MEGA THREAD of Educational Threads, Templates, and Tips that I've made so far🧵

My content is made to bring value to the community and I do it all for FREE so a like & retweet goes a long way as it would be much appreciated, enjoy🧡

♥️&🔁

My content is made to bring value to the community and I do it all for FREE so a like & retweet goes a long way as it would be much appreciated, enjoy🧡

♥️&🔁

My Trading Journey

https://twitter.com/Dangstrat/status/1639364069156085760?s=20

Trading Psychology

https://twitter.com/Dangstrat/status/1639191455293116416?s=20

Killzones & Macros

https://twitter.com/Dangstrat/status/1638860141192699904?s=20

Trading Acronyms

https://twitter.com/Dangstrat/status/1639220524592295940?s=20

What is Liquidity and what are the Different Types of Liquidity

https://twitter.com/Dangstrat/status/1640060127016284161?s=20

External vs Internal Liquidity, Dealing Ranges, & Draw on Liquidity

https://twitter.com/Dangstrat/status/1642143049219289088?s=20

Market Structure, Market Structure Shifts, and Displacement vs. Inducement

https://twitter.com/Dangstrat/status/1640750954524934165?s=20

Using Asia, London, New York Sessions to Create Daily Bias

https://twitter.com/Dangstrat/status/1637848935938109442?s=20

Favorite Buy & Sell Model

https://twitter.com/Dangstrat/status/1639602799133569024?s=20

Favorite Entry Models

https://twitter.com/Dangstrat/status/1637118321840603140?s=20

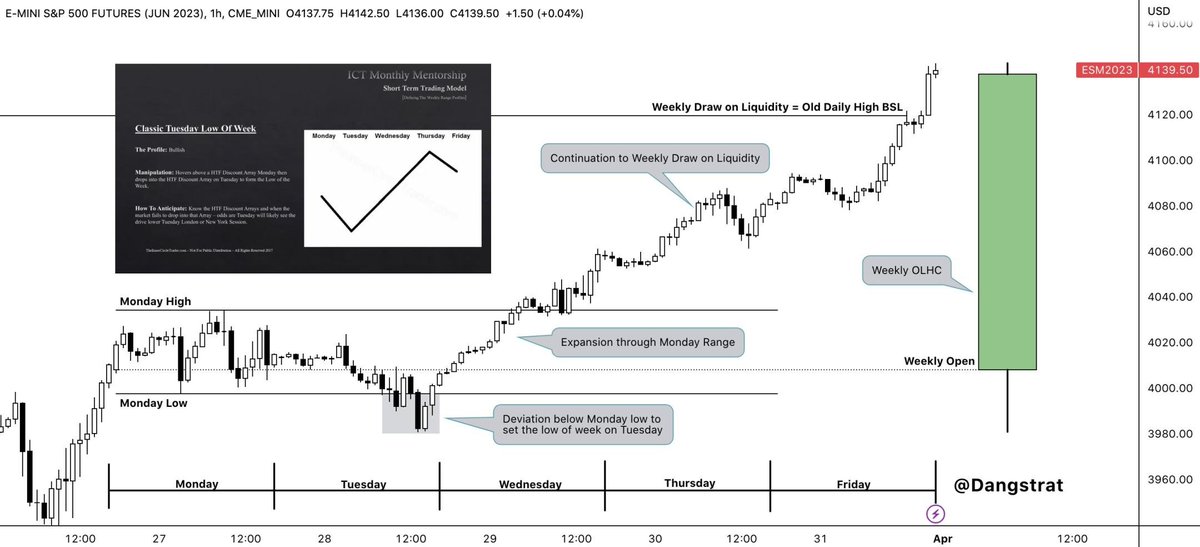

Monday Ranges & Deviations

https://twitter.com/Dangstrat/status/1638512776413863936?s=20

Tips on passing funding challenge accounts

https://twitter.com/Dangstrat/status/1641004626081206273?s=20

Print out your charts

https://twitter.com/Dangstrat/status/1641079229029789698?s=20

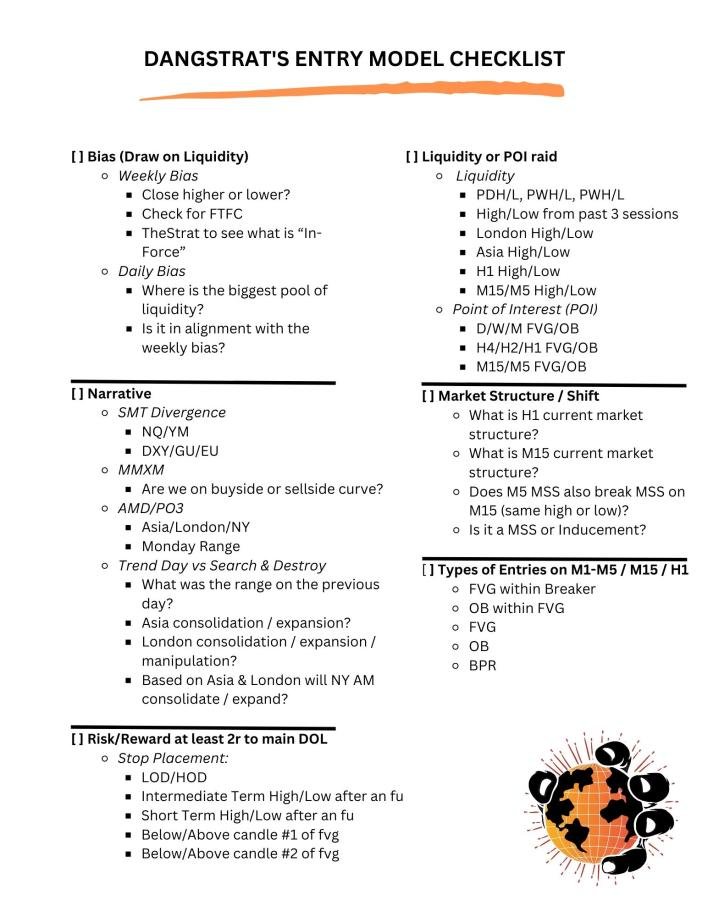

Checklist for A+ setups

https://twitter.com/Dangstrat/status/1622265726567333894?s=20

ICT Paint Brush Analogy

https://twitter.com/Dangstrat/status/1640671637707059202?s=20

Improve Discipline & Edge by Journaling trades

https://twitter.com/Dangstrat/status/1641754962605506560?s=20

Discord for Lifetime & Gold Membership linktr.ee/dangstrat

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter