1/ Is it time to #QUITCEX ?

We know about Decentralized Exchanges (DEX) but what about "Self-Custodial Exchanges"?

@C3protocol is making a bet on decentralization by separating custody from exchanges.

Let's dive into what makes C3 so special:

We know about Decentralized Exchanges (DEX) but what about "Self-Custodial Exchanges"?

@C3protocol is making a bet on decentralization by separating custody from exchanges.

Let's dive into what makes C3 so special:

2/ The collapse of @CelsiusNetwork, @FTX_Official, @investvoyager, and @BlockFi has served as a strong reminder of the risks of centralization. These events also highlight how far the crypto industry has strayed from its promise of being truly decentralized, transparent and open.

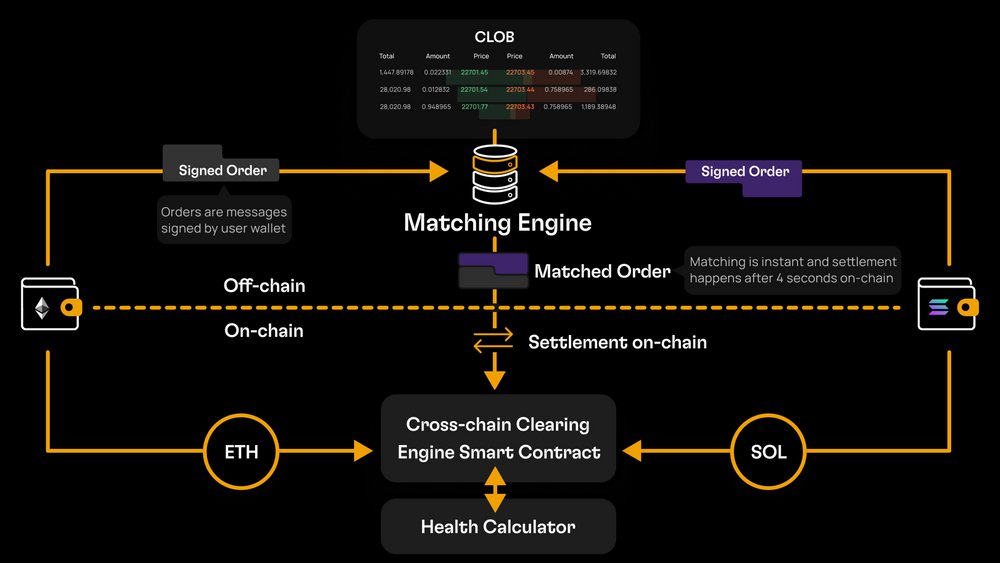

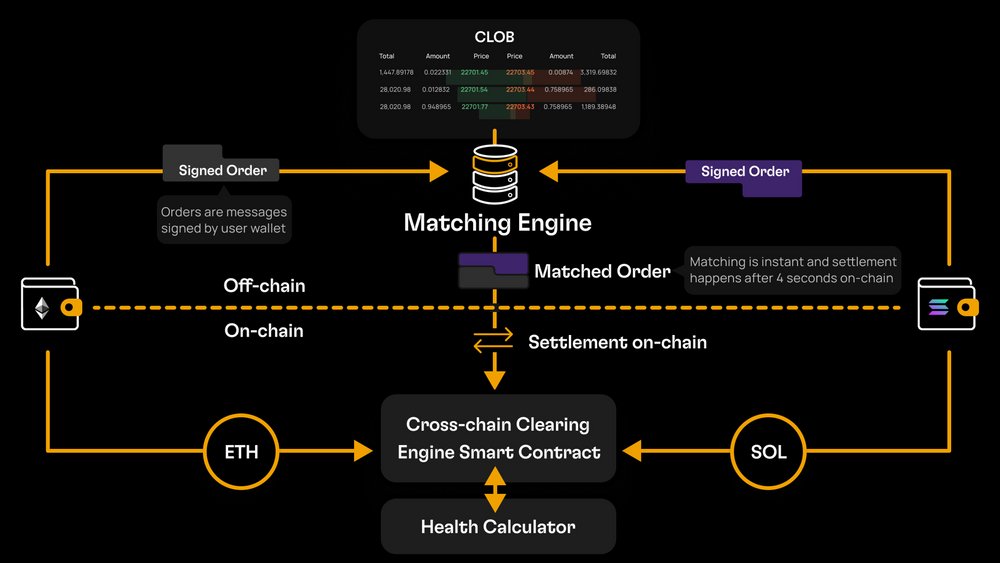

3/ C3 is a self-custodial exchange that uses a hybrid architecture of off-chain and on-chain components for optimal performance and security allowing:

- Faster Trade Execution;

- No Gas Costs;

- Scalability;

- Privacy; and

- Advanced Features.

- Faster Trade Execution;

- No Gas Costs;

- Scalability;

- Privacy; and

- Advanced Features.

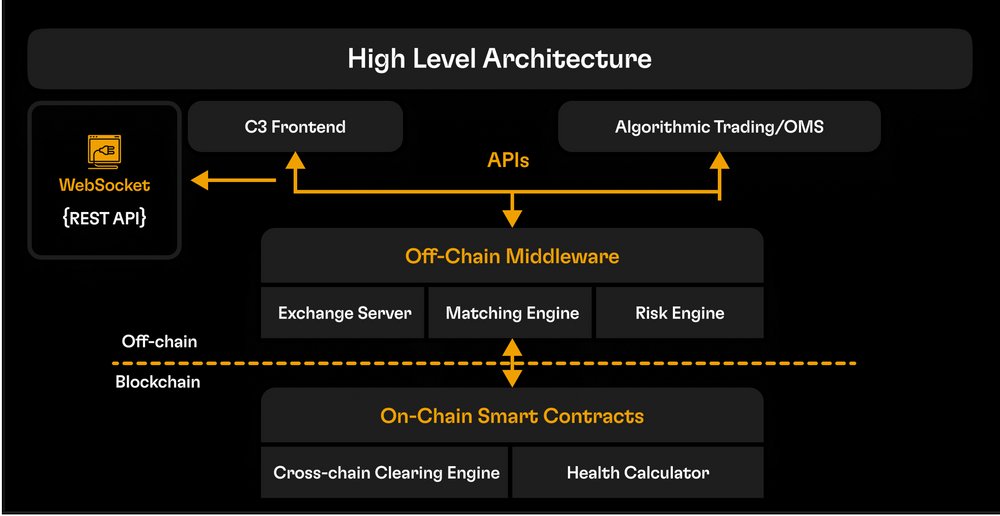

4/ C3's architecture is structured into three layers, the access layer, a middleware off-chain component, and the on-chain component.

This innovative hybrid architecture allows the platform to be both performant and accessible while remaining trustless and non-custodial.

This innovative hybrid architecture allows the platform to be both performant and accessible while remaining trustless and non-custodial.

5/ Chain Agnostic Acces Layer

The first layer is the access layer. It features a Multi-Chain Architecture, where users can interact with C3 either directly through traditional APIs or via C3’s frontend giving users the flexibility to trade and deposit assets from any blockchain.

The first layer is the access layer. It features a Multi-Chain Architecture, where users can interact with C3 either directly through traditional APIs or via C3’s frontend giving users the flexibility to trade and deposit assets from any blockchain.

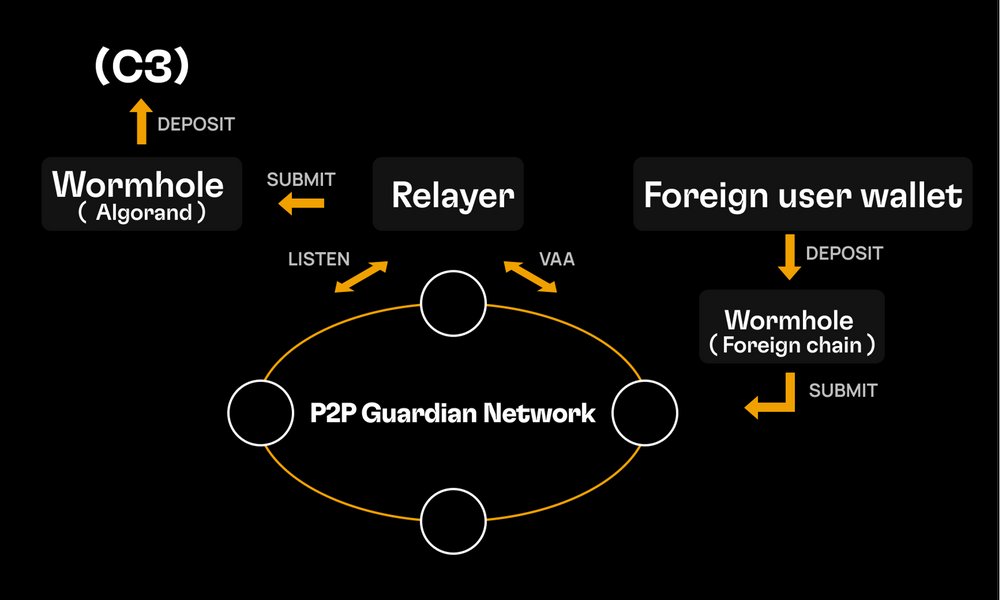

6/ C3 consolidates asset balances from all the supported blockchains in a single layer, the on-chain settlement layer, built on the @Algorand blockchain. This gives the system a unified view of all assets to efficiently manage balances and settle trades with full transparency.

7/ To consolidate balances, C3 leverages @wormholecrypto’s Portal Bridge to lock assets in the smart contract of the blockchain of origin and mint wrapped assets which are automatically deposited into C3’s Cross-collateral Clearing Engine smart contract in Algorand.

8/ Off-chain Component

The off-chain component handles instant trade processing and matching. It consists of an exchange server that operates off-chain, hosts the CLOB, and serves as the trading hub where trade operations are received, approved, and matched.

The off-chain component handles instant trade processing and matching. It consists of an exchange server that operates off-chain, hosts the CLOB, and serves as the trading hub where trade operations are received, approved, and matched.

9/ Thanks to this off-chain component, C3 offers low-latency trading and allows orders to be posted and canceled for free without having to pay on-chain transaction fees which makes it comparable to a CEX and is very attractive for market makers and trading desks.

10/ Risk Engine

The off-chain Risk Engine is responsible for approving and validating trade orders and other account operations. Liquidators can also initiate the liquidation process by verifying the request through the off-chain Risk Engine.

The off-chain Risk Engine is responsible for approving and validating trade orders and other account operations. Liquidators can also initiate the liquidation process by verifying the request through the off-chain Risk Engine.

10/ On-chain Component

C3’s on-chain component consists of two smart contract applications, the Cross-collateral Clearing Engine, and the Health Calculator, which are deployed on the Algorand blockchain and serve as C3's settlement layer.

C3’s on-chain component consists of two smart contract applications, the Cross-collateral Clearing Engine, and the Health Calculator, which are deployed on the Algorand blockchain and serve as C3's settlement layer.

11/ Cross-collateral Clearing Engine

The Cross-collateral Clearing Engine is the core smart contract of C3, manages the funds deposited by users, approves and executes all trade settlements, as well as facilitates withdrawal, borrow, lend, and liquidation operations.

The Cross-collateral Clearing Engine is the core smart contract of C3, manages the funds deposited by users, approves and executes all trade settlements, as well as facilitates withdrawal, borrow, lend, and liquidation operations.

12/ Health Calculator

The Health Calculator smart contract serves as C3's on-chain risk engine. It calculates the health of all C3 accounts by using the on-chain Pyth price feed to determine the value of all assets held in each account.

The Health Calculator smart contract serves as C3's on-chain risk engine. It calculates the health of all C3 accounts by using the on-chain Pyth price feed to determine the value of all assets held in each account.

13/ The On-chain Component handles trade settlement by verifying every single matched trade. It validates the signatures of both buyer and seller and the health of their accounts before allowing settlement to take place and transferring ownership of the traded assets.

13/ @C3protocol was founded in 2018 by the team behind @randlabs notably @pipaman and @micheldahdah. Its second funding round was led by @TwoSigmaVC this February, and also includes a mix of VCs, quant firms, and liquidity providers like @cmsholdings, @janestreet, @jump_.

16/ @C3protocol is currently in development but you can join the waitlist to know when it's ready.

What do you think of C3's architecture ? Is it the future of crypto trading? Let me know your thoughts!

Join the waitlist here: c3.io/?r=qjAuS

What do you think of C3's architecture ? Is it the future of crypto trading? Let me know your thoughts!

Join the waitlist here: c3.io/?r=qjAuS

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter