Everyone buys into hot tokens to make 100x.

But no one wants to be dumped on by VCs, Influencers or the Devs.

I show you how to use @DefiLlama to make sure you don't. 🧵

But no one wants to be dumped on by VCs, Influencers or the Devs.

I show you how to use @DefiLlama to make sure you don't. 🧵

1/ Crypto projects often detail their tokenomics in a pre-launch white paper. The problem? Users rarely find or use this key information.

Thankfully, @DefiLlama simplifies the search and saves you from being dumped on.

Let's break this down into 5 steps!

Thankfully, @DefiLlama simplifies the search and saves you from being dumped on.

Let's break this down into 5 steps!

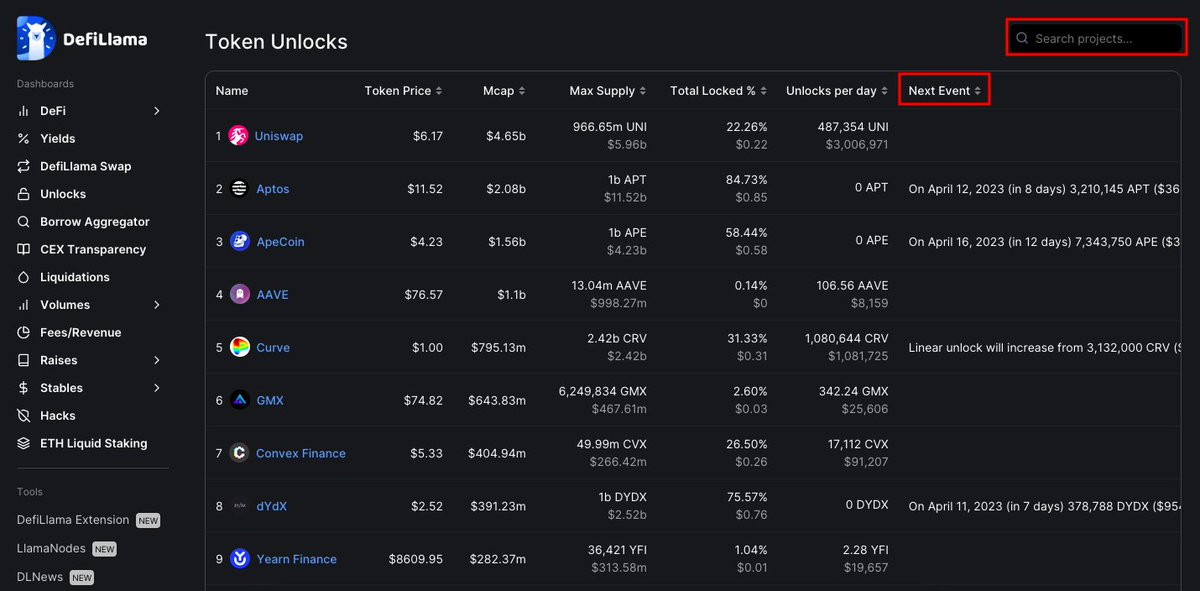

2/ Step 1

- Let's begin by first going to defillama.com

- Select "Token Unlocks"

- This will take you to the Token Unlocks main page

A quick demonstration 👇

- Let's begin by first going to defillama.com

- Select "Token Unlocks"

- This will take you to the Token Unlocks main page

A quick demonstration 👇

3/ Step 2

- Select Next Event

- This will sort Token Unlocks based on the date

- You can see $APT is unlocking $36.98m in 8 days.

You can also individually search tokens by typing in the search bar, for example $ARB unlocks occur in 1 year.

- Select Next Event

- This will sort Token Unlocks based on the date

- You can see $APT is unlocking $36.98m in 8 days.

You can also individually search tokens by typing in the search bar, for example $ARB unlocks occur in 1 year.

4/ Step 3

- Select $APT

- This will take you to the Allocation page.

- This page provides a breakdown of the token release schedule.

You may notice the vesting schedule is interactive and allows you to see unlocks over time.

- Select $APT

- This will take you to the Allocation page.

- This page provides a breakdown of the token release schedule.

You may notice the vesting schedule is interactive and allows you to see unlocks over time.

5/ Step 4

- Toggle through the vesting schedule

- This provides you a breakdown of the $APT release

- You can now see tokens will be number of tokens that will be unlocked.

Community: 3,210,145 $APT

Foundation: 1,333,333 $APT

- Toggle through the vesting schedule

- This provides you a breakdown of the $APT release

- You can now see tokens will be number of tokens that will be unlocked.

Community: 3,210,145 $APT

Foundation: 1,333,333 $APT

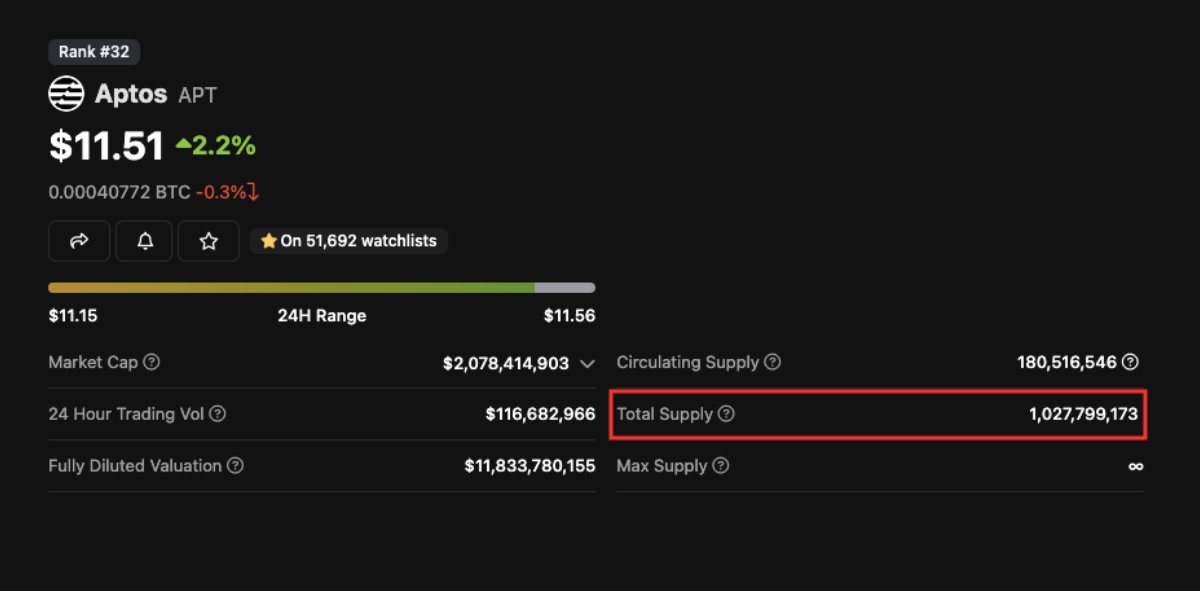

6/ Step 5

💥This step requires you to step outside of Defi Llama.

You need to calculate how significant of an unlock this is for $APT to understand the impact.

- Go to @coingecko to determine the impact.

Here's what I found 👇

💥This step requires you to step outside of Defi Llama.

You need to calculate how significant of an unlock this is for $APT to understand the impact.

- Go to @coingecko to determine the impact.

Here's what I found 👇

7/ $APT has a total circulating supply of 1,027,799,173

We know the upcoming unlock will amount to a total of 4,543,478.03 $APT ( $52M currently).

If you divide the total being unlocked vs. the total circulating supply, you see the unlock amounts to 0.45% of the total supply.

We know the upcoming unlock will amount to a total of 4,543,478.03 $APT ( $52M currently).

If you divide the total being unlocked vs. the total circulating supply, you see the unlock amounts to 0.45% of the total supply.

8/ Although this upcoming unlock is not massive, it does allow you to understand how much of a token is being introduced to the market.

General rule of thumb, more supply without more demand results in downward price action. 📉

General rule of thumb, more supply without more demand results in downward price action. 📉

9/ Tracking Token Unlocks can potentially save you from being dumped on by early stage "investors".

Or it can provide you with an opportunity to scoop some tokens as you can typically expect there to be negative price action

Or it can provide you with an opportunity to scoop some tokens as you can typically expect there to be negative price action

10/ The best part of it this is, this tool is 100% free!

So take advantage of it, and save yourself potential losses, or position yourself to capitalize from potential dumps.

defillama.com/unlocks

So take advantage of it, and save yourself potential losses, or position yourself to capitalize from potential dumps.

defillama.com/unlocks

11/ Tagging Fellow DeFi Chads to follow:

@Deebs_DeFi

@CryptoStreamHub

@crypto_linn

@DeFiMinty

@DeFi_Taha

@Chinchillah_

@0xTindorr

@0xsurferboy

@Louround_

@Curious__J

@Hercules_Defi

@MercyDeGreat

@0xSalazar

@thelearningpill

@FarmerTuHao

@0xShinChannn

@Deebs_DeFi

@CryptoStreamHub

@crypto_linn

@DeFiMinty

@DeFi_Taha

@Chinchillah_

@0xTindorr

@0xsurferboy

@Louround_

@Curious__J

@Hercules_Defi

@MercyDeGreat

@0xSalazar

@thelearningpill

@FarmerTuHao

@0xShinChannn

12/ Thank you for reading!

I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Show your support by Liking and Retweeting the first tweet below 👇

I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Show your support by Liking and Retweeting the first tweet below 👇

https://twitter.com/Flowslikeosmo/status/1644716754315415556

• • •

Missing some Tweet in this thread? You can try to

force a refresh