Thread on how to use my Trading Journal Template to improve discipline & edge🧵

Buy me lunch by purchasing my Trading Journal Template here! dangstratify.gumroad.com/l/hqpkb

Buy me lunch by purchasing my Trading Journal Template here! dangstratify.gumroad.com/l/hqpkb

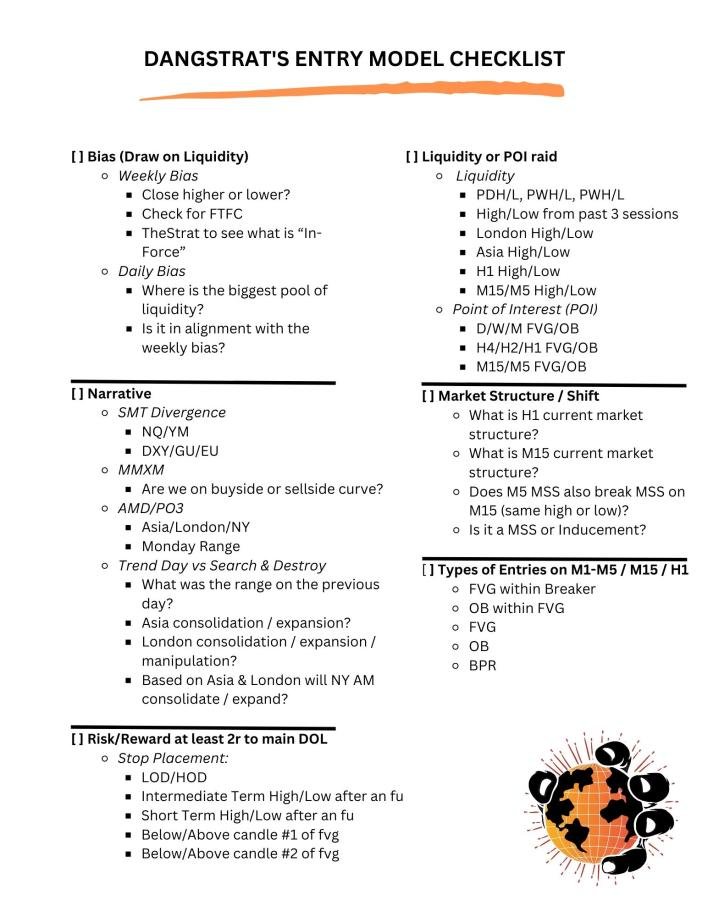

Before I place a buy/sell order, this is the checklist that I use to find high probability setups. My trading journal is built off of this checklist.

The 1st & 2nd categories of my Notion Trading Journal Template is the 'Trade' & 'Date'. It's important to keep track of how many trades you take and list the date of each trade so when you want to review a trade or backtest that specific day you know exactly what day to go to.

The 3rd category of my Notion Trading Journal Template is the 'Day of the Week'. It's important to note what day it was of the week so you know what days you perform the best & what days you take the most losses on. Overtime you will learn what days to avoid trading.

The 4th & 5th categories are 'Weekly and Daily Bias'. It's important to have a bias aka thinking you know where the next draw on liquidity is. Trading in the direction of your weekly and daily bias will improve your winrate.

The 6th & 7th category are type of 'Position' and 'Killzone'. It's important to note if you're either going long or short on the position and also note what killzone was it when you entered the position so overtime you know which killzone you perform the best in.

The 8th category is a checkbox to show if you 'Won' the trade or not. This keeps track of your winrate and the goal is to improve WR & RR over time.

The 9th category keeps track of the 'Profit or Loss' for each trade in dollar amounts.

The 10th & 11th category keeps track of percentage of 'Risk' per trade and what was the Risk/Reward gained or lost from the trade.

The 12th category keeps track to see if you had a 'Narrative' for that trade. Having a narrative and having it play out will increase the probability for that trade to be successful which will improve winrate.

The 13th category will note what the 'Draw on Liquidity' is. Over time you will see that it's usually the same draw on liquidity for your setups. When there's no clear DOL then it's a lower probability setup.

The 14th category will note what was the 'Raid on Liquidity or Point of Interest'. If there is no raid on liquidity or POI then there is no setup.

The 15th category is 'Timeframe of the Market Structure Shift'. After a raid there has to be a MSS before you place any orders to enter a trade. Noting the timeframe of the MSS is very important.

The 16th category is 'Entry Model' used to enter the trade. There are many different types of entry for ways to enter a trade. Learn which one works best for you.

The 17th category is 'Stop Placement'. It's important to keep track of this because it will let you know if you're placing where you put your stops correctly when you review a trade. It will also let you know if you can adjust SL to make it tighter for better RR.

The 18th category is 'Time in Trade'. It's important to know normally how long your winners are and how long your losers are. Usually with your winners, you're in the trade for a shorter period of time and for your losers, you're in the trade for a longer period of time.

The 19th category is a checkbox to see if you 'Followed your Rules' or not. This keeps track of your discipline.

The 20th category keeps track of your 'Emotions' during the trade. With your winners you will find that most of the time you are calm and with your losers you will find that most of the time you got frustrated or got FOMO. Overtime you want to be calm in every trade win or loss.

The 21st category lets you link your 'Tradingview Chart' so you can easily review it whenever you want and also so you never lose the chart.

The 22nd category is 'Notes' so you can list out any extra thoughts or analysis from the trade.

Improve discipline & edge by journaling trades. Buy Dangstrat's Trading Journal Template here! dangstratify.gumroad.com/l/hqpkb

Join Dangstrat's Discord Server here: linktr.ee/dangstrat

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter