🚨 𝗖𝗛𝗼𝗖𝗛 𝗜𝗦 𝗩𝗘𝗥𝗬 𝗩𝗘𝗥𝗬 𝗔𝗚𝗚𝗥𝗘𝗦𝗦𝗜𝗩𝗘.

It leads to multiple back-to-back losses when not used properly.

So here's a quick tip on how & when to trade the highest probability CHoCH (with trade examples).

A short thread 🧵 🪡

It leads to multiple back-to-back losses when not used properly.

So here's a quick tip on how & when to trade the highest probability CHoCH (with trade examples).

A short thread 🧵 🪡

"why did price stop me out even when the CHoCH is aligned with HTF trend?"

I get this question alot, and it's because you've been doing it the wrong way.

In this thread I'll highlight common mistakes you must avoid in order to maintain a high winrate trading CHoCH.

Let's go 🚀

I get this question alot, and it's because you've been doing it the wrong way.

In this thread I'll highlight common mistakes you must avoid in order to maintain a high winrate trading CHoCH.

Let's go 🚀

First things first,

◾What is a CHoCH?

CHoCH (or CH): stands for Change of Character, and it's the first sign of a trend change.

In much simpler term:

It is the first sign of weakness, and also the first sign of strength.

Let me explain better 👇

◾What is a CHoCH?

CHoCH (or CH): stands for Change of Character, and it's the first sign of a trend change.

In much simpler term:

It is the first sign of weakness, and also the first sign of strength.

Let me explain better 👇

When you see a protected low being violated in an up-trending market, it signals that:

• Buys are getting weaker (weakness)

• Sells are getting in control (sign of strength)

Vise versa for down-trend

So it signals when a pullback / trend-change is starting /is over.

Eg. 👇

• Buys are getting weaker (weakness)

• Sells are getting in control (sign of strength)

Vise versa for down-trend

So it signals when a pullback / trend-change is starting /is over.

Eg. 👇

Change of Character (CHoCH) tells you when the market is likely to reverse, so you can get in and ride the trend.

But when misused, it can cause you take so many unnecessary losses.

To explain that better, we'll go through an example with today's price action on EURUSD

👇👇

But when misused, it can cause you take so many unnecessary losses.

To explain that better, we'll go through an example with today's price action on EURUSD

👇👇

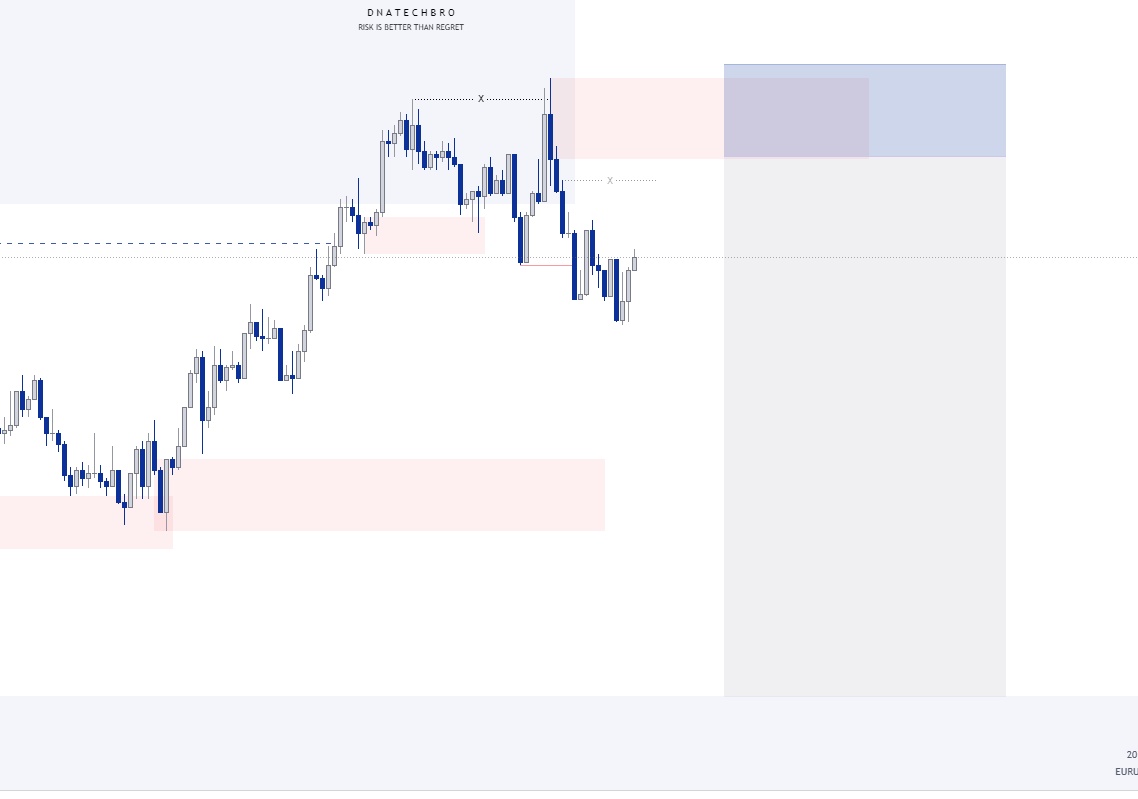

I need you to observe the image above carefully, and also pay close attention.

From that image on the M15, internal structure + orderflow is bullish, and we expect it to continue.

We also have 3 zones where price could potentially pullback into, mitigate and continue upward.

From that image on the M15, internal structure + orderflow is bullish, and we expect it to continue.

We also have 3 zones where price could potentially pullback into, mitigate and continue upward.

Now this is where most people get it wrong:

On the 3 minutes timeframe as price was pulling back, it gave a bullish CHoCH - which signals that the pullback may now be over and price could continue upward,

But it hasn't mitigated any of our M15 zones...

see below 👇 (zoom in)

On the 3 minutes timeframe as price was pulling back, it gave a bullish CHoCH - which signals that the pullback may now be over and price could continue upward,

But it hasn't mitigated any of our M15 zones...

see below 👇 (zoom in)

Now the mistake most people make is that they trade CHoCH anywhere they see it.

But that's wrong, and will cause you to take unnecessary losses,

just as anyone who took the bullish CHoCH this morning would have been stopped out for a loss.

👇

But that's wrong, and will cause you to take unnecessary losses,

just as anyone who took the bullish CHoCH this morning would have been stopped out for a loss.

👇

Change of Character is powerful but very aggressive.

It happens too frequently especially on the lower timeframes /internal /fractal structure.

So it's best to always wait for zone mitigation, before considering CHoCH

Here's another example to help you understand better 👇

It happens too frequently especially on the lower timeframes /internal /fractal structure.

So it's best to always wait for zone mitigation, before considering CHoCH

Here's another example to help you understand better 👇

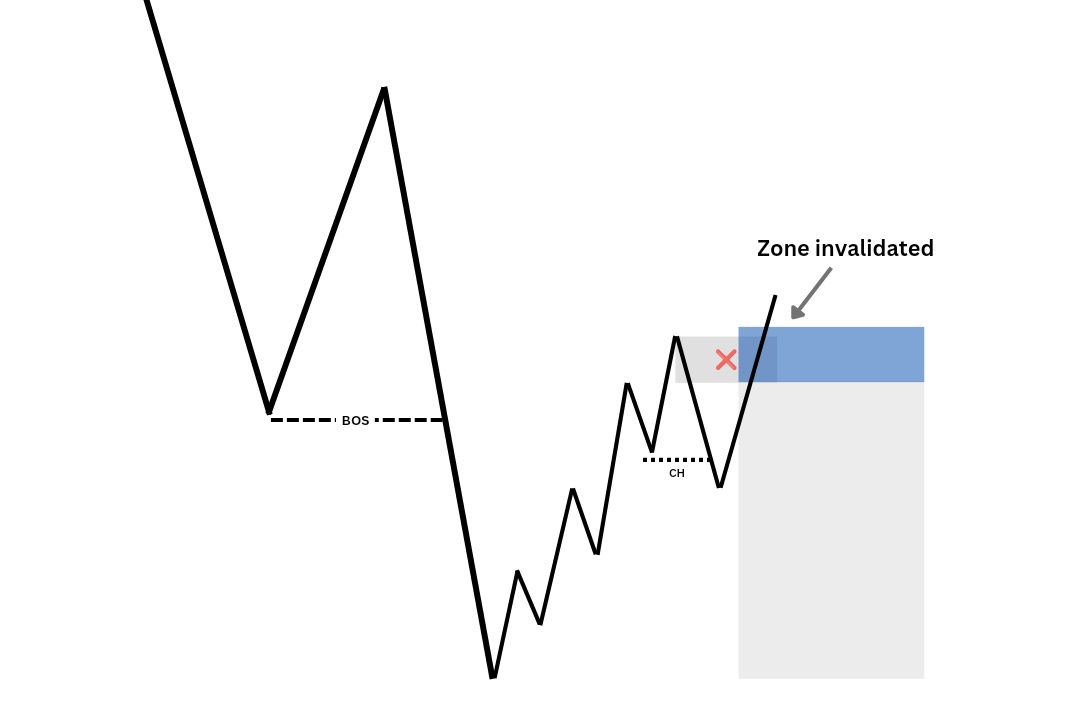

Notice how swing trend is bearish in that image above.

We know that after a BOS, price will pullback and then continue bearish.

The job of CHoCH is to help signal when that pullback is over, so that we can now enter the sells.

But you can see that it was stopped out.

Why? 👇

We know that after a BOS, price will pullback and then continue bearish.

The job of CHoCH is to help signal when that pullback is over, so that we can now enter the sells.

But you can see that it was stopped out.

Why? 👇

The CHoCH gave a fake signal -- it happened in the middle of no where (no mitigation).

But when you wait for CHoCH after a zone mitigation, the it is higher probability.

Because it signals that the zone is now likely to hold.

Example 👇

But when you wait for CHoCH after a zone mitigation, the it is higher probability.

Because it signals that the zone is now likely to hold.

Example 👇

What can also happen is, when there are multiple zones,

The first one tends to only cause a reaction and then fail to mitigate the origin zone which is higher probability.

See example 👇

The first one tends to only cause a reaction and then fail to mitigate the origin zone which is higher probability.

See example 👇

In that case you'd probably be stopped out on breakeven instead of a loss, and you can re-enter after the other zone is mitigated.

Just like what happened this morning after the M15 Zone 1 was mitigated.

The zone later failed, but gave room to set break even and remove risk.

Just like what happened this morning after the M15 Zone 1 was mitigated.

The zone later failed, but gave room to set break even and remove risk.

It is always better to take a break even rather than straight invalidation -- loss...

And that's what trading CHoCH from zones would do you for.

Because even if the zone later fails, at least you could have taken some partials, and or remove your initial risk from the trade.

And that's what trading CHoCH from zones would do you for.

Because even if the zone later fails, at least you could have taken some partials, and or remove your initial risk from the trade.

In summary:

• CHoCH is first sign of a trend change

• It is powerful but aggressive, occurs frequently

• Don't trade CHoCH from any random place you see it...

Always wait for zone mitigation as ait has higher probability to hold, or at least give room to remove initial risk.

• CHoCH is first sign of a trend change

• It is powerful but aggressive, occurs frequently

• Don't trade CHoCH from any random place you see it...

Always wait for zone mitigation as ait has higher probability to hold, or at least give room to remove initial risk.

And that's a wrap for now.

If you found this helpful

1. Like and Retweet for others to learn.

2. Follow me @dnatechbro to get more like this.

3. Don't just learn; implement, get better and give me feedback.

Cheers 🥂

If you found this helpful

1. Like and Retweet for others to learn.

2. Follow me @dnatechbro to get more like this.

3. Don't just learn; implement, get better and give me feedback.

Cheers 🥂

PS:

If you liked this, I'd love to connect with you on WhatsApp.

Send me a message with your name via this link 👇👇

wa.link/j5q92r

If you liked this, I'd love to connect with you on WhatsApp.

Send me a message with your name via this link 👇👇

wa.link/j5q92r

• • •

Missing some Tweet in this thread? You can try to

force a refresh