The Blur x DeGods partnership could single-handedly catalyze the next wave of adoption for NFTs.

Here's why you should pay attention.🧵(1/16)

Here's why you should pay attention.🧵(1/16)

Blur has been divisive.

The initial airdrop & liquidity injection was praised.

But the tide changed after incentives drove counterproductive airdrop farming behaviour.

Daily bidding pool liquidity is in decline.

Farmers are realizing Season 2 ≠ Season 1 profitability.

/2

The initial airdrop & liquidity injection was praised.

But the tide changed after incentives drove counterproductive airdrop farming behaviour.

Daily bidding pool liquidity is in decline.

Farmers are realizing Season 2 ≠ Season 1 profitability.

/2

20% of Blur's volume comes from only 15 wallets.

This isn't anything new.

It's a typical Market Maker (MM) model.

MMs provide liquidity & depth to markets.

They profit from the difference in the bid-ask spread.

But the airdrop is skewing it.

/3

This isn't anything new.

It's a typical Market Maker (MM) model.

MMs provide liquidity & depth to markets.

They profit from the difference in the bid-ask spread.

But the airdrop is skewing it.

/3

https://twitter.com/poof_eth/status/1628452399315550208?s=20

Whales are taking net losses in the hopes the airdrop will compensate them.

The largest Market Maker is Machi.

He's already taken 4.6k ETH ($8.4m) in losses from his BAYC, Gitcoin & Punk activity.

It's unlikely the $BLUR spot value will compensate.

/4

The largest Market Maker is Machi.

He's already taken 4.6k ETH ($8.4m) in losses from his BAYC, Gitcoin & Punk activity.

It's unlikely the $BLUR spot value will compensate.

/4

https://twitter.com/liamherbst_/status/1628823682280988673?s=20

But this could change once the $BLUR token becomes a productive asset.

Not only could a MM receive a token, but could also receive distributions from marketplace fees.

But Blur doesn't have fees!

It needed to gain market share from Opensea to become viable (hence loyalty).

/5

Not only could a MM receive a token, but could also receive distributions from marketplace fees.

But Blur doesn't have fees!

It needed to gain market share from Opensea to become viable (hence loyalty).

/5

The initial VC funds don't put money into a company without the prospects of future returns.

They will receive 19% of the token allocation which vests in six months - their exit.

The $BLUR token is purely governance (at the moment).

But what decisions could be made?

/6

They will receive 19% of the token allocation which vests in six months - their exit.

The $BLUR token is purely governance (at the moment).

But what decisions could be made?

/6

The recent regulatory impost makes it difficult for tokens NOT to be classified as a security.

But if decisions are determined by a decentralized governance framework then there could be a vote to turn fees on & distribute w/o this concern.

But the product needs to be good.

/7

But if decisions are determined by a decentralized governance framework then there could be a vote to turn fees on & distribute w/o this concern.

But the product needs to be good.

/7

That's where partners like DeGods come in.

Have knowledgeable partners onboarded to iterate their product.

Create an optimal decision-making tool that contains all the news, research and data in one place.

One that also supports creators.

/8

Have knowledgeable partners onboarded to iterate their product.

Create an optimal decision-making tool that contains all the news, research and data in one place.

One that also supports creators.

/8

The bulk (51%) of the distribution is going to the community.

The core users of the product.

But making decentralized decisions can be inefficient.

There needs to be a delegate/committee.

Some interesting suggestions are being put forward.

/9

The core users of the product.

But making decentralized decisions can be inefficient.

There needs to be a delegate/committee.

Some interesting suggestions are being put forward.

/9

But incentives drive market behaviour.

That's why Blur has set up an "Incentive Committee" to consider this.

If we assume participants are profit maximizers then we can predict & adjust behaviour accordingly.

/10

That's why Blur has set up an "Incentive Committee" to consider this.

If we assume participants are profit maximizers then we can predict & adjust behaviour accordingly.

/10

Incentivizing liquidity for an illiquid asset class should be the focus.

Enabling holders to exit positions efficiently for fair value will help adoption.

Bur market depth is shallow: 72kΞ.

That's 0.5% of the 16mΞ TVL on Ethereum.

Single NFT traders can move the market.

/11

Enabling holders to exit positions efficiently for fair value will help adoption.

Bur market depth is shallow: 72kΞ.

That's 0.5% of the 16mΞ TVL on Ethereum.

Single NFT traders can move the market.

/11

Whales that provide the liquidity will become the Market Makers.

The more tokens they accrue the more they will be able to direct incentives.

Committees will need to regulate this.

Stepped rewards based on the depth of the market would be beneficial.

/12

The more tokens they accrue the more they will be able to direct incentives.

Committees will need to regulate this.

Stepped rewards based on the depth of the market would be beneficial.

/12

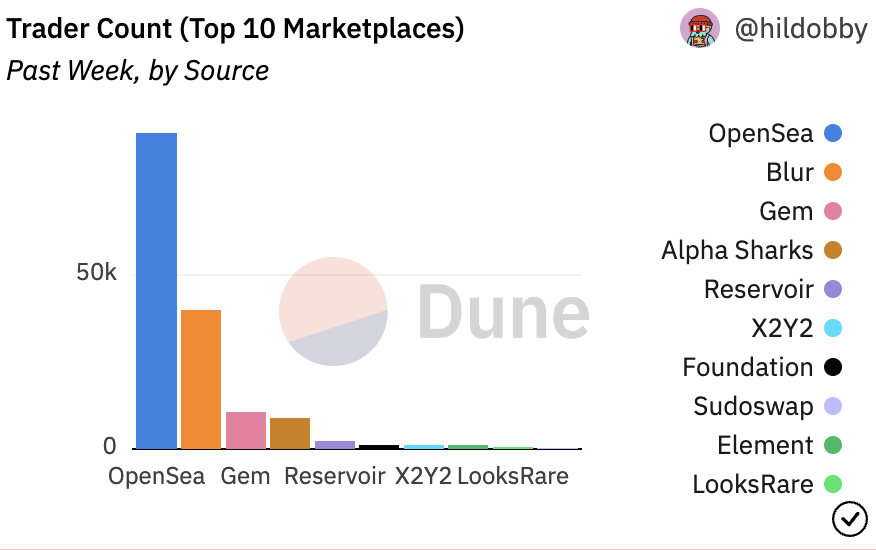

Leveraging the DeGods appeal to onboard new participants (eventually) will be useful.

Get them onto a superior platform to Opensea.

A platform that involves its users, aligns incentives & has a decentralized focus.

After all, volume is on Blur, but the # traders are low.

/13

Get them onto a superior platform to Opensea.

A platform that involves its users, aligns incentives & has a decentralized focus.

After all, volume is on Blur, but the # traders are low.

/13

Do I think the DeGods x Blur partnership will actually change much overnight?

No.

Progress will also be determined by macro, real utility & improved user experience/interface.

But the collaborative approach is beneficial.

Silos will just drive wedges in the ecosystem.

/14

No.

Progress will also be determined by macro, real utility & improved user experience/interface.

But the collaborative approach is beneficial.

Silos will just drive wedges in the ecosystem.

/14

There will be several big players in the market.

LooksRare has already integrated fiat on/off ramps with Moonpay.

Any decentralized protocol with optimized incentives & an easy-to-use product is good for progress.

Opensea will always struggle with user/investor conflicts.

/15

LooksRare has already integrated fiat on/off ramps with Moonpay.

Any decentralized protocol with optimized incentives & an easy-to-use product is good for progress.

Opensea will always struggle with user/investor conflicts.

/15

I hope the DeGods x Blur partnership encourages further collaboration in the NFT space.

The PVP silo approach is a hindrance to progress.

Forward-looking innovative change should be incentivized.

After all, a rising tide lifts all boats.

/16

The PVP silo approach is a hindrance to progress.

Forward-looking innovative change should be incentivized.

After all, a rising tide lifts all boats.

/16

https://twitter.com/huntersolaire_/status/1641811133664497665?s=20

Keen to hear your thoughts on the partnership!👇

If you found this🧵useful please hit RT on the first tweet to spread awareness.

Thanks for reading. 🙏

If you found this🧵useful please hit RT on the first tweet to spread awareness.

Thanks for reading. 🙏

https://twitter.com/S4mmyEth/status/1641839275787288578?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter