First a few resources.

Seeking Alpha transcript & voice.

seekingalpha.com/article/459162…

Call link (requires login)

event.choruscall.com/mediaframe/web…

Slide deck: sec.gov/Archives/edgar…

10K sec.gov/ix?doc=/Archiv…

2/

Seeking Alpha transcript & voice.

seekingalpha.com/article/459162…

Call link (requires login)

event.choruscall.com/mediaframe/web…

Slide deck: sec.gov/Archives/edgar…

10K sec.gov/ix?doc=/Archiv…

2/

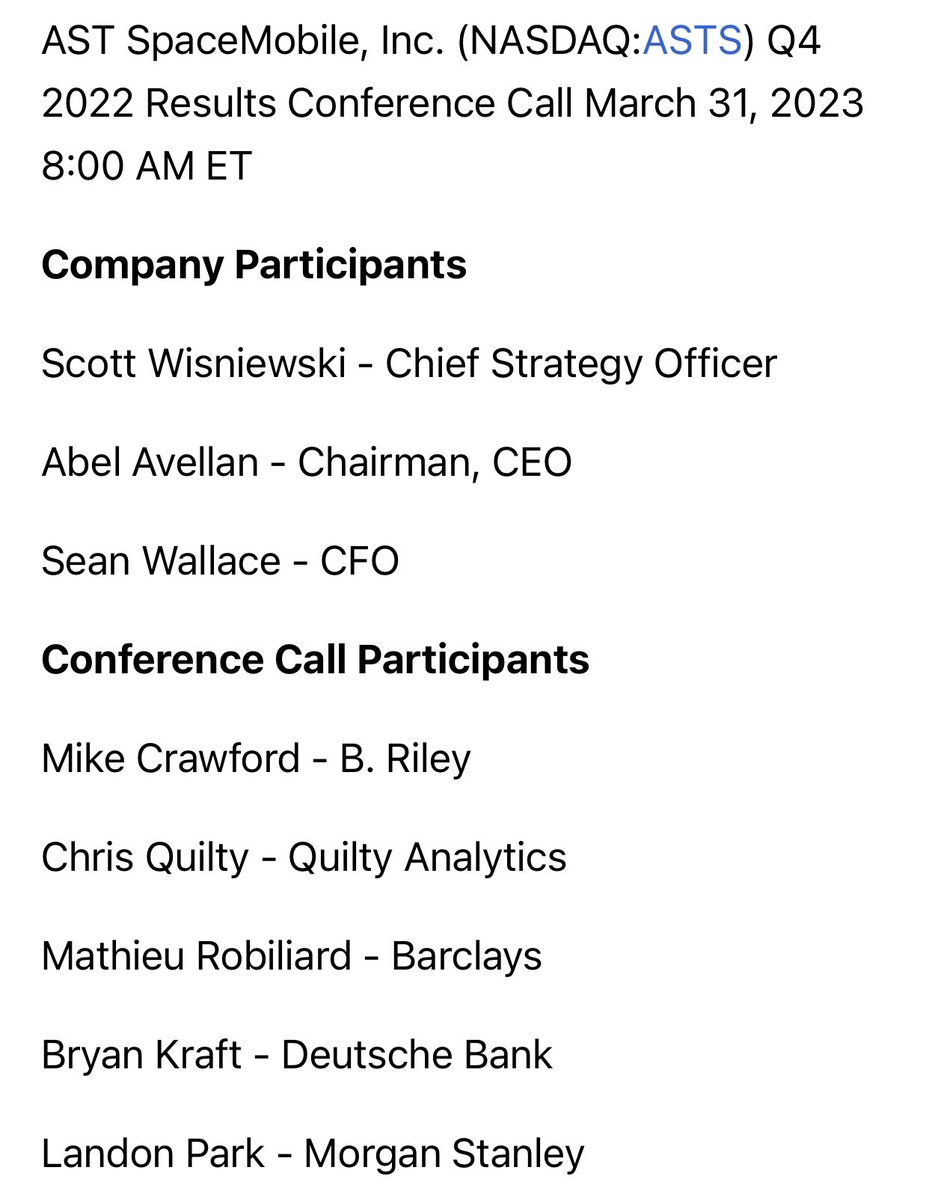

The call was held, as customary for $ASTS, announced on short notice and on the latest day possible for a non-accelerated filer.

Pre-admitted Q/A and on-call analysts are getting a bit better for each new call and were interesting, but before that they had the presentation.

3/

Pre-admitted Q/A and on-call analysts are getting a bit better for each new call and were interesting, but before that they had the presentation.

3/

Only thing out of pattern, was that call was held pre-market.

Might be what they like to do on a Friday for the analysts etc.

Abel Avellan initially adressed the status of current testing with test satellite BlueWalker3:

4/

Might be what they like to do on a Friday for the analysts etc.

Abel Avellan initially adressed the status of current testing with test satellite BlueWalker3:

4/

Lets stick to that subject.

Prior to tests I had discussions with @steve_larrison, RIP brother, on the nature of these tests.

”Testing is a process not an event”, he said. And I agreed.

”Investors will expect quick results, it will not be like that, it will be gradual.”

5/

Prior to tests I had discussions with @steve_larrison, RIP brother, on the nature of these tests.

”Testing is a process not an event”, he said. And I agreed.

”Investors will expect quick results, it will not be like that, it will be gradual.”

5/

His expertise was the software part, whereas mine is the mechanics. And where we differed was on risks.

I downplayed mechanical risks of bw3 versus the software/electronics risks.

In that we saw the bigger risks in what the other knew best. Which is natural, I guess.

6/

I downplayed mechanical risks of bw3 versus the software/electronics risks.

In that we saw the bigger risks in what the other knew best. Which is natural, I guess.

6/

To this date, and as far as we know, mechanical / deployment worked as intended.

Software/electronics/RF seems on track. In a process / on track.

And for where this track leads lets hear Steve on what he knew best.

Software.

7/

Software/electronics/RF seems on track. In a process / on track.

And for where this track leads lets hear Steve on what he knew best.

Software.

7/

Steve emphasised sa is software defined. And that means ASTS have the tools to tweak the sat software until it works.

