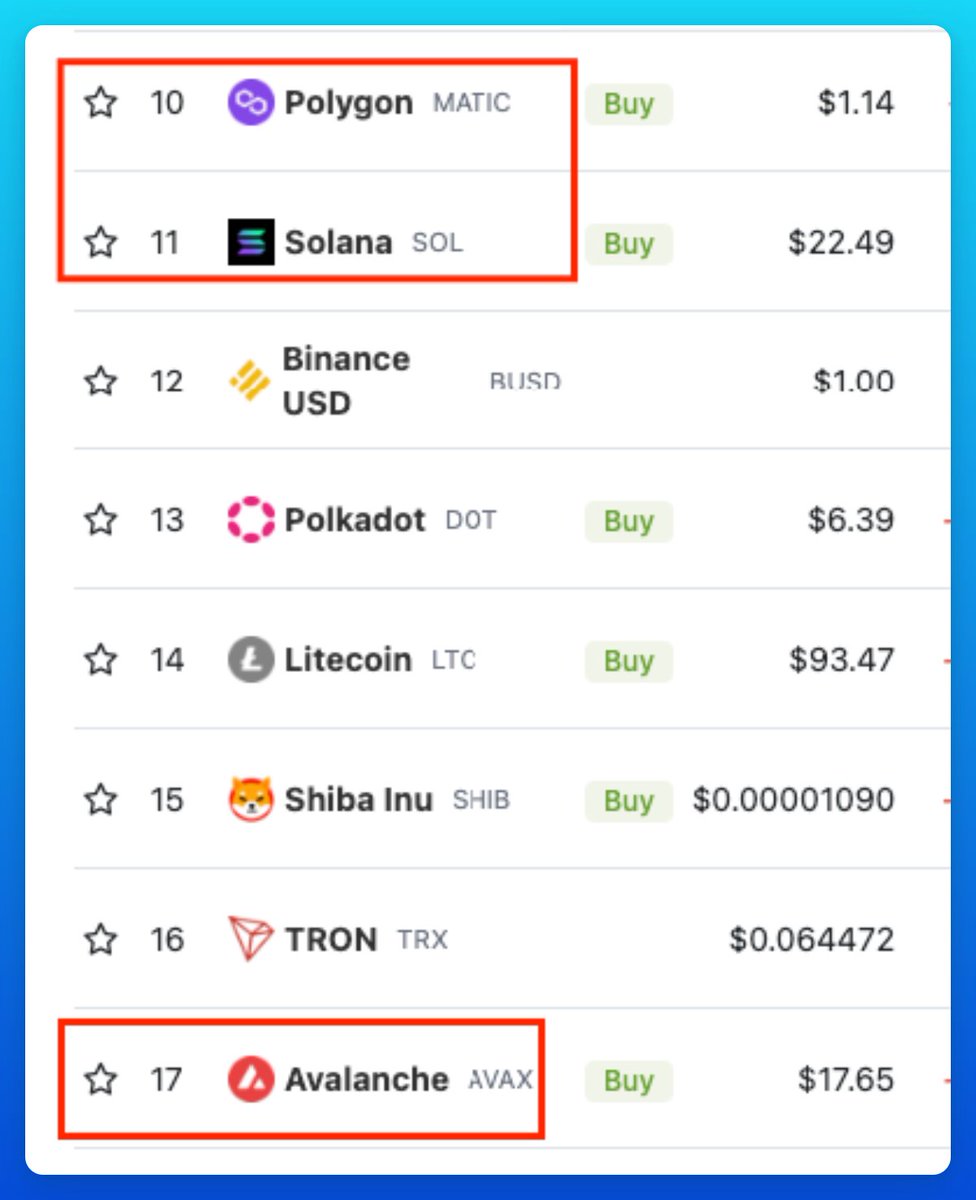

I've been a fan of Trader Joe since its launch on AVAX.

The team is full of builders, and they keep building and delivering new features.

It's gratifying to see they are doing well with their Liquidity Book.

Degen chads should acknowledge its full potential from this thread.

The team is full of builders, and they keep building and delivering new features.

It's gratifying to see they are doing well with their Liquidity Book.

Degen chads should acknowledge its full potential from this thread.

This thread will discover and explain:

• Liquidity Book

• User Strategies

• Potential

• Tindorr's Bullish Take

• Liquidity Book

• User Strategies

• Potential

• Tindorr's Bullish Take

1. Liquidity Book

We normally see "Order Book" in Binance trading, where one user sets an order to buy or sell at a specific price.

User on Trader Joe instead provide liquidity into their preferred price range, making it called "Liquidity Book"

We normally see "Order Book" in Binance trading, where one user sets an order to buy or sell at a specific price.

User on Trader Joe instead provide liquidity into their preferred price range, making it called "Liquidity Book"

Liquidity Book combines bins into one structure, aggregating liquidity from all of them.

For example, ARB/USDC pool at 1 ARB = $1.14827:

• Red box #1 shows the txn will be transacted within that green-purple bin until there is only one asset left in that bin.

For example, ARB/USDC pool at 1 ARB = $1.14827:

• Red box #1 shows the txn will be transacted within that green-purple bin until there is only one asset left in that bin.

After that, it moves to the closest bin, either its left or right.

