#FedFAQ: Is FedNow replacing cash? Is it a central bank digital currency?

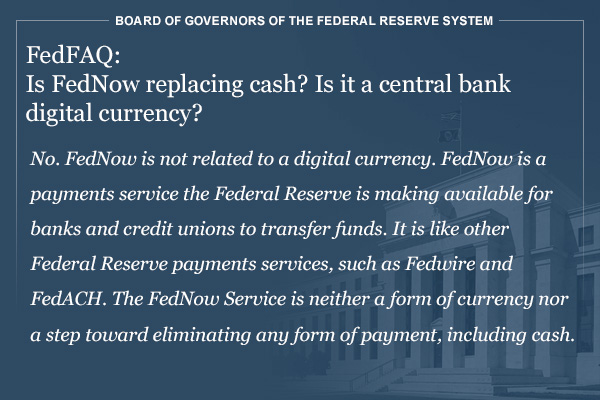

No. FedNow is not related to a digital currency. FedNow is a payments service the Federal Reserve is making available for banks and credit unions to transfer funds. (1/6) federalreserve.gov/faqs/is-fednow…

No. FedNow is not related to a digital currency. FedNow is a payments service the Federal Reserve is making available for banks and credit unions to transfer funds. (1/6) federalreserve.gov/faqs/is-fednow…

The FedNow Service is neither a form of currency nor a step toward eliminating any form of payment, including cash. The FedNow Service is an instant payments service provided by the Federal Reserve, launching in July 2023. (2/6)

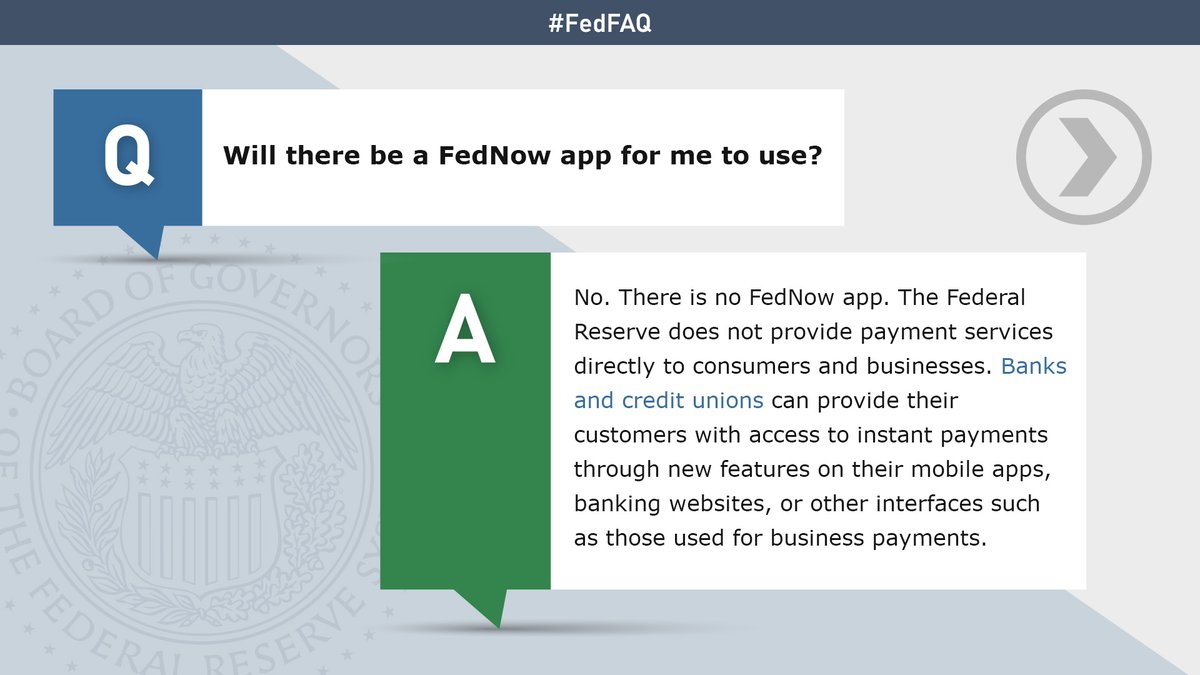

FedNow will be available to depository institutions, such as banks and credit unions, in the United States and will enable individuals and businesses to send instant payments through their depository institution accounts. (3/6)

Instant payments allow individuals and businesses to send and receive payments within seconds at any time of the day, on any day of the year, so that the receiver of a payment can use the funds almost instantly. (4/6)

Testifying before the House Financial Services Committee in March, Powell said a central bank digital currency is “something we would certainly need congressional approval for.” (5/6)

Learn more about FedNow and about the Fed’s work related to CBDCs (6/6):

federalreserve.gov/paymentsystems…

federalreserve.gov/cbdc-faqs.htm

federalreserve.gov/paymentsystems…

federalreserve.gov/cbdc-faqs.htm

• • •

Missing some Tweet in this thread? You can try to

force a refresh