It will take time, but if the mechanical deployment works (which it did), Steve was very confident they would make it all work.

Abel: ”Never satisfied”

8/

It will take time, but if the mechanical deployment works (which it did), Steve was very confident they would make it all work.

Abel: ”Never satisfied”

8/

Ofcourse he had a point there.

Whereas the mechanics are dead-simple IF they fail there is nothing to do.

Whereas the electronics & software are complex stuff you can tune and tweak them until you are satisfied.

Abel: ”We are there in the downlink”

9/

Whereas the mechanics are dead-simple IF they fail there is nothing to do.

Whereas the electronics & software are complex stuff you can tune and tweak them until you are satisfied.

Abel: ”We are there in the downlink”

9/

In summary the company states they have achieved Broadband speeds (Abel: 30 mbit) in the downlink, and validated the tech end-2-end.

Scott on Mechanical and end-2-end: ”in our back pocket”

10/

Scott on Mechanical and end-2-end: ”in our back pocket”

10/

Let me be clear that what they achieved so far is monumental, not just for $ASTS.

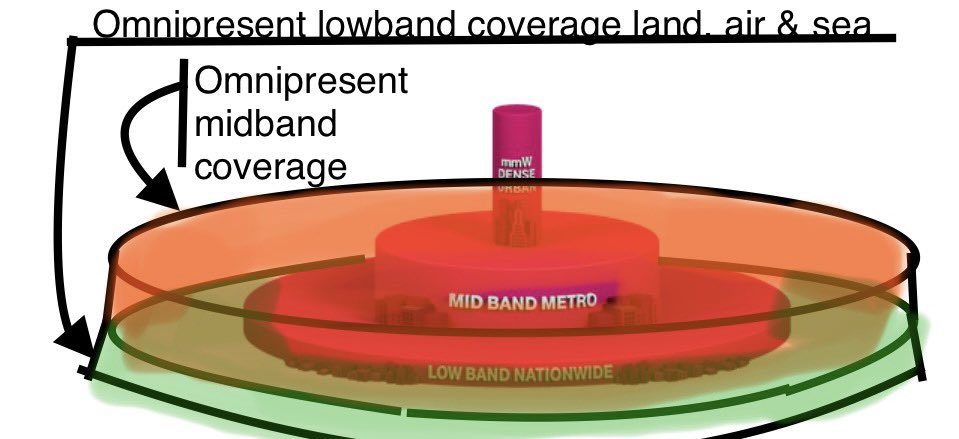

Uplink is something I never expected broadband speeds in, the link is a bit harder to make.

Which is the reason why carrier aggregation will be key to use also midband in downlink.

11/

Uplink is something I never expected broadband speeds in, the link is a bit harder to make.

Which is the reason why carrier aggregation will be key to use also midband in downlink.

11/

But so far they use lowband, which allows the strongest connection.

There is an anlogy to towers. They also started w lowband and then evolved. Sats will follow.

Public Safety net is also lowband.

12/

There is an anlogy to towers. They also started w lowband and then evolved. Sats will follow.

Public Safety net is also lowband.

12/

And so it is apparent that $ASTS has results of significance, yet they are not ready yet to present them.

At the heart of this is the nature of tweaking a software defined network becoming gradually better.

When is is good enough?

Scott is apparently thinking of HOW

13/

At the heart of this is the nature of tweaking a software defined network becoming gradually better.

When is is good enough?

Scott is apparently thinking of HOW

13/

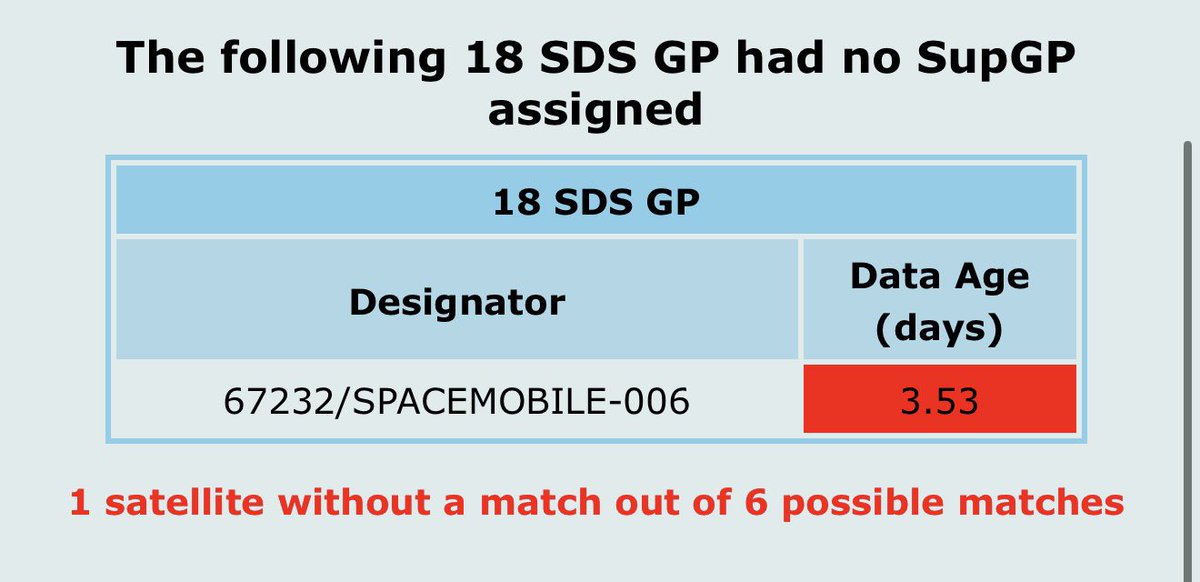

He is no longer thinking about IF they will announce succesful tests.

I have a canary-bird test for that statement:

Orbital data.

The instrument at hand besides software tweaks that $ASTS have to improve link budget is altitude.

It is unchanged at ~500km.

Test✅

14/

I have a canary-bird test for that statement:

Orbital data.

The instrument at hand besides software tweaks that $ASTS have to improve link budget is altitude.

It is unchanged at ~500km.

Test✅

14/

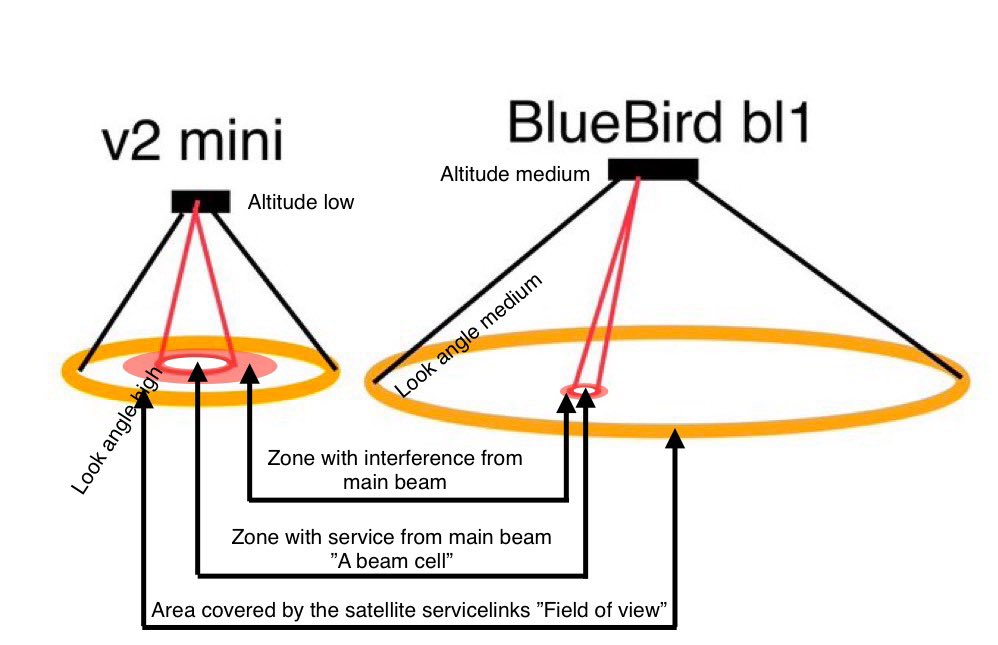

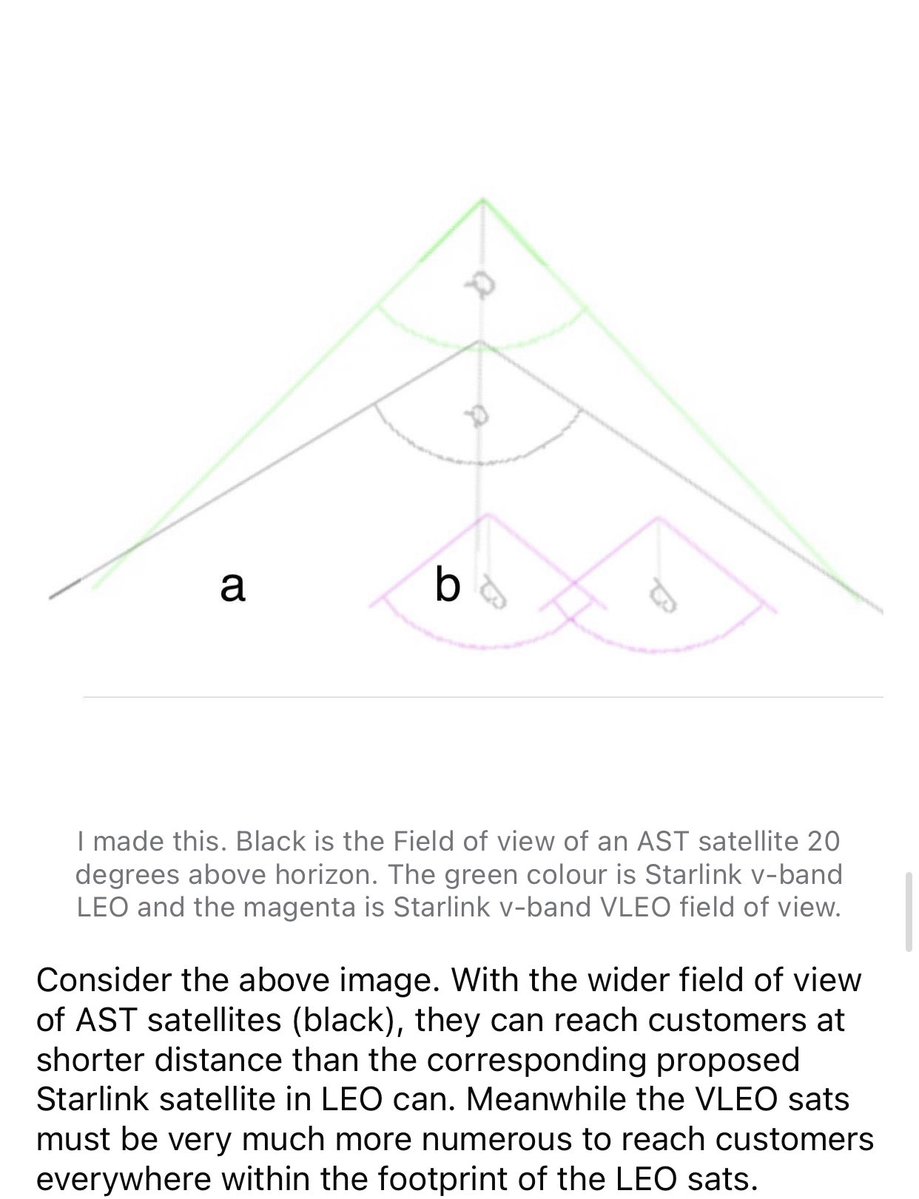

If they had problems to make the link they would have lovered their satellite (like SpaceX v2 mini). They did not.

As to complete that analogy having only one test sat, $ASTS test window is narrow that test & tweaking _process_ is supposed to take some time.

15/

As to complete that analogy having only one test sat, $ASTS test window is narrow that test & tweaking _process_ is supposed to take some time.

15/

As for orbital data. Radar Cross Section has been ”Large” all of this year. Well after deployment.

And for exactly 1 month oct 6 to nov 6th. Well before deployment during some of the time inside the LVA.

The latter period of in conjunction with a higher mean drag level.

16/

And for exactly 1 month oct 6 to nov 6th. Well before deployment during some of the time inside the LVA.

The latter period of in conjunction with a higher mean drag level.

16/

And so there are some patterns there that have not been explained.

Seems also that some things was done to alter the reflections from the spacecraft (/-s) to mitigate solar flares / brightness.

17/

Seems also that some things was done to alter the reflections from the spacecraft (/-s) to mitigate solar flares / brightness.

17/

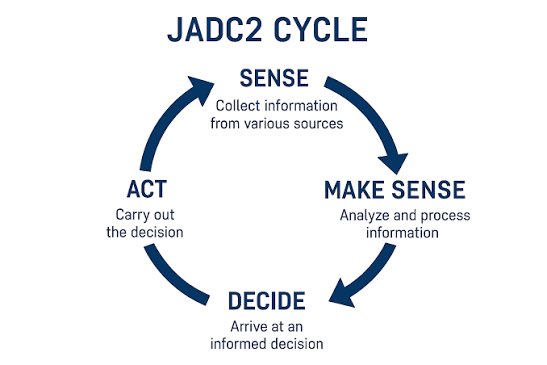

A first for an $ASTS call was to acknowledge the defense and intelligence use case of NTN sliced 5g.

I like to add to that the fact of FPGAs BB block1 & BW3s ability to do other coms than transparent architecture cellular. And the odd orbital signatures may be related.

18/

I like to add to that the fact of FPGAs BB block1 & BW3s ability to do other coms than transparent architecture cellular. And the odd orbital signatures may be related.

18/

I did this on a previous call. For some reasons they shifted to 5 block1s (FoGAs) on a single launch.

Supposed (then) to go up near years end.

19/

Supposed (then) to go up near years end.

19/

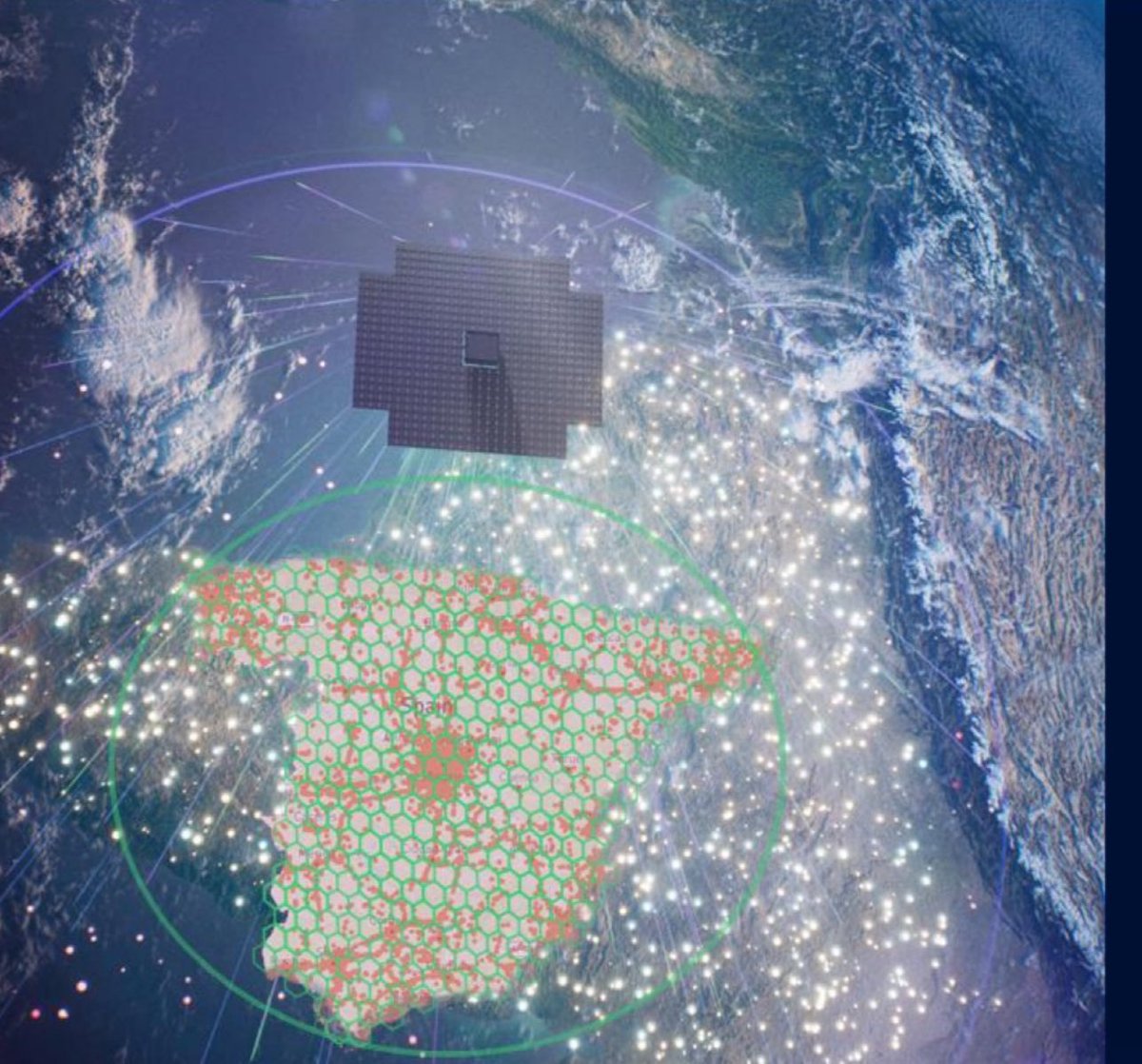

On this call they clarify/ bump that launch of 5 Block1s into Q1 2024.

Abel also say it will be on single F9 which means inclined launch.

(Southern USA at least covered maybe all.)

20/n

Abel also say it will be on single F9 which means inclined launch.

(Southern USA at least covered maybe all.)

20/n

There seems to be final negotiations ongoing. But where this leans is hinted with the words ”near continous” for 20 Block 2s.

On equatorial it is continous and so this hints to Block2s slso going inclined (perhaps an AT&T or gov/DoD deal could see them cover USA?)

/21

On equatorial it is continous and so this hints to Block2s slso going inclined (perhaps an AT&T or gov/DoD deal could see them cover USA?)

/21

Launch cost increases and material cost increases propagates to satellite cost increases which now are projected to cost:

20-22 Mn per block 1,

16-18 Mn per block2.

I plan to continue this thread on regulatory versus tech timeline.

Now for some coffee ☕️

/22

20-22 Mn per block 1,

16-18 Mn per block2.

I plan to continue this thread on regulatory versus tech timeline.

Now for some coffee ☕️

/22

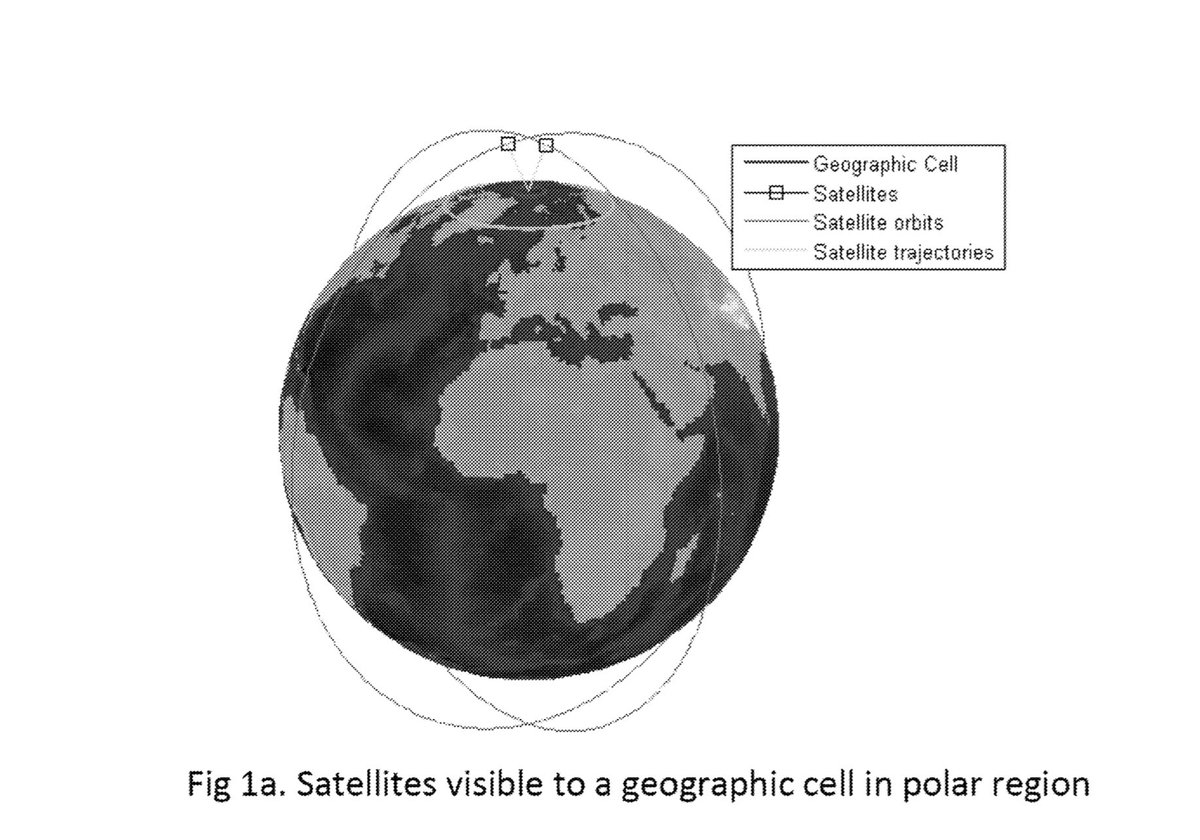

Let us work from this old image to understand timelines.

We see how BW3 launch was bumped to its sept 10th launch and the planned 2 seperate bluebirds (for equatorial) became 5 FPGAs on single F9.

That we now know will be inclined. (F9 does not have power for equatorial).

/23

We see how BW3 launch was bumped to its sept 10th launch and the planned 2 seperate bluebirds (for equatorial) became 5 FPGAs on single F9.

That we now know will be inclined. (F9 does not have power for equatorial).

/23

And so USA and India are in the play for 2024-2025 tech timeline.

And so the tech timeline looks a bit like this and seems to be targeting inclined orbits. Abother hint to that is the statement at the call FPGAs (block1) will form joint constellation with ASICs (block2s).

In short they aim for US market.

There is also regulatory timeline.

/25

In short they aim for US market.

There is also regulatory timeline.

/25

I expect the Block1 production line at Midlabd (FPGAs) to continue in parallell with ASICs at Odessa plant beyond BBs 1–5.

That these are produced in parallell.

ASICs are high capacity 10x vs FPGA

But FPGAs are flexible 100x vs ASICs

/26

That these are produced in parallell.

ASICs are high capacity 10x vs FPGA

But FPGAs are flexible 100x vs ASICs

/26

One reason I think so is my knowledge of military affairs.

Listen to Lance Spencer(AT&T defense) for instance.

It is not just me.

/27

Listen to Lance Spencer(AT&T defense) for instance.

It is not just me.

/27

Back to that timeline.

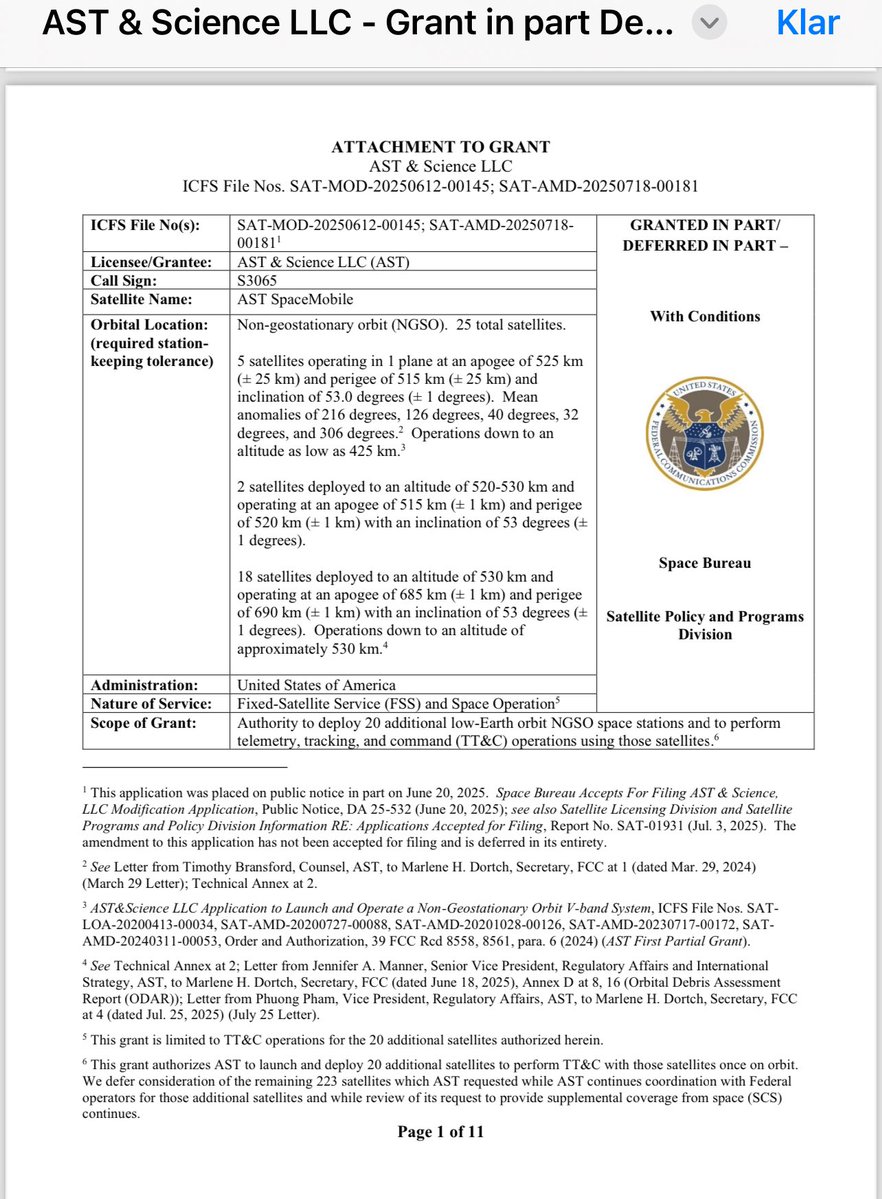

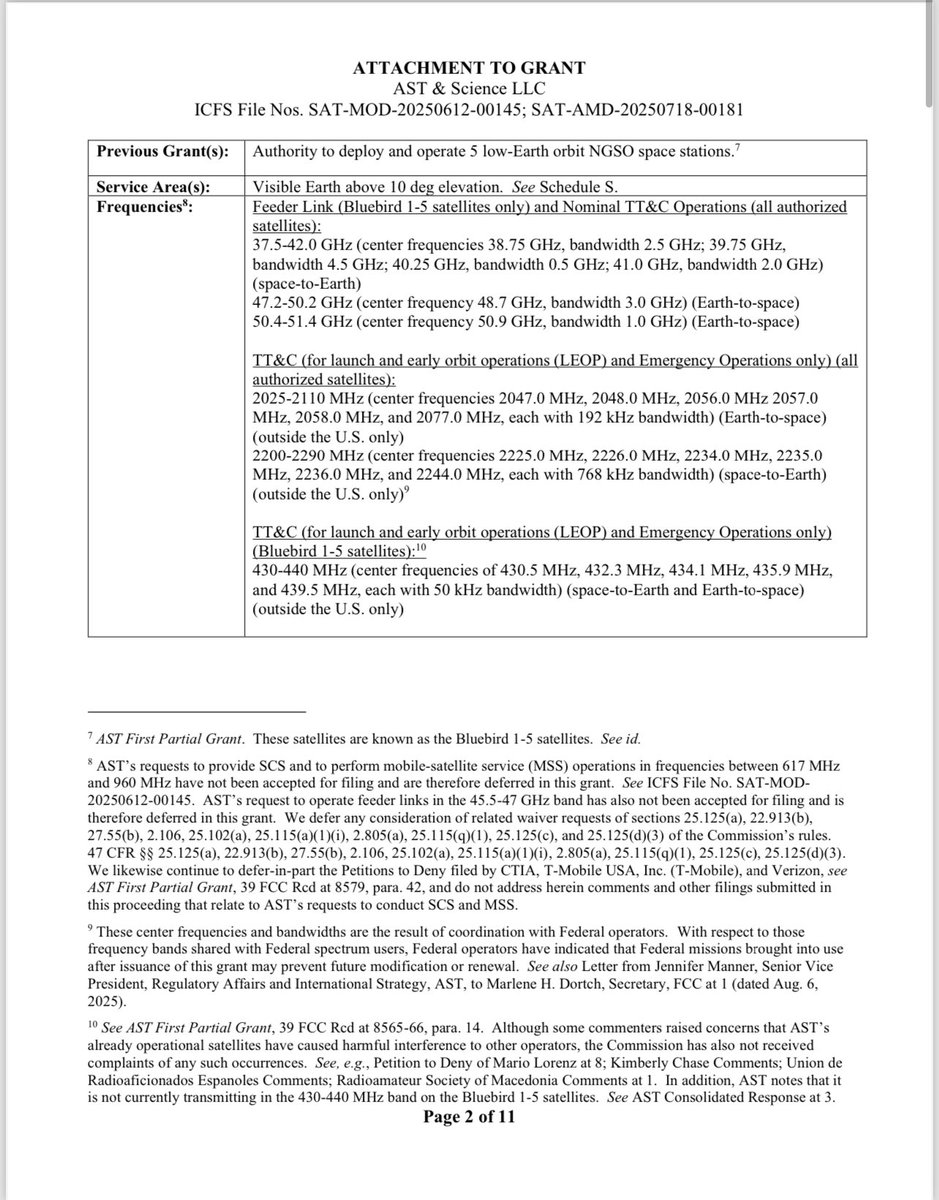

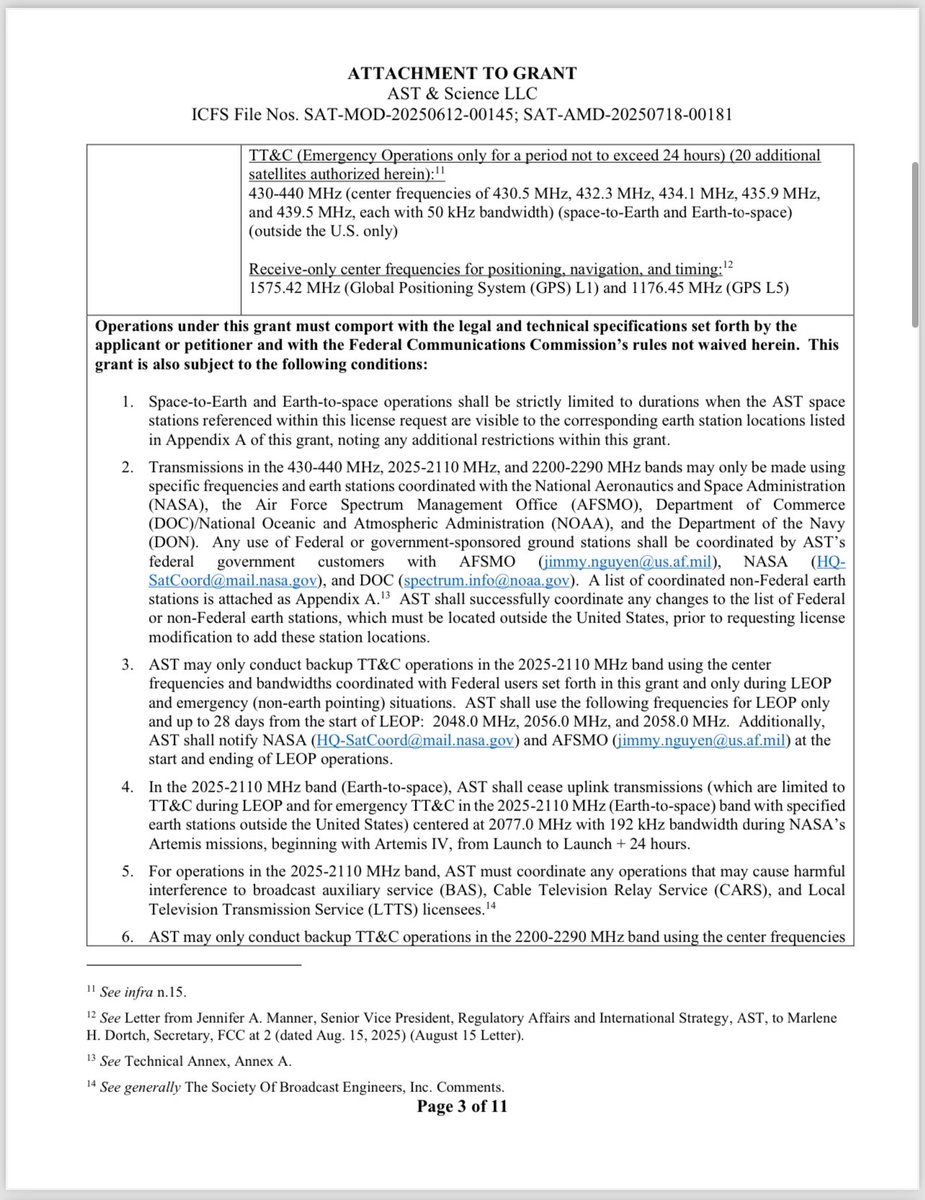

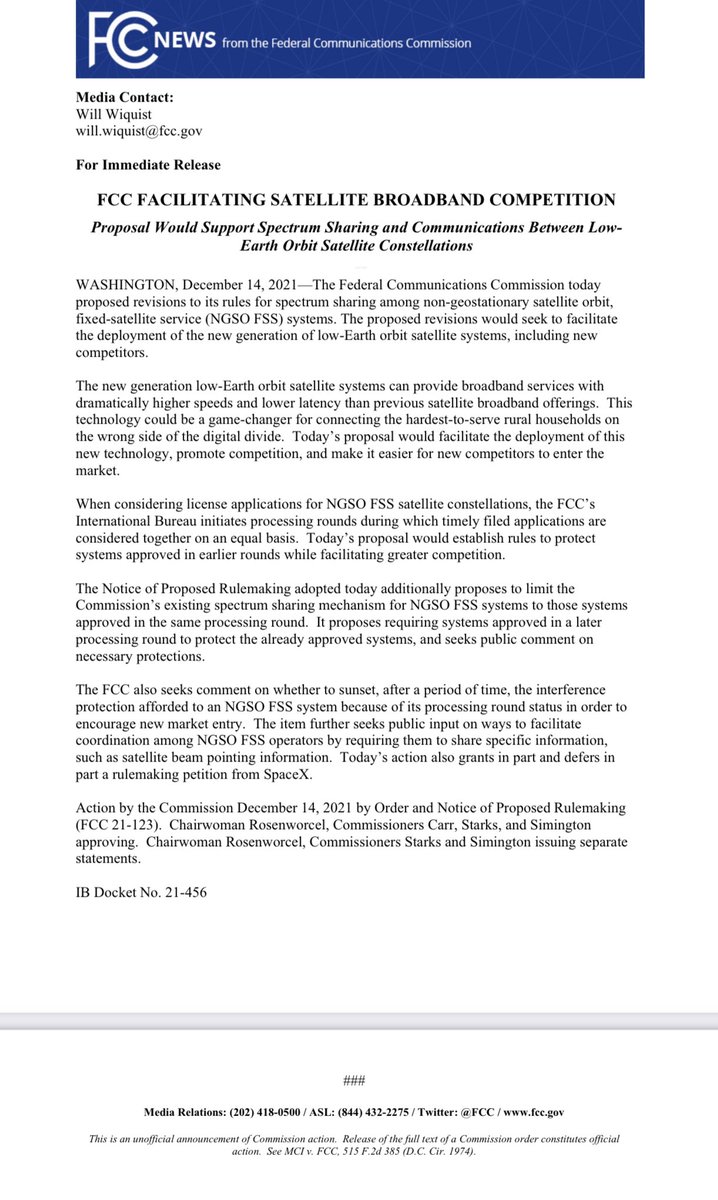

In 2020-04-13 $ASTS applies to the FCC to be granted US market access for their SpaceMobile constellation.

Starting a regulatory pathway.

28/

In 2020-04-13 $ASTS applies to the FCC to be granted US market access for their SpaceMobile constellation.

Starting a regulatory pathway.

28/

That docket is here and in functional freeze, simply waiting for something .

fcc.report/IBFS/SAT-LOI-2…

And you thought you have been waiting long for test results?

Let me introduce to You the regulatory red-tape of the @FCC

Sitting on this since spring of 2020.

29/

fcc.report/IBFS/SAT-LOI-2…

And you thought you have been waiting long for test results?

Let me introduce to You the regulatory red-tape of the @FCC

Sitting on this since spring of 2020.

29/

Two main parts left in that application. 1) Orbital debris risks and

2) Q/V backhaul spectrum grant.

To ”facilitate things” the FCC decided to first rewrite the spectrum sharing regulations.

A process that started 2021-12-14

30/

2) Q/V backhaul spectrum grant.

To ”facilitate things” the FCC decided to first rewrite the spectrum sharing regulations.

A process that started 2021-12-14

30/

The docket is here. With 113 filings from everyone in triplicates, reiterating the same views toward the end.

fcc.gov/ecfs/search/se…

31/

fcc.gov/ecfs/search/se…

31/

But then on March 30 2023, two days ago. The @FCC had waited long enough.

I consider this more important/critical for $ASTS than anything on that call, btw.

fcc.gov/document/fcc-a…

32/

I consider this more important/critical for $ASTS than anything on that call, btw.

fcc.gov/document/fcc-a…

32/

And this is how it is important.

Literally nothing has been done to the US market access application simce this rulemaking started.

And so: In April it can restart.

33/

Literally nothing has been done to the US market access application simce this rulemaking started.

And so: In April it can restart.

33/

Lets add the BlueWalker 3 single experimental satellite application timeline. For context.

2021-01-14 —-2022-06-02

3d party version of FCC docket is here:

fcc.report/ELS/AST-Scienc…

34/

2021-01-14 —-2022-06-02

3d party version of FCC docket is here:

fcc.report/ELS/AST-Scienc…

34/

After the FCC adopts new spectrum sharing regulations they will consider the two parts of the SpaceMobile application after that.

One is concerning V band backhaul. 10 GigaHerz worth of it (yes Giga).

$ASTS has been in processing round for it since 2021-08-04

35/

One is concerning V band backhaul. 10 GigaHerz worth of it (yes Giga).

$ASTS has been in processing round for it since 2021-08-04

35/

Judging from previous round this will take 92 days (oneweb) — 65 days (kuiper) offset from after the rules are set.

Let us add those ~3 months of processing to regulatory timeline

36/

Let us add those ~3 months of processing to regulatory timeline

36/

Then we add orbital and re-entry risk assessment.

Lots of work made in parallell. NASA SpaceAct agreement and edge on flight configuration helps a lot.

Kuiper is my benchmark for saying it is parallell process to Q/V rights.

An uknown what date it will be granted.

37/

Lots of work made in parallell. NASA SpaceAct agreement and edge on flight configuration helps a lot.

Kuiper is my benchmark for saying it is parallell process to Q/V rights.

An uknown what date it will be granted.

37/

But. We also need fronthaul.

2023-02-23 @fcc and @JRosenworcelFCC opens a docket on a ”Single Network Future”

And establish the expression SCS.

Supplementary Coverage from Space.

38/

2023-02-23 @fcc and @JRosenworcelFCC opens a docket on a ”Single Network Future”

And establish the expression SCS.

Supplementary Coverage from Space.

38/

It is a Notice Of Proposed Rulemaking that after some initial comments has taken the form you find in the docket here:

fcc.gov/ecfs/search/se…))

After which the rules need to be commented on starting 2023-03-17, ending -05-16.

If the @fcc honors Those deadlines (big if).

/39

fcc.gov/ecfs/search/se…))

After which the rules need to be commented on starting 2023-03-17, ending -05-16.

If the @fcc honors Those deadlines (big if).

/39

And so we add half a year, not two months for some margin.

Given the fact that @fcc rarely meets its own rulemaking deadlines.

( Hi @JRosenworcelFCC )

/40

Given the fact that @fcc rarely meets its own rulemaking deadlines.

( Hi @JRosenworcelFCC )

/40

After which $ASTS partner MNO @ATT $T will need to apply according to those rules.

Commissioner @SimingtonFCC did issue a statement regarding avoiding this time consuming process for active constellation applications.

But..

/41

Commissioner @SimingtonFCC did issue a statement regarding avoiding this time consuming process for active constellation applications.

But..

/41

Give the @fcc track record of being not so very fast with things.

It is my estimation that regulatory timing risks > technological timing risks.

And thus the fact April has a Q/V ruling > any launch delay of Block1 s.

They still need regulatory OK to operate, see.

42/42

It is my estimation that regulatory timing risks > technological timing risks.

And thus the fact April has a Q/V ruling > any launch delay of Block1 s.

They still need regulatory OK to operate, see.

42/42

If You liked that thread. I recommend @thekookreport thread, it is here.

https://twitter.com/thekookreport/status/1642420678132645889

• • •

Missing some Tweet in this thread? You can try to

force a refresh