But the key important thing is to understand that:

• There is ONLY USDC asset on the left bin (1.1369 ARB/USDC)

• While on the right, there is only ARB (1.15975 ARB/USDC)

But the key important thing is to understand that:

• There is ONLY USDC asset on the left bin (1.1369 ARB/USDC)

• While on the right, there is only ARB (1.15975 ARB/USDC)

The point is you will get to choose which bin you want to provide LP into.

Whether:

• Single-side asset (ARB or USDC)

• Number of bins you want to partake

• And the size of liquidity in each bin

Whether:

• Single-side asset (ARB or USDC)

• Number of bins you want to partake

• And the size of liquidity in each bin

You now realize this is a completely new architecture and it also enables:

• Position customization

• Concentrated liquidity

• Capital efficiency

• Zero slippage swaps as it swaps in one bin)

• Position customization

• Concentrated liquidity

• Capital efficiency

• Zero slippage swaps as it swaps in one bin)

2. User Strategies

The fun part you can do whatever you want with Liquidity Book.

I will give you one example how I'd provide liquidity using the ARB/USDC pair to eat good profit.

The fun part you can do whatever you want with Liquidity Book.

I will give you one example how I'd provide liquidity using the ARB/USDC pair to eat good profit.

2.1 Dollar Cost Average While Earning

As I said previously, I believe that $ARB will eventually go up again.

Hence, setting up the bins like this (ignore the Bin price) can help you earn fee while DCAing at your selected prices.

As I said previously, I believe that $ARB will eventually go up again.

Hence, setting up the bins like this (ignore the Bin price) can help you earn fee while DCAing at your selected prices.

You'll need to open two positions

• Bid-ask shape: Provide only one side (USDC) to get the tall bins on the left

• Spot: Provide both assets using min. price from bid-ask shape

• Bid-ask shape: Provide only one side (USDC) to get the tall bins on the left

• Spot: Provide both assets using min. price from bid-ask shape

3. Potential

TVL on Trader Joe has spiked up 256% in the last 7 days, becoming one of the fastest growing protocol recently on Arbitrum.

Also, they've been providing chads really good APR on ARB pools.

TVL on Trader Joe has spiked up 256% in the last 7 days, becoming one of the fastest growing protocol recently on Arbitrum.

Also, they've been providing chads really good APR on ARB pools.

This ARB airdrop makes a lot of users realize the potential of liquidity book and what they can do more in the future with new token launches.

I expect they will be having more liquidity into the protocol and eventually hit top 10 TVL on Arbitrum.

I expect they will be having more liquidity into the protocol and eventually hit top 10 TVL on Arbitrum.

4. Tindorr's Bullish Take

I believe in DeFi and the features that help us do all the transactions on-chain without the need of feature on CEX.

And Trader Joe has been serving it to us well on AVAX, Arbitrum, and BNB chains.

In the end, I believe it will become one of the top.

I believe in DeFi and the features that help us do all the transactions on-chain without the need of feature on CEX.

And Trader Joe has been serving it to us well on AVAX, Arbitrum, and BNB chains.

In the end, I believe it will become one of the top.

$JOE has been pumping so hard recently. I believe there are already some believers seeing this potential before us.

Remember to not FOMO, wait for consolidation first, there is still plenty of time before bull comes.

But you can't leave $JOE out of radar anymore.

Remember to not FOMO, wait for consolidation first, there is still plenty of time before bull comes.

But you can't leave $JOE out of radar anymore.

cc Tindorr’s fav threadors (1):

@rektfencer

@Slappjakke

@Only1temmy

@rektdiomedes

@Chinchillah_

@DeFiMinty

@TheDeFISaint

@DeFi_Cheetah

@Louround_

@CryptoShiro_

@defi_mochi

@crypto_linn

@GrowWithPassive

@0xFlips

@2lambro

@crypto_yuvi

@rektfencer

@Slappjakke

@Only1temmy

@rektdiomedes

@Chinchillah_

@DeFiMinty

@TheDeFISaint

@DeFi_Cheetah

@Louround_

@CryptoShiro_

@defi_mochi

@crypto_linn

@GrowWithPassive

@0xFlips

@2lambro

@crypto_yuvi

cc Tindorr’s fav threadors (2):

@ardizor

@crypthoem

@0xsurferboy

@Cryptotrissy

@bizyugo

@0xCrypto_doctor

@VirtualKenji

@psychguy_eth

@WinterSoldierxz

@DAdvisoor

@0xShinChannn

@arndxt_xo

@Flowslikeosmo

@0xSalazar

@CryptoStreamHub

@ardizor

@crypthoem

@0xsurferboy

@Cryptotrissy

@bizyugo

@0xCrypto_doctor

@VirtualKenji

@psychguy_eth

@WinterSoldierxz

@DAdvisoor

@0xShinChannn

@arndxt_xo

@Flowslikeosmo

@0xSalazar

@CryptoStreamHub

If you have any defi projects in mind, let's connect. I'm always happy to answer or discuss.

Feel free to share this thread with peers, and follow to be the first to learn about my next gems.

Feel free to share this thread with peers, and follow to be the first to learn about my next gems.

https://twitter.com/0xTindorr/status/1640794177943506944

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter