I've used Microsoft Excel for 20 years and these 10 tips will make you an expert & increase your productivity 100X

Don't use Excel again without learning these 10 functions:

Don't use Excel again without learning these 10 functions:

Top 10 MUST KNOW Microsoft Excel tips & functions:

(1) XLOOKUP

(2) Sparklines

(3) Importing PDF data

(4) IF Statements

(5) TRIM

(6) UPPER, LOWER, and PROPER

(7) Wildcards

(8) CONVERT

(9) Transpose

(10) Pivot Tables

Examples of each:

(1) XLOOKUP

(2) Sparklines

(3) Importing PDF data

(4) IF Statements

(5) TRIM

(6) UPPER, LOWER, and PROPER

(7) Wildcards

(8) CONVERT

(9) Transpose

(10) Pivot Tables

Examples of each:

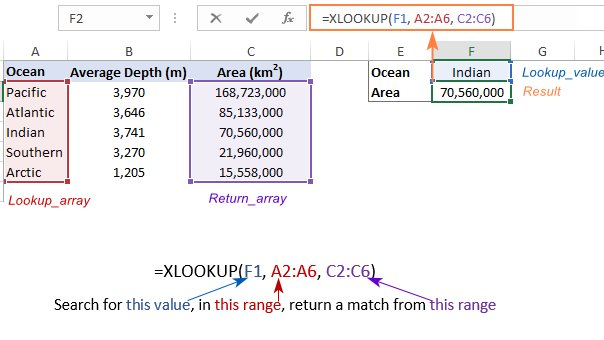

(1) XLOOKUP

XLookup is an upgrade compared to VLOOKUP or Index & Match. Use it to perform both VLOOKUP or HLOOKUP.

Formula: =XLOOKUP (lookup value, lookup array, return array)

XLookup is an upgrade compared to VLOOKUP or Index & Match. Use it to perform both VLOOKUP or HLOOKUP.

Formula: =XLOOKUP (lookup value, lookup array, return array)

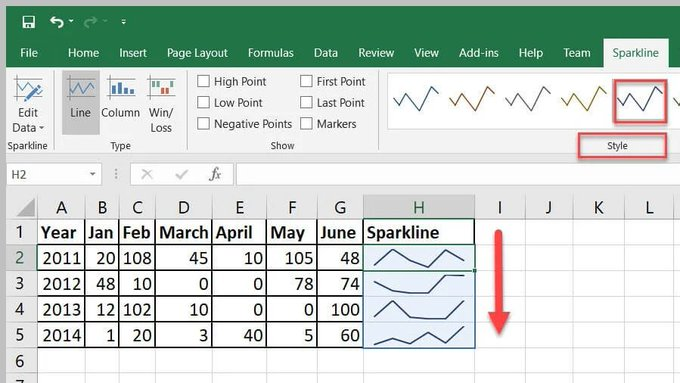

(2) Sparklines

Sparklines are mini charts inside of cells, to provide visual representations of data.

Sparklines can show trends or patterns in data, and are useful for summary tables.

On the 'Insert tab', click 'Sparklines'

Sparklines are mini charts inside of cells, to provide visual representations of data.

Sparklines can show trends or patterns in data, and are useful for summary tables.

On the 'Insert tab', click 'Sparklines'

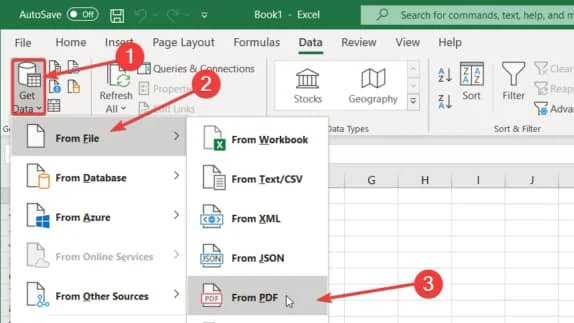

(3) Importing PDF data

This automates the process of manually typing data from a PDF into an Excel spreadsheet. This function saves hours!

This automates the process of manually typing data from a PDF into an Excel spreadsheet. This function saves hours!

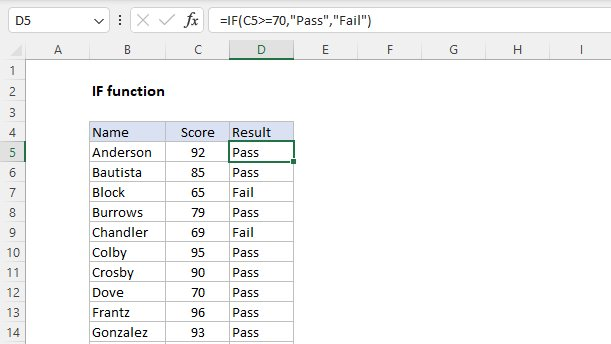

(4) IF Statements

IF Statements make logical comparisons & tell you when certain conditions are met.

For example, a logical comparison would be to return the word "Pass" if a score is >70, and if not, it will say "Fail".

An example of this would be =IF(C5>70,"Pass","Fail")

IF Statements make logical comparisons & tell you when certain conditions are met.

For example, a logical comparison would be to return the word "Pass" if a score is >70, and if not, it will say "Fail".

An example of this would be =IF(C5>70,"Pass","Fail")

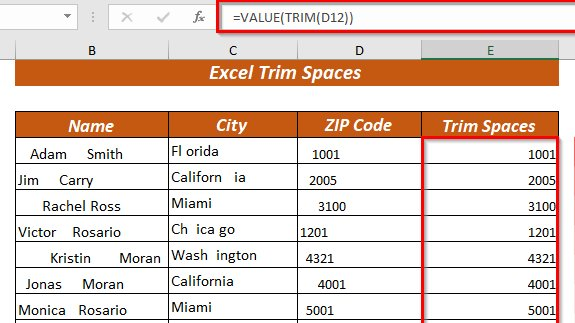

(5) TRIM

TRIM is useful in removing irregular spacing from imported data, or removing extra spaces in data.

Formula: =TRIM()

TRIM is useful in removing irregular spacing from imported data, or removing extra spaces in data.

Formula: =TRIM()

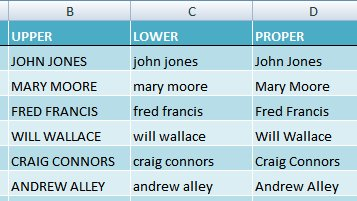

(6) UPPER, LOWER, and PROPER

=UPPER, Converts text to all uppercase,

=LOWER, Converts text string to lowercase,

=PROPER, Converts text to proper case.

=UPPER, Converts text to all uppercase,

=LOWER, Converts text string to lowercase,

=PROPER, Converts text to proper case.

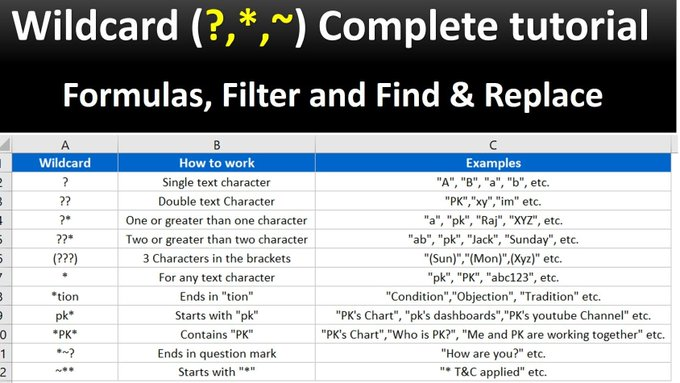

(7) Wildcards

Wildcards are special characters that allow you to perform partial matches in lookup formulas. Excel has three wildcards:

(1) an asterisk "*"

(2) a question mark "?"

(3) a tidle "~"

Wildcards are special characters that allow you to perform partial matches in lookup formulas. Excel has three wildcards:

(1) an asterisk "*"

(2) a question mark "?"

(3) a tidle "~"

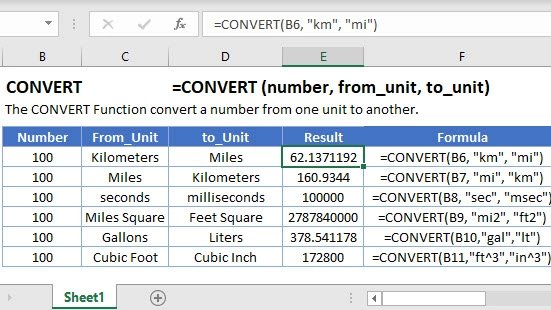

(8) CONVERT

This converts one unit of measurement to another unit, and there are multiple other conversions you can perform.

An example is converting meters to feet, or Celsius to Fahrenheit.

This converts one unit of measurement to another unit, and there are multiple other conversions you can perform.

An example is converting meters to feet, or Celsius to Fahrenheit.

(9) Transpose

Transpose can transform data displayed in rows, to instead be shown in columns, or vice versa

To transpose a column to a row (or vice versa):

1. Select the data

2. Select the cell you want the row to start

3. Right-click, choose paste special, select transpose

Transpose can transform data displayed in rows, to instead be shown in columns, or vice versa

To transpose a column to a row (or vice versa):

1. Select the data

2. Select the cell you want the row to start

3. Right-click, choose paste special, select transpose

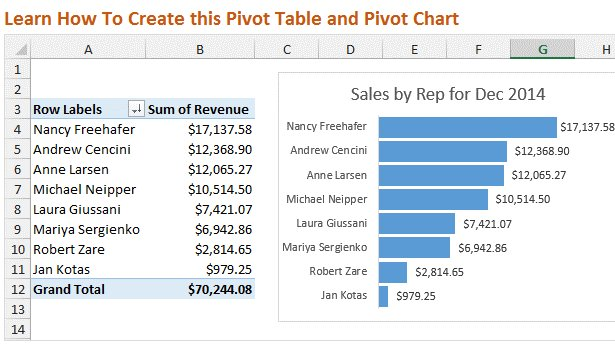

(10) Pivot Tables

Pivot tables are a powerful tool to summarize & analyze data, which will help you to compare data or find patterns & trends.

To access this function, go to "Insert" in the Menu bar, and then select "Pivot Table".

Pivot tables are a powerful tool to summarize & analyze data, which will help you to compare data or find patterns & trends.

To access this function, go to "Insert" in the Menu bar, and then select "Pivot Table".

Microsoft Excel is a must-have skill in today's job market. If you found this thread helpful, please:

• RT the FIRST tweet to share it🔁

• Follow me @FluentInFinance for more

• Sign-up for my FREE newsletter to learn more valuable skills: TheMoneyNewsletter.com!

• RT the FIRST tweet to share it🔁

• Follow me @FluentInFinance for more

• Sign-up for my FREE newsletter to learn more valuable skills: TheMoneyNewsletter.com!

• • •

Missing some Tweet in this thread? You can try to

force a refresh