@Uniswap, the big kid on the block, has a mighty competitor - @traderjoe_xyz

JOE V2 (Liquidity Book) has achieved TVL of $16M and total hit a high of $100M daily volume across chains.

The most detailed thread on a comparision between Uniswap V3($UNI) v/s Trader Joe V2 ($JOE)🧵

JOE V2 (Liquidity Book) has achieved TVL of $16M and total hit a high of $100M daily volume across chains.

The most detailed thread on a comparision between Uniswap V3($UNI) v/s Trader Joe V2 ($JOE)🧵

This thread will cover :

1️⃣ Liquidity Book (LB)

2️⃣ Difference b/w LB and UNI V3

2.1 Design difference

2.2 LP Management

2.3 Constant Product v/s Constant Sum

2.4 Swap Fee

3️⃣ Performance Metrics

4️⃣ Tokenomics & Price

5️⃣ DeFi Monkey's take

Let's dive in 🪂

1️⃣ Liquidity Book (LB)

2️⃣ Difference b/w LB and UNI V3

2.1 Design difference

2.2 LP Management

2.3 Constant Product v/s Constant Sum

2.4 Swap Fee

3️⃣ Performance Metrics

4️⃣ Tokenomics & Price

5️⃣ DeFi Monkey's take

Let's dive in 🪂

1. Liquidity Book (LB)

JOE strarted as a fork of UNI V2, which had the issues of low capital effiency & slippage.

Like UNI V3, LB works on the principles of concentrated liquidity too, with some key design changes.

I will explain the differences one-by-one.

JOE strarted as a fork of UNI V2, which had the issues of low capital effiency & slippage.

Like UNI V3, LB works on the principles of concentrated liquidity too, with some key design changes.

I will explain the differences one-by-one.

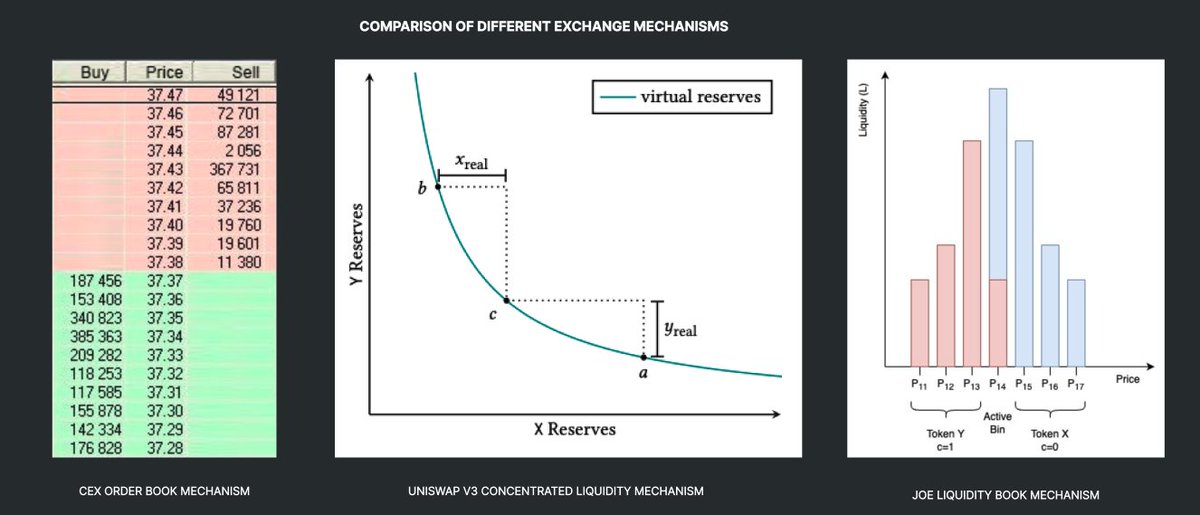

1.1 Design Differences

On LB, liquidity is allocated into discrete price bins (similar to UNI V3’s ticks), and trade occurs within the active bin.

On LB, liquidity is allocated into discrete price bins (similar to UNI V3’s ticks), and trade occurs within the active bin.

LPs can choose the price bin range to provide liquidity and receive a proportionate share of fees generated alongside other rewards.

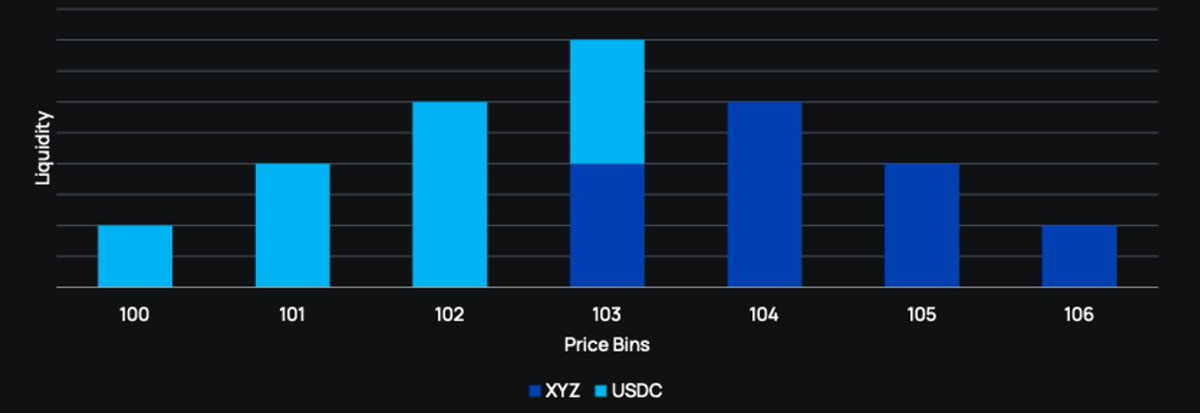

The graph below shows the ARB/ USDC pool on JOE. The green bins are the USDC ones, the purple ones are ARB, and an active price bin with both.

The graph below shows the ARB/ USDC pool on JOE. The green bins are the USDC ones, the purple ones are ARB, and an active price bin with both.

For ex, the graph indicates that the active price bin is '103'.This means that all trades will happen within that '103' price bin until liquidity is depleted in either the “XYZ” or “USDC” side.

After that, the active price bin will shift upwards or downwards to the next price bin and trades will utilize liquidity from that bin. That new bin will be the new active price bin.

1.2 LP Management

In LB, Liquidity positions utilize a fungible ERC-1155 tokens that gives LPs the flexibility to add/remove without exiting their positions entirely.

Liquidity spread is discretized through its segmentation of prices into different price bins.

In LB, Liquidity positions utilize a fungible ERC-1155 tokens that gives LPs the flexibility to add/remove without exiting their positions entirely.

Liquidity spread is discretized through its segmentation of prices into different price bins.

The LP has autonomy over which price bins they want to provide liquidity in.

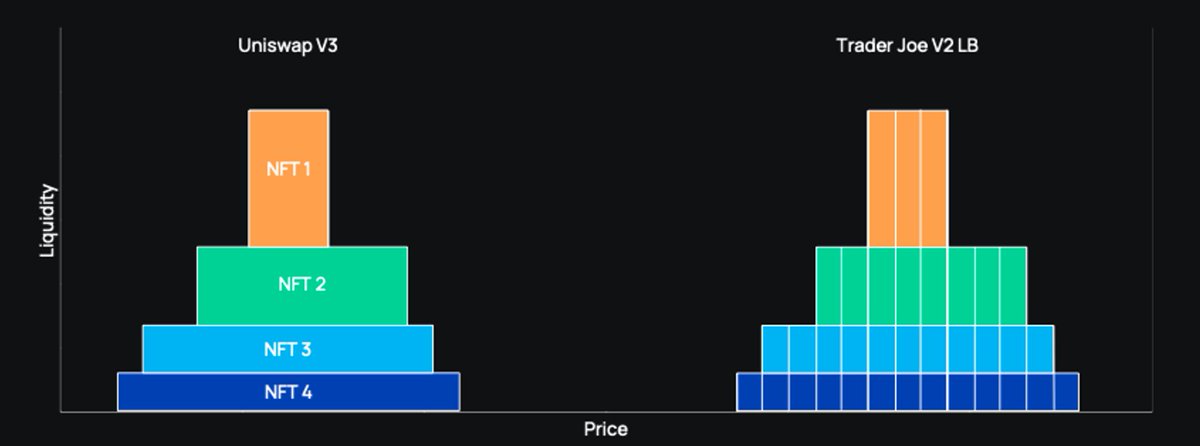

Thus, unlike UNI V3 that agreegates liquidity horizontally, Liquidity in LB is aggregated vertically on top of individual price bins. This allows liquidity to be added in a non-uniform way on LB.

Thus, unlike UNI V3 that agreegates liquidity horizontally, Liquidity in LB is aggregated vertically on top of individual price bins. This allows liquidity to be added in a non-uniform way on LB.

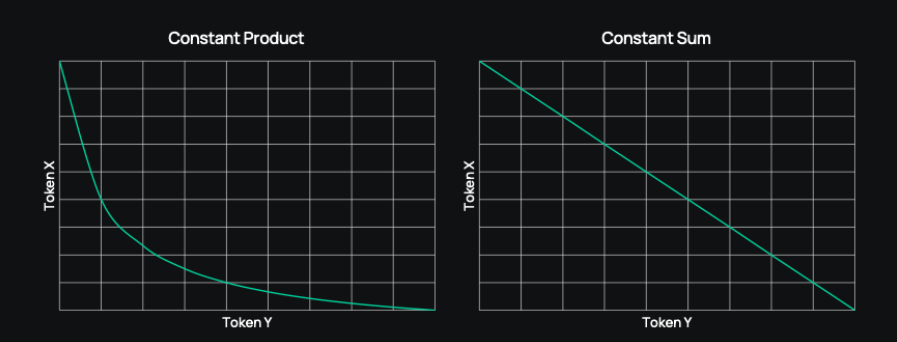

1.3 Constant Product v/s Constant Sum

Unlike Uniswap v3, which utilizes the constant product model (x*y=K) over a predetermined range determined by the LP, LB implements a constant sum model (x+y=K) within each price bin.

Unlike Uniswap v3, which utilizes the constant product model (x*y=K) over a predetermined range determined by the LP, LB implements a constant sum model (x+y=K) within each price bin.

As a result, traders enjoy zero slippage swaps if the trade occurs within the active price bins.

1.4 Swap Fee

While UNI V3 charges a flat fee, swap fee on LB consists of base fee (0.02% - 0.8%) & variable fee.

1.4 Swap Fee

While UNI V3 charges a flat fee, swap fee on LB consists of base fee (0.02% - 0.8%) & variable fee.

The variable fee is like surge pricing, which increases with pool volatility. LB uses a novel mechanism called the Volatility Accumulator (VA).

Volatility Accumulator works by monitoring a pool’s volatility and adjusting the variable fee accordingly based on 2 factors: the frequency of swaps and large swaps spanning more than one price bin.

2. JOE performance metrics

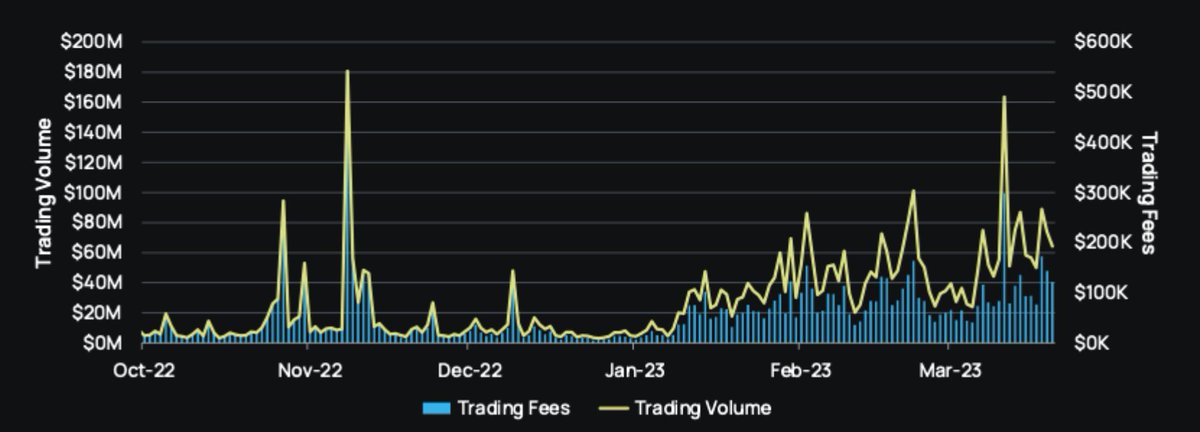

Since the LB launch on Arbitrum, volume & fees have spiked, hitting highs of $100M in daily volume on March 11th, 2023 after being stagnant at the end of 2022.

This reignited volume led to them generating $6.08M in fees for LPs year-to-date.

Since the LB launch on Arbitrum, volume & fees have spiked, hitting highs of $100M in daily volume on March 11th, 2023 after being stagnant at the end of 2022.

This reignited volume led to them generating $6.08M in fees for LPs year-to-date.

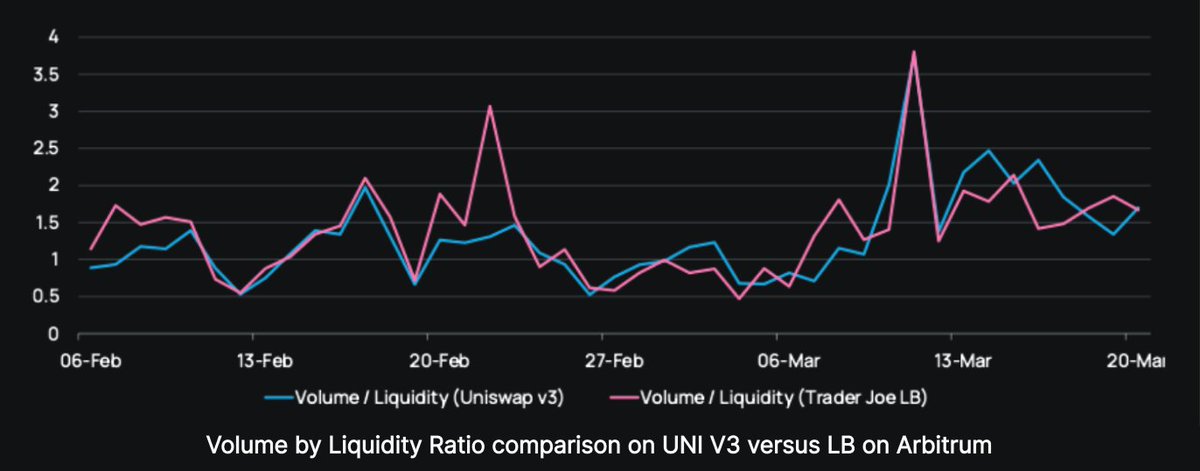

Using the Volume/Liquidity ratio to measure liquidity utilization performance, we see that both DEXs closely track each other.

This suggests that Uni V3 and LB perform similarly well, and LPs can expect comparable utilization — and thus fees — on either DEX.

This suggests that Uni V3 and LB perform similarly well, and LPs can expect comparable utilization — and thus fees — on either DEX.

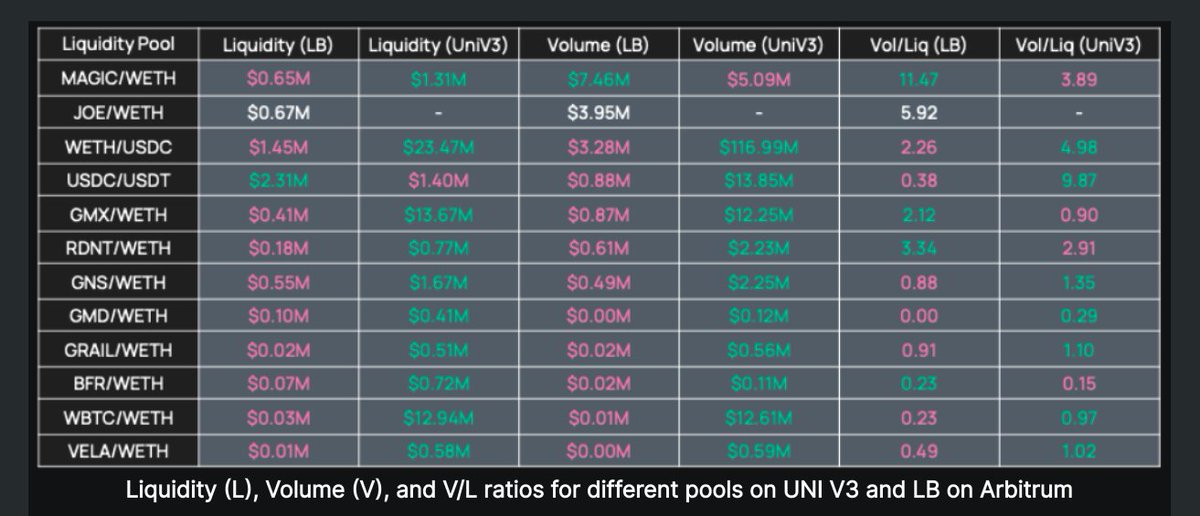

Finally, the table below compares the V/L ratio between the two DEXs across different pools.

The 3 main pools to highlight are MAGIC/WETH, RDNT/WETH, and GMX/WETH, all of which produced higher V/L ratios on LB that UNI V3.

The 3 main pools to highlight are MAGIC/WETH, RDNT/WETH, and GMX/WETH, all of which produced higher V/L ratios on LB that UNI V3.

3. Tokenomics & Price

3.1 Tokenomics

The JOE token accrues value in multiple ways, with 24.2% of JOE supply staked in sJOE for fee sharing.

A % of swap fees is deducted from every swap and used to purchase a stablecoin which is distributed on a pro-rata basis to sJOE stakers.

3.1 Tokenomics

The JOE token accrues value in multiple ways, with 24.2% of JOE supply staked in sJOE for fee sharing.

A % of swap fees is deducted from every swap and used to purchase a stablecoin which is distributed on a pro-rata basis to sJOE stakers.

veJOE allows stakers to boost JOE LP rewards in various boosted pools.

3.2 Token Price

$JOE is currently trading at $0.58, almost 50% up in the past week. Would be wise for the price of $JOE to come down before accumulating again (previous ATH at$4.53).

3.2 Token Price

$JOE is currently trading at $0.58, almost 50% up in the past week. Would be wise for the price of $JOE to come down before accumulating again (previous ATH at$4.53).

4. DeFi Monkey's take

With the ARBI DeFi ecosystem on fire, and LB gaining more traction, DeFi Monkey’s take on JOE is quite bullish.

Apart from LB, JOE is building an suite of products like Lend, Rocket Pool, NFT collection etc.

Exciting times ahead! 🚀

With the ARBI DeFi ecosystem on fire, and LB gaining more traction, DeFi Monkey’s take on JOE is quite bullish.

Apart from LB, JOE is building an suite of products like Lend, Rocket Pool, NFT collection etc.

Exciting times ahead! 🚀

However, As the UNI V3 license expires on Apr 1st, new forks would spring up.

It would be interesting to see how the DEX landscape plays out, and how UNI and JOE battle it out with the new forks to claim the #1🥇 DEX spot.

It would be interesting to see how the DEX landscape plays out, and how UNI and JOE battle it out with the new forks to claim the #1🥇 DEX spot.

Thank you for reading! Hope you've found this thread helpful 🙏

Follow me @web3_buidl for more alpha and protocol deepdives.🕶️

Link to the first tweet here -

Follow me @web3_buidl for more alpha and protocol deepdives.🕶️

Link to the first tweet here -

https://twitter.com/Web3_buidl/status/1641209739752411136?s=20

cc threadoors:

@rektfencer

@Slappjakke

@Only1temmy

@rektdiomedes

@Chinchillah_

@DeFiMinty

@TheDeFISaint

@DeFi_Cheetah

@Louround_

@CryptoShiro_

@defi_mochi

@crypto_linn

@GrowWithPassive

@0xFlips

@2lambro

@crypto_yuvi

@rektfencer

@Slappjakke

@Only1temmy

@rektdiomedes

@Chinchillah_

@DeFiMinty

@TheDeFISaint

@DeFi_Cheetah

@Louround_

@CryptoShiro_

@defi_mochi

@crypto_linn

@GrowWithPassive

@0xFlips

@2lambro

@crypto_yuvi

@rektfencer @Slappjakke @Only1temmy @rektdiomedes @Chinchillah_ @DeFiMinty @TheDeFISaint @DeFi_Cheetah @Louround_ @CryptoShiro_ @defi_mochi @crypto_linn @GrowWithPassive @0xFlips @2lambro @crypto_yuvi @ardizor

@crypthoem

@0xsurferboy

@Cryptotrissy

@bizyugo

@0xCrypto_doctor

@VirtualKenji

@psychguy_eth

@WinterSoldierxz

@DAdvisoor

@0xShinChannn

@arndxt_xo

@Flowslikeosmo

@0xSalazar

@CryptoStreamHub

@crypthoem

@0xsurferboy

@Cryptotrissy

@bizyugo

@0xCrypto_doctor

@VirtualKenji

@psychguy_eth

@WinterSoldierxz

@DAdvisoor

@0xShinChannn

@arndxt_xo

@Flowslikeosmo

@0xSalazar

@CryptoStreamHub

• • •

Missing some Tweet in this thread? You can try to

force a refresh