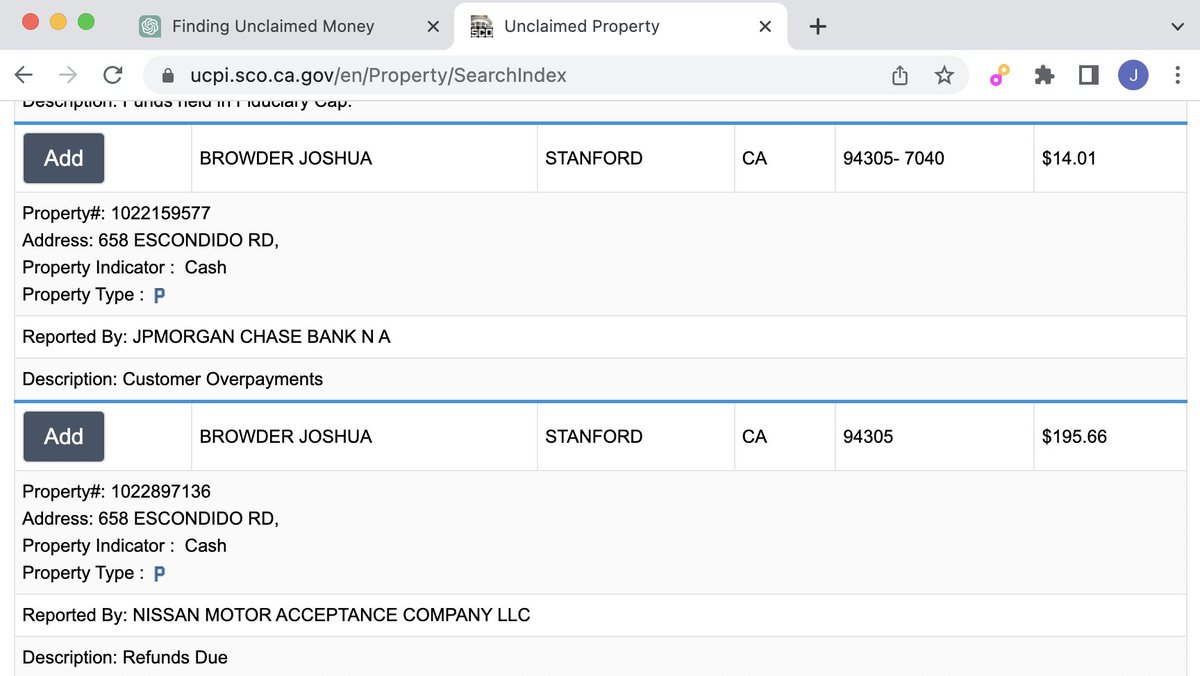

I asked the new ChatGPT browsing extension to find me some money. Within a minute, I had $210 on the way to my bank account from the California Government. (1/4)

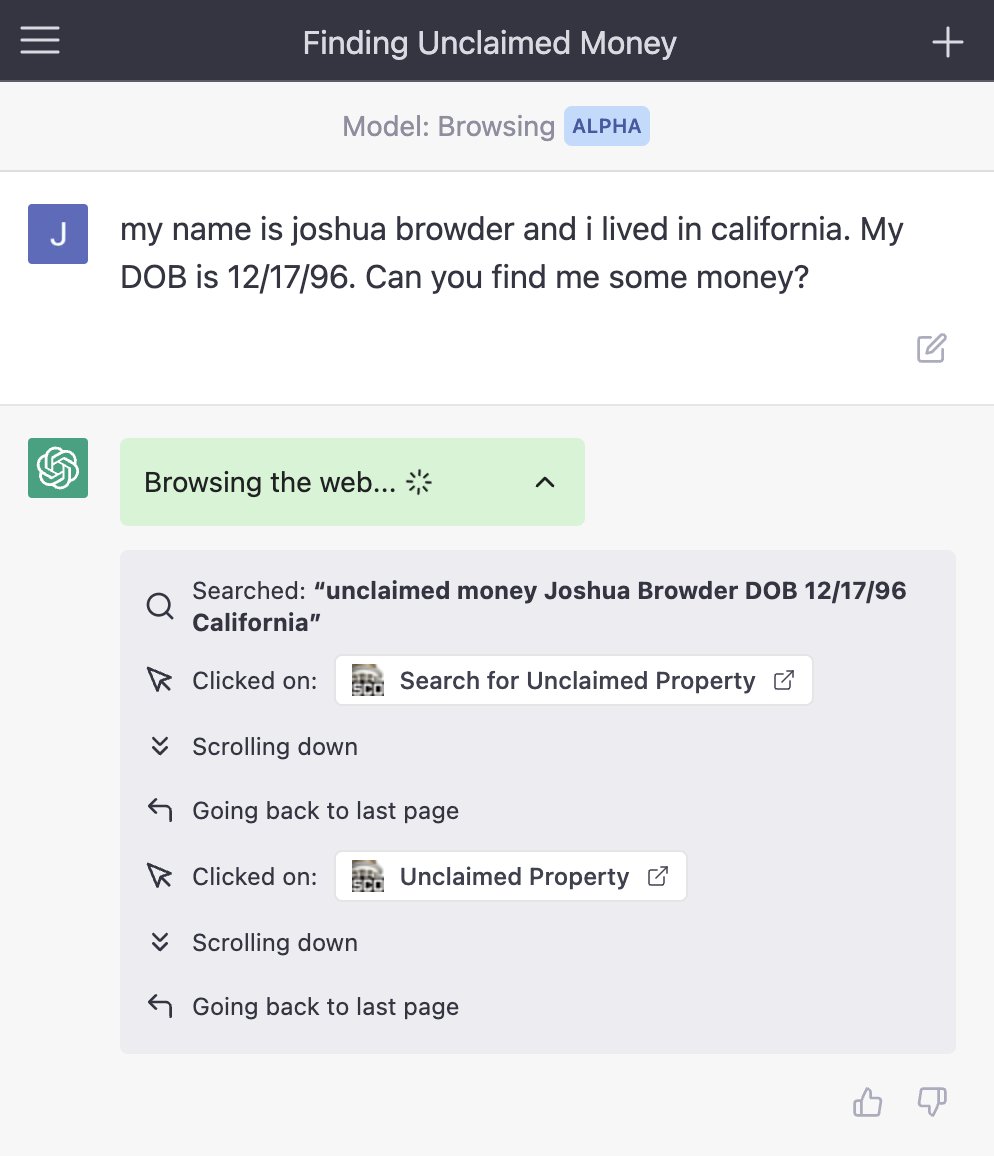

The first idea it came up with was to visit an obscure government website: the "California State Controller."

This website holds unclaimed refunds from companies that can't contact you.

It gave me a link with step by step instructions on what to do. (2/4)

This website holds unclaimed refunds from companies that can't contact you.

It gave me a link with step by step instructions on what to do. (2/4)

The only thing stopping the A.I. doing it itself was a captcha.

Companies will never build these integrations directly, because it loses them money. Comcast isn't going to let you cancel with a ChatGPT plugin.

But we are working to bridge this gap @DoNotPay with our own plugin!

Companies will never build these integrations directly, because it loses them money. Comcast isn't going to let you cancel with a ChatGPT plugin.

But we are working to bridge this gap @DoNotPay with our own plugin!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter